I. Mechanisms are not just tools, but expressions of belief

In the prediction market, a system that relies on collective cognition to construct prices, the trading market mechanism not only fulfills the function of order matching but also carries judgments about future events.

The quality of a mechanism not only determines whether trading is efficient but also whether we can accurately capture and express the contours of "future possibilities."

For this reason, the two mainstream prediction market mechanisms today—CLOB+CTF (Order Book + Conditional Token) and LSMR (Logarithmic Scoring Market)—despite their achievements in recent years, have both exposed structural deficiencies in practice.

These issues are not only technical challenges but also reflect an incomplete understanding of the core question of "how collective beliefs are generated and measured."

II. CLOB+CTF: Market fragmentation and low liquidity caused by high structure

1. Clear concept, but overly fragmented system

The logic of CLOB+CTF is not complex:

- CLOB provides a market interface for limit orders and matching.

- CTF breaks down multi-choice events into a series of YES/NO binary contracts and adjusts supply and demand through automatic token minting/burning.

This model is structurally highly consistent with traditional financial markets, thus having a certain user cognitive foundation.

However, once the number of event options increases, the system is forced to create multiple sub-markets, each with its own pair of tokens and order books, which greatly increases system complexity and user participation thresholds.

2. Counterparty dependence leads to liquidity imbalance

CLOB is an order-based mechanism, thus fundamentally relying on an active bilateral market. In most prediction markets, due to unstable user participation enthusiasm, diverse events, and information asymmetry, the depth of orders is often severely insufficient, resulting in "order gaps" or "one-sided squeezes."

The result is:

- Users place orders without counterparties, causing prices to stagnate;

- The market becomes ineffective in a non-liquid state, severely affecting user experience.

While CTF can somewhat fill the counterparty gap by minting YES/NO assets, it itself also becomes an arbitrage tool, making price signals more susceptible to short-term behavioral manipulation rather than being driven by long-term expectations.

3. "Arbitrage-driven" outweighs "cognitive aggregation"

The horizontal mechanism of CTF is intended to help market prices converge to true probabilities through the system's minting and burning of YES/NO assets. However, in practice, this mechanism instead:

- Encourages users to trade around arbitrage opportunities rather than the events themselves;

- Passively amplifies the short-term impact of irrational market behavior on prices;

- Weakens the interpretability and stability of prices as a "collective belief function."

In short, although CLOB+CTF is structurally complete, it is difficult to provide a stable and effective price discovery mechanism in a reality characterized by low liquidity, significant cognitive differences, and non-professional users.

III. LSMR: From elegant functions to the dilemma of settlement uncertainty

1. Simple mechanism, yet detached from user comprehensibility

LSMR (Logarithmic Scoring Market with Reservation) centers around a logarithmic function, unifying market prices and token issuance logic within a single mathematical expression. It has two notable advantages:

- Multi-choice markets do not need to be split; all options coexist within the same price structure;

- Theoretically, the total price of all tokens always equals 1, aligning with probability intuition.

However, the problem with LSMR lies in this overly "black box" mathematical system: users cannot assess the relationship between the actual cost of purchasing a certain option and the potential returns; the process of price formation lacks a clear path, and the trading experience is obscured by algorithmic abstraction; the settlement logic fails to form the "odds" that users expect, lacking transparency in the game.

2. Dual dilemma of slippage and parameter control loss

The only control parameter b in LSMR determines the market's price response intensity (degree of slippage). However, the design of this parameter itself faces a paradox:

- A large b value → price changes sluggishly, making it difficult to express true probabilities;

- A small b value → prices are extremely sensitive, easily manipulated, leading to price bubbles.

Worse still, b must be set before the market starts, but it is nearly impossible to gauge the expected trading volume and volatility range in the early stages. This makes b a structural risk factor rather than a stable anchor for the system.

IV. Core issues summarized: Three major defects of old mechanisms

1. Prices are difficult to express true probabilities

In CLOB+CTF, the order structure and liquidity supply and demand easily cause prices to deviate from the true probabilities of events occurring;

In LSMR, prices are merely the output of a function, making it hard for users to map the relationship between subjective probabilities and odds.

2. Mechanisms are easily dominated by arbitrage, making it difficult to form rational collective signals

Arbitrage logic is originally a supplementary mechanism to maintain price rationality, but in these two systems, arbitrage has instead become the primary trading motive, dominating market structure and interfering with cognitive aggregation.

3. Poor user participation experience, lack of certainty in trading

Whether it is the depth issue of the order book or the slippage jumps caused by the logarithmic function, users find it difficult to obtain a clear expected and cost-controlled trading experience, which is a fatal barrier for a prediction market mechanism that is "open to non-professional users."

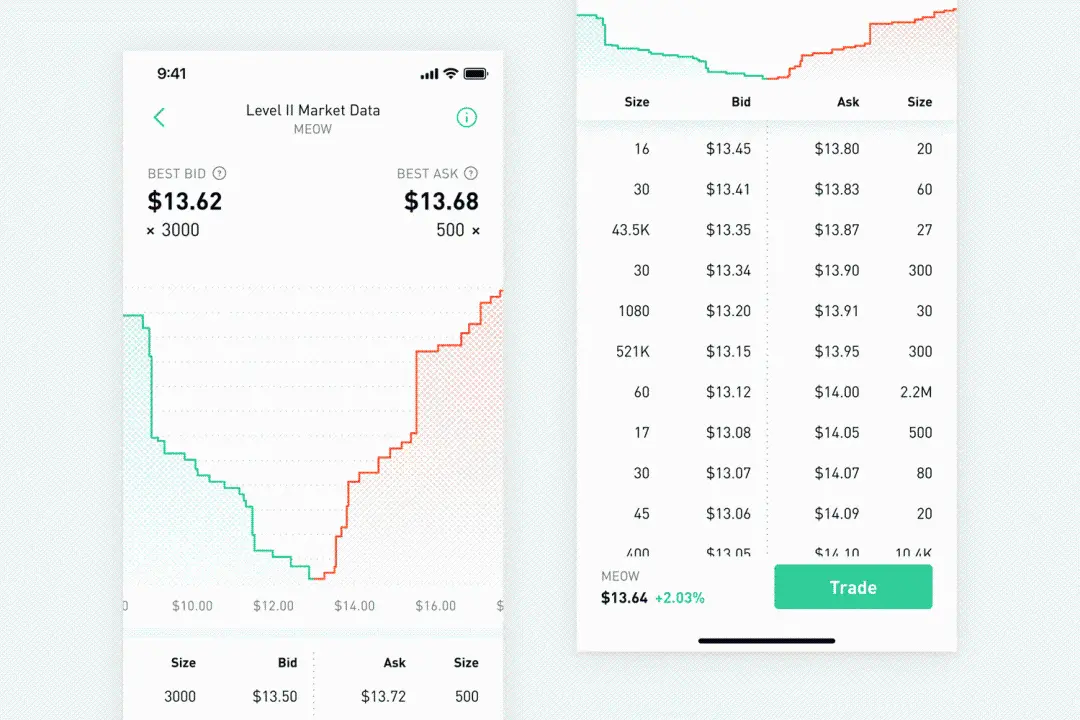

Order book depth illustration via Investopedia

V. The direction towards a new mechanism: Mechanisms should express beliefs, not just carry transactions

The essence of prediction markets is to assetize beliefs, serving as a fusion mechanism of social cognition and economic incentives. Therefore, an ideal market mechanism must meet the following three points:

- Clear pricing with a definite probability meaning, allowing users to understand the implications behind the price;

- A closed price and settlement structure, ensuring that participants' expected returns align with actual returns;

- Operate stably without complex splitting or parameter control, with the mechanism itself possessing anti-manipulation and self-balancing capabilities.

These goals are precisely what new mechanisms like APMM (Automatic Prediction Market Maker) aim to achieve. They draw on the experiences of previous mechanisms and address the core pain points in real trading behavior.

VI. Conclusion: The root of mechanism evolution is not just engineering, but the adaptation of cognitive ecology

The mechanism issues present in CLOB+CTF and LSMR are not due to their lack of "intelligence," but because they overly rely on the encapsulation of technology and the elegance of form when addressing the question of "how humans judge the future," neglecting the real behaviors, psychology, and cognitive paths of users.

Market mechanisms are a tool of civilization, ultimately serving not functions and assets, but the decision-making and expression of people in uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。