Original Title: Morph, Bitget's L2, is stymied by founder disputes, lavish spending and power struggles: Sources

Original Authors: Katherine Ross & Jack Kubinec, Blockworks Authors

Original Translation: Rhythm Little Deep

Editor’s Note: The article points out that Bitget's incubated L2 Morph is hindered by internal issues, including conflicts between founders, lavish spending, and the influence of the mysterious "shadow CEO" Forest Bai. In March 2024, Morph completed a $20 million seed round financing, but it faces challenges such as low mainnet transaction volume, delayed token issuance, layoffs, executive departures, and unclear strategic direction.

The following is the original content (edited for readability):

Some employees of Bitget's new blockchain Morph initially believed this L2 could become a future competitor to Coinbase Base.

However, sources familiar with the project revealed to Blockworks that Morph is stymied by internal chaos. Since completing a $20 million seed round financing in March last year, team conflicts, extravagant spending, and a mysterious "shadow CEO" have led to layoffs, delays, and a loss of direction.

Blockworks spoke with a dozen current and former employees who were granted anonymity to share candid details about the internal missteps of one of Bitget's most public bets.

The Origins of Morph

Cryptocurrency exchanges are the largest applications in the crypto space. One way these digital asset giants leverage their popularity is by launching their own blockchains.

Binance launched BNB Chain in 2020. Coinbase launched an Ethereum L2 called Base in 2023. Kraken, OKX, and Gate.io have either built or are building blockchains.

These chains can yield substantial profits. According to Blockworks Research data, Base generated $76 million in gross profit in 2024.

Against this backdrop, L2 Morph, incubated by Bitget, the world's tenth-largest spot trading volume exchange, became a hot project. However, unlike the traditional startup model where two co-founders collaborate around a single idea, the two co-founders of Morph did not know each other and were paired together.

The Morph team brought in Azeem Khan, who resides in the U.S. and was previously the head of influence at Gitcoin, and Cecilia Hsueh, who, according to her LinkedIn page, is based in Singapore. Hsueh was the Chief Marketing Officer of the crypto exchange Phemex and briefly served as its CEO. She was appointed as the CEO of Morph, while Khan took on the role of Chief Operating Officer.

The initial outlook was promising. As crypto financing began to recover, Morph raised $20 million in seed funding from the U.S. venture capital firm Dragonfly. Other investors included Pantera, MEXC Group, Bitget's venture capital arm Foresight Ventures, and Spartan Group.

Bitget and Foresight Ventures did not respond to multiple requests for comment. Dragonfly and Pantera declined to comment when contacted.

Morph's mainnet went live at the end of October last year. According to Morph's blockchain explorer, this L2 recorded about 16,000 transactions on May 12 (Monday). In contrast, according to Blockworks Research's dashboard, Base averages millions of transactions daily.

Launching was only half the battle. Former employees recalled that another major goal was to launch a token, but this goal has yet to be achieved.

Last month, Morph hinted that those minting the so-called "platinum NFTs" would "lock in their position in the ecosystem with a $500 million FDV and unlock 50% of the tokens at TGE."

According to insiders, the March 2024 seed round financing valued Morph at $125 million.

However, since the financing, Bitget's L2 has experienced a year of turmoil.

The "Ghost Founder"

As Morph expanded its team and attempted to launch a functional blockchain, fractures emerged in its leadership.

Insiders described the tension between Hsueh and Khan, who did not know each other before being appointed as co-founders.

Khan declined to comment when contacted by Blockworks.

Bitget's operations in the U.S. are unavailable, but according to company data, it has achieved strong growth in Africa, South Asia, and Southeast Asia over the past few years. Co-founder Azeem Khan explained in an interview with CoinDesk last year that Morph was initially aimed at serving users in the Global South that other exchange blockchains did not cover.

Multiple sources stated that Khan and Hsueh were not always aligned strategically. Khan spoke about emerging markets in media appearances, but former employees recalled that these initiatives progressed slowly internally. One source indicated that a team that had planned activities for these markets for months was told there was no budget.

Strangely, employees who spoke with Blockworks felt that Khan and CEO Hsueh did not always seem to have the final say.

One employee described Khan more as a "ghost founder" than a true co-founder, stating that they had never seen anything like it in their crypto careers.

Many decisions seemed to be in the hands of Forest Bai, co-founder and partner at Foresight Ventures (Bitget's venture capital arm and Morph's investor), who is also the chairman of The Block. Multiple sources confirmed that Bai acted like a "shadow CEO." Insiders noted that he had oversight over spending and company strategy.

Khan announced his departure from Morph in March, stating in an X post that resigning was "the best way forward for me." He has since become a co-founder of another blockchain called Miden.

Several insiders stated that the lack of consistency and independent decision-making contributed to Khan's departure.

Hsueh continues to serve as CEO—although three sources told Blockworks that her internal power has reportedly weakened further in recent months.

Who Really Holds Power?

Almost everyone who spoke with Blockworks described Hsueh's understanding of blockchain technology details as limited. While executives do not have to be crypto natives, insiders stated that Hsueh is disconnected from blockchain users and lacks interest in learning the technology, leading to a lack of clear strategic direction for Morph.

Insiders said that Hsueh instead focused on enhancing her online presence. Three former employees recalled being asked to engage with her posts. Others added that Hsueh would prioritize posting Morph announcements on her personal account rather than the official account.

At one point, Hsueh posted a photo of her foot on X.

It remains unclear how much power Hsueh still holds; one former employee described her as "indestructible."

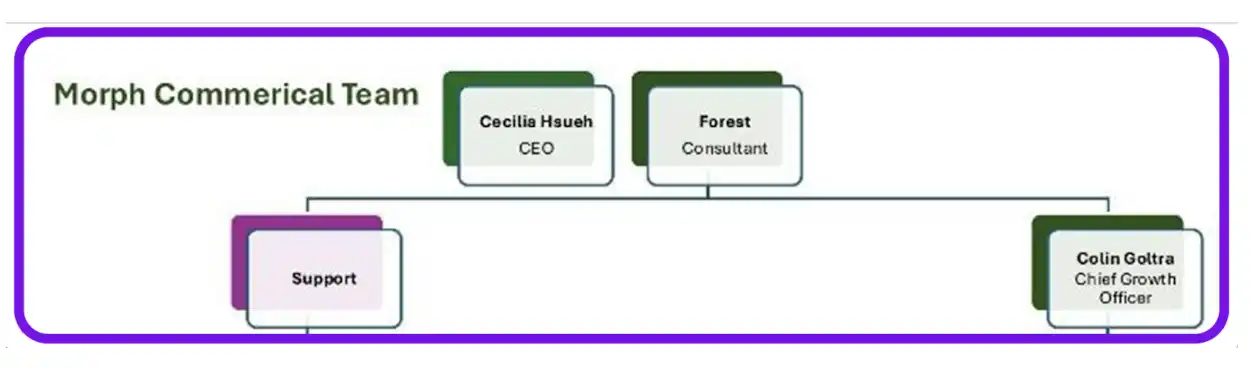

While she is listed as CEO in company documents, an internal organizational chart shared with Blockworks shows Foresight Ventures co-founder Forest Bai's name alongside hers.

Screenshot of Morph's organizational chart showing Bai and Hsueh's roles

Neither Hsueh nor Bai responded to requests for comment via email or messages.

Three insiders stated that Bai has strengthened his control in recent months—reportedly he has been formally added to the company Slack—while others noted that Bai had influence over both Khan and Hsueh before Khan's departure. According to internal Slack messages seen by Blockworks, Bai is formally listed as an advisor.

Another internal Slack message seen by Blockworks requested Bai to attend ecosystem and marketing team meetings.

Deals or No Deals?

Four sources stated that Morph was a big spender in 2024. Of course, the company had just completed a $20 million financing round.

But spending included activities with the K-pop group tripleS; according to one source, Morph allegedly paid for the group's travel and accommodation. Invitations on Lu.ma (a popular site often used for planning post-event activities) show that tripleS had a "special performance" at an event hosted by Zircuit, Bitget, Morph, Foresight Ventures, and Quantstamp last April.

Multiple sources discussed Morph spending hundreds of thousands of dollars hosting events at crypto conferences. At Token2049 in Singapore, Morph hosted a full day of side events at the ArtScience Museum in Singapore, insiders noted. Invitations on Lu.ma show that attendees included Vitalik Buterin, Stani Kulechov from Avara, and Mo Shaikh from Aptos, with renowned Korean DJ SODA as the headliner.

Another source pointed out that the lavish event spending did not align with investment returns or the bottom line. Insiders told Blockworks that despite the events seeming well-funded, Hsueh appeared reluctant to approve actual business deals.

One insider noted that a highlight of the company's spending was that Morph initially offered competitive salaries to employees.

Aside from events, three sources told Blockworks that Morph discussed establishing a physical office in New York City, ultimately renting space on the 77th floor of One World Trade Center.

The office also shares space with Foresight and The Block, but it is unclear who the tenant is.

In terms of development, multiple sources stated that Morph paid a development team over $200,000 to build a fork of Uniswap v2. Since Uniswap's code is open source, a former employee believed the project overpaid for this decentralized exchange (DEX) known as BulbaSwap. According to DeFiLlama data, BulbaSwap currently has a total value locked (TVL) of approximately $93 million, ranking around 200th among DEXs.

"Dark Arts"

Morph's cash burn rate may be alleviated by the planned Series A financing, but the new round of funding has yet to materialize.

Hsueh stated in a September interview with Web3TV, "We are looking for the next round of financing," noting that "operating a chain is very expensive," and the company hopes to expand its workforce.

However, insiders pointed out that there was a tense atmosphere regarding the Series A financing before Khan's departure. Two insiders stated that Bai pushed Morph to pursue another round of financing.

Blockworks could not determine the current status of the Series A.

Even without financing, one insider told Blockworks that Morph has not run out of funds and is still supported by Bitget.

Morph did not respond to multiple requests for comment.

Meanwhile, Morph has encountered some difficulties in retaining talent. A former employee stated that the company faced "staggering" employee turnover, ranging from resignations to layoffs. Others noted that some employees also accepted pay cuts.

Multiple employees indicated that they had not received token contracts. One source claimed that Morph attempted to force some employees who received contracts to sign new agreements last May, which would change their token vesting periods.

Another source told Blockworks that employee turnover has led to some teams being understaffed, with some Slack channels experiencing little activity. Despite the challenges, one insider stated that Morph still plans to launch its token by the end of this year.

For investors, Morph's redemption may lie in its connection with Bitget, which may still be keen to list the upcoming token for trading.

A former employee stated that Bitget is well-versed in the "dark arts" of trading tokens that may have questionable value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。