Original Title: The Fat App Thesis: L1s as Commodities, Not Monopolies

Original Author: @0x_Arcana, Crypto Research Institute

Original Translation: Rhythm Little Deep

Editor's Note: The "Fat App Thesis" posits that as the cost of block space approaches zero, L1 blockchains transition from monopolies to commodities, with value shifting from the foundational protocol layer (such as Ethereum and Solana) to the application layer. Successful applications capture more revenue through vertical integration, controlling order flow, and MEV, becoming sovereign application chains. The market is re-pricing L1/L2, and the future winners will be applications that are close to demand and focus on practicality, rather than chains pursuing high TPS.

The following is the original content (reorganized for readability):

The stage of crypto infrastructure is entering a world of post-marginal cost. Just like bandwidth and computing power, the price of block space will rapidly approach zero. The only chains that can survive are those that can:

- Achieve growth today through subsidies

- Capture non-inflationary revenue tomorrow

- Provide infrastructure that applications find difficult to easily replicate or abandon

However, in this new environment, L1 is no longer defined as a monopolist by early advantages or native ecosystems. Instead, they have become commodities—interchangeable tools competing in economic activities based on performance, interoperability, and cost efficiency.

Their value now depends on how well they can embed into application processes and provide indispensable or non-outsourcable services. The "protocol premium" that once drove high valuations is fading, replaced by a demand for real utility and performance. The current re-pricing of many L1/L2 markets reflects this trend.

Chart includes: BERA, MOVE, SCR, STRK

Is the Fat Protocol Thesis Wrong?

In 2016, Joel Monegro proposed the Fat Protocol Thesis, pointing out that in crypto networks, most value is concentrated at the foundational protocol layer (like Ethereum and Solana), rather than the application layer. This is in stark contrast to the Web2 model, where applications like Facebook, Google, and Amazon capture most of the value, while protocols like HTTP and TCP/IP are commoditized.

The Fat Protocol Thesis has indeed been correct over the past eight years. This can be seen in the vast differences in valuation and revenue multiples between infrastructure and applications. On average, applications' trading valuations remain far below those of infrastructure relative to revenue.

In this model, crypto infrastructure has attracted significant funding and venture capital. In fact, this situation is so prevalent that founders and developers are almost incentivized to launch another alternative L1 or general Rollup, knowing that venture capital will support them at any time.

In a recent report, I mentioned that data availability (DA) is being commoditized and will inevitably trend towards zero. Based on the same logic, we can assume that all parts of the infrastructure stack will eventually be commoditized and have their value extracted. Why is that?

Fat App Thesis: Applications realize that by becoming sovereign "application chains" and vertically integrating the entire stack, they can capture more value.

Application-Specific Ordering: Applications can control their own transaction ordering and inclusion processes. This is an alternative path for applications that do not want to build an application chain from scratch.

Fat App Thesis

The Fat App Thesis argues that successful crypto applications will capture more value than the underlying blockchain protocols. The simple reason is: applications are business entities, and business entities prioritize maximizing revenue.

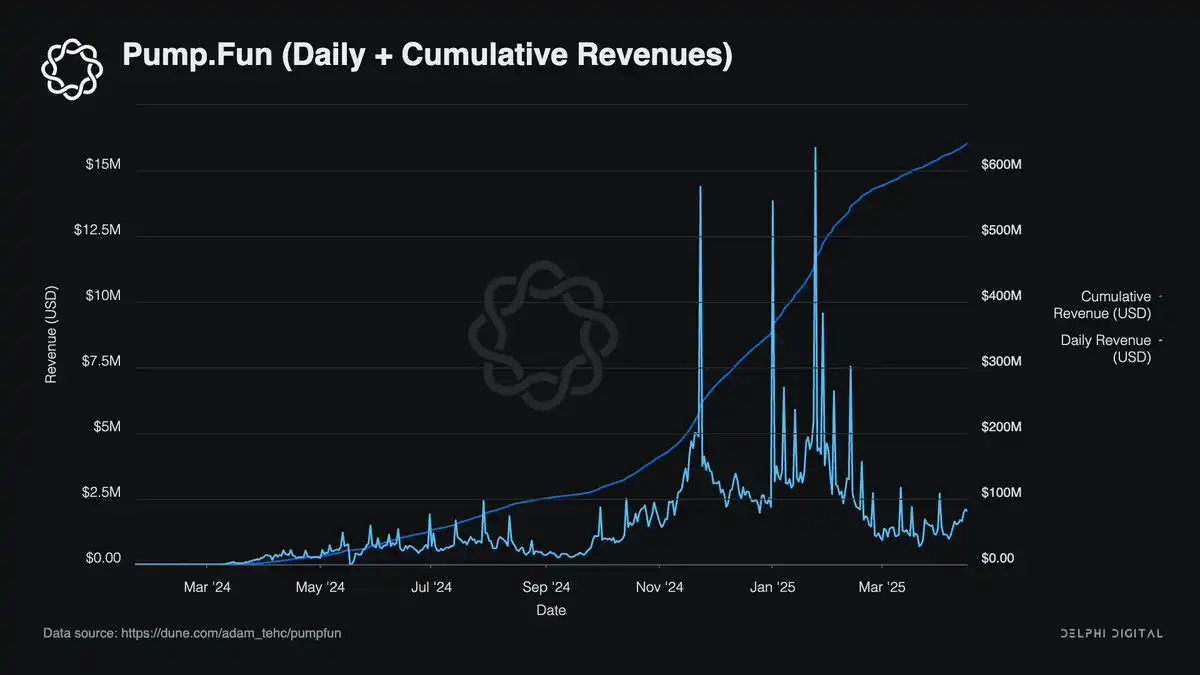

The most successful applications in the space are those that continuously generate revenue, such as: pumpfun, Hyperliquid, Jupiter, and Uniswap. What do they have in common? Fee revenue. These business entities want to control their own order flow and MEV capture, or in many cases, become sovereign application chains, which is entirely reasonable.

Vertical integration seems to be the most cost-effective direction for applications to plug value leaks. As applications scale, the opportunity cost of not doing so only increases. This is good for applications, but not necessarily for underlying infrastructures like Ethereum. We have already seen clear signs of this trend in Unichain and JupNet.

What is Left for the Protocol Layer?

There are two views regarding the future value accumulation of the foundational protocol layer:

Base fees and transaction fees will trend towards zero over time. MEV, as the only remaining source of revenue, will be abstracted by applications seeking to internalize all value. The protocol layer (like Ethereum and Solana) will provide value as a settlement layer but will not capture any value—similar to HTTP and TCP/IP.

Cheap block space will lead to increased demand and a surge in applications. Transaction volume will thus increase to offset low base fees and will re-accumulate value at the protocol layer.

Let’s break down the first scenario:

Possible series of occurrences: · SOL surpasses ETH · We all realize that no one is special, just technology · SOL is surpassed · The value of L1 provides more and more to the world, but the value captured by its tokens decreases relatively · BTC reigns

This view is based on the assumption of complete commoditization of infrastructure. Regardless of data availability, fees, or computing costs, all parts of the stack will trend towards zero over time. The cheap and abundant block space of Rollup and DA layers is eroding Ethereum's transaction monopoly.

Blob-based data inclusion (EIP-4844) will decouple execution from settlement, allowing L2 to choose alternative DA solutions, further reducing the remaining value of ordering and data storage over the past year.

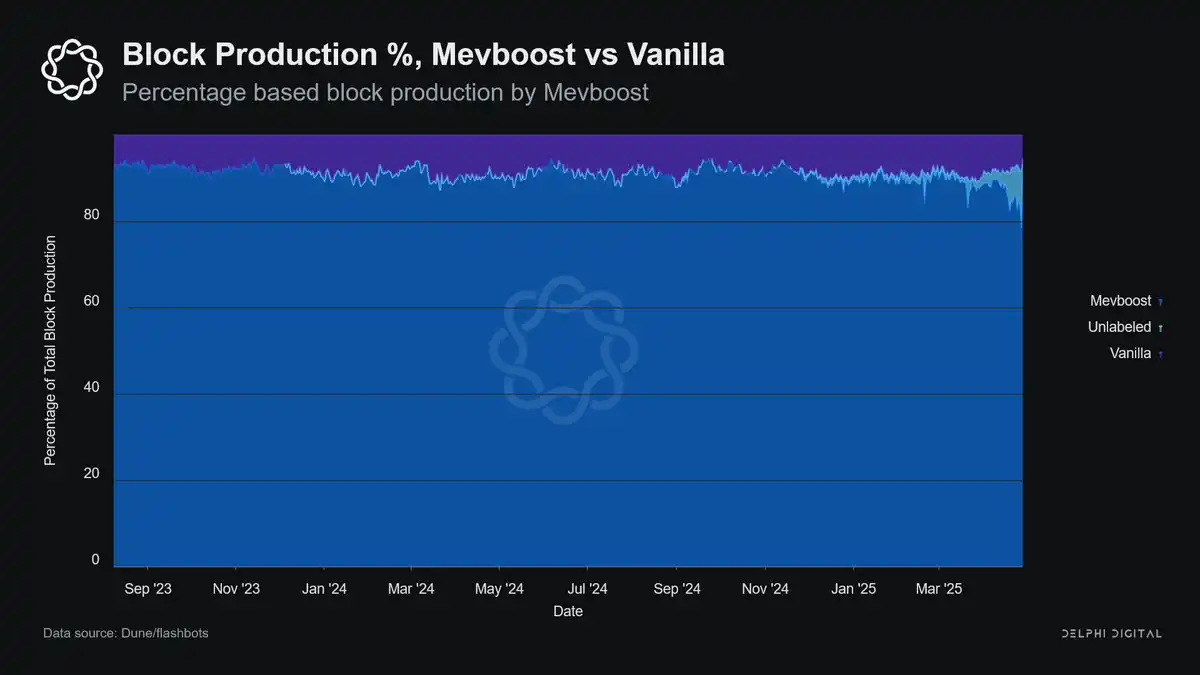

But the main evidence for this direction is the declining share of MEV captured by L1 block proposers. In 2024, most MEV is captured by searchers and relayers through systems like Flashbots, rather than Ethereum validators. Currently, 90% of Ethereum blocks are proposed through MEV-Boost, a significant portion of which is processed by relayers associated with Flashbots.

This does not even consider applications like CoW Swap, which use solver networks to handle matching and execution off-chain, completely bypassing the public mempool and its associated MEV.

The second scenario heavily relies on the demand and transaction volume surge brought about by near-zero fees. It assumes that the abundance of cheap block space will lead to increased consumption, rather than a deflationary effect.

Just as declining computing costs spurred the internet boom, lower transaction fees will unlock new categories of applications and use cases. The main analogy here is that general computing and coordination layers are more akin to AWS or Linux, rather than HTTP. Ethereum and Solana are not just "settling" transactions, but supporting large-scale programmable state coordination.

As usage grows and cost barriers lower, this support for trustless computing becomes more valuable, not less. Low fees will not push value to zero but will expand the addressable market for block space.

- Low fees > Increased network demand

- Increased network demand > Total fee revenue

Token Valuation—What Does This Mean for My Investments?

If I were to summarize one point, it would be: capital allocation will shift in a way that is unfamiliar to many since 2016/17.

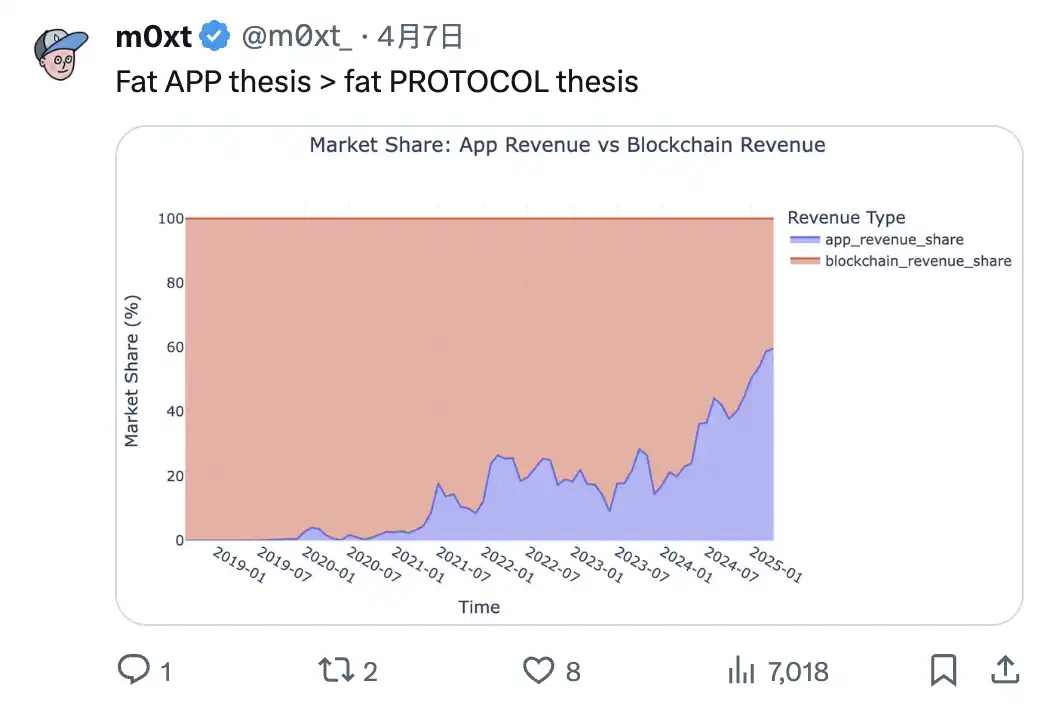

The Fat Protocol Thesis unfortunately implanted a false illusion of L1 premiums subsidized by hundreds of millions in venture capital. However, we are currently at a turning point in the value distribution curve, where the revenue of applications relative to the protocol layer is becoming evident.

Fat App Thesis > Fat Protocol Thesis

In terms of L1 valuations, we have abused the narrative to the extent that these tokens can no longer maintain their prices post-TGE. Hundreds of millions in funding and billion-dollar valuations before mainnet launches have become the norm for L1/L2. The common trend among most new protocols is: prices only fall and do not rise.

This is not to say that infrastructure will become irrelevant; however, the signs of market maturation are evident. Yet, trading in L1/L2 has become saturated. The sentiment of low throughput and high FDV reflects this. Newly launched L1s have FDVs several orders of magnitude higher than those of the previous cycle. Monad, Bera, and Story Protocol all raised nine-figure funding before launch, while Solana only raised $45 million (including public token sales).

The next cycle will not be led by chains competing to reach 100,000 TPS. It will be driven by focused and composable applications that prioritize usage over architecture, sustainability over speculative hype. The winners will be those applications closest to the source of demand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。