Original Title: Fatty Fatty Boom Boom

Original Author: Arthur Hayes

Original Translator: Shenchao TechFlow

Surprisingly, there are many similarities between the "fat aesthetic" advocated by singer Lizzo and the economic imbalance of "Pax Americana." Don't get me wrong; it doesn't matter whether you think "curvy bodies" are an aesthetic. However, the metabolic issues caused by obesity, while sometimes appearing "beautiful," are always deadly. Similarly, while the American economy benefits some, the extreme social disharmony may ultimately lead to revolution.

The waistlines and economic conditions during the "Pax Americana" era were not always so imbalanced. In the mid-20th century, Americans were neither generally obese nor was the economy in severe imbalance. However, over time, the problems gradually worsened.

The food system has been hijacked by Big Ag, which promotes its processed "delicious" but nutritionally deficient lab foods through fabricated nutritional guidelines. Americans have become increasingly obese and developed chronic diseases after consuming these nutrient-poor foods, while Big Pharma has seized the opportunity to launch various drugs to treat the symptoms of these metabolic diseases (like diabetes) rather than the root causes. In the unwillingness to curb the influence of corporations controlling the food supply, the social narrative has shifted to the "fat aesthetic" or "fat is beautiful," telling obese individuals that it is not the corrupt system's fault, but rather they should be proud of their "beautiful bodies." Thus, stars like Lizzo are elevated to idol status; although she is a talented singer, the message she conveys promotes a lifestyle that may lead to premature death. Lizzo represents the status quo of obesity, which is extremely profitable for a few corporate giants.

The American economy has also been hijacked by the "money printer." Before the Federal Reserve was established in 1913, financial panics would ensue when the pace of credit expansion outstripped cash flow support. Some bad companies and some good ones would go bankrupt, allowing the economy to reset, clearing credit and revitalizing the system. However, since the birth of the Federal Reserve, every credit bubble has been accompanied by massive money printing to cope. Since the Great Depression of the 1930s, the imbalance in the American economy has never truly been corrected.

This is the fundamental reason for the imbalance of trade and financial capital during the "Pax Americana" era, rather than the level of tariff policies (Daniel Oliver wrote a brilliant article exploring why excess credit is the root of trade imbalance, while tariffs are merely a red herring). The status quo has led to issues of inequality, despair, and addiction among the general populace, while the "cosmic overlords" controlling stocks, bonds, and real estate assets enjoy unprecedented wealth in human history.

Not all hope is lost; change is still possible, but one can choose the hard way or the easy way.

For decades, the pharmaceutical industry has been marketing drugs that can "miraculously" melt away fat. Remember Fen-Phen? No drug has truly worked. Therefore, the only viable solution is the complex, unpopular, expensive, and low-profit method: going to the gym, reducing the consumption of cheap processed foods, and switching to fresh organic produce. However, even these methods are insufficient to solve the problem, as once in an "obese state," the body adjusts hunger and metabolism to ensure the maintenance of obesity. According to some scientists, it may take up to seven years to change the body's metabolism to support a slimmer physique.

Then, Denmark brought the "easy button." GLP-1 agonists, originally used to treat diabetes, have been found to reduce cravings for food and addictive substances like alcohol and nicotine. Drugs like Ozempic, Wegovy, and Monjaro have significantly reduced weight in a short time. Currently, these drugs have proven safe enough that some believe many formerly obese individuals may take them for life. Thanks to modern medicine, if you can afford it, these injections or pills provide an easy "off switch" for obesity.

Even Lizzo eventually chose this "miracle weight loss drug" to avoid premature death from preventable metabolic diseases. Awesome! However, she may not be invited to campaign for Kamala Harris in 2028… Solving the issue of America's trade imbalance has both painful and painless solutions. For American politicians, implementing policies that cause pain or discomfort to neutral voters will undoubtedly lead to their defeat in elections.

Previously, the Trump administration attempted the hard and painful option but quickly realized that the median voter could not tolerate the high-priced American goods that might take a decade to achieve, nor could they endure the empty shelves resulting from American manufacturers' inability to produce the vast quantities of goods that China once supplied. This dissatisfaction was communicated to Congress members and senators, especially in Republican districts, prompting the Trump team to retreat and now seek other ways to achieve the same rebalancing. Actions to roll back maximum tariffs are underway, with the recent announcement of a bilateral reduction of U.S.-China tariffs to about 10% within 90 days serving as evidence.

A successful general can retreat from a wrong strategy and still achieve victory.

Another politically more acceptable method for American trade rebalancing is to attack the capital account surplus through various forms of capital controls. These capital controls would act as a tax on foreigners purchasing and holding U.S. financial assets. If high taxes cause foreigners to abandon purchasing U.S. financial assets, they must also give up selling cheap goods to the U.S. If foreigners continue to sell cheap goods and buy assets, then tax revenues can be returned to median voters through stimulus checks or reduced income taxes. In this way, Trump could claim he is striking against those "evil foreigners" while providing the American public with lower taxes. This strategy won midterm and presidential elections and achieved the same goal of reducing the influx of cheap foreign goods into the U.S. consumer market and relocating manufacturing capacity back home.

The ultimate result of Trump's shift from hard solutions to easy solutions is that foreign capital will gradually, then suddenly, flee U.S. stocks, bonds, and real estate. Subsequently, the dollar will depreciate against the currencies of surplus countries. The problem facing the U.S., especially Treasury Secretary Bessent, is that if foreigners shift from net buyers to sellers, who will finance the exponentially growing U.S. national debt? The problem facing the governments and businesses of surplus countries is where to "store" these surpluses if they continue to run surpluses. The answer for the former is to print money, while the answer for the latter is to buy gold and Bitcoin.

The core of this article will focus on the mathematical identity of trade, how capital controls work—the "boiling frog" theory, how these taxes affect capital flows in surplus countries, how Bessent explicitly and implicitly prints money to fund the U.S. Treasury market, and why Bitcoin will be the best-performing asset during this global monetary transformation.

Trade Accounting Identity and Geopolitical Issues

Let’s illustrate the relationship between the trade account and the capital account with this ironic example.

It is now 2025, and Trump's election reaffirms that little boys can once again play with action figures. Mattel is re-releasing "He-Man" action figures with AR-15 plastic rifles. Masculinity is back, baby… The spokesperson for the toys is Andrew Tate! Mattel needs to quickly produce a million units at the lowest price. With the U.S. manufacturing base nearly nonexistent, Mattel must purchase these toys from Chinese factories.

Mr. Zhou owns a manufacturing company in Guangdong that produces cheap plastic toys. He agrees to Mattel's terms, one of which is payment in U.S. dollars. Mattel wires the money to Mr. Zhou, and a month later, the toys arrive. Wow, that was fast. Mr. Zhou's profit margin is 1%. Competition in China is fierce. Due to the large volume of orders he handles, the total revenue from Mattel and other similar companies reaches $1 billion. Mr. Zhou must decide how to handle these dollars. He does not want to bring them back to China by converting them into renminbi, as the renminbi has no productive use given the low interest rates on government and corporate bonds. Additionally, banks pay almost no interest on deposits.

Mr. Zhou dislikes all the anti-China rhetoric, as he felt unwelcome during his last visit to the U.S. His daughter attends UCLA, and she receives strange looks for driving the latest Phantom convertible, while ordinary Americans take the Los Angeles subway, or rather, I mean Uber, to class. Therefore, even if U.S. Treasury yields are among the highest government bond yields in the world, he would prefer not to buy those bonds if possible. Mr. Zhou has a favorable view of Japan, and long-term government bond yields are much higher than before. He asks his banker to help him purchase Japanese government bonds (JGB). The banker tells him that the Japanese government does not want foreigners to buy their debt in large quantities, as it would push up the value of the yen, which they want to keep competitive for exports. If Mr. Zhou sells dollars to obtain the yen needed to buy JGBs, the yen will appreciate.

The JGB market is the only sufficiently large market to absorb his surplus, and Japan does not want foreigners to push up their currency's value. Mr. Zhou accepts reality and reluctantly uses his dollar export income to purchase U.S. Treasury bonds.

What impact does this have on the U.S. trade and capital accounts?

U.S. Trade Account:

Trade account deficit: $1 billion

Mr. Zhou's bank account: $1 billion in cash

Purchase: $1 billion in Treasury bonds.

Because these surpluses do not flow back to China, Japan, or elsewhere, but are instead reinvested into U.S. Treasuries:

U.S. Capital Account:

- Capital account surplus: $1 billion

The moral of this part of the story is that if other countries are unwilling to allow their currencies to appreciate, the trade account deficit will convert into a capital account surplus. This is the current situation: no market besides the U.S. is large enough or willing to absorb the global trade imbalance. This is also why, even as the U.S. issues trillions of dollars in debt each year to finance the government, the dollar remains strong. By the way, years ago, China asked Japan if it could buy Japanese government bonds (JGB), but Japan's response was, "No, unless you let us buy Chinese government bonds (CGB)." China replied, "No, you can't buy CGB." Thus, both countries continue to pour their surplus capital into U.S. financial assets.

In the current global trade landscape, any discussion about the renminbi, yen, or euro replacing the dollar as the global reserve currency is nonsense unless China, Japan, or the EU is willing to open their capital accounts and their financial markets are large enough to absorb the income of surplus countries.

Next, Trump announces that the U.S. must revitalize manufacturing and reverse the trade account deficit. His current tool of choice is tariffs. But let’s analyze why tariffs are politically unfeasible.

Using Mattel as an example, they sell cheap toy dolls to little boys. However, most families are financially strapped, with not even $1,000 in emergency savings. If the price of the toy doll rises from $10 to $20, little boy Jonny can no longer afford it. Without tariffs, Mattel can sell the dolls for $10 because they are produced cheaply in China. But now, Trump has imposed a 100% tariff on Chinese goods. Mr. Zhou cannot bear the cost of the tariff, so he passes it on to Mattel. And since Mattel has a profit margin of only 10%, they pass the cost on to consumers.

As a result, the price of the dolls skyrockets to $20. This is too expensive for most families, and they choose to forgo the purchase. Little boy Jonny doesn't understand why his parents won't buy him his beloved gunfight action figure. His parents work hard driving Uber and delivering food, barely making ends meet, and now because Trump has made toys more expensive, their child is throwing a tantrum at home. When the next election comes, will the parents vote for the Republicans or the Democrats?

Before the election, they might diagnose their child with Attention Deficit Hyperactivity Disorder (ADHD) and then give him medication to calm him down. Meanwhile, the Democrats will campaign on "making toys and other goods affordable again," advocating a return to "free trade" policies that allow China to continue flooding the U.S. market with cheap goods. The Democrats will claim that all smart economists agree that "free trade" allows Americans to enjoy cheap goods and maintain their lifestyles, while Trump and his advisors are a bunch of ignorant fools. If things continue on their current trajectory, the Democrats may make a comeback in the 2026 midterm elections.

Can Mr. Zhou avoid tariffs by moving production from China to countries with lower tariffs? Of course.

Since the early 2000s, Mr. Zhou has accumulated significant wealth by investing in factories in Mexico, Vietnam, Thailand, and other locations. He began producing dolls in these places and then shipping them to the U.S. With effective tariffs lowered, he can sell the dolls for $12 instead of $20. Parents can accept spending an extra $2 to avoid their child throwing a tantrum and to prevent their child from relying on prescription drugs too early.

Since Trump has not proposed a uniform tariff across all markets but rather has taken a piecemeal approach with bilateral agreements, savvy manufacturers like Mr. Zhou will always find low-tariff pathways into the U.S. The Trump team is well aware of this, but due to geopolitical considerations—such as whether a country hosts U.S. military bases, sells critical goods to the U.S., or sends soldiers to participate in America's long wars—they cannot completely shut down the economies of allies, or those countries may choose not to cooperate with the "U.S. world police" anymore.

Without a uniform tariff, there will always be countries or regions that become "transshipment arbitrage points." For example, China can leverage TSMC and NVIDIA to obtain advanced semiconductors and AI chips, allowing Chinese goods or those manufactured by Chinese-owned companies to evade the high tariffs on goods exported directly from China to the U.S.

Ultimately, tariffs cannot achieve the goal of significantly reducing the U.S. trade deficit. The American public will not be willing to wait five to ten years until manufacturing returns to a level that allows cheap goods to fill the shelves again. If the trade deficit does not significantly shrink within the next 12 months, Trump's policies will only exacerbate goods inflation, leaving economically distressed citizens with no tangible benefits.

At the end of the day, the problem is not the tariffs themselves, but that for tariffs to truly work, every country must face the same tax rate, with no exemptions or special deals. However, this is not achievable in reality, especially when surplus countries include not just "evil China," but also steadfast allies like Japan and Germany. It is absurd to expect Japan to continue to contain China and Russia on a naval level, host tens of thousands of U.S. troops, and bear over 120 military bases, while simultaneously allowing its manufacturing sector to be crushed by tariffs.

Therefore, this 90-day pause on tariff policies will ultimately become a permanent suspension.

Tax Me, Baby

If attacking the trade account deficit is fraught with domestic political and geopolitical issues, what about turning to the capital account surplus? Is there a way to make foreign investors less eager to accumulate U.S. financial assets? The answer is yes. However, for those wealthy individuals who firmly believe in the glory of the free market, this method may seem dirty and despicable—this is capital controls. Specifically, I am not referring to the U.S. prohibiting or heavily restricting foreign ownership of financial assets (which is the practice of most countries globally), but rather taxing foreign asset holdings. Foreigners can still hold most U.S. financial assets in any amount, but the value of their assets will continuously be taxed at a certain percentage.

These tax revenues will be returned to the American public by reducing their income taxes or through other government subsidies to ensure their support. The result may be that foreigners continue to generate surpluses by selling goods to the U.S., but their earnings are taxed; or they reduce exports to the U.S. to avoid paying taxes; or they turn to purchasing other stateless financial assets, such as gold or Bitcoin.

There are various ways to tax foreign capital. But to simplify the explanation of the tax's effects, let’s assume a tax rate of 2% per year on all foreign capital. Here, we mainly focus on foreign portfolio assets, which are liquid stocks, bonds, and real estate, excluding illiquid assets like factories owned by foreign car manufacturers in Ohio.

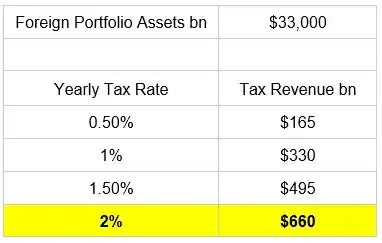

Currently, the total value of foreign portfolio assets is about $33 trillion. Assuming prices remain constant and no capital flows out due to taxes, let’s look at the annual tax revenue.

It is worth noting that the bottom 90% of income earners in the U.S. paid about $600 billion in income taxes in 2022. Therefore, Trump could completely eliminate the income taxes of the vast majority of voters by imposing a 2% capital tax on stocks, bonds, and real estate held by foreigners. This is undoubtedly a highly attractive political strategy.

Next, let’s examine the effects of capital tax vs. tariffs:

Collectability:

The U.S. Treasury has complete control over the banking system and financial markets. They may not know the specific owners of every asset, but they can distinguish whether the asset holders are U.S. entities or foreign entities. Therefore, for financial institutions or local governments, it is relatively straightforward to tax stocks, bonds, and real estate held by non-U.S. entities. In contrast, collecting tariffs is more complex because it is difficult to accurately trace the origin of each product or the value added at each stage of the supply chain. This also makes tariff policies more susceptible to loopholes.

Uniform Tax Rate: One Tax to Rule Them All

The purpose of the capital tax is to eliminate net capital account surpluses, which only requires a uniform tax rate. If foreigners are unwilling to pay this tax, then they should not buy U.S. financial assets. They can reinvest their export revenues in their domestic markets. This tax will not immediately stop exporters from selling cheap goods to the U.S., so the impact on the quantity of trade goods will not be immediately apparent. While capital controls can generate revenue to reduce income taxes, will they help bring manufacturing back to the U.S.?

Assuming exporters do not want to pay a 2% tax each year for holding U.S. financial assets. They believe the post-tax net expected return is too low and choose domestic investment opportunities instead. They sell their assets, convert them back into dollars, and then exchange the dollars for their local currency. The end result is a weaker dollar, while the currencies of surplus countries (like the yen) appreciate. Over time, the dollar will gradually weaken, while the currencies of surplus countries will significantly strengthen. At that point, even without tariffs, goods produced in Japan will become more expensive when priced in dollars—this is the crux of the matter.

Goods made in America will become cheap, while foreign goods will become expensive over time. This process may take decades, but regardless, American voters will benefit from it. Either foreign capital stays, pays taxes, and this revenue is used to eliminate income taxes for most voters; or foreign capital leaves, U.S. manufacturing grows, providing more high-paying jobs, thus improving voters' income levels. In either case, the shelves will not be immediately empty, nor will it trigger inflation in goods prices.

Steady Capital Controls

I am a global macro "DJ," enjoying remixing others' ideas with my own language style and rhythm. Just as every house music track has standard beats, snares, claps, and syncopation, my "beats" revolve around the rhythm of the "money printer," hoping to add interesting "bass lines," "harmony," and "effects" to the text, ultimately presenting a brilliant "breakdown" and "drop" like Solomun.

I say this to emphasize that the idea of using capital controls instead of tariffs to narrow the U.S. trade and capital account imbalances is not new and is not my original thought. During the negotiations of the Bretton Woods system after World War II, economist Maynard Keynes advocated for charging "usage fees" on the capital of surplus countries and recycling it into the capital markets of deficit countries to balance trade and capital flows. Recently, Stephen Miran (current chair of the Council of Economic Advisers) discussed in his paper "A Guide to Restructuring the Global Trade System" how to impose specific types of fees on foreign ownership and trading of U.S. financial assets to force a rebalancing of capital flows. Additionally, a very influential macro analyst (who requested anonymity) has published several articles over the past year arguing that capital controls are necessary and that countries wishing to become U.S. allies must pay for it. Furthermore, Michel Pettis speculated in a recent webinar that tariffs will not significantly reduce the U.S. trade deficit and capital account surplus, concluding that capital controls are on the horizon because the government realizes this is the only way to truly change the flow of funds.

I mention these individuals to demonstrate that today's financial think tanks are advocating for capital controls rather than tariffs. The benefit for investors is that we can observe in real-time how the hardline tariff faction, led by Commerce Secretary Howard Lutnick, executes plans to reduce U.S. imbalances. However, due to the market crash in early April this year, tariff policies were hastily implemented, and internal struggles seem to have ended. Lobbyists for capital controls, like Bessent, are now beginning to take over. My description of the effectiveness of capital controls may be as optimistic as Sam Bankman-Fried (SBF) presenting the financial status of FTX/Alameda to investors. However, implementing capital controls in the "Pax Americana" financial market could have serious consequences. I predict that the way capital controls are implemented will lead to an accelerated rise in Bitcoin prices. This is the core of what I call the "boiling frog theory."

The Unhappened Crash

Due to the negative impact of capital controls on U.S. financial assets, these measures will be implemented gradually. Global financial markets will slowly accept U.S. capital controls as the norm rather than some heretical doctrine. Just as a frog in gradually warming water does not realize it is about to be boiled, capital controls will quietly become the new normal.

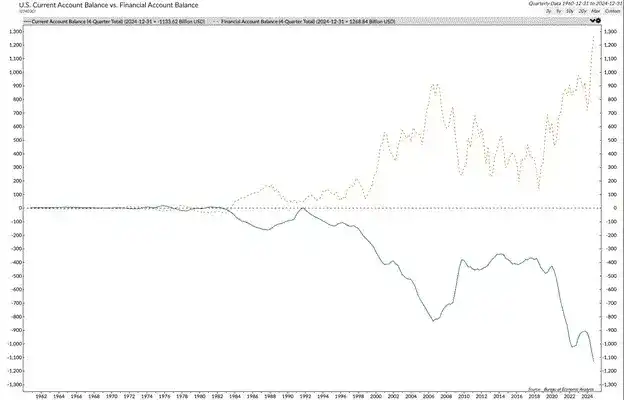

Foreigners earn a large amount of dollars by selling goods to Americans, and they have no choice but to reinvest these dollars in the U.S. stock, bond, and real estate markets. Below are some charts that demonstrate the excellent performance of the U.S. financial markets with the influx of foreign capital. The chart below is the cornerstone of all my analysis. If you are the issuer of a reserve currency and must open your capital account, then a trade deficit will lead to a capital account surplus.

In the next three charts, I use data from 2002 to early 2025, as China joined the World Trade Organization in 2002, and early January 2025 was a period of heightened optimism in the U.S. market regarding "Trump's plan to fix the world."

Since 2022, the MSCI U.S. Index (white) has outperformed the MSCI World Index (gold) by 148%: a special performance of the U.S. stock market.

The total amount of tradable U.S. Treasury bonds (gold) has increased by 1000%, but the yield on 10-year U.S. Treasury bonds has slightly decreased: a special performance of the U.S. bond market.

The working-age population in the U.S. aged 15-64 (gold) has only grown by 14%, but the Cash Shiller National Home Price Index (white) has increased by 177%: a special performance of the U.S. real estate market. This is quite astonishing, as the data from the 2008 global financial crisis is also included.

If taxes are imposed on foreign capital, and it becomes marginally unfeasible for them to invest in the U.S., then mathematically, stock, bond, and real estate prices will inevitably fall. This is a problem for several reasons. If stock prices fall, capital gains tax revenue will decrease, and this tax revenue is a marginal driver of government income. If bond prices fall and yields rise, the government's interest expenses will increase, as it must continue to issue new bonds to fund a massive deficit and roll over the existing $36 trillion debt. If home prices fall, the middle class and wealthy baby boomer Americans, who own most of the real estate, will see their net worth collapse just when they need that wealth to fund years of retirement. These individuals will vote against the incumbent Republicans in the November 2026 midterm elections.

"Pax Americana" relies on foreign capital; if capital controls are implemented and foreign capital leaves, it will be bad news for the economy. Can politicians, the Federal Reserve, and the Treasury take measures to replace foreign capital and maintain stability in the financial markets? Remember that four-four beat, the Brrr button. Everyone knows the answer. The answer is the same as always. If foreigners do not provide dollars, the government will provide them through the money printer. Here are the policies that the Federal Reserve, Treasury, and Republican lawmakers will adopt to replace foreign capital:

Federal Reserve:

- Stop quantitative tightening (QT) on mortgage-backed securities (MBS) and Treasury bonds.

- Restart quantitative easing (QE) for MBS and Treasury bonds.

- Exclude MBS and Treasury bonds from the supplementary leverage ratio (SLR).

Treasury:

- Increase the number of Treasury bond repurchases each quarter.

- Continue issuing a large number of short-term Treasury bills (1-year maturity) instead of long-term Treasury bonds (>10 years maturity).

Republican Lawmakers:

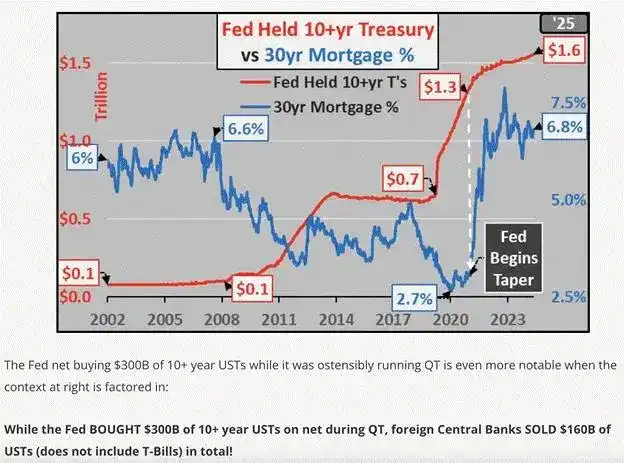

End the conservatorship of Fannie Mae and Freddie Mac (the two major housing mortgage agencies in the U.S.). It doesn't take much imagination to see Treasury and Republican lawmakers following Trump's orders, but why would the Federal Reserve act at Trump's request? The answer to this question is that it is the wrong question. The Federal Reserve has already been acting behind the scenes at the request of Trump and Bessent. Look at this beautiful example marked by Luke Gromen:

The Federal Reserve is shrinking its balance sheet. However, it has some discretion in how to achieve this, especially since the policy's task is net reduction, not uniform reduction across all maturity categories. Yellen and now Bessent need to fund the government's massive debt. Foreign investors and the U.S. private sector like to buy Treasury bills because they are short-term bonds that pay interest, making them high-yield cash alternatives that are more popular than low-yield bank deposits. But no one wants to buy long-term Treasury bonds, i.e., those with maturities of 10 years or more. To help Yellen and now Bessent raise funds, the Federal Reserve has provided significant support by conducting quantitative easing (QE) for 10-year Treasury bonds. Powell cites the government deficit as a problem but continues to use the money printer to keep 10-year yields at politically acceptable low levels, which is very dishonest.

Given that Powell is already conducting covert quantitative easing for Treasury bonds, he will also accept requests from the BBC and powerful commercial banks (like JPMorgan CEO Jamie Dimon) to stop quantitative tightening (QT), restore quantitative easing (QE), and grant supplementary leverage ratio (SLR) exemptions. I don't care how stubborn he is in his press conference responses to Trump's calls for looser monetary conditions. Powell's position is fixed; he will not leave. Now, let's keep moving.

These measures will provide money printing through various channels to replace the foreign capital lost due to capital controls and will elevate stock, bond, and real estate prices in the following ways:

Bond prices will rise, and yields will collapse. Due to the Federal Reserve's quantitative easing policy, it will purchase bonds. Banks will buy bonds because they can use unlimited leverage to do so, and they will rush to buy before the Federal Reserve. With a lower discount rate applied to future earnings, the overall stock market will rise; certain sectors will benefit more than others. Manufacturing companies will benefit the most as credit costs decrease and availability increases. This is a direct result of the decline in government bond yields and banks having more balance sheets to lend to the real economy.

Because mortgage rates will decrease, home prices will rise. The Federal Reserve's quantitative easing purchases of mortgage-backed securities will lower mortgage rates. As Fannie Mae and Freddie Mac rush to re-enter the loan underwriting business, leveraging their implicit government guarantees, the availability of credit will increase. Don't expect these policies to be implemented overnight. This is a multi-year process, but it must happen; otherwise, the U.S. financial markets will collapse. Given that politicians cannot handle the financial crisis a week after liberation day, they will always press the money printing button in some way.

Will They Withdraw Capital?

Before concluding my Bitcoin price prediction, we must raise a significant question: Will foreign capital withdraw? If so, are there any signs that this hypothesis is becoming a reality?

My hypothesis, which aligns with the views of many other analysts, is that the rapid appreciation of certain Asian export currencies (such as the New Taiwan Dollar and the South Korean Won) in recent weeks suggests that capital flows are reversing. Therefore, this provides credible evidence for the view that capital controls are imminent, while also indicating that some forward-looking market participants are withdrawing in advance. Additionally, the finance ministers responsible for monetary policy are allowing their currencies to appreciate because this specific arbitrage trade is gradually being unwound.

Private capital from Asian enterprises, insurance companies, and pension funds typically moves with market trends. Since the 1997-1998 Asian financial crisis, Asian exporting countries have devalued their currencies and adopted a policy of manipulating their currencies to depreciate against the dollar. Since then, Asian private capital has been doing the following:

- Keeping capital earned overseas abroad.

- Transferring domestic capital overseas, primarily into U.S. financial markets for higher returns.

Essentially, this is a massive arbitrage trade. Ultimately, this capital must either be returned to local shareholders in the form of local Asian currency or meet liabilities denominated in local Asian currency. Therefore, Asian private capital is effectively shorting their own currencies. In some cases, they even borrow domestically because the central bank has created a large amount of domestic currency bank deposits to keep their currency weak, resulting in very low domestic interest rates. Meanwhile, Asian private capital holds long positions in high-yield dollar assets (such as stocks, bonds, and real estate). They do not hedge these dollar long positions because the state-supported policy itself is manipulating the currency price downward.

This arbitrage trade will unwind under two conditions:

- The yield spread between U.S. and local financial assets narrows.

- Asian currencies begin to appreciate against the dollar.

Capital controls reduce the net return on U.S. financial assets. If the net return declines, or if market expectations indicate that this trend will continue due to rising foreign capital tax rates, then capital from the Asian private sector will begin to unwind its arbitrage trades. They will sell stocks, bonds, and real estate, then convert dollars back into local Asian currencies. Marginally, this will lead to a decline in the prices of certain U.S. financial assets while Asian currencies appreciate against the dollar.

In terms of U.S. assets, the first and most critical battleground will be the U.S. Treasury bond market, especially the long-term bond market for maturities of 10 years and above. This market is most susceptible to foreign sell-offs because almost no one wants to hold these "junk bonds." Correspondingly, the currency market battleground will be the currencies of certain Asian exporting countries.

When the USD/KRW price falls, the won appreciates against the dollar. Many sovereign and private foreign funds are also engaging in similar arbitrage trades. If the flow of Asian private capital is reversing, then these funds must also unwind their positions. Therefore, even before the scale and scope of U.S. capital controls are clearly defined, foreign investors holding U.S. assets and local currency liabilities must begin to sell stocks, bonds, and real estate and repurchase their local currencies.

Ultimately, the slow and irreversible rise in 10-year Treasury yields will force the Federal Reserve, Treasury, and politicians to implement partial or full monetary printing measures. As capital flows back, yields will rise. Given the significant leverage embedded in the system, the strike price for financial market yields is between 4.5% and 5% for 10-year Treasury bonds. As yields rise, volatility in the bond market will increase, which can be observed through the MOVE index. Remember, when this index exceeds 140, policy action is immediate and inevitable. Therefore, even if rising yields constrain the stock market rebound, Bitcoin will see an acceleration in monetary printing through this weakness.

The Bloomberg Asian Dollar Index (gold) versus the U.S. 10-Year Treasury Yield (white). When the dollar index rises, Asian local currencies strengthen, and we see the 10-year yield correspondingly increase.

Lifeboat

As U.S.-China relations gradually fracture, global financial markets will trend towards balkanization. National interest-first monetary policies will require capital controls, which will be implemented in various places, including the U.S. No matter who you are, there is no guarantee that your capital can be invested in the highest-yielding, lowest-risk assets of the statutory financial system globally. In the past, gold was the only liquid connection between different financial systems, but now Satoshi Nakamoto has given believers Bitcoin!

As long as there is the internet, you can exchange fiat currency for Bitcoin.

Even if centralized trading platforms are banned and banks are prohibited from processing Bitcoin-related transactions, you can still exchange fiat currency for Bitcoin. Since 2017, China has effectively banned centralized trading platforms from operating on centralized limit order books. The over-the-counter Bitcoin market in mainland China remains very active. So take your money out now! Listen to my speech at the crypto finance conference earlier this year to understand why capital controls are about to be implemented in the EU.

A big question is whether the Trump team will attempt to sink both gold and Bitcoin, the lifeboats of global capital. I don't think so, because he and his aides believe that the arrangement of U.S. Treasury bonds becoming a global reserve asset after 1971 has not benefited the segment of Americans that put them in power. They believe that the financialization of the U.S. has led to a decline in military preparedness, manufacturing capacity, and social harmony. To address this issue, gold and/or Bitcoin will be elevated as neutral global reserve assets. National imbalances will be balanced by gold, while the private sector will use Bitcoin.

We know the Trump team has a positive attitude towards gold because it was exempted from tariffs from the start. We also know the Trump team has a positive attitude towards Bitcoin due to changes in various regulatory agencies. While I believe these measures may not be sufficient for a truly fair expansion of Bitcoin under Pax Americana, you cannot deny that the retreat of law enforcement agencies is an important step in the right direction. Considering we know that the total amount of foreign portfolio assets is $33 trillion, the next question is how much capital will flow out of the U.S. and into Bitcoin. Depending on how quickly you want this to happen, it determines what proportion of assets will flee to Bitcoin.

What if 10% of these assets ($3.3 trillion) flow into Bitcoin over the next few years? At current market prices, the Bitcoin held on trading platforms is about $300 billion. If ten times that capital tries to squeeze into the market, prices will rise far more than tenfold. This is because the final price is set at the margin. Of course, if the price skyrockets to $1 million, long-term holders will emerge and sell their Bitcoin for fiat currency, but as these portfolio assets migrate to Bitcoin, an epic short squeeze will follow.

Bitcoin is the superior vehicle for capital flows in the balkanized global financial landscape because it is a digital holding asset. Storing and transferring wealth does not require intermediaries. While gold has a 10,000-year history as a stateless capital, it can only circulate in digital form as paper. This means that financial intermediaries must be trusted to store your physical gold, and then you trade a digital receipt. These intermediaries will be constrained by financial regulations aimed at isolating capital domestically for taxation to fund state-prioritized industrial policies. Therefore, unless you are a state or quasi-state actor, gold as a physical holding asset cannot move quickly in the global digital economy. Bitcoin is the perfect and only lifeboat for global capital that must leave the U.S. and elsewhere.

Additional bullish momentum will come from the actual default of the U.S. on its massive national debt. A bond with a face value of $1,000 will yield $1,000 at maturity, meaning nominally you will recover your principal. However, the future $1,000 will buy fewer units of energy. The U.S. has been seriously defaulting on the real value of its Treasury bonds since the 2008 global financial crisis when they decided to solve the problem by printing money. But after COVID, the pace of default has accelerated. This trend will accelerate again as the Trump team seeks to revive the U.S. economy by devaluing Treasury bonds relative to hard currencies like gold and Bitcoin. This is the real insight gained from the "Liberation Day" tariff debacle. As businesses rebuild better domestically, nominal growth will surge; however, high nominal GDP growth in terms of units will not match the high nominal yield rates of Treasury bonds and bank deposits. This inflation will manifest in future gold and Bitcoin prices as it has in the past.

This chart shows the performance of the U.S. Long-Term Treasury ETF (TLT) priced in gold (gold) and Bitcoin (red), with a baseline of 100 since 2009. From 2021 to the present, Treasury bonds have depreciated by 64% and 84% compared to gold and Bitcoin, respectively.

The repatriation of foreign capital and the depreciation of the massive U.S. national debt will become the two main catalysts driving Bitcoin to reach $1 million between now and 2028. I mention 2028 because that is the time of the next U.S. presidential election, at which point it is uncertain who will win and what policies will be implemented. Perhaps, through some divine intervention, the American public will be ready to accept the "currency hangover" brought about by a century of profligacy and eliminate the rotten credit that is destroying society. Of course, I don't hold out much hope for this, but it's not entirely impossible. Therefore, now is the time to seize the opportunity; when the "Sun King" (referring to the current market environment) shows favor towards Bitcoin, don't miss out.

Trading Strategy

From a macro perspective, as the Chief Investment Officer (CIO) of Maelstrom, I have completed my task. At the end of January, I reduced risk and increased fiat holdings. Then, from the end of March to early April, I gradually re-entered the market. During the week of the financial market crash on "Liberation Day," we maximized our exposure to cryptocurrencies. Now it is time to decide which quality "shitcoins" will outperform Bitcoin in the next wave of the bull market.

I believe this time the market will reward those "shitcoins" that have real users, where users pay real money for products or services, and the protocols return part of the profits to token holders. Two projects stand out, and Maelstrom bought in at the lows: $PENDLE and $ETHFI. Pendle will dominate the crypto fixed income trading market, which I see as the largest undeveloped opportunity in the crypto capital market. Ether.fi will become the "American Express" of the crypto space, a prototype crypto financial institution aimed at wealthy holders. I will comment further on these "shitcoins" in subsequent articles.

While I believe Bitcoin will reach $1 million, that does not mean there are no opportunities for tactical short positions. Capital controls and monetary printing are imminent, but the road from now until then is fraught with challenges. The Trump team has not fully bet on capital controls, so it can be expected that those who hope Trump will lead the empire in a different direction will raise their voices again. Trump does not have a fixed ideology; he will adjust his direction based on environmental constraints, navigating twists and turns to achieve his goals. Therefore, the trend is your friend—until it is not.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。