ICM is a hybrid model driven by blockchain that combines crowdfunding, structured markets, and online communities.

Author: Pink Brains, Blockworks Research

Compiled by: Deep Tide TechFlow

The recent emergence of Believe has not only created a wealth effect for Launchcoin but has also sparked interest in the new narrative of ICM (Internet Capital Markets) in an otherwise stagnant market.

Some say it looks no different from crowdfunding; others argue it revitalizes the financing channels for Web2 companies, allowing the attention market to directly fund and price a company through social media posts.

We have compiled various interpretations from external sources to help you quickly understand this narrative from a data perspective.

The following content is sourced from: @PinkBrains and @Blockworks

The crypto market has never stopped redefining the way tokens are issued:

ICO/IEO → IDO → Fair Launch/Launchpads → Points Farming Model → Bonding Curves

If you missed it, the new trend might be ICM (Internet Capital Markets).

@believeapp is disrupting project financing on Solana with its "Tweet-to-Token" model. This model allows anyone to issue tokens simply by replying to a tweet.

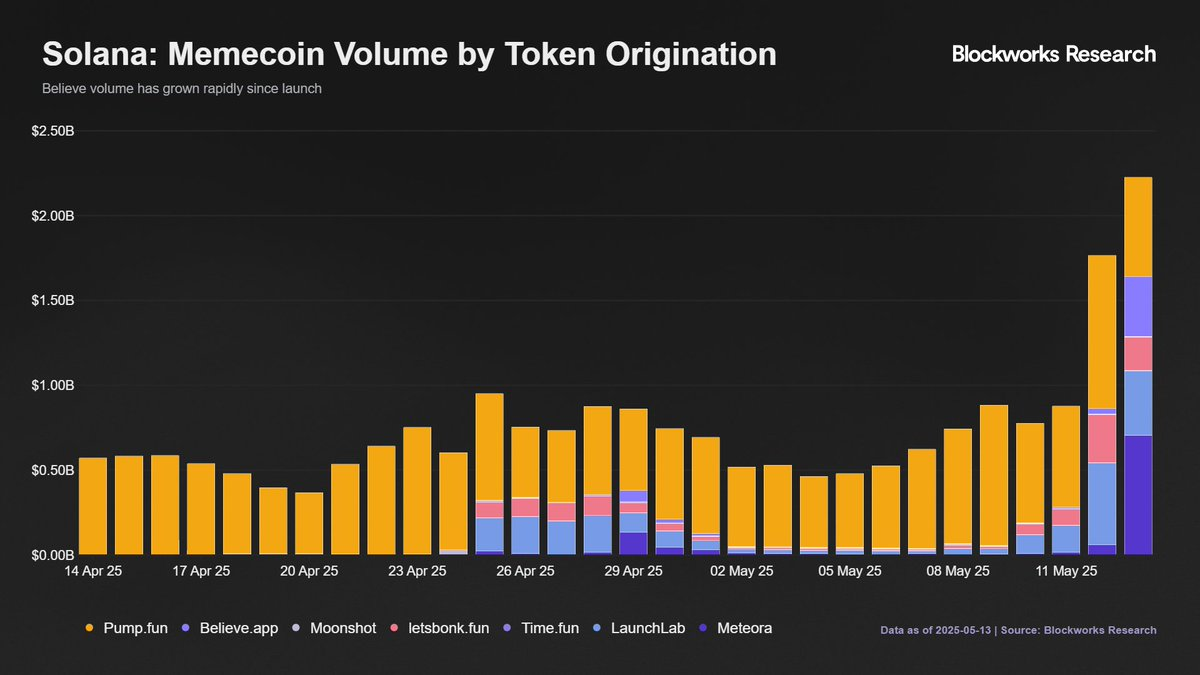

Currently, it has become the third-largest memecoin issuance platform, following @pumpdotfun and @MeteoraAG.

What is ICM?

2017-2022: Anonymous users created Memecoins.

2023-2024: Anyone can issue their own tokens, but mostly for entertainment.

2025: Everyone can tokenize their ideas and raise funds via the internet, like a "decentralized Y Combinator."

This is a hybrid model driven by blockchain that combines crowdfunding, structured markets, and online communities.

What does ICM look like?

Suppose you developed a cool application, it became popular, and you want to raise funds for the next stage. You have the following options:

Schedule a venture capital (VC) meeting, endure 50 rejections, and possibly lose control of the project;

Struggle on Kickstarter, praying that strangers believe in you;

Or simply "Tweet-to-Token," receiving funding support in real-time from your community without intermediaries. People who like your project become your early investors directly.

This is the allure of Internet Capital Markets (ICM).

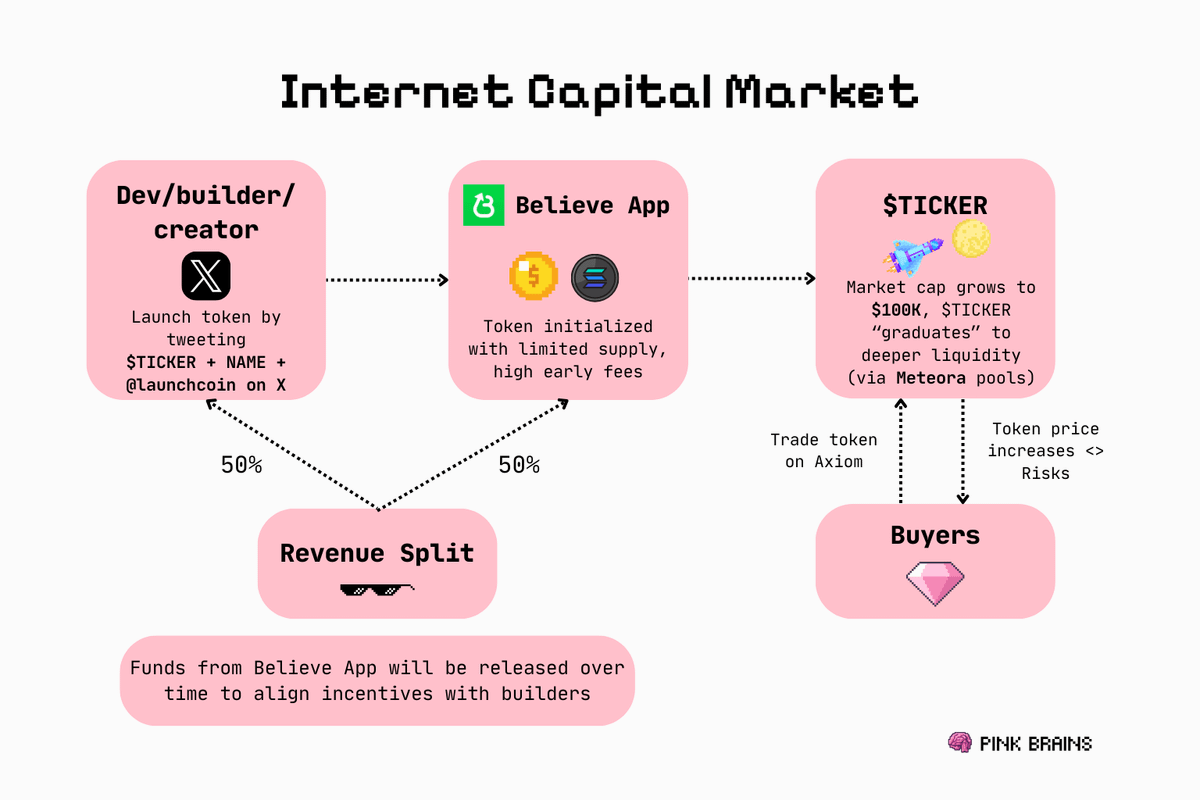

How does @believeapp achieve all this?

The answer lies in its "Tweet-to-Token" model and its flywheel effect:

You tweet to create a token;

The bonding curve initiates trading;

When the token's market cap reaches $100,000, it can "graduate" into Meteora's deep liquidity pool;

Transaction fees are split 50% between the creator and Believe;

If your project stands out, Believe App will prominently feature it on the platform;

Founders receive funds in stages.

Unlike points models or private sales, Believe's model lowers the barrier to token creation to just one tweet.

This permissionless capital forms a reflexive cycle:

More creators → Better issuances → More traders → More transaction fees → More creators.

What is the vision? To democratize venture capital.

Users simply reply to a tweet, entering "@launchcoin + name," to mint a new token, aiming to convert online attention into permissionless capital.

This significantly lowers the barrier to issuing tokens on Solana.

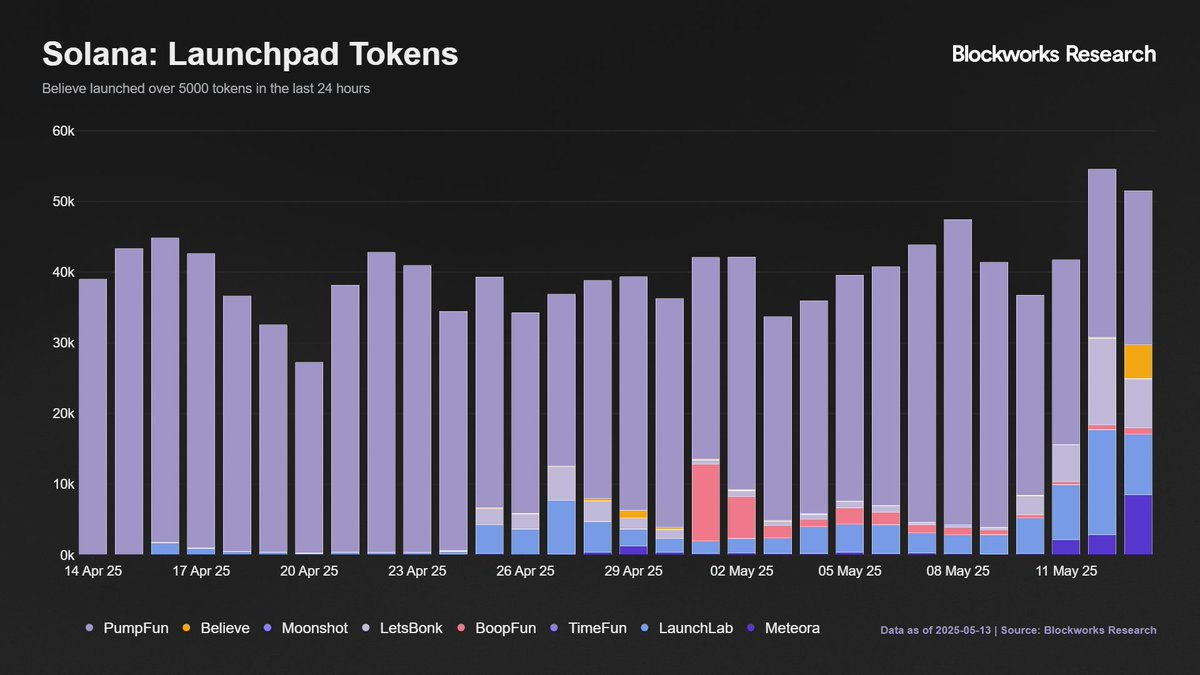

In the past 24 hours, over 5,000 tokens have been launched on the Believe platform.

This achievement ranks it third in terms of token issuance, capturing 14% of the market share.

New tokens start with a bonding curve and have anti-snipe fees.

If the market cap reaches $100,000, these tokens can "graduate" into the Meteora decentralized exchange (DEX) pool for deeper liquidity.

Creators can earn 50% of the transaction fees, incentivizing more participation.

@believeapp is rapidly gaining traction, targeting "utility coins" and aiming at Web2 developers.

There is a gap in the market for undervalued venture capital businesses, and Believe is poised to fill this void.

However, regulatory uncertainty remains high. Believe refers to tokens as "digital merchandise" rather than equity, but scrutiny from the U.S. Securities and Exchange Commission (SEC) remains a key uncertainty.

Market volatility is extremely high, similar to memecoins, which means there is potential for quick gains, but also significant risks of losses.

Believe's "Tweet-to-Token" is an engaging SocialFi experiment that provides unprecedented convenience for token issuance.

However, its sustainability depends on whether it can create real value beyond the hype.

Why is everyone interested in this?

ICM is timely:

This is the era of "vibe coding," and ICM fills the gap where undervalued internet ideas cannot adapt to traditional venture capital models;

Social media has become a distribution engine;

Memecoins have already proven the power of community;

Solana is driving this new narrative.

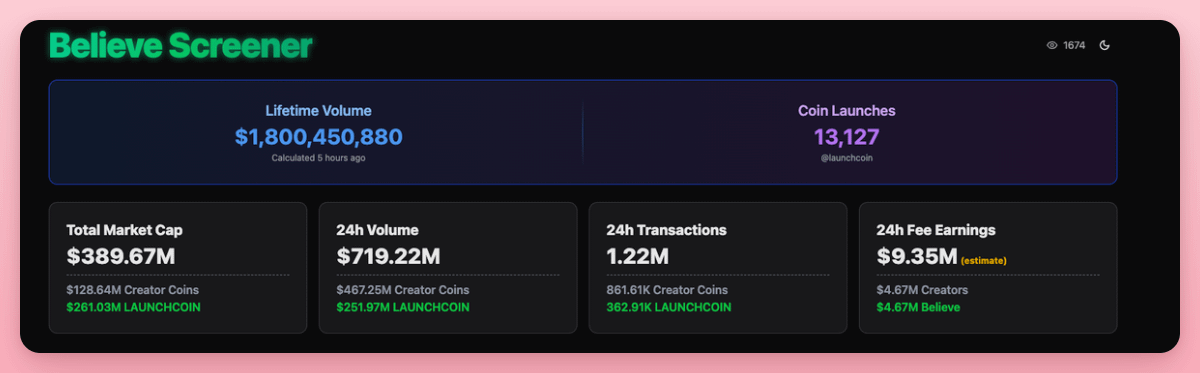

How is @believeapp performing?

Performance is outstanding.

Believe App currently ranks third in issuance volume, only behind @pumpdotfun and @MeteoraAG.

It has issued over 13,000 tokens, capturing 14% of the market share, with 24-hour transaction fee revenue exceeding $9 million, which is astonishing.

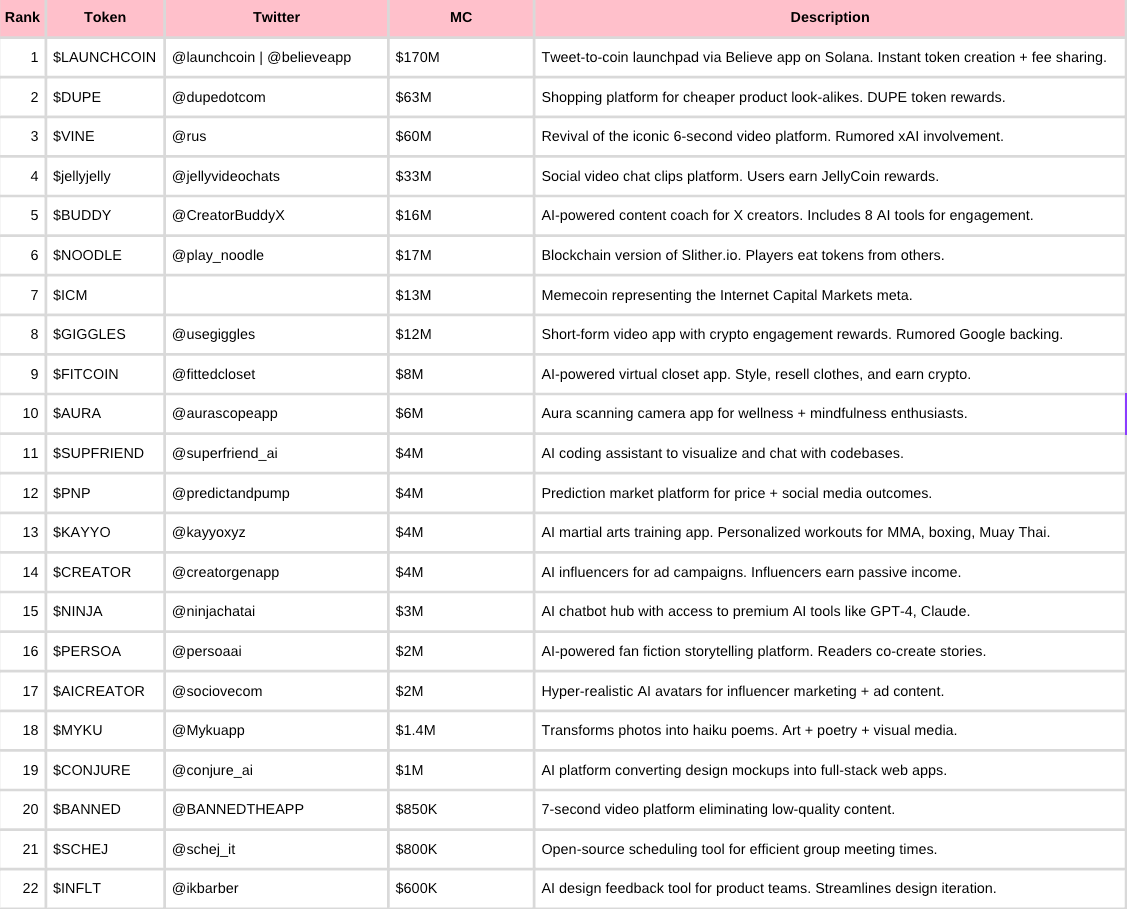

ICM Projects

Here are some popular projects launched through @believeapp's Launchcoin:

Among them, $LAUNCHCOIN (launched by @launchcoin) peaked at a market cap of $352 million (growing 50 times in 3 days).

Data may change while reading.

Other token issuance platforms on Solana:

@pumpdotfun, @MeteoraAG, @RaydiumProtocol: The earliest memecoin factories on Solana;

@boopdotfun: A newer, KOL-centered issuance platform offering structured rewards, including airdrops and fee sharing for $BOOP stakers.

What Believe App is doing is full of SocialFi energy:

Can frictionless token creation build a real ecosystem? Or will it be crushed by its own hype cycle?

We cannot determine that at this moment.

But you should explore cautiously, as everyone is watching the progress of all this.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。