This content is provided by a sponsor.

As of April 2025, Solana’s decentralized application (dApp) ecosystem has seen significant swings in revenue and activity. Here’s a look at the latest trends—and the emerging opportunities they reveal:

Recent Revenue Trends

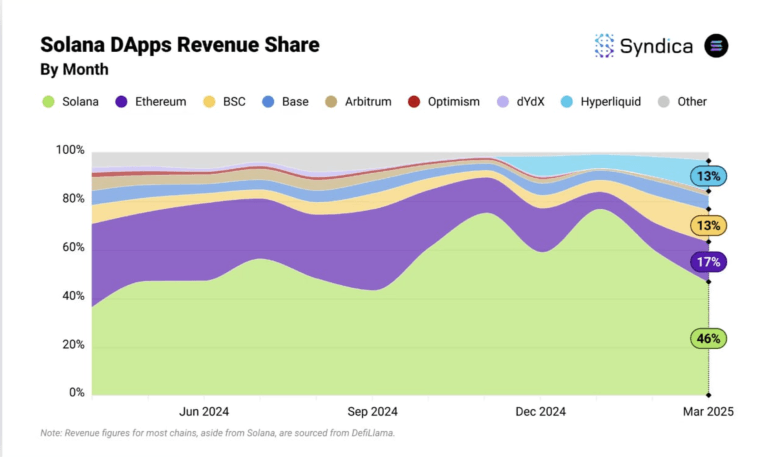

In March 2025, Solana’s dApp ecosystem generated $146 million in total revenue, capturing 46% of all Web3 dApp revenue. This represents a decline from $300 million in February and a peak of $650 million in January. While the drop reflects a short-term cooldown in user activity, especially in speculative sectors like memecoins and decentralized exchanges (DEXs), it also signals a maturing market.

Q1 2025 Performance: A Record-Breaking Quarter

Despite March’s pullback, Solana achieved a record-breaking quarter. Solana-based dApps generated $1.16 billion in revenue during Q1 2025—the highest quarterly total on record. The strong performance in January and early February, particularly across memecoin platforms and DEXs, underscores Solana’s position as a leading high-performance platform for Web3 applications.

Solana also led all Layer 1 and Layer 2 blockchains in network-level revenue, posting $819 million in transaction fees and out-of-protocol earnings. This figure surpassed the combined revenue of Ethereum, Tron, and Bitcoin, further establishing Solana’s dominance in both activity and protocol-level economics.

Key Drivers of Activity

- Memecoins: Platforms like Pump.fun(https://x.com/pumpdotfun) were major revenue drivers early in the quarter, but activity fell sharply in March, with Pump.fun experiencing a 95% revenue decline. Nevertheless, the launch of PumpSwap, an automated market maker (AMM) released on March 20, quickly gained traction and helped sustain user engagement during the slowdown.

- DEXs: Jupiter Exchange(https://x.com/JupiterExchange) maintained strong performance with $22 million in March revenue, driven largely by its Perpetuals (Perps) product. In contrast, platforms like Raydium(https://x.com/RaydiumProtocol) saw a marked decline in usage and fee generation, contributing to the broader slowdown in the DEX category.

- Consumer Apps: DeFi and NFT infrastructure remained active, with Kamino(https://x.com/KaminoFinance) generating $2.7 million from lending services, Metaplex(https://x.com/metaplex) earning $1.3 million through NFT minting tools, and Magic Eden(https://x.com/MagicEden) bringing in $400,000, accounting for 97% of Solana’s NFT marketplace revenue.

Innovation in Action: Solana’s Emerging dApp Frontiers

If revenue charts tell the story of market momentum, then individual dApps reveal the creative engine behind Solana’s ecosystem. In Q1 2025, several breakout projects pushed the boundaries of what’s possible on-chain—spanning creator monetization, real-world assets, gamified behavior, and social tokenization. These aren’t just applications; they’re early signals of how Web3 might permeate everyday life.

Redefining Everyday Value: Time, Steps, and Participation

Projects like Time.fun(https://x.com/timedotfun) and Moonwalk Fitness(https://x.com/moonwalkfitness) show how Solana is powering a new era of behavior-linked finance.

- Time.fun transforms personal time into tradable digital assets. By letting creators auction or trade minutes of their attention, the platform turns scheduling into a dynamic, liquid market—blurring the line between fan engagement and creator economy infrastructure. The concept has gained strong traction, backed by a $3M seed round led by Brevan Howard Digital.

- Moonwalk Fitness gamifies healthy habits. Users stake tokens on daily step goals, with financial incentives driving consistency. It’s not just “move-to-earn”—it’s a social experiment in turning wellness into Web3-native accountability. The project raised $3.4M to expand its incentive-based fitness ecosystem and integrate with mainstream platforms like Google Fit and Apple Health.

Blending Reality and the Blockchain: RWA & Viral Game Mechanics

Web3’s promise of programmable ownership finds fresh ground in real-world and immersive use cases.

- Bloom Protocol (https://x.com/BloomProtocolAI) is a modular crowdfunding platform designed to help early-stage builders—from both Web2 and Web3—raise capital, validate supporters, and grow with their communities before launching tokens or giving up equity. In a world where AI and low-code tools make it easier than ever to build a product, Bloom fills the critical gap in turning those products into sustainable businesses. With milestone-based microfunding, quest-driven growth, and reputation-backed referrals, Bloom empowers builders to move from idea to traction with aligned backers. Whether launching an app or a protocol, builders use Bloom to go from product to business with community-first momentum.

- dVIN Labs(https://x.com/dVINLabs) brings luxury wine into the blockchain era. Bottles are tokenized, tracked, and linked to “Tasting Tokens™” that activate when opened—merging physical goods, supply chain visibility, and experiential NFTs. At Solana Breakpoint, the project distributed 3,000 NFT champagne bottles valued at $1M, showcasing how blockchain can elevate luxury and traceability.

- Infected.fun(https://x.com/infecteddotfun) uses a virus-spreading game mechanic to drive user growth and speculation. Players compete to “infect” wallets by sending tokens, with leaderboard rewards and bonding curves creating both excitement and economic stakes. More than 132,000 users joined the game in just 48 hours, making it one of the most viral on-chain experiments of the quarter.

From Ideas to Tokens: Social Virality Meets Real Utility

Solana’s low fees and high speed enable new kinds of expression.

- News2Pump(https://x.com/news2pump) turns viral tweets into on-chain tokens. Anyone can launch a token from a single tweet, and both creators and tweet authors share in transaction revenue. This injects financial logic into internet culture, rewarding meme creators and fueling spontaneous micro-economies. Within just 48 hours of launch, the platform saw 300 token creations and $300K in trading volume—demonstrating how quickly ideas can become markets.

- Dripster.fun(https://x.com/dripsterdotfun) bridges digital creativity with physical production. Designs—like custom phone cases—can be submitted, minted as tokens, and unlocked for manufacturing once value milestones are reached. It’s Kickstarter reimagined for tokenized manufacturing pipelines. Launch day activity saw $3M in trading volume and 3,000 unique token holders, validating demand for Web3-native product launches.

These projects, though varied in style and scope, all point to a single truth: Solana is no longer just a trading chain—it’s becoming a playground for experimental utility. Whether tokenizing time, reshaping social content, or redefining how we buy, move, or play, the ecosystem’s creative frontier is wide open.

Why It Matters: Strength Beyond the Metrics

Solana’s Q1 revenue performance is a headline achievement—but it’s the underlying developer activity, category diversity, and consumer experimentation that point to long-term health. The March cooldown should be read in context: speculative froth may fade, but innovative applications—from tokenized time to decentralized fitness—are gaining real traction.

Conclusion

Solana continues to lead the blockchain application space not just in numbers, but in real product innovation. As high-impact projects push into new verticals and Solana maintains its technical edge, the ecosystem is well-positioned for its next wave of growth.

_________________________________________________________________________

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。