Prediction marketplaces such as Polymarket—a decentralized, blockchain-based platform—and Kalshi—a regulated U.S. market—have become the go-to destinations over the past year for forecasting future outcomes.

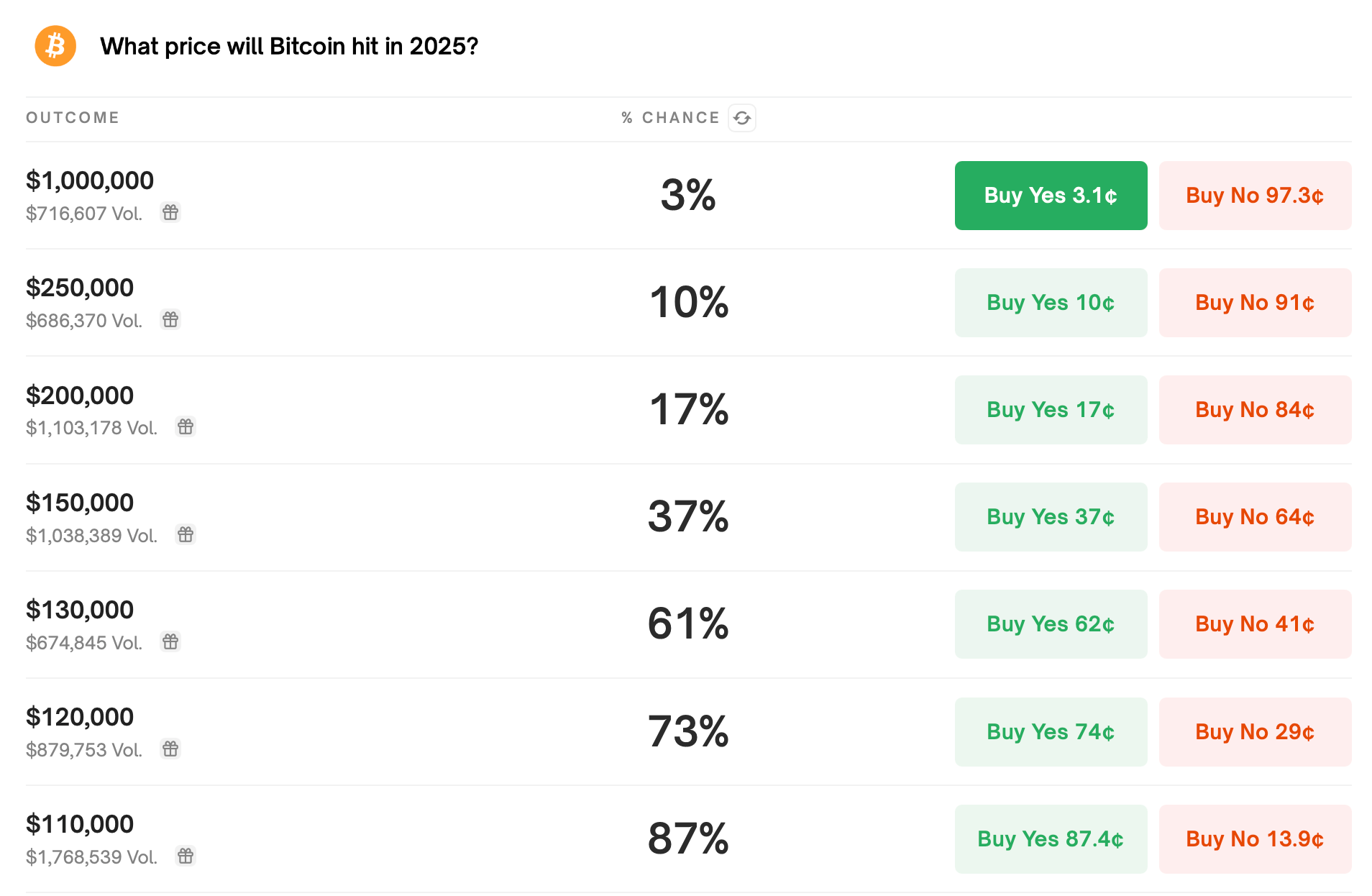

Among this year’s forecasts is bitcoin’s valuation, and Polymarket participants predict BTC will remain above $100,000 at year’s end. Indeed, with $9.51 million in trading volume, participants assign an 87% probability of bitcoin entering the $110,000 bracket.

Source: Polymarket

The wager assigns a 73% probability that BTC will breach $120,000, with a 61% likelihood of testing $130,000 by Dec. 31, 2025. 37% of Polymarket market participants deem $150,000 attainable, while 17% wager on $200,000.

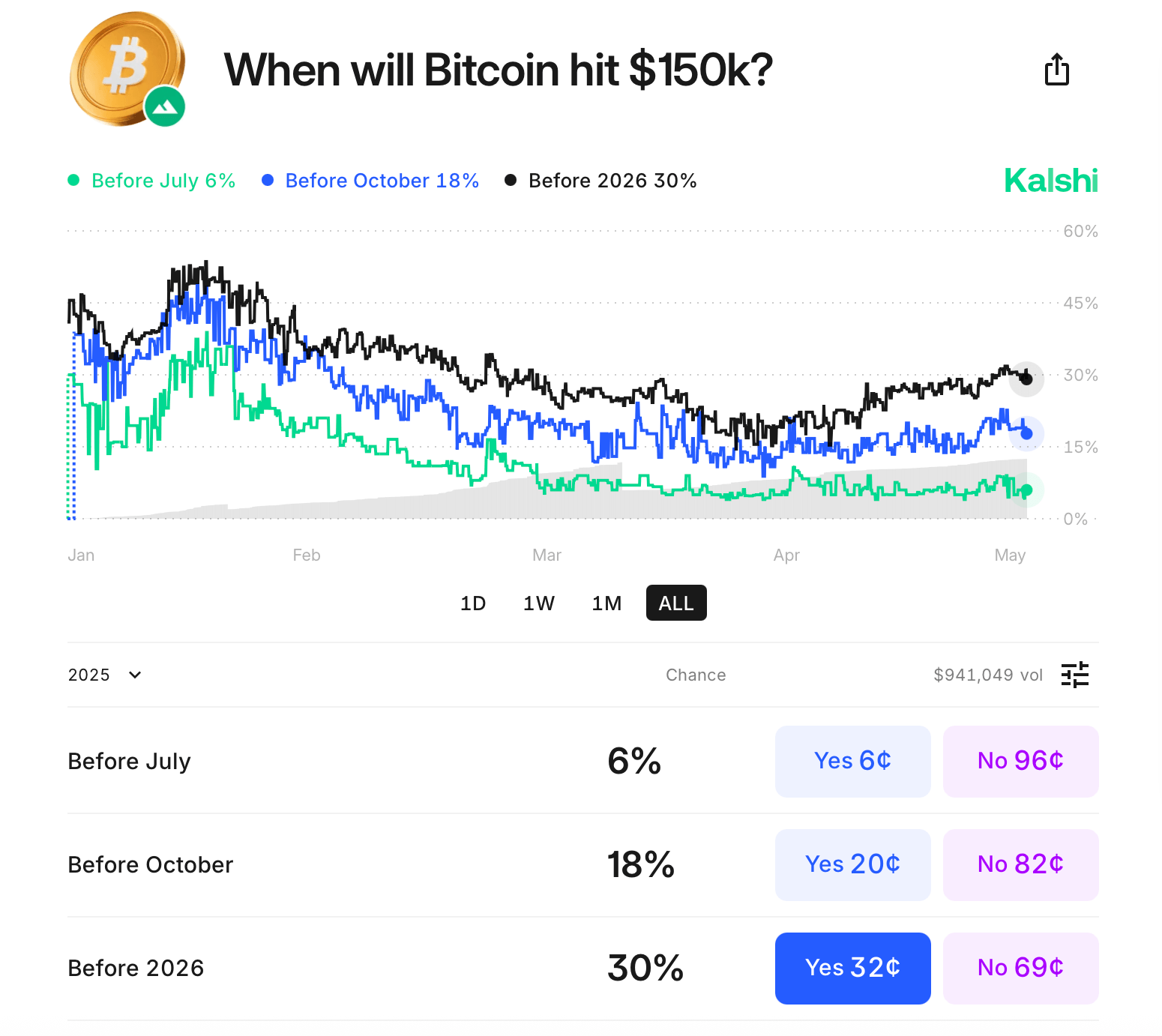

A $250,000 threshold carries a 10% probability, and an intrepid 3% wager envisions BTC achieving seven figures. Meanwhile, 38% anticipate bitcoin trading near $70,000, and 17% foresee a slide toward $50,000. Interestingly, 5% of bettors expect BTC to sink to $20,000 by year’s end. A bet on Kalshi asks “When will bitcoin hit $150K?” and there’s a 30% chance it will happen before 2026.

Source: Kalshi

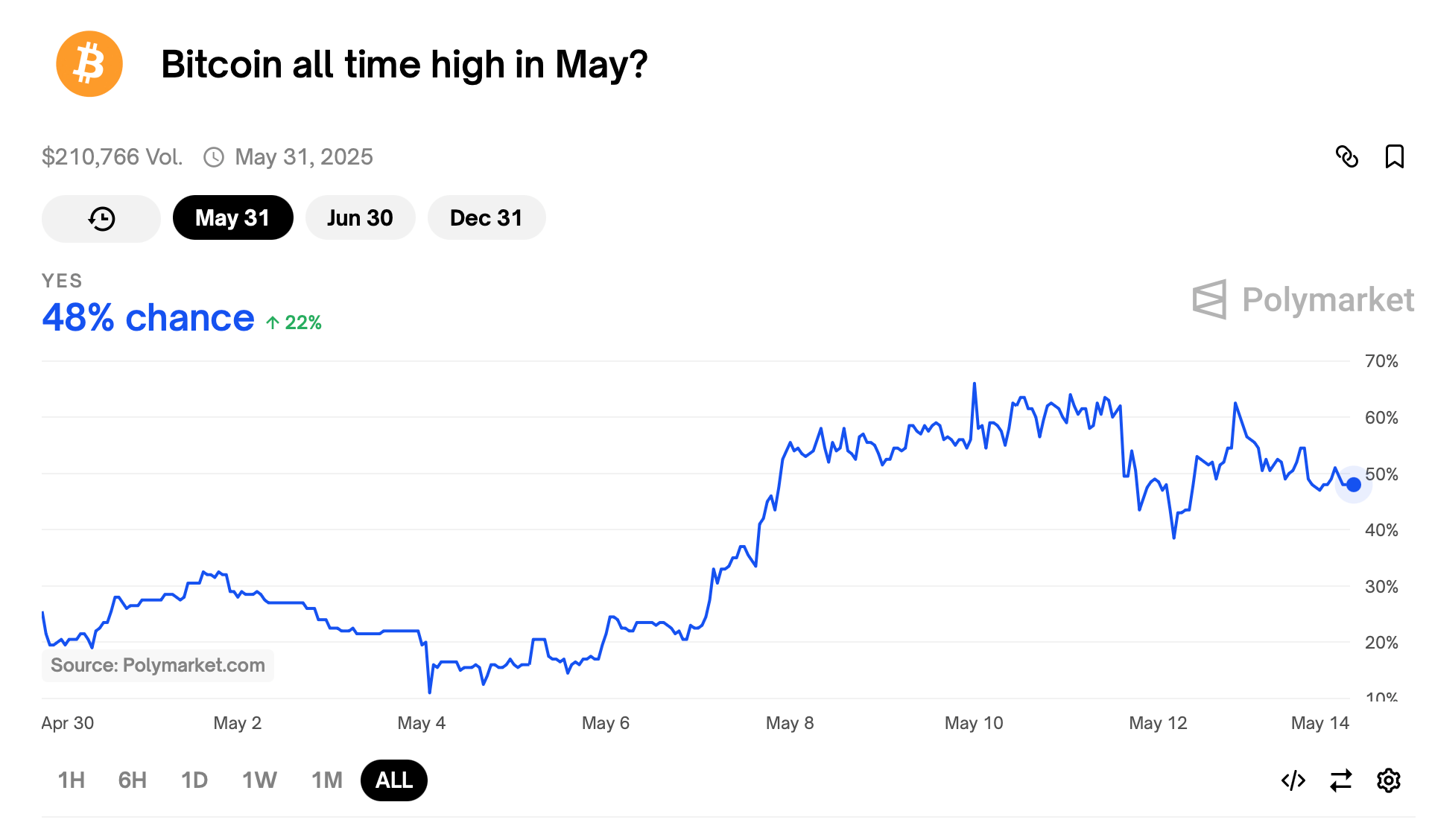

Kalshi bettors assign an 18% probability of reaching $150,000 by October and a 6% probability by July. With two weeks left in May, another Polymarket wager—featuring $210,766 in volume—implies a 48% probability that BTC will hit a new all-time high by month’s end.

Source: Polymarket

These projections reveal a compelling mix of caution and optimism among betting participants, suggesting that price swings may endure even if fresh records fall. The sentiment, fueled by both historical precedent and forward-looking bets, paints a picture of a market teetering between euphoria and prudence, where expectations are as volatile as the asset itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。