Original: The Round Trip

整理:Yuliya,PANews

In the era where cryptocurrency and AI intersect, the truly important stories often lie beyond the noise. To uncover these overlooked truths, PANONY and Web3.com Ventures have jointly launched the English video program "The Round Trip." Co-hosted by John Scianna and Cassidy Huang, this episode will delve into key global market trends, from the India-Pakistan conflict to breakthroughs in cryptocurrency, from China-U.S. trade negotiations to the divergence in global monetary policies, providing readers with comprehensive market insights.

Token2049 Dubai Scene: Renewed Enthusiasm, Return of Construction Mood

The Token2049 event in Dubai saw a dense crowd, with exchanges making a high-profile appearance and many quality projects on display. The heavy rains that plagued last year's event did not reoccur, significantly enhancing the overall experience. Market sentiment has notably warmed, with project teams returning to a "construction mode," showcasing their faith and vision.

However, the side events were overly concentrated, and coupled with Dubai's traffic congestion, it often took thirty to forty minutes to navigate between activities. Despite this, the execution power and long-term thinking of some founders were still impressive. Additionally, there was an interesting anecdote: the world is currently facing a "pistachio shortage," partly due to the popular pistachio chocolate from Dubai. It is reported that this chocolate is sold at Costco, with prices rising from $7 to $10, while the locally produced version in Dubai is priced as high as $20 per piece.

Geopolitical Turmoil: Escalation of India-Pakistan Conflict

The most concerning serious event last week was the full escalation of tensions between India and Pakistan. The roots of this conflict can be traced back to the partition of British India in 1947, after which the two countries have fought four major wars: the 1947-48 Kashmir War, the 1965 Second Kashmir War, the 1971 Bangladesh Liberation War, and the 1999 Kargil War. Notably, since 1998, both India and Pakistan have become nuclear-armed states, making any conflict carry more severe potential consequences.

The current round of tensions originated from a terrorist attack on April 22 in Indian-administered Kashmir, which resulted in the deaths of 26 tourists (mostly Hindus). The attack was claimed by the "Resistance Front," which is linked to the "Lashkar-e-Taiba" (LeT), the group responsible for the 2001 Indian Parliament attack and the 2008 Mumbai attacks. India immediately accused Pakistan of harboring terrorists.

Earlier last week, India launched a military operation codenamed "Operation Sindoor," targeting nine sites in Pakistan-administered Kashmir. The Indian side emphasized that this was a precision strike against terrorist infrastructure, avoiding Pakistani military targets. However, Pakistan condemned this as "an act of war," reporting civilian casualties, including women and children, and claimed to have shot down an Indian aircraft and conducted retaliatory strikes.

As the conflict escalated, both sides exchanged fire near the Line of Control (LOC), leading to mass evacuations of civilians. China, as a close ally of Pakistan, expressed serious concern, and Western intelligence even reported that a Chinese J-10 fighter jet shot down an Indian Rafale aircraft. The international community, including UN Secretary-General Guterres and U.S. President Trump, called for restraint from all parties, but under the influence of populist leaders like Modi, both sides find it difficult to back down without a "victory."

Divergence in Macroeconomic Policies: Global Liquidity and Interest Rate Trends

Global macroeconomic policies are showing clear divergence. The People's Bank of China lowered the reserve requirement ratio, injecting $143 billion into the system, initiating a liquidity release mode. It remains unclear whether this liquidity injection is a response to the trade war or a quiet panic in the market. Meanwhile, despite falling oil prices, OPEC members agreed to increase production, a decision that may aim to stimulate global economic growth.

In the U.S., Federal Reserve Chairman Powell maintained interest rates at 4.25%-4.5% despite a negative GDP in the first quarter, and it remains to be seen whether inflation is under control or if economic growth is being sacrificed. In contrast, the UK chose to lower interest rates to 4.25%, showcasing a different monetary policy path.

Additionally, U.S. President Trump reached a trade agreement with the UK, marking the first formal agreement since Trump initiated a global tariff offensive. Both sides agreed to reduce trade barriers in automobiles, agriculture, and steel, with U.S. tariffs on UK steel dropping from 25% to 0% and auto tariffs from 27.5% to 10%. In exchange, the UK will ease access for U.S. automobiles, ethanol, agricultural products, and industrial equipment. This agreement provides targeted tariff reductions but is still far from a comprehensive trade agreement, resembling more of a first step in a long negotiation process.

Chip Diplomacy and AI Strategic Shift

Interestingly, the Trump administration hinted last week at possibly revoking or not enforcing the AI diffusion framework established during the Biden era. This framework aims to control the global distribution of U.S. AI chips by categorizing countries into three tiers, imposing export limits even on long-term allies, with enforcement set to take effect on May 15.

This shift is strategically significant and could serve as leverage in trade negotiations. For instance, secondary countries like Israel, India, and Switzerland are purchasing U.S. F-35 fighter jets but face restrictions on acquiring Nvidia chips. The contradiction lies in trusting them to use your most advanced stealth fighters while not trusting them to use GPUs. This strategic shift indicates that the current administration plans to use AI chip exports as a tool in trade negotiations rather than impose comprehensive restrictions. By granting allies greater access, U.S. companies like Nvidia and AMD can expand their markets, increase profits, and reinvest in next-generation hardware, ensuring that the U.S. maintains its technological edge.

This is not just about trade and economics; it is also about strategic dynamics. Restrictive measures may backfire and instead stimulate innovation. Take Tencent, for example; in response to chip restrictions, they developed the Mix Yuan Turbo S, a highly efficient AI model capable of responding to queries in under a second, combining elements of Mamba and Transformer. They also launched the Mix Yuan T1, utilizing an expert mixing system for event reasoning and problem-solving. As the saying goes, "Necessity is the mother of invention."

At last week's ICLR conference, representatives from OpenAI, Google DeepMind, and universities from the U.S., China, and around the world attended to showcase their research achievements. A significant number of Chinese students and corporate representatives emphasized that their models use less memory. China is not waiting for access; it is innovating out of necessity. If the U.S. imposes excessive restrictions, it may only temporarily slow down the development of these countries, inadvertently accelerating their progress. Therefore, changing this policy is not a sign of weakness but a move towards strategic clarity.

Fluctuations in the New Taiwan Dollar and Capital Flows

The market has reacted, with the New Taiwan Dollar surging over 10% in just two trading days, marking the most significant volatility since the 1980s. Foreign capital has flowed into the Taiwanese stock market, particularly in the semiconductor sector. Taiwan has chosen not to intervene, signaling a willingness to allow the New Taiwan Dollar to appreciate. However, the appreciation of the New Taiwan Dollar could harm exports, which the Taiwanese economy heavily relies on. Other Asian currencies have also shown volatility, with traders predicting that other central banks may take similar actions. Analysts are divided; some believe the New Taiwan Dollar will continue to appreciate, while others predict an imminent correction. The rise of the New Taiwan Dollar is driven by the AI boom and foreign capital influx, but underlying risks remain, and if export data suffers, policies may adjust accordingly.

New Developments in China-U.S. Trade Negotiations

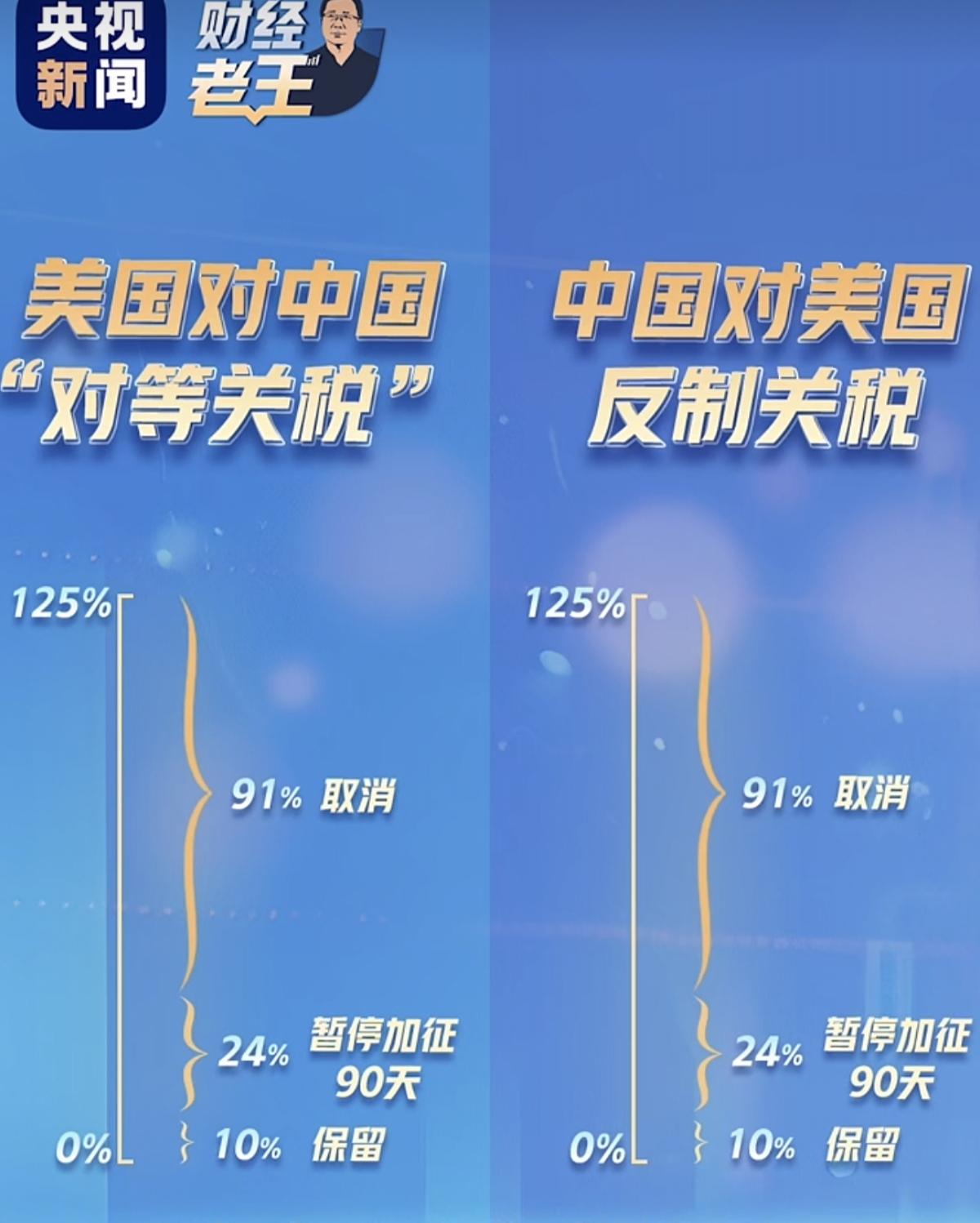

On May 12, after trade talks in Geneva, China and the U.S. issued a joint statement announcing adjustments to certain tariffs. According to the statement, the U.S. will eliminate 91% of the additional tariffs and suspend 24% of the "reciprocal tariffs" for 90 days, reducing the current "reciprocal tariffs" on China to 10%. China has also correspondingly canceled and suspended some countermeasures. This round of negotiations primarily focused on tariff reductions and did not involve the tariffs imposed by the U.S. on the grounds of fentanyl or some of China's countermeasures. Both sides also agreed to establish a mechanism to continue consultations on economic and trade relations to resolve differences through institutionalized communication. The Ministry of Commerce stated that the ultimate goal is to completely correct the error of unilateral tariff increases, continuously strengthen mutually beneficial cooperation, and maintain the healthy, stable, and sustainable development of China-U.S. economic and trade relations.

Since the onset of the U.S.-China trade war, both economies have been significantly impacted: U.S. companies have faced rising costs, which have been passed on to consumers, leading to price increases and supply chain delays; Chinese factory activity has slowed, and exports have declined. Beijing has responded with interest rate cuts, capital injections, and a series of stimulus measures, but the ripple effects of the trade war have surpassed the tariffs themselves, affecting global trade stability.

Bitcoin Corporate Trend: From Strategy to MetaPlanet

Bitcoin recently broke through the $100,000 mark, currently trading at around $101,000, reflecting a surge in market enthusiasm for crypto assets. The trend of corporations holding Bitcoin continues to strengthen:

Strategy (formerly MicroStrategy) held the fifth "Corporate Bitcoin Conference" in Florida, where CEO Michael Saylor emphasized the importance of Bitcoin as a corporate reserve asset. It was announced that they would purchase an additional 1,895 Bitcoins, bringing their total holdings to 555,450, maintaining their position as the world's largest corporate Bitcoin holder.

Tokyo-listed company MetaPlanet also purchased 555 Bitcoins last week, increasing its total holdings to 5,555. This number has symbolic significance in Japanese, as the pronunciation of "5" is "Go," and 5-5-5-5 symbolizes "Go! Go! Go! Go!" (Charge!). This purchase was valued at approximately $53 million, and the company's stock price subsequently rose by 13%. MetaPlanet has become the largest publicly listed Bitcoin holding company in Asia and ranks 11th globally, aiming to hold 10,000 Bitcoins by the end of the year.

David Bailey, CEO of Bitcoin Magazine and advisor to MetaPlanet, announced the establishment of "Nakamoto Company," focusing on Bitcoin media, mining, and infrastructure development, aiming to acquire struggling Bitcoin companies and restart their assets, backed by institutional and sovereign funds, reportedly capable of mobilizing billions of dollars in capital.

Cryptocurrency Policy Observations: Shift in South Korean ETFs and Divergent Reserve Attitudes Among Countries

The 21st presidential election in South Korea will be held on June 3, 2025, with the presidential campaign officially starting on May 12. Seven candidates will engage in a fierce 22-day campaign battle. Lee Jae-myung of the Democratic Party is leading in the polls and is designated as the number one candidate, while his main opponent, Kim Moon-soo of the ruling People Power Party, is the number two candidate.

Leftist Democratic Party candidate Lee Jae-myung and right-wing party candidate Kim Moon-soo have both pledged to promote the legalization of Bitcoin ETFs, forming a rare bipartisan consensus. This policy aims to facilitate wealth accumulation for the middle class and provide more opportunities for the younger generation. Financial Services Commission (FSC) Chairman Kim Byung-hwan expressed willingness to discuss implementation plans with the new government, marking a significant shift in policy attitude. The FSC had previously been firmly opposed to spot crypto ETFs, citing their excessive volatility. The success of the U.S. spot crypto ETF (with net inflows exceeding $43 billion) has become a key factor for South Korea to reconsider such products.

Meanwhile, some states in the U.S. are gradually accepting Bitcoin: New Hampshire has approved legislation allowing the state to invest up to 5% of public funds in Bitcoin, while Arizona allows unclaimed digital assets to be used for staking or earning rewards before being transferred to a reserve fund.

However, Florida has withdrawn its Bitcoin strategic reserve bill, and UK Treasury Economic Secretary Emma Reynolds has explicitly stated that the volatility of Bitcoin makes it unsuitable as a public fund reserve. Similarly, countries like Japan, Switzerland, and Russia have also excluded Bitcoin reserves, emphasizing the importance of stability in public financial management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。