Why is it Most Suitable for AI Native Companies?

Author: Henry Shi

Translation: Random Small Team

Small Team Introduction

Henry Shi is the Co-founder and COO of Super.com (formerly Snapcommerce), successfully leading the company to achieve an annual revenue of $150 million.

Recently, after in-depth discussions with over 100 founders, Henry summarized four early-stage financing models for companies and provided detailed data analysis, which is sure to open new perspectives for you. Enjoy!

Henry Shi recently exited his startup, which reached an annual revenue of $150 million and raised $200 million. He discovered a shocking fact: 90% of founders fundamentally build their companies the wrong way.

For decades, entrepreneurs have been trapped in a false binary choice: either bootstrap (which means struggling for years) or raise funds (which means potentially giving up control). But in 2025, AI changed everything. Henry Shi witnessed a revolution in company creation models, with the smartest founders employing an emerging model that is rarely mentioned.

Henry communicated with over 100 founders and learned from outstanding founders on the Lean AI leaderboard. Based on this, he summarized four methods for creating companies and raising funds, along with his own recommendations.

1. Traditional Financing: The Way That Causes Most Founders to Fail

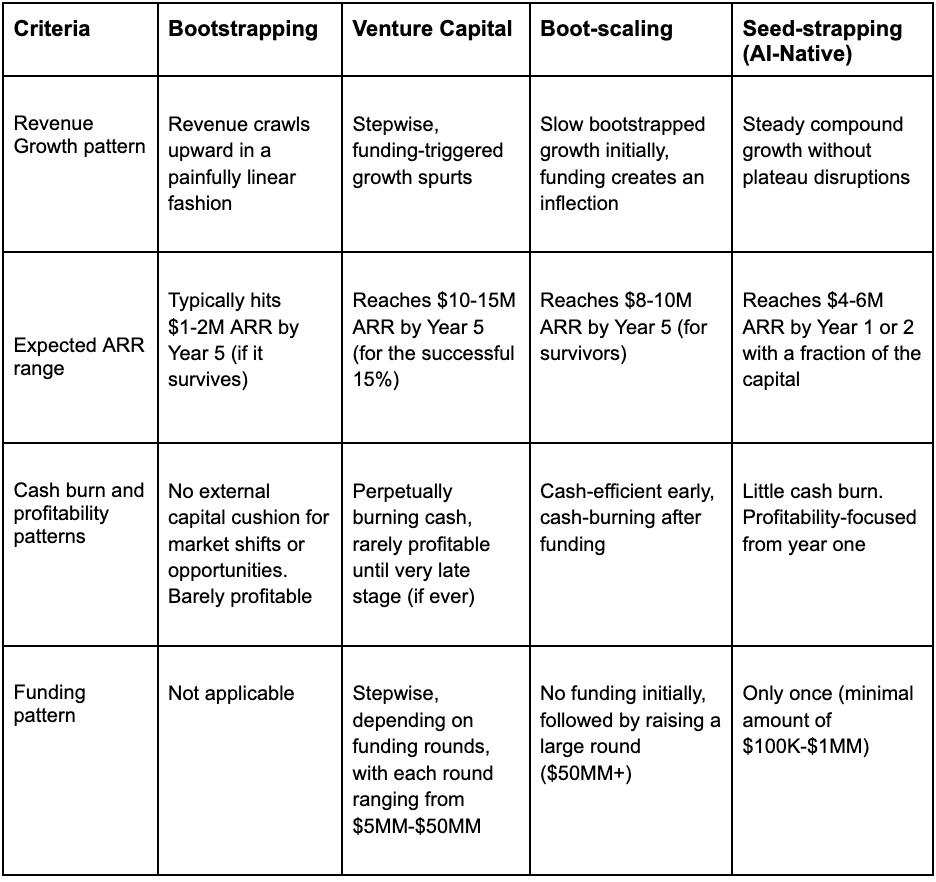

Model 1: Bootstrapping

Founders bear all the costs themselves, maxing out credit cards and depleting savings accounts, but can retain 100% ownership. In this model, 90% of startups fail within the first three years, and the failure rate of bootstrapped companies is higher compared to those that accept other financing methods.

8 out of 10 bootstrapped companies will fail within 18 months due to funding constraints. Over the years, entrepreneurs' personal finances will remain in deficit, and there is no guarantee that the company will survive. Even successful bootstrapped companies typically take over five years to reach just six-figure revenues (and that’s while working 80 hours a week at less than minimum wage).

Model 2: Venture Capital

Among the many VC-backed startups, 75% of companies never return any profits to investors, and only 0.1% of companies can grow into unicorns that provide substantial returns to investors, as reported by TechCrunch.

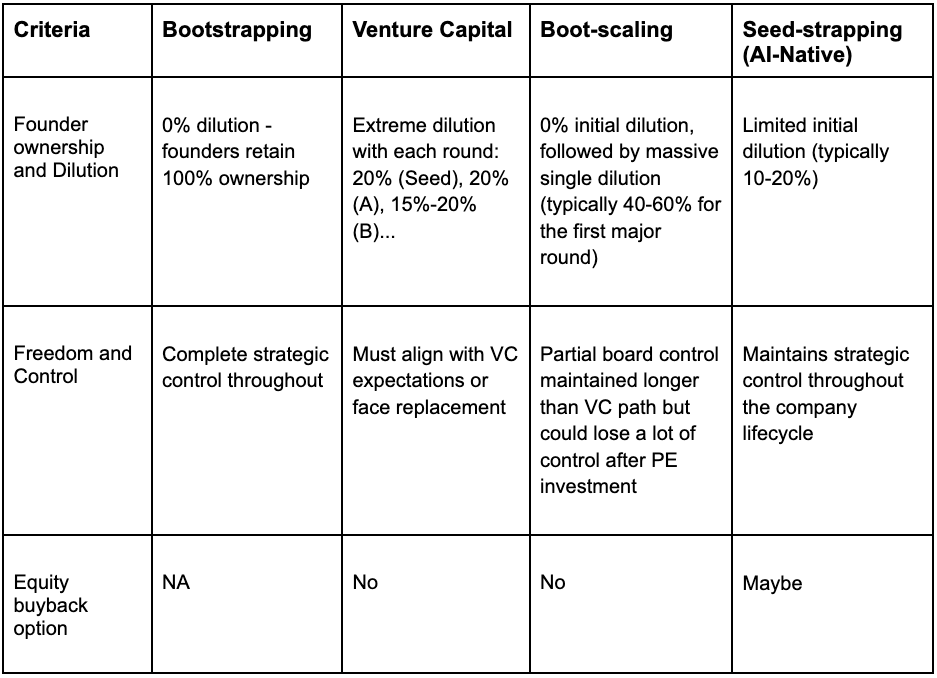

However, in this model, all founders must operate as if they will be part of that 0.1%. Founders have to give up a significant amount of equity in each funding round: 20% in the seed round, 20% in Series A, 15-20% in Series B, and so on.

By Series C, founders typically own only 15% of the company, while 99% of companies never even reach this stage. A founder who creates a company valued at $50 million through VC often has much less personal wealth than a founder who creates a company valued at $10 million through bootstrapping.

Model 3: Boot - Scaling

Entrepreneurs first bootstrap until the company shows good momentum, then conduct a round of large-scale financing, usually from private equity.

The advantage of this method is that it allows founders to retain ownership early on, but it also has many pitfalls: entrepreneurs must endure years of financial strain from bootstrapping. Later, they will face significant dilution of equity (even up to 40-50%) in this large-scale financing, losing control of the company to private equity buyers who may also disrupt company culture.

This risk is high: entrepreneurs exhaust personal funds and then bet everything on this one "expansion," which has a 72% failure rate.

2. New Model: AI Makes It Possible

Model 4: Seed-Strapping (for AI Native Companies)

For AI native companies, this model is precisely why Henry is excited about the future of company creation. Entrepreneurs need to find investors who understand the desire of founders to maintain control and ownership of their companies and are willing to invest $100,000 - $1 million in seed funding.

From day one of establishing the company, the focus should be on revenue and profitability, disregarding vanity metrics that impress VCs. Entrepreneurs can achieve revenue growth without further diluting equity, allowing them to focus 100% on the business without worrying about running out of funds or constantly chasing VC money.

As AI disrupts the economic model of company creation, more and more founders are beginning to expand AI-based services and price based on results—something that was previously unattainable. Now, entrepreneurs can quickly become profitable and elevate their ARR to seven or even eight figures.

In this model, entrepreneurs can earn stable income from profits without waiting for uncertain exit opportunities. Over time, they may even buy back equity, increasing their ownership stake. The greatest advantage of this model is the ability to achieve compound revenue growth early in the entrepreneurial journey.

For example:

With the same $100,000, starting today with a 30% annual growth rate compounded over 5 years yields significantly higher returns compared to starting two years later with the same growth rate.

$100,000 × 1.3^5 = $371,000,

$100,000 × 1.3^3 = $219,000,

which means 70% higher revenue.

3. Why AI Makes Seed-Strapping the Ultimate Model

AI fundamentally disrupts the economic model of company creation:

According to YC, 25% of the codebase in YC W25 was almost entirely generated by AI.

More than 15 AI native companies have increased their ARR to eight figures within 1-2 years with teams of fewer than 50 people.

As AI can generate complete functional systems, some software development costs are gradually approaching zero.

These changes bring numerous opportunities: today, independent individual entrepreneurs also have the chance to build companies worth $100 million. Henry knows some expert founders in vertical industries who, with the help of AI, have achieved ARR of $3-5 million with zero employees.

With the assistance of AI, capital efficiency has significantly improved. A company that required $3 million to start in 2020 can now be launched with just $100,000. Moreover, the time for AI native companies to enter the market has drastically shortened from months or even years to just weeks.

Compared to traditional SaaS companies, the average contract value (ACV) of AI-related services is much higher—because AI-based services can be priced based on results rather than per seat. These services can also take up a portion of the company's budget that is several times higher than the software budget.

Achieving profitability has also become unprecedentedly easy. Historically, salaries were the largest expense for startups, consuming 70-80% of funds. However, AI native companies can now operate normally even with very few or no employees, achieving over 80% profit margins from day one without spending years burning cash to build large teams.

Finally, adopting the Seed-Strapping model still allows for flexibility and multiple options, such as generating cash flow, selling the company, or raising VC funds, with virtually no significant downsides.

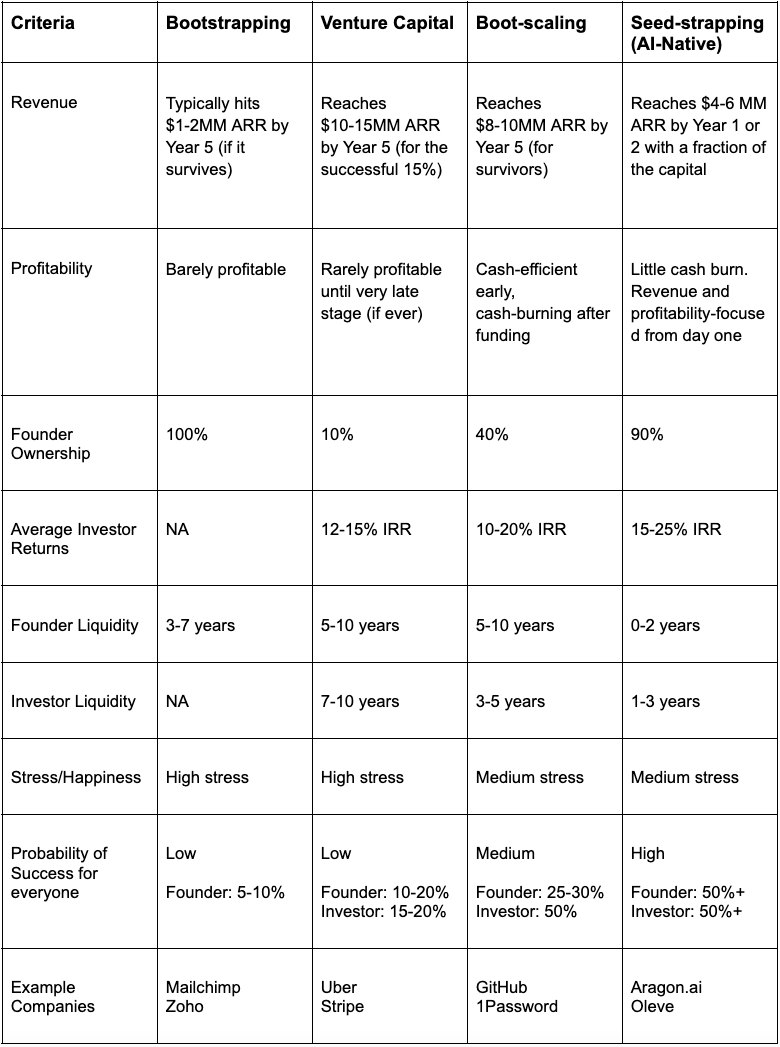

4. Intuitive Comparison of the Four Models

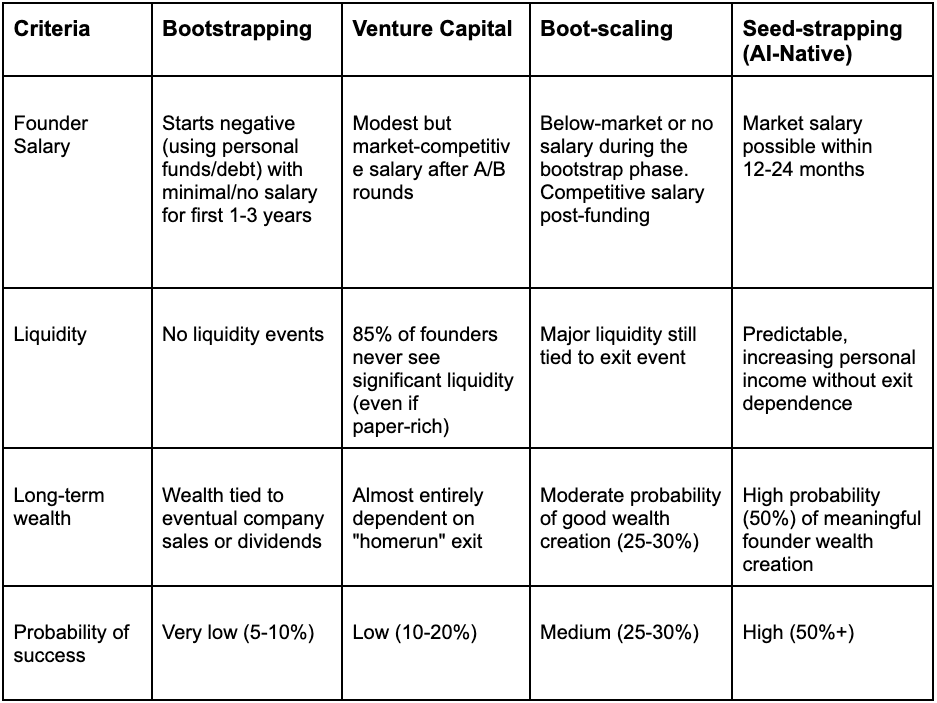

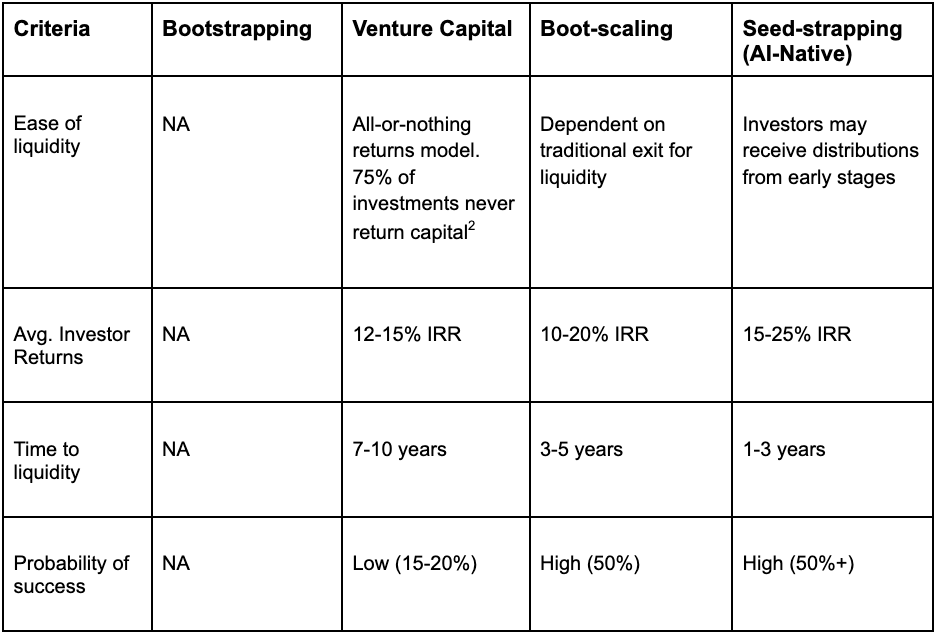

Henry will analyze the performance of these models based on metrics that truly matter to founders and investors.

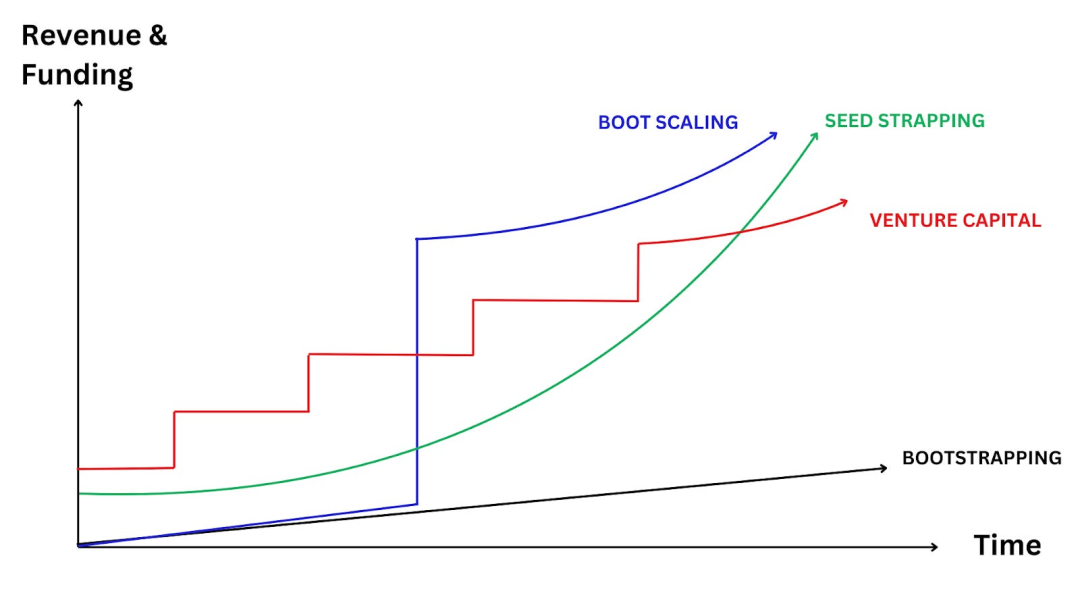

1. Revenue Growth + Financing Trajectory

The Seed-Strapping model combines the advantages of two models: it has initial funding that allows founders to freely advance their plans without worrying about running out of funds, and it does not require frequent fundraising. Compared to pure bootstrapping, it can achieve faster growth while maintaining a sustainable economic model.

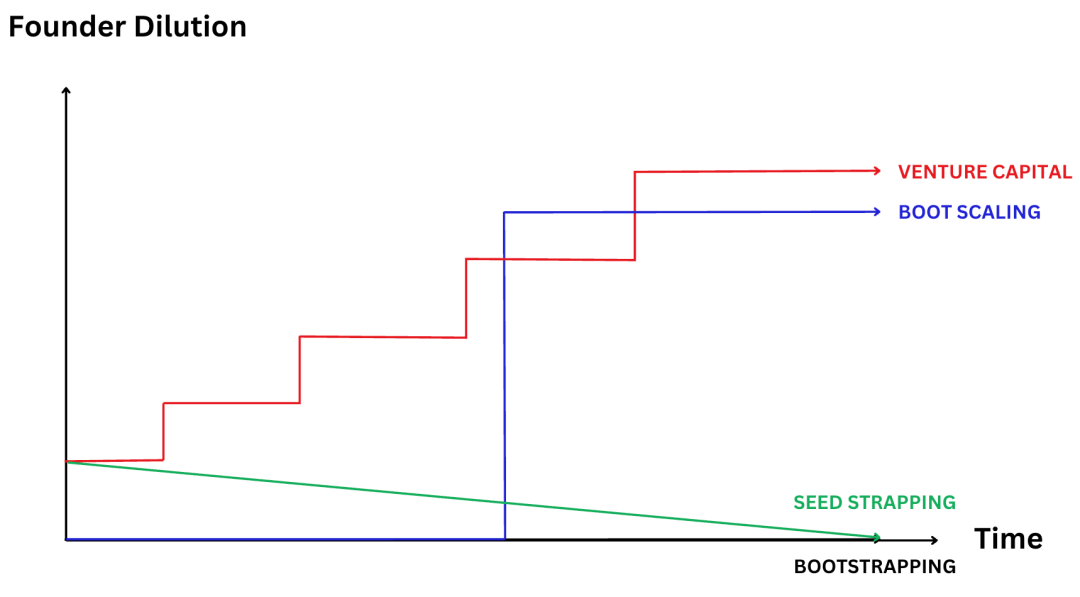

2. Founder Equity Dilution and Control

The Seed-Strapping model is the only model where founders can potentially increase their ownership stake over time through continuous equity buybacks. Entrepreneurs can leverage investment for funding support without falling into the endless equity dilution trap typical of VC models. In this model, entrepreneurs can firmly grasp the strategic control of company development, achieving a perfect balance between ownership and leverage.

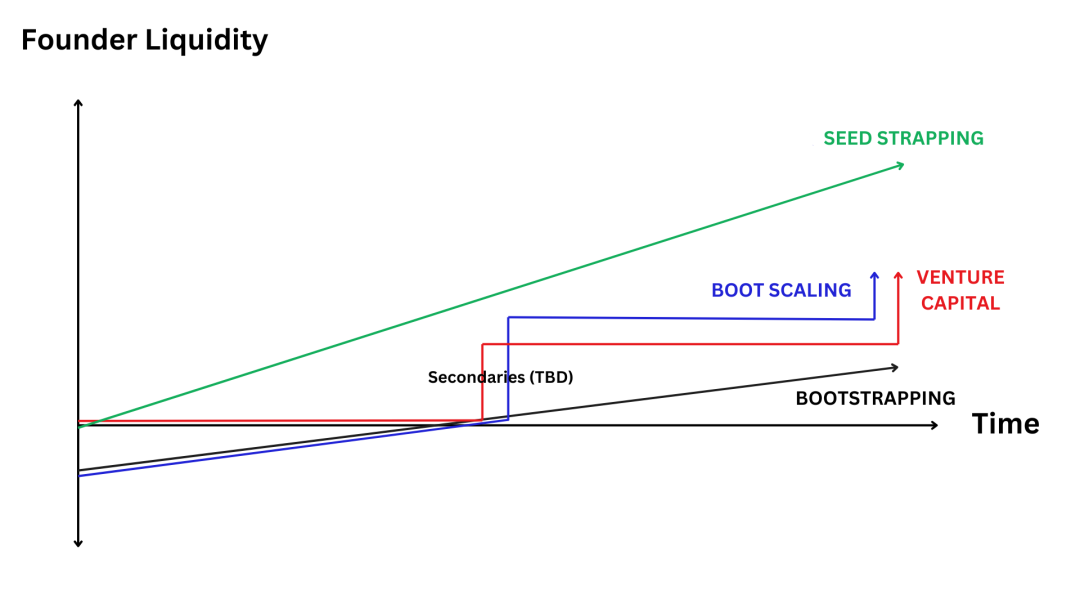

3. Founder Liquidity (Money in Pocket)

The Seed-Strapping model is the only one that consistently prioritizes putting money into the founder's pocket, even in the early stages of entrepreneurship. While other founders spend years hoping for a unicorn exit that may never materialize, entrepreneurs using the Seed-Strapping model have accumulated substantial personal wealth through profit distribution year after year. This is a form of financial freedom that does not require selling the company or relying on going public.

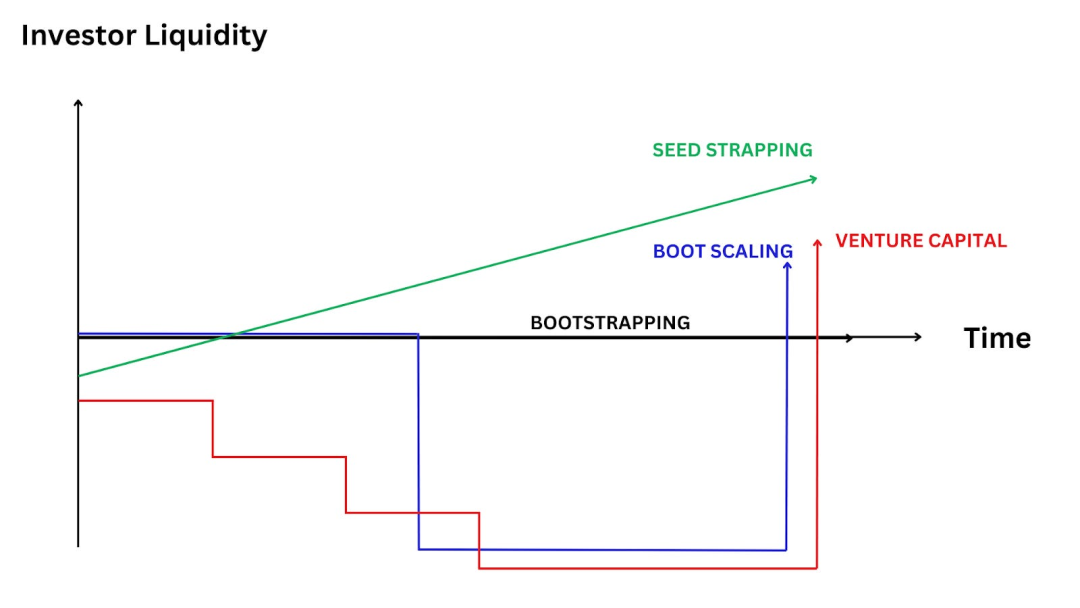

4. Investor Returns and Liquidity

The Seed-Strapping model creates a win-win situation between founders and investors that is difficult to achieve with other models. Investors do not have to wait ten years for uncertain illiquid returns; instead, they can receive early and continuous liquidity benefits. The stability of these returns means that investors will support the sustainable growth of the business rather than pushing for premature exits or unnecessary financing (their interests align with those of the entrepreneurs).

Five, Summary of the Four Models:

Six, Psychological Aspects

Beyond the numbers, there are also psychological differences:

Founders who bootstrap often feel trapped by their own "success," creating jobs from which they cannot escape.

VC-backed founders experience the most pressure, constantly pursuing growth while worrying about running out of funds.

Entrepreneurs using the Boot-Scaling model describe it as being on a "roller coaster," first enduring early struggles and then facing the pressure to prove themselves to investors.

Founders in the Seed-Strapping model report the highest levels of satisfaction, freedom, and sense of control, while also maintaining flexibility and having multiple options later (such as generating cash flow, selling the company, or raising VC funds).

Seven, The Path Forward for AI Native Companies

For entrepreneurs in AI native companies, the "Seed-Strapping" model offers an ideal balance:

Sufficient funds to effectively leverage AI tools.

Minimal or no equity dilution, allowing founders to retain ownership of the company.

The ability to quickly achieve personal profitability.

No need to exhaust themselves in a VC model while being capable of achieving compounding growth.

As barriers to scaling the business gradually disappear, there is an opportunity to build a "one-person billion-dollar company."

Flexibility and multiple options later (such as generating cash flow, selling the company, or raising VC funds).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。