Jump Trading's goal is not people, but computers.

In the ever-changing financial markets, speed is money. 2/3 the speed of light is just a blink of an eye for an ordinary person, but for high-frequency trading firms, it could determine the outcome of a trade. Today, let's talk about the "speed war" in high-frequency trading and the stories of those who invest heavily for microsecond advantages.

To be 0.07 milliseconds faster than competitors, some companies have spent 14 million dollars, which is merely 1/5700 of a blink!

The Value of 0.07 Milliseconds: A Contest of Speed

Imagine that blinking takes 0.4 seconds, while a high-frequency trading company called Jump Trading spent 14 million dollars just to improve data transmission speed by 0.07 milliseconds (i.e., 0.00007 seconds). This company purchased a 120,000 square meter plot of land directly across from the Chicago Mercantile Exchange (CME) data center, not to build a building or for feng shui, but to set up microwave communication stations to ensure that trading instructions can reach the exchange as quickly as possible.

According to a similar microwave tower case from Nasdaq, this improvement can only bring about a 0.07 millisecond enhancement. It seems trivial, but for high-frequency trading, this tiny bit of time could be the source of huge profits. Traditional fiber optic transmission speed is about 2/3 the speed of light, while microwave transmission speed is close to the speed of light, making it 50% faster than fiber optics. More importantly, fiber optic installations are often not straight lines, while microwave transmission can take "shortcuts."

For human traders, the difference between 0.00007 seconds and 0.00014 seconds is meaningless, as it takes the human eye 0.15 to 0.225 seconds to process information. But Jump Trading's target is not humans, but computers—their algorithmic trading systems can make decisions and execute operations in microseconds.

High-Frequency Trading: Transactions Completed in 0.2 Seconds

Jump Trading is a typical high-frequency trading (HFT) company. When a public company releases earnings reports, central banks adjust interest rates, or significant data like CPI is announced, its servers use complex algorithms to predict stock price fluctuations in the next few seconds, and computers automatically execute buy or sell operations. Because high-frequency trading occurs in extremely short time frames, even minor fluctuations in stock prices can yield considerable profits or reduce losses. Therefore, how to obtain information and complete trades faster than competitors is the core pursuit of every high-frequency trading firm.

This is not the first time Jump Trading has "spent money" for speed. As early as 2013, they acquired a microwave tower in the UK that was previously used by NATO, solely to transmit data faster to the London Commodity Exchange. Speed has become the lifeline of high-frequency trading.

The Ultimate Interpretation of Trading Speed: The Ulta Earnings Event

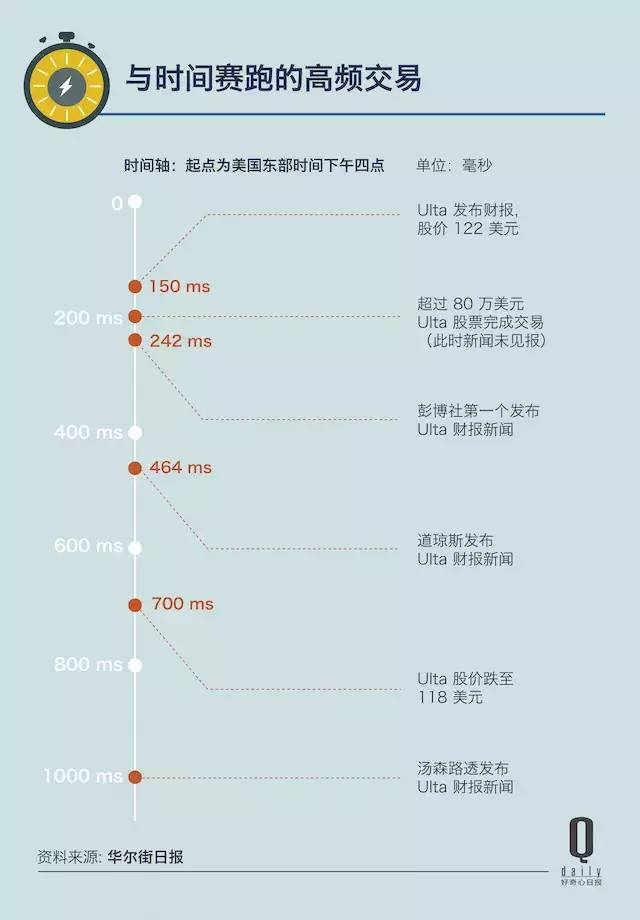

The Wall Street Journal once revealed a classic case that illustrates just how fast high-frequency trading can be. On December 5, 2014, at 4:00 PM Eastern Time, cosmetics retailer Ulta released its earnings report, with the stock price at $122. The events unfolded in milliseconds:

• 4:00:00.15: PR Newswire released the earnings report news to high-frequency trading firms and terminals like Bloomberg.

• 4:00:00.20: A high-frequency trading firm sold $800,000 worth of Ulta stock at $122.

• 4:00:00.242: Bloomberg was the first to publish the Ulta earnings report news.

• 4:00:00.464: Dow Jones released related news.

• 4:00:00.7: Ulta's stock price had dropped to $118.

• 4:00:01: Thomson Reuters finally released the earnings report news.

At this moment, only 0.85 seconds had passed, and no human trader could read the earnings report headline, but the high-frequency trading computers had already completed their operations. Humans simply cannot compete with such speed.

This incident drew the attention of the U.S. Securities and Exchange Commission (SEC), and PR Newswire faced regulatory pressure. Although its CEO Cathy Baron Tamraz insisted that "nothing wrong was done," the company, under public pressure and potential impact, ceased its practice of directly sending financial data to specific paying users after consulting its major shareholder Buffett. Now, high-frequency trading firms must wait for Bloomberg to release information before they can act, delaying their actions by about 0.192 seconds. It seems fairer, but the speed competition for machines has never stopped.

Technological Frenzy: The Battle of Microwaves, Fiber Optics, and Lasers

In the "speed war" of high-frequency trading, the most advanced technologies are employed. Typically, fiber optic networks are the preferred choice for long-distance high-speed connections, but their transmission speed is limited by the medium (about 200,000 meters/second), and the installation routes along railways are often not straight lines. In contrast, microwave transmission speed in the air is close to the speed of light (300,000 meters/second), and by setting up signal towers on mountaintops or high-rise buildings, companies can minimize transmission distances as much as possible.

Jump Trading's installation of microwave towers across from the Chicago Mercantile Exchange is aimed at pursuing ultimate speed. In fact, the CME's own data center also relies on microwave transmission. In 2015, McKay sold land to the CME for use as a data center, and recently, DuPage County near Aurora approved McKay to build a new microwave tower, which is now 188 meters closer to the CME trading center, also aimed at saving even 0.00007 seconds.

However, microwave transmission is not perfect. Its communication quality is easily affected by adverse weather (especially rain), with reliability around 90%. Additionally, microwave bandwidth is limited; for example, a single microwave base station provided by Anova has a bandwidth of only 100 Mbps, while fiber optics can reach 1000 times that. Therefore, microwaves are more suitable for speed-sensitive small data transactions, while fiber optics are better for transmitting large volumes of data, such as public company earnings reports.

In addition to microwaves and fiber optics, some companies are attempting more extreme solutions. Since 2010, Spread Networks has spent $300 million to dig a cable tunnel through the Appalachian Mountains, reducing data transmission time by about 3 milliseconds. Additionally, there are undersea cable projects across the Arctic, including "Artic Fibre," "Arctic Link," and Russia's "ROTACS," with a total cost of about $1.5 billion, aimed at reducing data transmission time between the financial centers of London and Tokyo from 0.23 seconds to 0.17 seconds, saving nearly 8000 kilometers in distance.

A more promising technology is laser communication. Anova has set up laser stations between Manhattan in New York and the NYSE and Nasdaq data centers, using infrared lasers to transmit data, which is twice as fast as fiber optics, with a bandwidth of 2 Gbps, and is largely unaffected by weather. Anova CEO Michael Persico revealed that they are also installing equipment at 1275 K Street in Washington to obtain U.S. government economic data as quickly as possible. However, laser communication requires straight-line transmission and must address the impact of high-rise building sway on signal accuracy.

The Value of High-Frequency Trading: Efficiency or Profit-Seeking?

What exactly has high-frequency trading brought? Larry Tabb, a writer for The Wall Street Journal, once asked, "High-frequency trading is widely criticized; what have they done wrong?" As the founder of Tabb Group, he is an advocate for high-frequency trading, believing it makes the market "more efficient than ever," allowing institutions to complete trades in milliseconds, which is a reflection of technological advancement.

The core of high-frequency trading is to save time, speed up buying and selling, and ultimately to make money more efficiently.

However, critics like NBA Dallas Mavericks owner Mark Cuban call high-frequency trading the "ultimate hacker," believing that its speed game has nothing to do with a company's real value. Buffett has also mocked investment strategies that rely on complex formulas. In 2005, he placed a $1 million bet, claiming that hedge fund returns could not outperform index funds. In 2007, Protege Partners partner Ted Seides accepted the challenge. Ten years later, the index fund chosen by Buffett had an average annual growth rate of 7.1%, while the five hedge funds returned only 2.2%, more than three times less.

The return rates of high-frequency trading firms are also declining. In 2016, according to data from Institutional Investor, only Renaissance and Bridgewater fund managers earned over $1 billion annually, but their returns had lagged behind the market for several consecutive years. Nowadays, there are more high-frequency trading firms, making the market fairer, but the earnings of participants are not as good as before. Nevertheless, the trend of machines replacing humans is irreversible. In March of this year, the world's largest asset management company, BlackRock (managing $5.1 trillion in assets), began using AI for stock selection and laid off more than 30 analysts and fund managers, accounting for 7% of the department's total staff.

Insights from High-Frequency Factors: From Microseconds to Daily Life

High-frequency trading may seem distant, but its principles can be applied to personal investing. Transforming high-frequency data into daily frequency data can still uncover decent alpha returns. The extreme pursuit of speed is not only a contest of technology but also a reflection of the efficiency improvement in financial markets.

In the competition between machines and speed, no one can afford to stop. In the future, financial technology will bring more surprises and challenges. Are you ready?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。