The power of construction is always more helpful for us to navigate through cycles than the power of destruction.

Author: Liu Run

Introduction

Yesterday, the United States and China issued a joint statement.

(Image from the internet)

There are many claims online regarding the specific numbers in the tariff negotiations. One widely circulated claim is that China retains a 10% tariff on the U.S.; the U.S. retains a 10% reciprocal tariff and a 20% "fentanyl tariff" on China. Whether to impose an additional 24% tariff on each other will depend on the results of subsequent negotiations after 90 days.

The trade war has finally reached a phased outcome. It is no longer as tense as it was a month ago, which is a relief.

But how long can this relief last? After 90 days, will it be a happy ending for all, or a new round of escalation?

It's hard to say.

On the surface, the U.S.-China game revolves around tariff barriers. But in fact, the U.S.-China struggle is about the discourse power of economic order and even the dominance of the new world pattern.

Why do I say this?

This is a very large topic, and it's hard to explain in just a few words. But fortunately, I know someone: Ray Dalio.

You may have heard of him, the founder of Bridgewater Associates, managing hundreds of billions of dollars in assets, and author of the best-selling book "Principles." But I think what makes him most impressive is not just these achievements, but his ability to explain particularly macro issues clearly.

This time, I recommend one of his videos, "The Changing World Order." In the video, Ray Dalio studies the history of the past 500 years and shares many insights on great power competition and thoughtful reflections.

Understanding this video may help you grasp the subtext of the recent U.S.-China joint statement and the direction of the U.S.-China game.

So, I have picked out several very important concepts from the video and will try to provide some explanations and clarifications.

Are you ready? Let's begin.

01 The Big Cycle

The Big Cycle.

This is the most mentioned concept in the video.

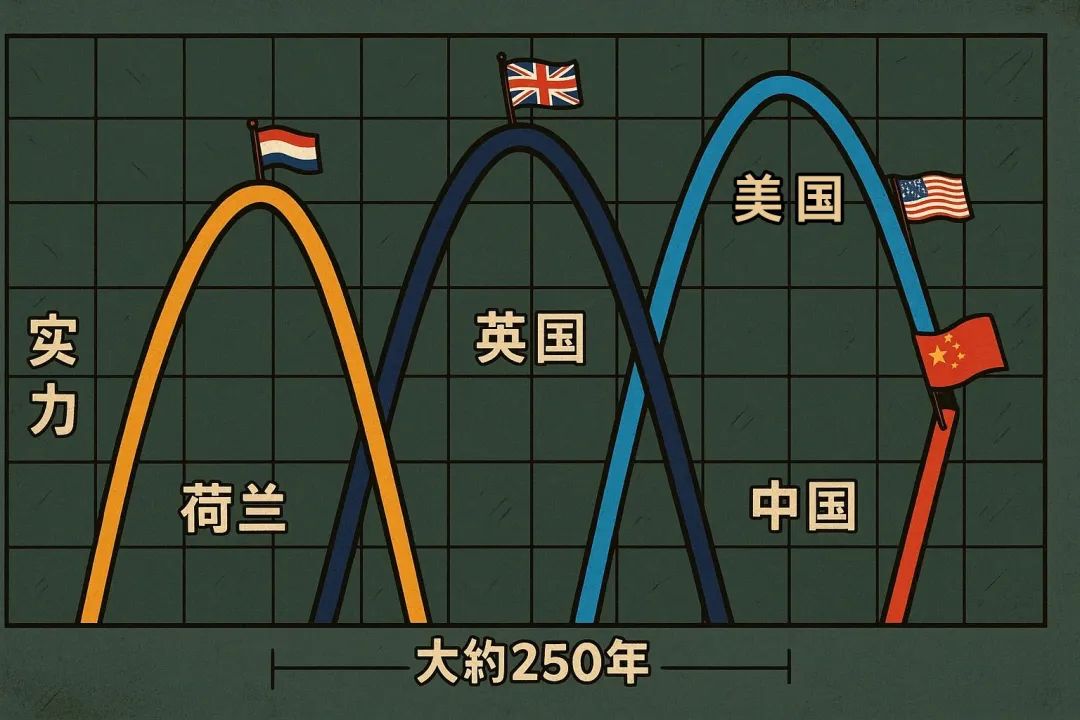

In a person's life, there are times of youth and vigor, as well as times of old age. Countries are similar. Looking back over the past 500 years, the entire process of a great power's rise and fall usually spans about 250 years.

(Information from: "The Changing World Order")

This 250 years typically includes rise, peak, and decline stages.

The rise is like a person's youth.

The common people work hard and value education, just like the Netherlands quickly became the center of knowledge in Europe. Technological innovations emerge one after another, similar to the Industrial Revolution in Britain. The economy develops rapidly, reaching its peak.

The peak is like middle age.

Economically, militarily, and culturally, it is at the world's top. The national currency becomes a hard currency. Whether it was the Dutch guilder, the British pound, or now the U.S. dollar. People begin to enjoy life and consume on credit, which also sows the seeds for decline.

The decline is like old age.

The cost of maintaining the "leader" position becomes increasingly high, leading to deficits. Just like the Netherlands and Britain, which colonized everywhere but ended up dragging themselves down. The wealth gap widens, and newly rising powers eye them covetously. Faced with internal and external troubles, they have no choice but to exit the stage quietly.

Understanding this model, does it make the current world clearer?

The current United States may have passed its peak of middle age and is beginning to show signs of aging, while China has already spread its wings and is striving for the top.

The underlying reasons for the continuous conflicts are not about a specific leader coming to power (like Trump) or a specific policy being implemented (like the 200% tariff policy).

Because the transition of the "leader" position inevitably brings conflict. A leading power must struggle before its decline.

Alright. Now, let's zoom in a bit closer and observe this process carefully.

02 The Rise of Great Powers

What does it take for a great power to rise?

Imagine you have just won a war. There is peace at home, and no one dares to provoke you.

At this time, you need to do one big thing first: improve education.

Because education brings higher productivity.

For example, the Netherlands. After defeating the Habsburg Empire, they leveraged universal education to achieve an explosion of innovation, contributing to a quarter of the world's major inventions, including ships capable of circumnavigating the globe.

With increased productivity, your products become more competitive. Selling more products allows for more investment in education. This process is like a snowball effect.

But to make this snowball roll faster, you need an "accelerator": the capital market.

For instance, loans, bonds, and stock markets allow people to convert savings into investments, thus providing funding for innovation and sharing success. Hence, the Dutch established the first publicly traded company, the Dutch East India Company, along with a stock market to finance it.

All rising nations develop a global financial center to attract and allocate capital.

For example, during the Dutch period, Amsterdam was the world financial center. During the British period, it was London. Now, it is New York. China is also rapidly building its financial center.

As a country becomes the largest trading nation globally, its currency will become the preferred medium of exchange worldwide.

This is: Reserve Currency.

03 Reserve Currency

A reserve currency is the Dutch guilder during the height of Dutch power, the British pound during the British Empire's "sun never sets" era, and the greenback since World War II.

Behind it is a strong economy, military power, and a stable financial system.

When a country's currency becomes a "reserve currency," that country gains the privilege of "cheating."

For example, you can borrow money more easily than other countries because the whole world wants to hold your currency.

This also means that when you run out of money, you can just turn on the printing press and print money to spend lavishly abroad, and others will still accept it.

It's quite enjoyable.

However, when a country becomes accustomed to "prosperity," its internal structure often faces crises.

04 Wealth Gap

When a dominant country is in the late middle age, one problem will self-reinforce like a cancer cell:

The wealth gap.

When you have money, you naturally want to provide better education and a higher starting point for your children. When you have money, you naturally want to allocate your assets, buying funds here and a property there.

This is much faster than earning money through hard work.

When the government notices this and starts taxing the rich, the wealthy feel their wealth is threatened and will move their assets to safer places, further weakening the country's economic base and tax revenue, creating a vicious cycle.

Over time, social classes begin to solidify.

It becomes increasingly difficult to rise from rags to riches.

When most people start to feel that the rules of the game are unfair and that the input does not match the output, resentment and dissatisfaction will spread like wildfire.

And then? Society begins to tear apart.

The boundary between "us" and "them" becomes increasingly clear.

The left and right factions, one wants to "rob the rich to help the poor," while the other wants to "protect private property."

This division will greatly consume the country's vitality.

Looking back at the late "Golden Age" of the Netherlands and the late Victorian era of Britain, the intensification of internal social conflicts is an important sign of the empire's transition from prosperity to decline.

Now, you can probably understand why today's American politics is so polarized and divided, with endless debates on social issues.

Because this is a typical characteristic of a country in late middle age, which not only affects the formulation and execution of domestic policies but also weakens the consensus and strength that the U.S. can gather in its long-term competition with China.

Once a dominant power, burdened by the abuse of its reserve currency and heavy debts, and facing an increasingly widening wealth gap, it becomes weak.

So, in the face of this predicament, what "prescription" is it most likely to pull out to prolong its life?

05 The Printing Press

History has repeatedly told us that this prescription is most likely called:

The Printing Press.

Sigh. Why not tighten the belt, implement fiscal austerity, or simply declare bankruptcy and default on debts?

Both options are theoretically feasible, but politically too difficult.

Fiscal tightening means cutting welfare and public spending. The common people will definitely oppose it. Do they still want votes?

Debt default means the complete collapse of national credit, and the financial system may directly collapse. Who would dare to lend you money?

In contrast, printing money becomes a seemingly "least painful" choice.

Although everyone knows this is "drinking poison to quench thirst," at least it can help push through the immediate debt pressure.

What about later? Who cares, trust in the wisdom of future generations.

As for the pain of inflation, letting all holders of this currency, including domestic citizens and foreign creditors, share it also seems "fair."

But is printing money really a panacea?

Of course not. It can lead to a series of negative effects.

For example, money becomes worthless.

100 dollars might only buy what 80 dollars could buy tomorrow. The prices of food, clothing, and necessities keep rising.

Another example is that asset bubbles are further inflated.

The excess money does not flow into the real economy to create jobs but instead floods into the stock market, real estate, and gold, pushing up asset prices.

Those who own assets see their wealth continue to grow. Those without assets are left further behind by inflation.

Now, you can probably understand why the U.S. implemented such large-scale fiscal stimulus after the 2008 subprime mortgage crisis and the 2020 pandemic economic crisis.

Because, faced with enormous unsustainable debts and the need to maintain global competitiveness, printing money became the easiest choice to make.

Although it may exacerbate inflation, create bubbles, and long-term damage the credibility of the dollar.

Once your strength declines, you can't pay off debts, and you keep printing money, who would still trust you? The number of people who trust you decreases, and everyone starts to sell your currency and assets, leading to financial collapse.

The histories of the Dutch guilder and the British pound confirm this point. The dollar, while still the dominant currency, is increasingly burdened by heavy debts and a potential crisis of trust, which hints at trouble.

In 2024, the total value of U.S. imports is 3.3 trillion, and the total value of exports is 2.1 trillion. Last year, Americans spent 1.2 trillion dollars more than they earned, about 9 trillion yuan.

At this point, the world enters an extremely unstable phase:

Transition Period.

06 Transition Period

We mentioned earlier that each big cycle lasts about 250 years, during which there is often a transition period of 10 to 20 years. The transition period is also a time of intense conflict.

The U.S.-China game is at the core of this transition period.

For today's United States, three major events have already emerged.

The first event is "money can only be printed."

The country does not have enough money to repay its debts. Even with interest rates at rock bottom, the central bank has started printing money to pay off debts. Annual fiscal expenditures even rely on borrowing to support them.

The second event is "public sentiment is beginning to disperse."

There is a particularly strong "gunpowder smell" in society. The root cause lies in the significant wealth gap. The rich want to maintain their wealth, while the poor hope for redistribution, turning politics into a battlefield of mutual attacks.

The third event is "external great powers are watching closely."

China is rising.

When the balance of power changes, the existing world order no longer adapts.

There is also a lack of a mechanism, like a court, to peacefully resolve disputes between countries. Therefore, in the end, conflicts are often resolved through various forms of power struggles, or even war, to determine the "leader."

Similar events have occurred multiple times in history.

The last time this situation arose was from 1930 to 1945. After World War II, the United States led the establishment of the United Nations, the World Bank, the International Monetary Fund, and the Bretton Woods system, establishing a post-war world order centered around the dollar.

The old cycle ends, and a new cycle begins.

History moves forward in this cycle of rise and fall.

So, having understood these patterns, what should ordinary people do?

07 Two Suggestions

Dalio's research is not just to satisfy curiosity or provide investment references.

He hopes to help us better understand the era we are in and make wiser choices by revealing these patterns.

At the end of the video, Ray Dalio offered two suggestions.

1) Live within your means. 2) Treat each other kindly.

What do these mean specifically?

Living within your means means: do what you can afford, and avoid excessive debt.

For a country, if it consistently spends more than it earns and relies on borrowing to survive, problems are inevitable. For individuals, managing cash flow and debt well is the foundation for coping with future uncertainties.

In this era where uncertainty is the greatest certainty, having cash on hand keeps your mind at ease.

Treating each other kindly means: more kindness, less hostility.

For a society, if there are numerous internal conflicts, it will consume enormous energy and become extremely weak. Only by promoting fairness and fostering cooperation can cohesion and competitiveness be maintained. For individuals, in a society with diverse opinions, it is essential to seek understanding and communication rather than intensifying opposition.

Constructive power will always help us navigate through cycles more than destructive power.

Standing in 2025, looking back over 500 years, the current "chaotic" world seems to become a bit clearer.

This world is undergoing a profound transformation.

When a great power no longer proves itself through innovation and progress but relies on raising taxes, sanctions, and suppression to show strength; when it no longer uses unity and wisdom to solve problems but resorts to printing money and inciting division to maintain control, its future may already be self-evident.

It's like a once-mighty ship that swept across the seas. The captain keeps fueling the engine, hoping to make the ship go faster. But he forgets that the hull has started to leak, the crew is blaming each other, and a storm is approaching.

This is not a matter of who is right or wrong; it is a law, the power of cycles.

As individuals, what we can do is stay clear-headed, live within our means, and treat each other kindly.

In this era full of uncertainties, perhaps the most important thing is not to argue about who is right or wrong, but to maintain a sense of peace and rationality within ourselves.

The storm will eventually pass, and the sun will rise again.

Until then, we observe the changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。