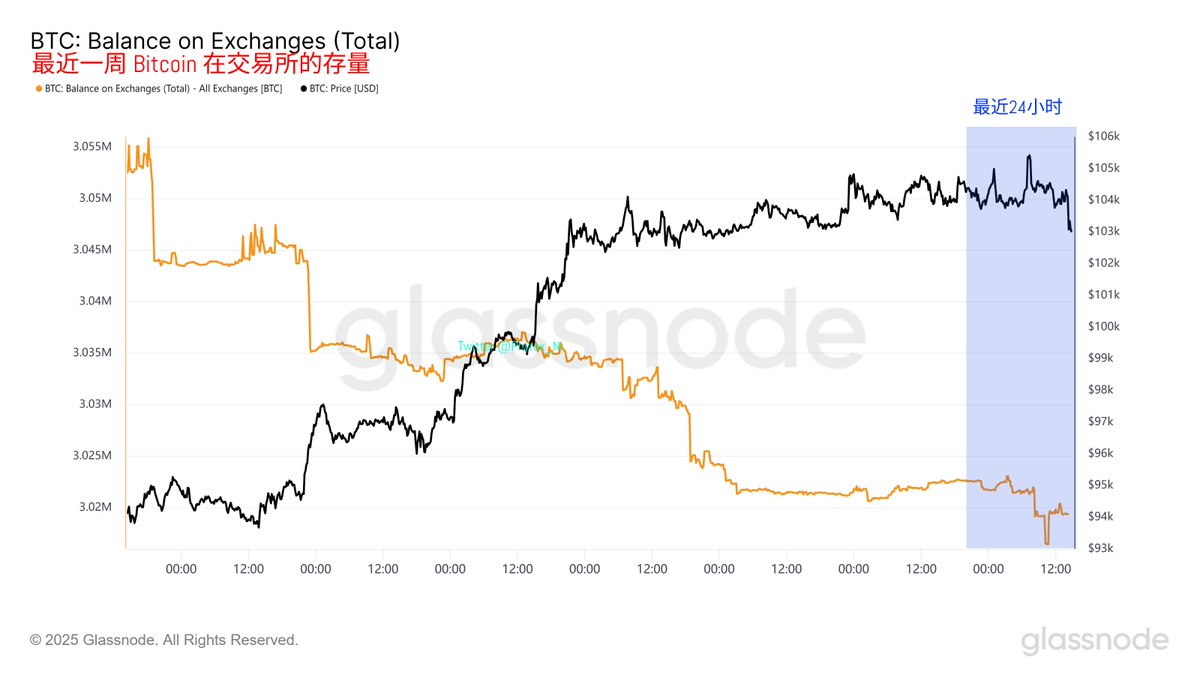

Today, U.S. stocks surged significantly (the Nasdaq rose over 4%, and the S&P 500 rose 3.3%), with risk sentiment high, but Bitcoin fell against the trend by 2.2%, dipping below $101,000 at its lowest, appearing out of place. There are no obvious macroeconomic headwinds; although U.S. Treasury yields have risen and rate cut expectations have weakened, U.S. stocks remain strong, and on-chain data does not indicate a large-scale sell-off. In fact, the exchange's $BTC supply has slightly decreased, suggesting no systemic risk.

Given the rising rates in U.S. Treasury auctions and the lukewarm performance of bid multiples, some investors may have shifted to short-term U.S. Treasuries through liquidating cryptocurrency allocations during the strong performance of U.S. stocks, putting temporary pressure on BTC. However, with low turnover and the support zone not being broken, there is no panic in the market, and investors remain cautiously optimistic about BTC's long-term trend.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。