Whether you are inside or outside the circle, you must be familiar with the recent news about Ethereum. The reason is simple: it has caused E guardians to sigh in despair and defenders of Ethereum to nearly be washed out, as it surged "40% in 3 days," reaching the top of Douyin's hot list.

Where does the upward momentum come from?

As is well known, Ethereum launched the Pectra upgrade on May 7. This is the most significant network upgrade since early 2024, integrating the Prague execution layer hard fork and the Electra consensus layer upgrade, significantly enhancing Ethereum's performance through 11 improvement proposals. The account abstraction feature (EIP-7702) allows users to flexibly manage wallets through social media accounts or multi-signature schemes, lowering the usage threshold and attracting more users and developers. The optimization of the staking mechanism increased the validator ETH cap from 32 ETH to 2048 ETH and introduced flexible withdrawal methods, making it easier for institutions and individuals to participate in network security, thereby enhancing market confidence in Ethereum's long-term value.

At the same time, Pectra optimized the interaction efficiency of Layer 2 networks such as Arbitrum and Optimism, resulting in faster transaction speeds and lower costs, leading to a surge in on-chain activities. As a key step for Ethereum from "2G" to "5G," the Pectra upgrade not only revitalized the network but also "recharged" market confidence, directly driving up prices.

Related reading: "Ethereum Surges 22% in One Day, E Guardians Stand Up"

Not only Ethereum itself, but also important positive news has come from Wall Street.

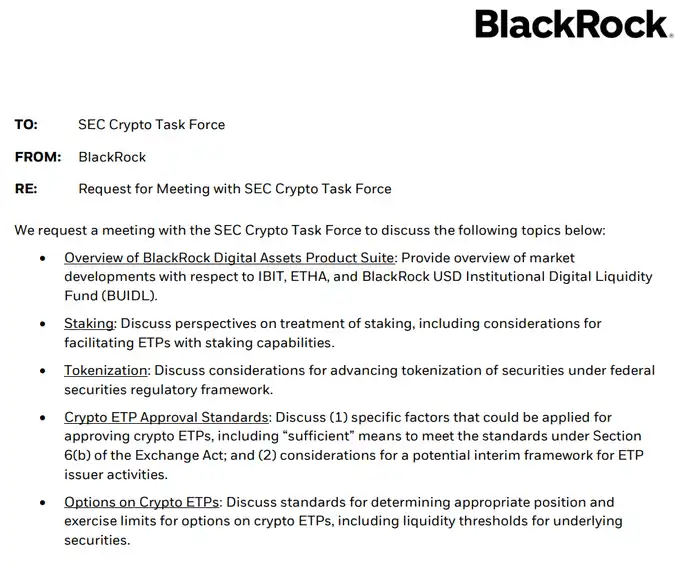

The world's largest asset management company, BlackRock, proposed to the SEC to allow staking for Ethereum ETFs. This proposal not only hopes to upgrade Ethereum ETFs from mere investment tools to "yield-generating assets" similar to bonds, providing investors with both capital appreciation and passive income, but also ignited optimistic sentiment in the market regarding Ethereum's future potential.

Specifically, BlackRock proposed to amend its S-1 filing to allow investors to create and redeem ETF shares directly with Ethereum instead of US dollars (i.e., physical redemption), and to deepen the integration of traditional finance and blockchain with its $2.9 billion BUIDL fund launched in March 2024. The BUIDL fund is a tokenized fund operating on the Ethereum network, investing in traditional assets such as US Treasury bonds. This is highly attractive to institutional investors, as they can not only share in the gains from Ethereum's price increase but also obtain stable cash flow through staking.

Robert Mitchnick, head of digital assets at BlackRock, stated in a CNBC interview in March 2025 that the addition of staking functionality would significantly enhance the attractiveness of Ethereum ETFs. He admitted that after the launch of the Ethereum spot ETF in July 2024, market demand was tepid due to the lack of staking functionality, and staking could be the key to reversing the situation.

At the same time, the SEC's shift in attitude towards cryptocurrency regulation has also fueled this wave of price increases. During the tenure of the previous chairman, the SEC maintained a tough stance, strictly viewing staking as a potential unregistered security based on the Howey test, and explicitly prohibited staking functionality when approving the Ethereum spot ETF in May 2024.

However, with Trump returning to the White House and Paul Atkins taking over as SEC chairman, there has been a noticeable loosening of crypto regulation. In addition to BlackRock, ETF issuers such as Invesco Galaxy, VanEck, WisdomTree, and 21Shares have also submitted similar applications for staking and physical redemption.

Related reading: "New Chairman Takes Office, SEC Becomes 'Crypto Daddy' in 48 Hours"

However, if the staking ETF is approved, the benefits should go far beyond just price increases. The introduction of staking functionality could redefine the role of crypto assets, making them closer to traditional financial products that can generate income and appreciate in value, pushing Ethereum closer to mainstream finance.

Currently, the SEC still needs to handle several decisions related to crypto ETFs, including whether to approve spot ETFs for other cryptocurrencies such as Solana, XRP, Litecoin, and even Dogecoin. As the call for a "altcoin season" grows louder, Ethereum's strong performance may just be the beginning of a larger wave in the crypto market.

Additionally, the DeFi project WLFI, related to the Trump family, is also optimistic about this price increase, frequently making on-chain moves. According to on-chain data analyst @ai_9684xtpa monitoring, WLFI-related addresses are borrowing to go long on ETH, borrowing 4 million USDT from Aave to buy 1590 ETH at an average price of $2515.

Has Ethereum reached its price peak?

This epic surge in Ethereum after a six-month lull has indeed given the community more confidence and hope, also reviving the entire altcoin market. However, amidst the joy, there are also bearish voices. Below is a summary based on community discussions compiled by BlockBeats.

Optimists point out that the current market structure is similar to the eve of the bull markets in 2016 and 2020, predicting that a life-changing surge may occur in the next 3-6 months, with some altcoins potentially achieving astonishing daily gains of 40%.

@liuwei16602825 stated that this round of price increase signifies the return of the bull market as "a done deal." There is no need to worry about a pullback. The main force behind the rise is using high-cost isolation trading, fearing declines more than any retail investor, and will undoubtedly protect the market.

Related reading: "Ethereum Leads the Charge, Triggering Speculation on 'Altcoin Season', How Do Traders View the Future?"

The bears mainly believe that this surge is different from the 2021 bull market, as the current market lacks the confidence of retail investors to enter on a large scale and hold long-term, with capital rotation happening too quickly.

@market_beggar observed that Bitfinex E/B whales have begun to close positions and believes that if this whale continues to maintain high-speed closing operations in the coming days, it can be inferred that the whale is no longer optimistic about ETH's upward potential and is preparing to take profits and exit, thus the focus should be on the timing of the position closure.

@FLS_OTC stated that there are still many uncertainties at the macro level, and liquidity cannot support a major bull market; the current stage is a "flash in the pan," not a complete reversal, and will remain in a short position.

@off_thetarget believes that after ETH transitioned from POW to POS, it lost the "gold standard" support of mining power costs, and the staking economic model has led to a failure of value anchoring; at the same time, the L2 ecosystem (such as Starknet, zkSync, etc.) has fragmented liquidity, failing to form an effective capital return mechanism, leading to the collapse of the split trading model; coupled with the ETH community's excessive pursuit of technical narratives while detaching from actual demand, resulting in weak ecological growth. Therefore, he believes that ETH's intrinsic value system has collapsed, and the price will inevitably plummet to the range of $800-1200, decisively shorting at the $1800 level.

@Airdrop_Guard, based on the core logic of "high-probability trading strategies," stated that when three trading systems with different underlying logics (such as volume exhaustion, price supply and demand, long-short holding rates, etc.) simultaneously issue short signals at the same price point (2580), it forms a high-probability trading opportunity. He emphasized that these systems must be based on different algorithms and logic (rather than simply overlapping technical indicators), and the current ETH trend meets the short conditions of multiple independent dimensions in his trading system, thus choosing to short.

Overall, Bitcoin still maintains over 54% market dominance, and the continued preference of institutional funds for it may limit the upward potential of altcoins. The future direction of the market will depend on multiple factors, such as Bitcoin's price trend, the global macroeconomic situation, and whether capital can effectively rotate from Bitcoin to the altcoin sector.

Although Ethereum's recent leadership has brought optimistic sentiment, investors still need to remain rational, as different sectors of altcoins are likely to show divergent trends. Whether this round of Ethereum's rise can usher in a true altcoin frenzy may still require more time and favorable conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。