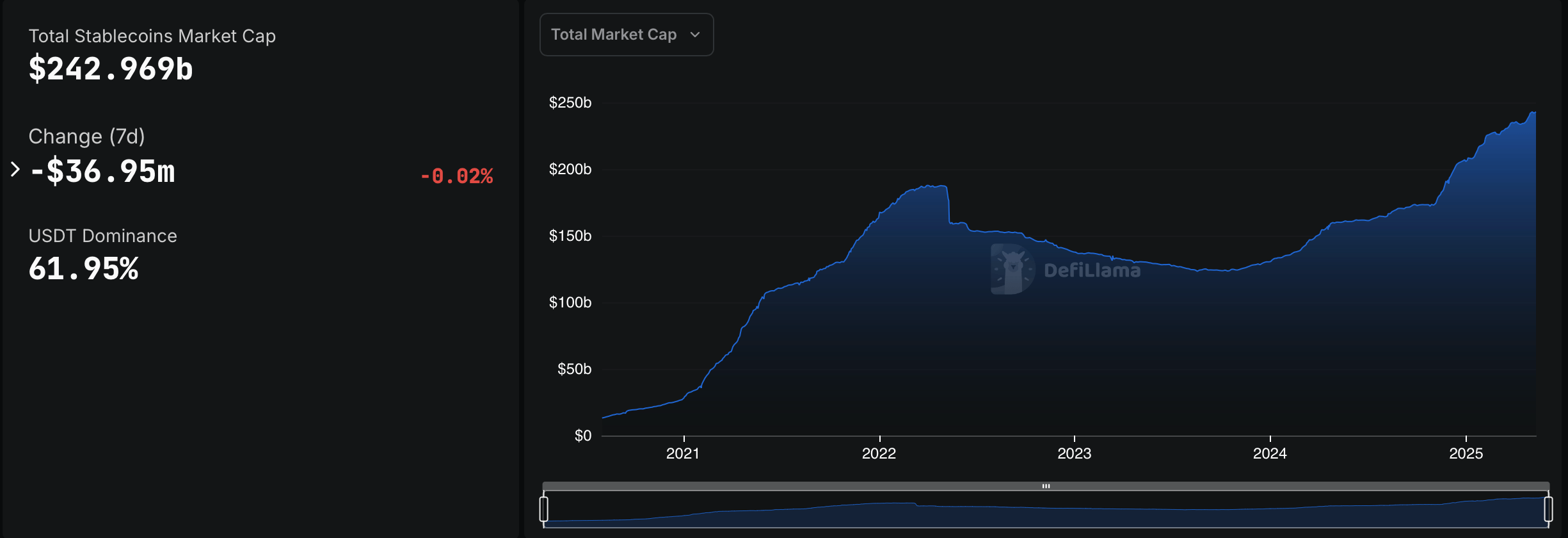

The total market cap for stablecoins currently stands at $242.97 billion, according to data from defillama.com. Despite the small drop, the stablecoin sector remains resilient with major tokens like tether ( USDT) reinforcing their dominance.

USDT, the largest stablecoin by market cap, maintained its top position with a valuation of $149.87 billion and registered a modest 7-day gain of 0.36%. It now accounts for 61% of the total stablecoin market. In contrast, USDC saw a decline of 1.21% in the same period, settling at a $60.808 billion market cap.

Source: Defillama.com

DAI posted a notable weekly gain of 6.39%, bringing its market cap to $4.372 billion. Meanwhile, Blackrock’s BUIDL token surged by 1.33% over the week, pushing its market cap to $2.897 billion and leading monthly gains with a 26.14% increase.

On the downside, sky dollar (USDS) experienced a 5.5% drop in market cap, and Ethena’s USDe declined by 0.56%. These movements contributed to the overall negative weekly balance for the fiat-pegged crypto sector.

While the broader trend shows minor contraction, the performance disparity among individual stablecoins highlights varying investor sentiment and emerging competition in the stablecoin ecosystem.

With bitcoin, ethereum, and a range of altcoins posting strong gains, investor appetite is shifting toward risk-on crypto assets. As bullish momentum returns to crypto markets, exposure to stablecoins is declining slightly as traders reallocate capital into appreciating tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。