Coinbase (Nasdaq: COIN) saw its shares drop Thursday afternoon when it announced lower-than-expected revenue for the first quarter of the year. Even the firm’s historic acquisition of the world’s largest crypto derivatives platform Deribit, a $2.9 billion transaction, the largest deal in crypto history, and bitcoin’s recent surge past $100K, both failed to rally the exchange’s stock, which closed at $199.32 on Friday, down 1.5%, according to Yahoo Finance.

The exchange raked in $2.0 billion in total revenue for the quarter but netted only $66 million, according to its shareholder letter. In comparison, Coinbase’s net income for the previous quarter was $2.27 billion and net income was roughly $1.2 billion.

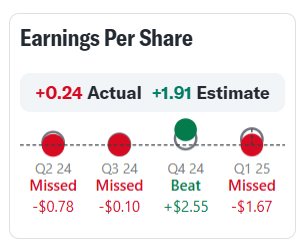

(Coinbase missed analyst estimates by 87.46% / Yahoo Finance)

The major reason for the exchange’s underperformance appears to have been a decline in transaction revenue in Q1 2025 as compared to Q4 2024. That decline, according to Coinbase Chief Financial Officer Alesia Haas, turned out to be an industry-wide phenomenon, with Haas claiming her firm still outperformed its competitors. Nevertheless, Wall Street was expecting around $1.91 in earnings per share (EPS), but the exchange revealed a paltry $0.24 EPS, missing analyst estimates by a whopping 87.46%.

“I want to start with our transaction revenue, which was $1.3 billion, down 19% quarter-over-quarter,” Haas said during the company’s earnings call on Thursday. “Total global spot trading was down 13% with Coinbase outperforming at down 10%.”

Haas went on to explain that Coinbase’s efforts to expand its derivatives trading business have involved providing rebates and other incentives to acquire customers, an approach that has caused a dip in overall transaction revenue. Given the acquisition of Deribit, it does appear that right now, the exchange is focused on growth, sometimes even at the expense of revenue.

“We posted strong financials, rolled out product innovations at a rapid pace, and continued to grow global market share,” said CEO Brian Armstrong in his opening statement during the call. “Financially, we’re better positioned than ever to capitalize on the opportunities ahead of us in 2025.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。