Original Authors: SanTiLi, Naxida, Legolas

Abstract:

This article will focus on the four halving events of Bitcoin from 2012 to April 2024, systematically sorting out the halving mechanism of Bitcoin, the trend of inflation rate changes, and exploring the impact of these events on price trends by combining the market performance before and after each halving. Through historical data analysis and macro comparisons, this article points out that Bitcoin has currently entered a cycle where its inflation rate is lower than that of gold, highlighting its increasing scarcity and gradually establishing a long-term value logic that can compete with traditional assets. At the same time, from the perspective of the cyclical rhythm of the four halvings, although the price increase since the 2024 halving has been moderate, it is still in a stage of accumulation, and the real window may gradually open between 2025 and 2026. The article concludes by discussing the core value foundation of Bitcoin, including scarcity, decentralization mechanism, and deflationary model, indicating that its logic as "digital gold" is becoming increasingly mature.

I. Bitcoin Halving Cycle Basic Rewards and Inflation Rate:

Bitcoin was designed by Satoshi Nakamoto in 2009, with a total supply fixed at 21 million coins. In the early days, miners could receive 50 BTC as a reward for successfully mining a block. This reward is halved approximately every 210,000 blocks (about every four years), gradually reducing the new issuance.

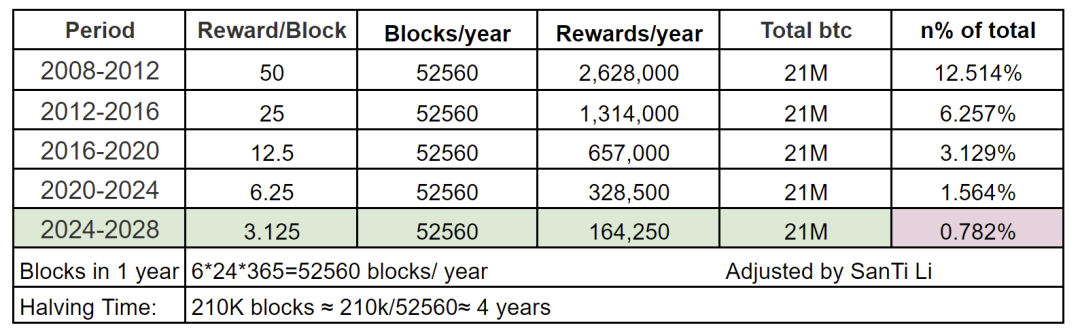

The halving cycle of BTC officially began in 2012, halving every four years, with the 2024 halving reducing the block reward to 3.125 BTC, resulting in an annual inflation amount of: 52560 x 3.125 = 164,250 coins, accounting for approximately 0.782% of the total supply. An inflation rate of around 0.78% is already lower than the annual inflation rates of most developed countries, while the inflation rate of gold mining's increased production is approximately between 1.5% and 2%. Currently, BTC has entered a cycle where its inflation rate is lower than that of gold.

Fig.1 Bitcoin Halving Cycle Rewards and Inflation Chart

As shown in the chart: When each block has a reward of 50, the annual increase is approximately: 52560 x 50 = 2.628 million coins, accounting for 12.5% of the total supply of 21 million. By 2025, when each block has a reward of 6.25, the annual increase will be: 52560 x 6.25 = 328,500, accounting for 1.564% of the total supply of 21 million.

As of May 7, 2025, around 14:00, approximately 19,861,268 BTC have been mined, accounting for about 94.58%, with a total market value of approximately $2 trillion ( $2034,300,009,004). Compared to the last halving cycle in 2020, when about 18,385,031 BTC were mined, accounting for about 87.5%, the total market value at that time was approximately $161.8 billion. After about five years, the total market value has increased by approximately 1236%.

In the next four years, the annual inflation rate will only be 0.782%.

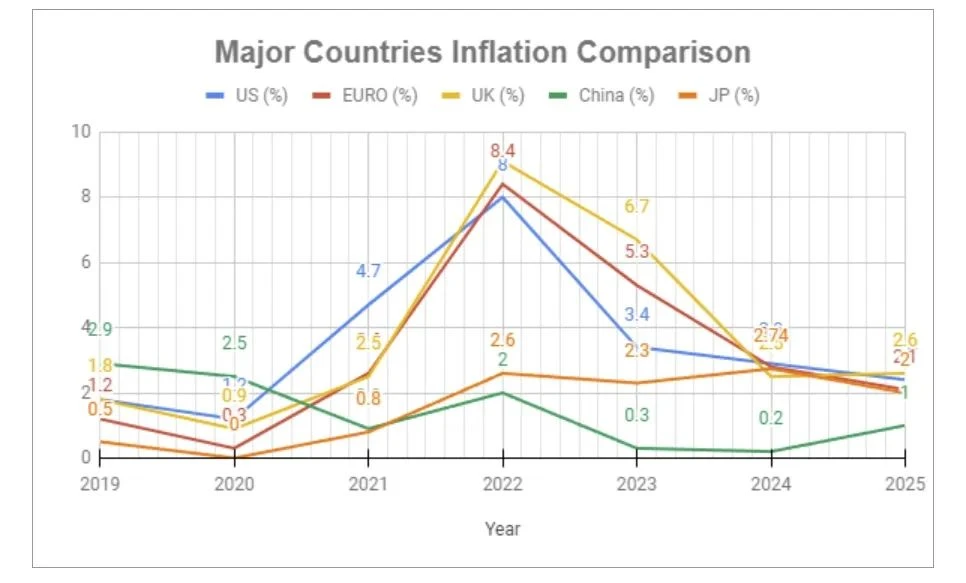

Fig.2 Comparison of Inflation Rates of Major Countries from 2019 to 2025

China's inflation rate in 2019 was about 2.9%, while the United States had an inflation rate of 2.3%. Due to COVID-19 subsidies in 2020, we predicted that the significant increase in the issuance of the US dollar would lead to a substantial rise in inflation rates from 2020 to 2022. The inflation rate in the US indeed reached a high of 8%, and subsequently decreased year by year due to the Federal Reserve's interest rate hike policy. By 2024, it had dropped to around 2.2%, while China's annual inflation was about 0.2%, making it one of the major countries with better inflation control (2019–2024: data from official statistics of various countries. 2025: data from the International Monetary Fund (IMF) report and actual updated forecasts). Most developed countries' data is around 2.5%, but the actual shopping experience and currency depreciation should be significantly greater than the statistical data.

At this time, this halving of Bitcoin will again halve BTC's inflation rate, entering a new historical low inflation level of 0.782%. The reduction in inflation rate is generally not a bad thing for any asset, as it further increases scarcity. However, this does not necessarily mean that the asset's value will rise 100% in a short time, but it is a relatively important anti-devaluation factor.

II. Comparative Analysis of Market Performance After Four Bitcoin Halvings:

Since the inception of Bitcoin, each halving of block rewards has had a profound impact on the BTC market price. From 2012 to 2024, the four halving events exhibit some relatively consistent cyclical characteristics. This article provides a detailed comparison of the market price trends before and after each halving, extracting some valuable patterns for readers. History does not repeat itself exactly, but there are always similar patterns before reaching a peak or nearing destruction.

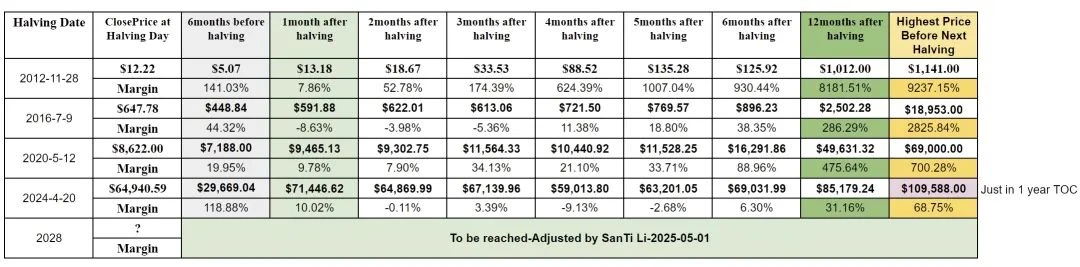

Fig.3 Value Change Data of BTC During Four Halving Cycles

As shown in Fig.3, the data for the first six months before each of the four halvings and the trend data for one year after the halving, as well as the highest points during the corresponding cycles, are summarized. It can be seen from the chart that after each halving, Bitcoin's price has experienced significant increases. Calculating based on the closing price on the day of the halving, the price increased by over 8000% within one year after the 2012 halving, approximately 286% after the 2016 halving, and about 475% after the 2020 halving, while the increase after the 2024 halving has only been about 31% so far (with a maximum of 68.75% - $109,588).

1. Significant Price Increases Generally Occur in the Six Months Before Halving

Looking back at the four halving events, Bitcoin typically begins to enter an upward channel six months before the halving. For example:

During the 2012 halving, the price increased by 141.03% compared to six months prior.

During the 2024 halving, the price increased by 118.88% compared to six months prior.

This stage often corresponds to the market gradually pricing in the "halving expectation," providing strong preparatory signal value.

2. The Core Explosive Period is 6 to 12 Months After Halving, but Not Necessarily the Highest Point

Historical experience from the three previous halvings shows that the 6 to 12 months after halving is the main upward phase for Bitcoin:

2012: Price increased by 8181.51% after one year.

2016: Price increased by 286.29% after one year.

2020: Price increased by 475.64% after one year.

2024: Currently not yet a year, with a temporary increase of 31.18%, and a maximum of 68.75% ($100.9k).

Especially in 2012 and 2020, a typical structure of "consolidation within six months, followed by an explosion" was observed. After one year, the maximum explosive period reached a historical peak. Currently, with the 2024 halving just under a year ago, if history repeats itself, the real explosive window may open between Q1 2025 and Q1 2026.

3. The Price Trend in the First Year After Halving Provides Preliminary Reference for Judgment

After the 2024 halving, Bitcoin increased by 10.02% within a month, but then experienced fluctuations and corrections over the next two months, remaining in a stage of accumulation. As of October 2024 (i.e., six months after the halving), the price has only slightly increased by 6.30% compared to the halving day, far from entering the main upward phase. However, this is not uncommon in history, as both 2016 and 2020 officially started their market trends only after six months post-halving.

4. The Peaks of Each Bull Market Mainly Occur Within 6 to 12 Months After Halving

Based on data from the previous three halvings, the highest prices relative to the closing price on the day of halving occurred in the mid-term before the next halving:

2012: Maximum increase of 9237.15%.

2016: Increase of 2825.84%.

2020: Increase of 700.28%.

In the current 2024 halving, a peak of $109,588 has been reached, representing a 68.75% increase from the halving day, and has not yet entered an exponential explosion phase. This pattern only applies to this round, as if BTC can reach values as high as 300,000 to 500,000 or even 1,000,000, its valuation would be extremely large. In the next halving, unless it is based on the depreciation of reference anchor assets or further exploration of applications, such as interstellar exploration, it will be difficult to see several times growth again.

Chart Summary:

The historical halving cycles of Bitcoin exhibit a highly consistent three-phase rhythm:

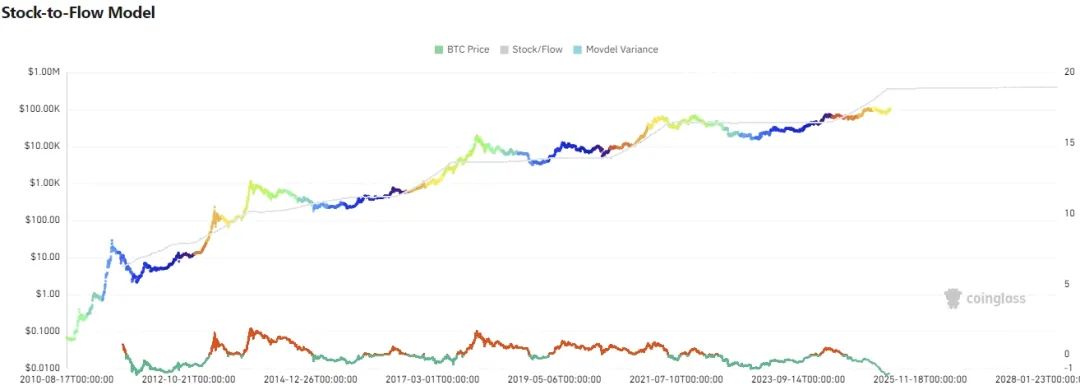

Accumulation Uptrend (6 months before halving) → Stable Fluctuation (6 months after halving) → Main Upward Explosion (6 to 18 months after halving). The current 2024 halving is approaching one year, indicating that the market may still be accumulating energy for a later explosion. Coincidentally, this is similar to the eve of 2017, which also coincided with the early days of Trump's presidency. At the same time, the Stock-to-Flow chart indirectly supports our reference value viewpoint that we are still in a phase of thick accumulation before thin release: however, historical data and patterns only have reference value, and one should not blindly follow the data's guidance but also have sufficient self-judgment to study DYOR.

Fig.4 Bitcoin Price Stock-to-Flow Chart

III. The Long-Term Value Scientific Attributes of BTC:

The value of an asset comes from consensus and its intrinsic value, while long-term consensus must come from its inherent advancement, scientific attributes, and irreplaceable pioneering nature. Bitcoin (BTC) is not just a cryptocurrency; it is an innovative result at the intersection of multiple disciplines, including technology, economics, mathematics, and cryptography. Its long-term value is not merely maintained by market speculation but is built on a complete, rigorous, verifiable, and anti-manipulation system design.

1. Scarcity:

As mentioned earlier, the total supply of Bitcoin is fixed at 21 million coins, written into the protocol by Satoshi Nakamoto in the underlying code, and gradually released through the halving mechanism of block rewards. It halves approximately every four years, with the final issuance expected to be completed around 2140. In contrast to the unlimited issuance mechanism of fiat currency, Bitcoin has a natural deflationary characteristic, supporting its long-term appreciation logic from a supply and demand perspective.

The design of scarcity is the core pillar of Bitcoin's resistance to inflation, laying the foundation for it to become "digital gold."

2. #Decentralization: Consensus Mechanism Ensures Network Neutrality

The Bitcoin network relies on a decentralized PoW (Proof of Work) consensus mechanism provided by computational power, allowing any node to verify transactions and participate in maintaining the ledger. This structure effectively avoids issues such as centralized single points of failure, power abuse, and system control found in traditional financial networks. The significant global decentralization also minimizes the risk of a 51% attack.

3. Deflationary Model Against Fiat Currency Depreciation

As shown in Fig.2, Bitcoin's built-in deflationary issuance model sharply contrasts with the inflation structure of fiat currencies worldwide. Especially in the context of massive quantitative easing (QE) and currency flooding by global central banks since 2020, Bitcoin has gradually proven to be a hedge against the depreciation of fiat currencies and the risks of asset bubbles. BTC is increasingly becoming a safe haven for global capital in the "era of diminishing trust in fiat currencies."

4. Technological Attributes: Advanced Cryptography + Peer-to-Peer Network Design

Bitcoin comprehensively applies several cutting-edge technologies:

● Elliptic Curve Digital Signature Algorithm (ECDSA): Ensures account security and private key signing.

● SHA-256 Hash Algorithm: Ensures data immutability.

● Merkle Tree Structure: Efficiently verifies transactions within blocks.

● P2P Peer-to-Peer Network: Achieves global value transfer without intermediaries.

The combination of these core technologies makes Bitcoin a highly robust, counterfeit-proof value transfer network, while also possessing infinite scalability, laying a solid foundation for subsequent layer-two expansions (such as the Lightning Network and ecological applications). BTC is not only an asset but also a masterpiece of cryptographic engineering. Future anti-quantum updates are also worth looking forward to.

5. Challenger to Global Financial Order: An Alternative Consensus Asset Amidst Dollar Trend Changes

The world is currently experiencing a wave of de-dollarization: settlements between countries are beginning to shift towards local currencies, gold, and decentralized assets. Bitcoin, with its non-sovereign objectivity, globalization, and scarcity, has become an important channel for asset transfer and value storage in emerging markets and turbulent countries. It constructs a new financial order model that coexists with but is independent of the #US dollar and #gold—"a neutral system of consensus currency." When "the credit of certain countries" is hard to trust, relying on objective algorithmic credit will become a moat between nations, although further intervention from regulatory agencies in various countries is needed to prevent frequent illegal activities.

6. Potential Financial Infrastructure for Interstellar Civilization (Currently Unapplied, Personal Exploration Perspective)

Bitcoin is currently the only value protocol that does not rely on any country, #bank, or #internet entity. Its ledger can exist at any node between planets, requiring only electricity and computational power to maintain the network. This structure is naturally suitable for future space exploration scenarios, such as Mars or lunar exploration, facilitating quick and direct use and application. However, since human exploration of outer space is still in its infancy, with no significant breakthroughs in stable landings and arrivals, this point is limited to personal imagination. Yet, looking ahead to a 30-50 year cycle, preliminary planetary applications do not seem entirely impossible. Bitcoin (or similar credit points) could serve as the underlying token of human digital civilization.

Thus, the overall scientific attributes of BTC are:

Supply Cap (Scarcity) + Consensus Strength (Decentralization);

Real-World Context: Continuous Weakening of Fiat Currency Credit, Expansion of Debt Bubbles;

In the face of future uncertainties, Bitcoin's 'anchoring property' is becoming increasingly prominent.

IV. Summary of BTC's Main Long-Term Trend Value

This article concludes the following based on the analysis of BTC's halving cycle performance and its long-term scientific attributes:

The four halving cycles of Bitcoin exhibit a highly consistent market rhythm: expectations before halving drive price increases, followed by short-term consolidation and accumulation after halving, leading to a main upward trend. From the perspective of inflation rates, after the 2024 halving, Bitcoin's annual inflation rate has dropped to 0.78%, for the first time lower than that of gold, further solidifying its position as a scarce asset. In the context of sustained high inflation, credit expansion, and increasingly large debt deficits in the global fiat currency system, Bitcoin's deflationary model and decentralized characteristics are attracting more and more attention and allocation from traditional capital.

Although short-term market volatility still exists, and the sudden emergence of black swan events cannot be ignored, the logic of Bitcoin's long-term value is gradually becoming clearer: it is not just a cryptocurrency but a new type of asset based on cryptography and consensus. In future cycles, its long-term value potential, ability to hedge against inflation, and the irreplaceability of its technological foundation, along with further ecological development, will continue to empower it, constructing the core value barriers that "digital gold" should possess.

Viewpoint Reminder: Some people categorize Bitcoin as speculative or fraudulent due to the presence of speculation and scams in the market, which is also an unobjective research attitude (or it can be said that projects relying solely on speculation are hard to sustain, like many memes).

Risk Warning: The discussion in this article regarding the halving cycle and long-term value is intended for educational and research reference purposes only and does not constitute investment advice. Readers are encouraged to conduct thorough research, form their own judgment logic, and not blindly follow or trust anyone, DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。