Author: Luke, Mars Finance

On the fervent stage of cryptocurrency, star meme coins streak across like meteors, dazzling yet fleeting. On May 8, 2025, the personal meme coin $Mikami of Japanese entertainment star Yua Mikami launched prominently on the Solana chain, accompanied by the anticipation of 17.5 million fans and $3.46 million in fundraising, vowing to ignite a revolution in fan economy. However, just hours later, the token price plummeted by 85%, with its market value shrinking from $16.9 million to $7.8 million, leaving presale investors with nothing and the community in despair. This was not just a "sneak attack" in the crypto world, but a microcosm of the celebrity meme coin craze.

From Idol to Crypto: Mikami's Web3 Ambition

Yua Mikami, a name that resonates throughout Japan and even the Asian entertainment industry. From debuting as an idol in SKE48 in 2009 to transforming into an adult entertainment superstar, she has repeatedly reshaped herself with a keen business sense. In 2021, her 28 NFT "art photos" sold for as much as 170,000 yuan each, proving fans' fervor for digital assets. When she announced the $Mikami token plan on the X platform at the end of April 2025, both the crypto and fan communities erupted.

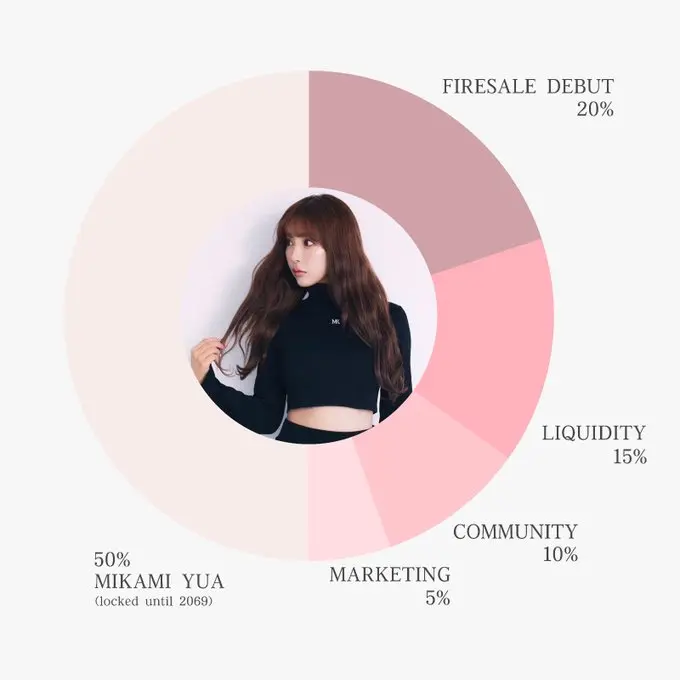

The vision for $Mikami was grand: leveraging the low fees and high efficiency of the Solana blockchain to create an ecosystem that integrates "temple economy," AI virtual personas, DAO governance, and exclusive fan experiences (meet-and-greets, concerts, etc.). The white paper outlined a clear distribution: a total supply of 69 million tokens, with 50% allocated to Mikami herself (locked until 2069), 20% for presale, 15% injected into liquidity, 10% for community distribution, and 5% for marketing. At the token's launch, the circulating market value was expected to be $8.45 million, igniting fans' enthusiasm with "scarcity" and "future value."

Presale Frenzy: A $3.46 Million Fan Carnival

On April 30, the presale of $Mikami kicked off, attracting 10,461 addresses to invest 23,333 SOL, approximately $3.46 million, within 72 hours. Solscan data showed that 94.4% of investors contributed less than 1 SOL (about $150), indicating a retail-dominated landscape. However, 0.1% of large holders—including a whale who splurged 574 SOL (about $84,000)—accounted for 17.8% of the funding pool. The average investment per person was 1.35 SOL, about $200, making it a typical "fan economy" feast.

Mikami herself fanned the flames on X: "Beauty fades, but scarcity endures. The future belongs to believers." The official account further fueled the hype, announcing the presale cost of 0.00169 SOL for 1 $Mikami, with a unit price of about $0.245. The 50% token lockup meant limited circulation, theoretically supporting price stability. However, alarms were already ringing in the X community. Some questioned Mikami's fans' spending power: "Most of her fans are 'free content' enthusiasts; expecting them to drive up a meme coin is a bit naive." Others speculated that there were Asian market operators behind the project, with Mikami merely "selling her name" for quick cash.

Midnight Crash: Retail Investors' "Sneak Attack" Nightmare

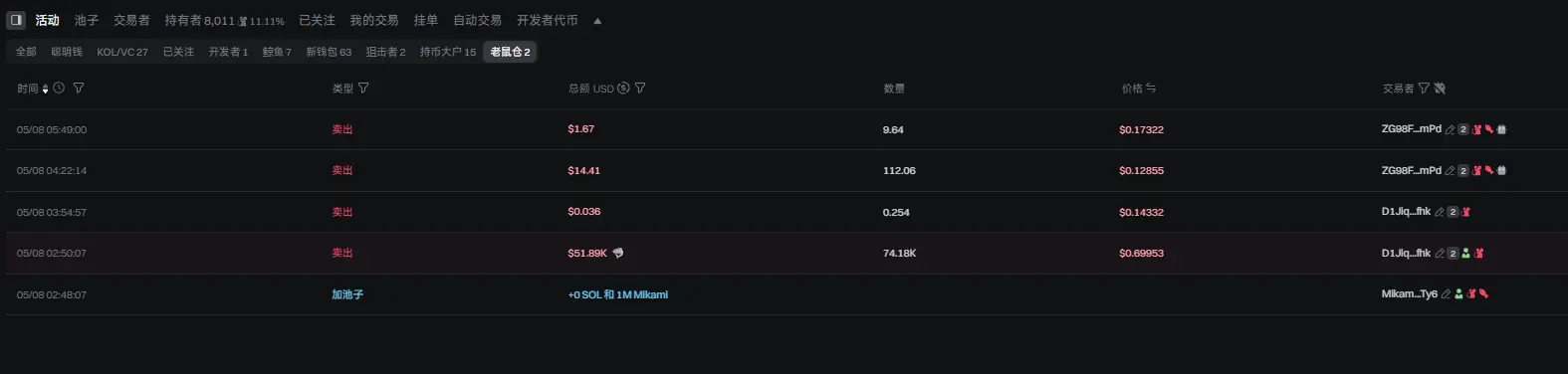

In the early hours of May 8, 2025, the $Mikami token quietly launched on the Solana chain. The official account announced the token's on-chain status on the X platform, with airdrops distributed in the order of presale time, an initial market value of $16.9 million, and a circulating market value of $8.45 million. However, before the midnight bell rang, joy turned into a nightmare. By 4 AM, X community members exclaimed that the token had "crashed," with the price plummeting from the presale price of $0.245 to $0.1, a 60% drop. By morning, the market value further shrank to $7.8 million, down 85% from its peak, nearly "tenfold to zero." "This is simply a sneak attack!" one community member fumed, suggesting that the midnight launch timing seemed meticulously designed to "pinch" retail investors' sleep time, allowing "the leaders to exit first."

The harsh reality of the data was suffocating: the $3.46 million of presale investors was now worth only $1.56 million, requiring the market value to rise to $17.5 million—more than double the current price—to break even. Liquidity accounted for only 15%, and in the low-volume DEX pool, prices ran wild like a runaway horse. The X community pointed fingers at the project's "domestic" attributes, suspecting that the behind-the-scenes team had meticulously planned a "harvest" of retail investors. "Launching at midnight while retail investors are still dreaming, the big players had already cleared out," one user criticized, "this is a typical domestic project trick: pump and dump, leaving retail investors to pick up the pieces."

The "Domestic" Conspiracy?

In the heated discussions within the X community, "domestic" became the keyword for the $Mikami crash. Community members speculated that the project team might be led by operators with a Chinese background, with Yua Mikami merely serving as the brand face, while actual operations were handled by a team familiar with crypto tactics. One piece of evidence supporting this speculation was the precise design of fundraising and launch. During the presale phase, the $3.46 million funding pool seemed substantial, but the 20% token allocation corresponded to only 13.8 million $Mikami tokens, meaning the team could quickly cash out through high premiums. In contrast, the 15% liquidity allocation (about 10.35 million tokens) was far from sufficient to support market trading, and the thin liquidity pool made prices easily manipulable.

Even more striking was the choice of launch time. Launching at midnight Beijing time coincided with the rest period for Chinese retail investors, while investors in other Asian regions (like Japan) and the Western markets were also unable to react immediately due to time differences. This "time difference tactic" is not new in the crypto world. Community members recalled that several Solana meme coin projects in 2024 had also used similar methods, launching late at night to create information asymmetry, allowing insider traders to sell off first. One user analyzed: "Launching at midnight allows bots and internal addresses to clear out in seconds, leaving retail investors with only the aftermath." Solscan data showed that within minutes of $Mikami's launch, several large addresses sold off millions of tokens, leading to a price collapse, indirectly supporting this speculation.

The token distribution structure further fueled the conspiracy theories. The 50% token lockup for Mikami until 2069 ostensibly promised "long-termism," but in reality compressed the circulating supply by half, raising initial price expectations. However, the community questioned the authenticity of this lockup: "Who can guarantee that it won't be secretly unlocked before 2069?" Even more unsettling was the lack of transparent usage records for the 5% marketing budget and 10% community allocation. Some revealed that the trending searches and bot comments for $Mikami on the X platform seemed to be driven by marketing funds, creating a false sense of prosperity. "This 5% is probably used to buy bots and KOLs to hype it up," one user sarcastically remarked, "and what about the community's 10%? Probably went into the team's pockets."

Retail Investors' "Tuition" and Manipulative Tactics

The community's criticism of the "domestic" project was not unfounded. Chinese crypto projects are known in the global crypto space for their "efficient execution" and "strong community mobilization," but they are also often criticized for "harvesting retail investors." In 2024, meme coins like $NEIRO and $SPX6900 on Solana, all operated by Chinese teams, saw initial skyrocketing prices followed by rapid declines, leaving retail investors in disarray. The $Mikami model was no different: high-profile presales to attract funds, thin liquidity to amplify volatility, and midnight launches to create panic selling. Community members lamented: "Domestic projects dare to show their faces, at least they should have some shame, but retail investors are always the last link."

It is worth noting that the $Mikami crash was not entirely intentional. The ecosystem of meme coins on the Solana chain is inherently speculative, with thin liquidity being a common issue, and the FOMO sentiment among retail investors also laid the groundwork for price bubbles. One user reflected: "We chased the highs ourselves; who can we blame? Mikami's name was just a hook; the real fishing was done by the market." However, the chaos surrounding the airdrop—some users did not receive tokens or only received part of them—exacerbated the trust crisis. The community speculated that the delay in airdrop distribution might have been a deliberate tactic by the team to buy back tokens at low prices, further driving down circulating prices.

The Calculated Manipulation and Market's Ruthlessness

From a manipulation perspective, the midnight crash of $Mikami was a "textbook" sell-off. The team cashed out $3.46 million SOL through the presale, and after deducting Mikami's share (estimated at $2.5 to $3.11 million), the remaining funds were sufficient to cover development and marketing costs. Even if the market value dropped to $7.8 million, the team's actual loss was minimal, while retail investors' $3.46 million investment was nearly halved. The community calculated that for presale investors to break even, $Mikami would need to rise above $0.5, with the market value returning to $17.5 million—something nearly impossible under the current market sentiment.

While the conspiracy theories surrounding the "domestic" project have not been officially confirmed, the community's anger reflects retail investors' deep distrust of opaque manipulation. Some summarized: "This isn't Mikami's fault; it's our fault for believing too much in the wealth myth of meme coins." Another user quipped: "Mikami taught us a lesson: there is no free lunch in the crypto world, only expensive tuition."

Mikami's "Easy Win" and Fans' "Tuition"

For Yua Mikami, the financial impact of this incident is minimal. It is estimated that, assuming the usual split between stars and agencies, she profited between $2.5 million and $3.11 million from the presale, far exceeding her previous appearance fee of 100,000 yen. The community sighed: "Wealth in the crypto world comes too suddenly; fans have paid 'tuition' to the 'enlightenment teacher'." Whether she actively manipulated or merely provided brand authorization, Mikami's personal image remains unscathed, and fan loyalty remains strong.

In terms of cultural impact, $Mikami ignited a fascinating chemistry between fans and speculation. The exclusive benefits promised by the token—signed posters, VIP events, etc.—attracted fans like moths to a flame. The community speculated that Chinese investors might drive up the coin price due to Mikami's appeal, especially if exclusive benefits spread. Some jokingly asked: "Is 1 fan worth $1 or $10?" alluding to Mikami's potential value among her 8.23 million X fans.

Celebrity Meme Coins in 2025: Revelry and Traps

The rise and fall of $Mikami is just the tip of the iceberg in the wave of celebrity meme coins in 2025. From Caitlyn Jenner's $JENNER to Iggy Azalea's $MOTHER, stars flock to Solana, chasing a win-win of fan economy and high profits. However, the reality is harsh. $JENNER plummeted from a market value of $42 million to $357,000, while Jason Derulo's $JASON and Waka Flocka's $FLOCKA saw declines of 97-99%. In November 2024, Jenner was sued for false advertising, highlighting legal risks.

Data shows that the average lifespan of meme coins is only 27 days, with most lacking intrinsic value and surviving on speculation and market sentiment. The total market value of meme coins on Solana reached $93.9 billion in 2025, but with extreme volatility. Projects like $Mikami, which have low liquidity and concentrated internal distribution, are particularly susceptible to manipulation. Bubblemaps found that when analyzing $MOTHER, sniper bots captured 20% of the supply at launch, and $Mikami may not have been spared.

Critics argue that celebrity meme coins exploit fan loyalty, turning emotions into speculative traps. Nick Vaiman from Bubblemaps told PANews: "Failed projects drain retail liquidity but fail to deliver on promises." However, there are optimists. Iggy Azalea interacts with fans through X, building trust, and the DAO and AI plans for $Mikami also suggest similar potential, although the execution remains questionable.

Insights and Future of $Mikami

The crash of $Mikami serves as a wake-up call for investors and celebrities. For fans, meme coins are entertainment rather than investments, and contributions should be made with the caution of "tipping a streamer." For celebrities, the temptation of high profits must be balanced with the risk to their reputation—Mikami's silence after the crash does little to restore trust. For the crypto world, transparency, sufficient liquidity, and practical use are key to shedding the "quantum scam" label.

Currently, the fate of $Mikami is uncertain. Whether it can rebound to the break-even point of $17.5 million depends on whether Mikami fulfills her promises—fan events, DAO governance, or a virtual "temple." For now, it remains a fleeting illusion in the frenzy of the crypto world. As the community puts it: "Beauty fades, but scarcity endures—provided the market buys it."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。