Despite facing multiple challenges such as technology, economy, regulation, and user trust, the integration of AI, the potential for assetization of health data, innovation in business models, and hardware development indicate that the combination of DePIN and smart wearables will profoundly transform personal health management, moving towards a future characterized by greater personalization, user empowerment, and value sharing.

❓ How should smart wearable devices unleash the infinite potential of health data while safeguarding user privacy?

❓ Users contribute data but do not benefit; how can DePIN rewrite the rules of the game?

This article explores how Decentralized Physical Infrastructure Networks (DePIN) can collaborate with smart wearable technology to reshape the landscape of personal health management. In the face of challenges related to data privacy, user control, and value distribution, how can DePIN provide breakthrough solutions to industry pain points?

We will analyze the integration models of DePIN and smart wearables (such as device integration and middleware platforms), key application scenarios (such as decentralized health data, "Wear-to-Earn," AI health services, and decentralized clinical trials), and discuss representative projects (such as Pulse, Cudis, HealthBlocks, WELL3) and underlying platforms (such as Solana, IoTeX, peaq), using smart rings (comparing Oura/Samsung with Cudis/WELL3) as case studies.

This report is produced by DePINone Labs; please contact us for reprints.

Introduction

Research Background

Smart wearable devices, through continuous monitoring of physiological indicators and increasingly complex algorithmic analysis, are evolving from simple activity trackers to comprehensive, forward-looking personal health management tools. These devices not only significantly enhance our awareness of our own health but also seamlessly integrate into the daily lives of modern individuals through communication, mobile payments, and other functions. It can be said that smart wearable technology is fundamentally changing how people connect with the world, enjoy entertainment, and manage their health, driven by data.

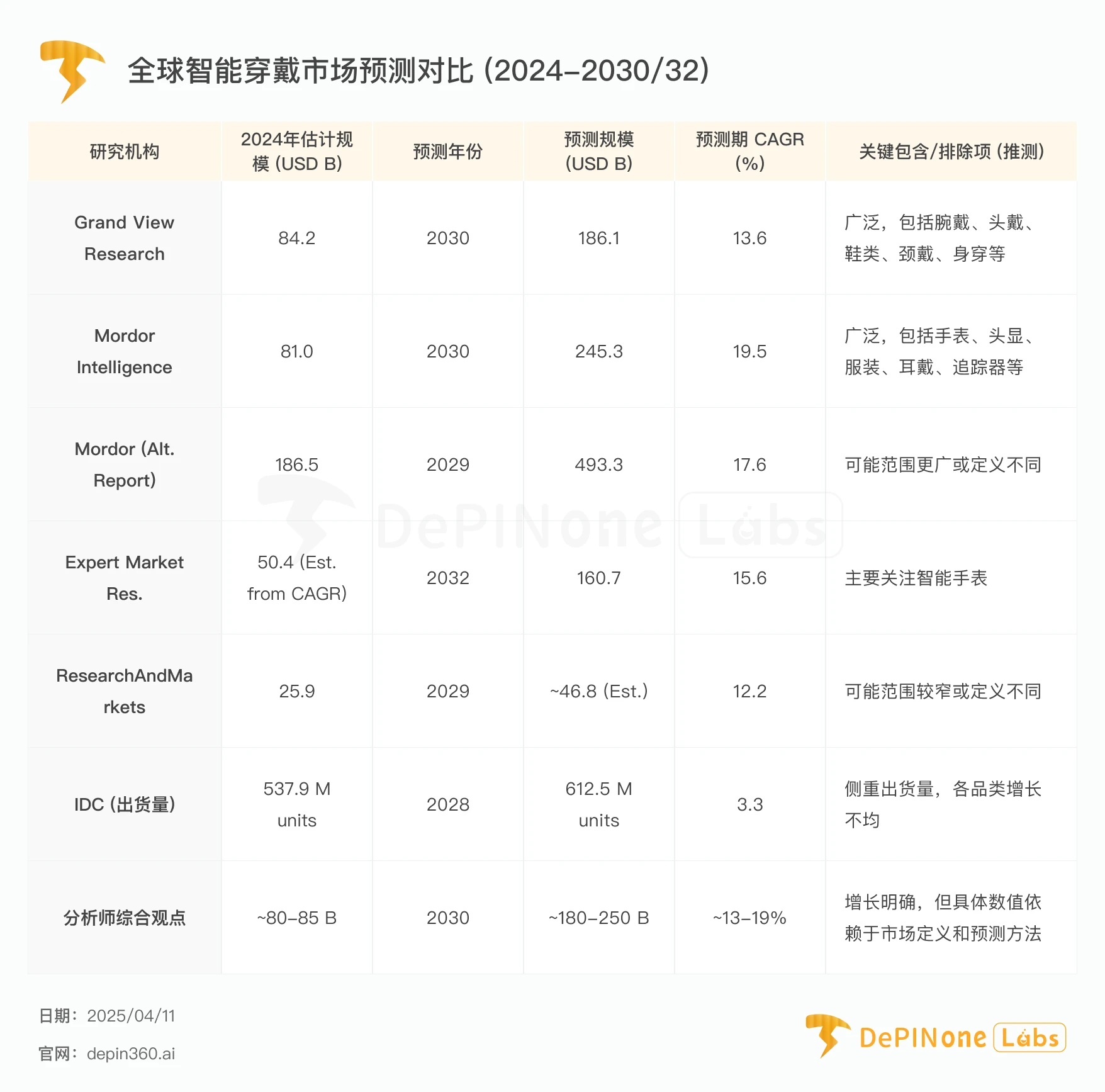

The global smart wearable market is on a fast track of rapid growth. Although different market research institutions have varying predictions, they all point to a strong growth trend. For example, Grand View Research predicts that the market size will grow from approximately $84.2 billion in 2024 to $186.1 billion in 2030, with a compound annual growth rate (CAGR) of 13.6%. Mordor Intelligence is even more optimistic, forecasting that the market size will grow from about $81 billion in 2024 to $245.3 billion in 2030, with a CAGR of 19.5%. Despite differences in specific predicted figures—likely stemming from different definitions of market scope (e.g., whether certain types of hearable devices or basic wristbands are included) or different forecasting models—the overall trend of the industry approaching a hundred billion and moving towards a multi-hundred billion scale is clear, with an expected size of nearly $250 billion by 2030.

The key factors driving this growth are multifaceted. First, there is an increasing global consumer focus on health, with the concept of preventive healthcare becoming deeply ingrained, driving demand for health monitoring devices. Second, continuous advancements in sensor technology have not only improved measurement accuracy but also enabled miniaturization of devices, making smaller and more powerful wearable devices possible. Additionally, the growth of global disposable income and increased consumer spending on electronics provide an economic foundation for market expansion. At the same time, the proliferation of smartphones and Internet of Things (IoT) devices provides the infrastructure for connectivity and data interaction for wearable devices. Finally, the application scenarios for wearable technology are continually expanding, moving from the initial fitness domain to healthcare (such as remote patient monitoring and chronic disease management), fashion (such as smart jewelry), enterprise applications, and even information entertainment (such as VR/AR headsets).

In this context, DePIN (Decentralized Physical Infrastructure Networks) has emerged as a key innovative paradigm in the Web3 space. DePIN aims to leverage blockchain technology, cryptoeconomic incentives (typically achieved through the issuance of native tokens), and the collective power of communities to build, deploy, and operate physical infrastructure networks in the real world in a more open, transparent, efficient, and community-driven manner. These infrastructures can encompass various types, including sensor networks, wireless communication base stations, data storage servers, and energy networks. The core idea of DePIN is to mobilize individuals or small-scale participants to contribute their idle resources (such as hardware devices, bandwidth, computing power, and data) through token incentives, collectively building an infrastructure network that can rival or even surpass traditional centralized giants, thereby breaking monopolies, reducing costs, and allowing participants to share in the value of network development.

Core Research Questions

When the data-intensive, rapidly growing smart wearable industry encounters the decentralized, user-empowering, and incentive-driven DePIN paradigm, what sparks will fly? This leads to the core research question of this report: Can DePIN effectively address the current pain points in data privacy protection, user data control, fair distribution of data value, and network interoperability in smart wearable devices? What innovative business models (for example, users earning rewards by sharing health data), novel application scenarios (such as decentralized health data markets or personalized health services), and potential investment opportunities will emerge from the integration of smart wearables and DePIN? This report aims to systematically explore and analyze these core issues.

Research Scope and Objectives

The research scope of this report focuses on the intersection of DePIN technology and the entire smart wearable industry ecosystem (including hardware, software, platforms, applications, and services). We aim to analyze the intrinsic logic of their integration, potential economic and social value, and possible development paths. The report will not be limited to a specific category of wearable devices but will consider the entire ecosystem as the research object, while selecting specific product forms such as smart rings for in-depth analysis to illustrate the specific models and impacts of integration.

The objectives of this report are to:

Depict a panoramic view of the smart wearable industry: Outline the global market size, growth trends, major sub-product areas (such as smartwatches, smart rings, hearable devices, etc.), key supporting technologies (sensors, connectivity, AI, etc.), and major market participants and their competitive landscape.

Deeply interpret the core mechanisms of DePIN: Explain the definition of DePIN, its core components (blockchain, token incentives, community governance), and the unique value proposition it brings to the smart wearable industry, particularly how it addresses existing pain points.

Explore the integration of DePIN and smart wearables: Analyze the key models of their combination, potential application scenarios (especially in health data management, health incentives, and personalized services), and the innovative potential arising from this integration.

Analyze market landscape and assess risks: Scan representative DePIN x smart wearable projects currently in the market, evaluate their market positioning, technical characteristics, and development status, and analyze the main challenges and risks faced in this field (technical, economic, regulatory, user adoption, etc.).

Look ahead to future trends and provide decision-making references: Predict the future development direction, potential breakthroughs, and long-term prospects of the integration of DePIN and smart wearables, providing valuable decision-making references for industry participants (device manufacturers, platform providers, application developers) and investors.

Report Structure

This report is divided into five chapters. The first chapter will deeply analyze the current status, scale, driving forces, structure, major players, and challenges faced by the smart wearable industry. The second chapter will detail the technical paradigm, core mechanisms, and value propositions of DePIN. The third chapter is the core of the report, focusing on the opportunities, key models, and innovative application scenarios arising from the integration of DePIN and the smart wearable industry. The fourth chapter will conduct a market landscape analysis, introduce representative projects, and may use smart rings as a case study. The fifth chapter will assess the challenges and risks faced during the integration process and look ahead to future development trends.

Chapter 1: In-Depth Analysis of the Smart Wearable Industry

Market Overview

The global smart wearable device market is experiencing significant and rapid growth. According to data from different market research institutions, the estimated global market size for 2024 falls within a certain range, roughly between $70 billion and $84 billion. For example, Grand View Research (GVR) estimates the market size for 2024 to be $84.2 billion, while Mordor Intelligence estimates it to be $81 billion. Another institution, ResearchAndMarkets (R&M), provides a lower estimate of $25.9 billion, which may reflect different market definitions or statistical scopes. Despite the differences in specific figures, there is a general consensus that the market size is approaching the hundred billion level.

Looking ahead, the industry is expected to maintain strong growth momentum. The predicted compound annual growth rate (CAGR) also varies, with the range mentioned in the user text being 13.6% to 16.8%. GVR predicts a CAGR of 13.6% from 2025 to 2030, with the market size expected to reach $186.1 billion by 2030. Mordor Intelligence's forecast is even more optimistic, predicting a CAGR of 19.5% from 2025 to 2030, with the market size reaching $245.3 billion by 2030. Expert Market Research (EMR) predicts a CAGR of 15.6% from 2024 to 2032, reaching $160.7 billion by 2032. Meanwhile, IDC's forecast based on shipment volume is relatively conservative, predicting a CAGR of only 3.3% for global wearable device shipments from 2024 to 2028.

Note: Estimates based on different sources and forecast periods may vary. IDC data refers to shipment volume rather than revenue.

This significant divergence in predictions highlights the complexity of defining this rapidly evolving market and the high uncertainty in forecasting future technology adoption and economic conditions. For instance, whether to fully include rapidly growing but smaller smart rings or the large market share of hearable devices in the "smart wearable" category can significantly affect overall size estimates. Therefore, rather than relying on a single precise figure, it is more prudent to focus on the certainty of market growth, key driving factors, and the relative growth trends of various sub-markets.

From a regional distribution perspective, North America is currently the largest market for smart wearable devices, holding a significant market share. For example, in 2024, North America's market share is expected to exceed 34%, with the U.S. market itself reaching nearly $20 billion in 2023 and expected to continue growing. However, the Asia-Pacific region is widely regarded as the fastest-growing market. This is mainly due to the region's large population base, increasing internet and IoT penetration, rising disposable incomes, and China's key position as a global electronics manufacturing hub. The Chinese market not only has strong manufacturing capabilities but also shows growing consumer demand for affordable wearables with unique features. The European market also demonstrates strong growth potential, partly driven by consumer preferences for sustainable electronic devices.

Growth Drivers

The booming smart wearable industry is driven by multiple factors that interact to shape the market's growth trajectory:

Awakening Health Awareness and Demand for Preventive Healthcare: This is one of the core driving forces. Global consumers are increasingly concerned about their health and actively seeking technological means for health monitoring, management, and disease prevention. Functions such as heart rate monitoring, sleep tracking, blood oxygen saturation measurement, and step counting have become standard features in many devices. Especially after the COVID-19 pandemic, public awareness of health monitoring has further increased, driving demand for devices like smartwatches with relevant features. The need for effective management of chronic diseases (such as diabetes and heart disease) has also promoted the development of medical-grade or quasi-medical-grade wearable devices.

Continuous Advancements in Sensor Technology: Sensors are the core of wearable devices. Ongoing technological advancements have led to significant breakthroughs in sensor accuracy, functionality, and size. For example, optical heart rate sensors (PPG), electrocardiogram sensors (ECG), blood oxygen sensors (SpO2), temperature sensors, accelerometers, gyroscopes, GPS, and NFC are being integrated into increasingly smaller devices. The miniaturization and energy efficiency improvements of sensors have made it possible to develop more comfortable, longer-lasting, and more powerful wearable devices.

Economic and Consumer Spending Power Increases: Globally, especially in emerging markets, the increase in per capita disposable income and consumers' willingness to spend on electronic products have laid the economic foundation for the proliferation of wearable devices. Particularly, younger consumer groups like millennials, who are more accepting of new technologies and have strong purchasing power, are significant buyers of devices like smartwatches.

Widespread Adoption of IoT and Connectivity: The widespread adoption of smartphones provides a primary connection and control center for wearable devices. At the same time, the development of the IoT ecosystem allows wearable devices to interconnect with other smart devices (such as smart homes), expanding application scenarios. The maturity of connectivity technologies such as Bluetooth, Wi-Fi, cellular networks (like 4G/5G), and NFC ensures smooth data transmission and multifunctionality of devices (such as mobile payments). The deployment of 5G technology is expected to support applications with lower latency and higher bandwidth, bringing new possibilities for wearable devices.

Diversification of Application Scenarios: The applications of wearable technology have far exceeded the initial focus on step counting and activity tracking. In healthcare, there is enormous potential for applications such as remote patient monitoring, mobile diagnostics, and medication adherence management. In enterprise and industrial sectors, wearable devices are used to enhance worker safety, logistics efficiency, and productivity. The fashion industry has also embraced wearable technology, with smart rings, smart bracelets, and smart clothing combining technology with aesthetics to meet consumers' demands for personalization and fashion expression. Additionally, the application of VR/AR headsets in information entertainment, gaming, education, and professional training is also growing.

Industry Deconstruction

Deconstruction from Different Perspectives

To gain a more comprehensive understanding of the smart wearable industry, we can deconstruct it from three dimensions: product, application scenarios, and technology.

Product Perspective: This is the most intuitive classification method, covering the diverse forms of wearable devices in the market:

Comprehensive Smartwatches: This is currently the largest segment in terms of market share, typically accounting for over 30% of the market. They offer a range of functions including notification push, app operation, comprehensive activity and health tracking (heart rate, sleep, ECG, blood oxygen, etc.), communication, entertainment, and mobile payments. The market is primarily dominated by large tech companies such as Apple (Apple Watch), Samsung (Galaxy Watch), Garmin, and Google (after acquiring Fitbit). Although the market is mature, it has recently faced challenges of slowing growth or even decline, particularly in markets like India, which are impacted by a surge of low-cost products. However, in the long term, with technological upgrades and the arrival of replacement cycles, growth is still expected to continue.

Hearable Devices: This includes smart headphones, hearing aids, etc. These devices integrate high-quality audio experiences (such as noise cancellation and spatial audio) with voice assistant interaction and health monitoring (such as heart rate, temperature, and activity tracking). Major manufacturers include Apple (AirPods), Samsung (Galaxy Buds), Bose, and Sony. This is one of the largest categories in terms of shipment volume, maintaining strong growth driven by replacement demand in both emerging and mature markets.

Activity Monitoring Devices/Bracelets: These focus on core functions such as activity tracking (steps, distance, calories) and sleep monitoring, typically in the form of wristbands or clip-on devices. Representative brands include Fitbit, Xiaomi, Huawei, and Garmin. Although their functions are relatively simple and priced lower, they face competitive pressure from the encroachment of smartwatch functionalities. IDC predicts that their market share will gradually shrink.

Smart Rings: This is a rapidly growing emerging sub-market. Its core value lies in providing a more unobtrusive and comfortable wearing experience while achieving precise health tracking (especially sleep and recovery monitoring), contactless payments, identity verification, and device control. Currently, Oura is the leader in this field, but Samsung (Galaxy Ring), RingConn, Ultrahuman, and numerous startups (including Cudis and WELL3 in the DePIN field) are actively entering, leading to increasing competition. IDC predicts that smart rings will be one of the fastest-growing categories of wearables.

VR/AR Headsets: These provide immersive visual experiences, primarily applied in gaming, entertainment, social interaction, education, training, and professional fields (such as design and healthcare). Major players in this field include Meta (Oculus/Quest), Sony (PlayStation VR), HTC (Vive), and Apple (Vision Pro). Although the current market size is relatively small, technological advancements (such as display resolution, field of view, and interaction methods) and a rich content ecosystem give it significant growth potential.

Smart Clothing: This integrates sensors and conductive fibers directly into clothing to monitor physiological signals (heart rate, respiration), movement posture, temperature, etc. It remains a relatively small niche market but has application potential in professional sports training, rehabilitation monitoring, and specialized occupations (such as firefighters and soldiers). Representative companies include Hexoskin and Athos.

Smart Patches/Medical Patches: These are primarily used for medical monitoring, such as continuous glucose monitoring (CGM), ECG recording, temperature monitoring, and medication delivery monitoring. They are typically disposable or reusable devices adhered to the skin. They are mainly applied in healthcare, particularly in chronic disease management. Notable companies in this field include Dexcom, Abbott, and Medtronic.

Other Devices: This includes smart glasses (such as early attempts like Google Glass and products combined with fashion brands like Ray-Ban Meta), wearable cameras (like GoPro), smart shoes (monitoring gait and pressure distribution), smart necklaces/pendants, and some more experimental forms like smart tattoos and implantable devices.

Application Scenario Perspective: This perspective helps us understand the core value of smart wearable devices and the problems they solve:

Healthcare: This is one of the most promising application areas. It includes remote patient monitoring (RPM) for chronic disease management, postoperative recovery tracking, mobile diagnostic assistance (such as ECG-based arrhythmia screening), medication adherence monitoring, and rehabilitation training guidance. Medical-grade devices or those approved by institutions like the FDA are key in this scenario.

Fitness and Health: This is currently the most mainstream application scenario. It includes tracking daily activity levels (steps, calories), recognizing and recording various exercise modes (running, swimming, cycling, etc.), analyzing exercise performance (pace, heart rate zones, VO2 Max), analyzing sleep quality (sleep stages, duration, disturbances), monitoring and managing stress levels (based on HRV and other indicators), and mindfulness and breathing training.

Information Entertainment: Primarily driven by VR/AR headsets, this provides immersive experiences in gaming, virtual socializing, and 3D video viewing. Smart headphones offer music streaming, podcast listening, and voice assistant interaction. Smartwatches also provide basic music control and communication functions.

Enterprise and Industry: In specific industries, wearable devices are used to improve productivity and ensure worker safety. For example, in logistics and warehousing, smart glasses equipped with scanning functions or navigation instructions can free up hands; in manufacturing, devices that monitor worker posture or environmental hazards can prevent workplace injuries; in field services, AR glasses can provide remote expert guidance.

Fashion and Lifestyle: Smart wearable devices are not just functional tools; they are increasingly becoming fashion accessories and expressions of personal style. Smart rings, smart bracelets, and smartwatches in collaboration with luxury brands combine technology with design aesthetics to meet consumers' demands for personalization and taste.

Technology Perspective: Smart wearable devices are an integration of various advanced technologies:

Sensors: These are the foundation for perceiving physiological and environmental information. Core sensors include:

Motion Sensors: Accelerometers (detecting movement and steps), gyroscopes (detecting direction and rotation).

Biosensors: Optical heart rate sensors (PPG, monitoring heart rate and blood oxygen), electrocardiogram sensors (ECG, more precise monitoring of heart electrical activity), electrodermal activity sensors (EDA, for stress monitoring), temperature sensors.

Positioning Sensors: GPS/GNSS (for outdoor activity tracking and positioning).

Near Field Communication: NFC (for contactless payments and pairing).

Environmental Sensors: Barometers (altitude), ambient light sensors (adjusting screen brightness), temperature/humidity sensors, etc.

Others: Pressure sensors (such as those used in smart insoles), inertial measurement units (IMU, combining accelerometers and gyroscopes).

Connectivity/Communication Technologies: Responsible for connecting devices to smartphones, the cloud, or other devices.

Bluetooth and Low Energy Bluetooth (BLE): The most commonly used short-range connection method, used for connecting to smartphones, syncing data, and controlling music.

Wi-Fi: Used for faster data transmission, such as downloading apps and updating firmware.

Cellular Networks (e.g., LTE/5G): Enable devices like smartwatches to communicate and connect independently of smartphones.

NFC: Used for mobile payments, quick pairing, and access card emulation.

Data Processing and Computing Power:

Microcontrollers (MCU)/Processors: Responsible for running the device's operating system, processing sensor data, and executing applications.

Memory and Storage: Used to store the operating system, applications, and user data.

AI Chips/Algorithms: Some high-end devices integrate dedicated AI chips or run optimized algorithms for more complex pattern recognition, data analysis, and personalized recommendations on the device, providing deeper health insights.

Display Technology: Provides an information interaction interface.

OLED/AMOLED: Bright colors, high contrast, and relatively low power consumption, commonly used in smartwatches.

LCD: Lower cost but may not perform as well as OLED in outdoor visibility and power consumption.

E-Ink: Extremely low power consumption, suitable for displaying static information or for devices prioritizing battery life.

Flexible/Foldable Screens: Offer possibilities for future innovations in wearable device forms.

Battery Technology: Balancing battery life, size, and charging speed is key.

Lithium-Ion (Li-ion)/Lithium Polymer (Li-Po) Batteries: Currently the mainstream technology with high energy density.

Battery Miniaturization and Energy Density Improvement: Ongoing technological pursuit to accommodate sufficient power in limited space.

Wireless Charging/Fast Charging: Enhances charging convenience.

Industry Value Chain

The value chain of the smart wearable industry involves multiple links and participants, collectively transforming technology into final products and services:

Component Suppliers: Provide the basic components that make up wearable devices. This includes sensor manufacturers (such as STMicroelectronics, NXP, Bosch, Sensirion), chip design and manufacturers (such as Qualcomm, Apple’s custom chips, Samsung Semiconductor), display panel suppliers (such as Samsung Display, LG Display), battery manufacturers, connectivity module suppliers (providing Bluetooth, Wi-Fi, cellular modules), and structural component suppliers for casings, straps, etc.

Device Manufacturers: Responsible for the overall design, R&D, system integration, assembly production, brand building, and marketing of products. This is the core link in the value chain, directly facing consumers or enterprise clients. It can be further divided into:

Mature Consumer Electronics Giants: Such as Apple, Samsung, and Google (after acquiring Fitbit), which leverage strong brand influence, mature supply chain management, a large user base, and ecosystem advantages (operating systems, app stores, cloud services) to dominate the market.

Specialized Vertical Brands: Such as Garmin, which focuses on sports and outdoor fields, Oura, which specializes in sleep and health monitoring smart rings, and Whoop, which offers subscription-based professional fitness tracking services. They establish competitive advantages through deep engagement and expertise in specific niche markets.

Emerging Enterprises and Startups: These companies typically explore innovative product forms (such as new smart clothing, medical patches), specific application scenarios, or breakthrough technologies, seeking differentiated competition. Companies in the DePIN field like CUDIS, Pulse, and WELL3 fall into this category.

Software and Platform Providers: Provide the operating systems, application ecosystems, cloud platforms for data storage and analysis, and core algorithms required for device operation.

Operating Systems: Apple's watchOS and Google's Wear OS are the two main platforms in the smartwatch field.

Application Ecosystem: App stores and developer communities built around the operating systems enrich the functionality and user experience of devices.

Cloud Platforms and Data Analysis: Used for storing user data, conducting backend analysis, and providing data synchronization and backup services. Large manufacturers typically have their own cloud platforms, with third-party cloud service providers also participating.

AI Algorithms: Developing algorithms for interpreting physiological data, providing health insights, and personalized recommendations is key to enhancing product value. This part may be developed in-house by device manufacturers or sourced from specialized algorithm companies or research institutions.

Distribution and Retail: Channels for delivering products to end users.

Online Channels: Major e-commerce platforms (such as Amazon, JD.com), brand official websites (DTC — Direct to Consumer), and specialized electronics retailer websites.

Offline Channels: Brand specialty stores, major electronics retail chains (such as Best Buy), department stores, and carrier stores (for cellular devices).

Cooperative Channels: Collaborating with healthcare providers (hospitals, clinics), fitness centers, insurance companies, etc., to offer wearable devices as part of service packages or recommend them to specific groups.

Consumers and End Users: The final link in the value chain, including individual consumers who purchase and use wearable devices, patients receiving remote monitoring, athletes needing to track training data, and enterprise employees using wearable devices at work. Their needs, feedback, and purchasing behavior ultimately drive the development of the entire industry chain.

Key Industry Participants

As mentioned earlier, the main participants in the smart wearable market can be roughly divided into two categories:

Comprehensive Players: These companies typically have a wide product line covering multiple wearable categories and offer comprehensive functionalities. They dominate the market with strong brands, technological accumulation, marketing capabilities, and ecosystem advantages.

Apple: Leads the smartwatch and hearable device market with its Apple Watch and AirPods series, boasting a strong watchOS ecosystem and brand loyalty.

Samsung: Offers products like Galaxy Watch and Galaxy Buds, being a major competitor in the Android camp with a complete hardware and software ecosystem. The recent launch of the Galaxy Ring indicates its ambition in new categories.

Google: Strengthened its position in wearable hardware by acquiring Fitbit and leads the development of the Wear OS platform.

Xiaomi: Holds a significant share in the global market with cost-effective smart bands and smartwatches, particularly excelling in emerging markets.

Huawei: Despite facing geopolitical challenges, it remains competitive in the global wearable market (especially in China), offering smartwatches, bands, and headphones while emphasizing investment in health R&D.

Vertical Players: These companies focus on specific product categories or application scenarios, establishing competitive barriers through depth and expertise.

Garmin: Holds strong brand and technological strength in the sports, outdoor, and aviation fields, providing functionally specialized and reliable smartwatches and tracking devices.

Oura: The leader in the smart ring market, focusing on sleep tracking and overall health status assessment.

Whoop: Offers subscription-based fitness bands, focusing on exercise recovery and training optimization.

Others: Include companies focused on VR/AR like Meta, Sony, and HTC; medical patch companies like Dexcom and Abbott; smart clothing companies like Hexoskin and Athos; and numerous companies innovating in specific niche markets or emerging forms.

Industry Trends and Challenges

The smart wearable industry is developing along several key trends:

Sustained Growth and Health Focus: The market is expected to maintain strong growth in the foreseeable future. Health monitoring (from basic physiological indicators to more complex disease screening and management) and personalized healthcare services will remain core driving forces, with application scenarios further deepening.

Deep Integration of Artificial Intelligence: AI will not only be used for data analysis but will also provide predictive insights, personalized suggestions, and adaptive experiences. For example, AI can adjust training plans based on real-time user data, predict fatigue or disease risks, and provide more precise nutrition or sleep guidance.

Form Innovation and Experience Optimization: Devices will continue to evolve towards being smaller, lighter, more comfortable, more unobtrusive, and with longer battery life. New forms such as smart rings, smart clothing, and even smart tattoos or implantable devices will continue to emerge, aiming to integrate more naturally into users' lives. User experience will focus more on intuitive interaction and providing truly valuable, actionable insights rather than just presenting raw data.

Enhanced Connectivity and Ecosystem Integration: 5G and future communication technologies will support more real-time and richer data transmission, giving rise to new applications (such as high-quality telemedicine and low-latency AR/VR interactions). Devices will be more closely integrated into a broader IoT ecosystem, enabling interactions with smart homes, smart cars, and more.

Expansion into New Application Areas: In addition to consumer health and fitness, wearable devices will find more applications in healthcare (such as clinical-grade monitoring and digital therapeutics), enterprises (improving efficiency and safety), industries (equipment maintenance and environmental monitoring), and insurance (dynamic pricing based on health data).

Sustainability Considerations: With increasing environmental awareness, consumers and regulators will pay more attention to product material choices, energy consumption and carbon emissions during production processes, and product recyclability. Sustainability will become an important factor in brand image and competitiveness.

At the same time, the industry faces significant challenges:

Data Privacy and Security: This is the most prominent challenge. Wearable devices collect vast amounts of highly sensitive personal health and behavioral data, and ensuring the secure storage, transmission, and use of this data, preventing unauthorized access, leaks, or misuse, is key to user trust and industry compliance. Users' demands for data control are increasing, while frequent data breaches exacerbate concerns.

Data Accuracy and Reliability: The sensor accuracy and algorithm interpretation capabilities of consumer-grade wearable devices vary widely. For medical or professional application scenarios requiring high-precision data, ensuring data accuracy and reliability, and obtaining necessary validations or certifications (such as FDA approval) is a significant challenge.

User Experience and Value Delivery: Avoiding "data overload" and transforming complex physiological data into easily understandable, actionable suggestions and insights for users is key to enhancing user stickiness. Many users may abandon devices after the novelty wears off due to a lack of sustained value. Additionally, the design, comfort, and usability of devices directly impact user experience.

Battery Life and Power Consumption: Maintaining sufficiently long battery life while pursuing stronger functionalities and smaller sizes remains a technical challenge. Frequent charging can severely affect user experience.

Cost and Business Model: High-end wearable devices come with a hefty price tag, and some products require additional subscription fees to unlock all features, which may limit their adoption. Finding a sustainable and user-acceptable business model among hardware sales, subscription services, and potential data services is a challenge. Meanwhile, the low-end market is flooded with a large number of homogeneous, low-profit products, leading to fierce competition.

Regulatory Compliance: Especially in the healthcare sector, products must meet strict regulatory requirements (such as HIPAA regulations on health data privacy and FDA approval processes for medical devices). Differences in regulations across countries and regions also add complexity to global operations.

Interoperability and Data Silos: There is often a lack of interoperability between devices and applications from different brands and platforms, resulting in user data being locked within specific ecosystems, making it difficult to form a complete health profile or migrate data between different services.

Summary

The smart wearable industry demonstrates significant market potential and ongoing innovation vitality, with technological advancements (especially in sensors and AI) and the expansion of application scenarios being the main driving forces behind its development. However, data privacy and security issues loom as a "sword of Damocles," while enhancing user experience, ensuring the sustainability of business models, and overcoming regulatory barriers are also key challenges the industry must address. The existence of these challenges provides potential entry points and value space for new paradigms like DePIN, which emphasize user empowerment, data sovereignty, and transparency.

Chapter Two: Interpretation of the DePIN Technical Paradigm

DePIN Definition: Core Concepts and Architecture

DePIN, or Decentralized Physical Infrastructure Networks, is a rapidly emerging concept in the Web3 space, aiming to reimagine and practice the construction, deployment, and operation of real-world physical infrastructure through the application of blockchain technology, cryptoeconomic incentive mechanisms, and the power of community collaboration. This term was popularized by the crypto analytics firm Messari, although similar concepts had previously been referred to as MachineFi, Token Incentivized Physical Infrastructure Networks (TIPIN), and the Economy of Things.

The core idea of DePIN is to no longer rely on a single centralized entity (such as large corporations or government agencies) to invest massive capital in building and maintaining infrastructure. Instead, it leverages the power of decentralized networks to incentivize individuals or organizations worldwide to contribute their physical resources (such as sensors, wireless hotspots, storage servers, computing power, energy devices, and even data collected from wearable devices) to collectively build a powerful and widely covered infrastructure network.

The core elements that constitute a DePIN system typically include:

Blockchain Technology: This is the cornerstone of DePIN. Blockchain provides a decentralized, transparent, and immutable distributed ledger for recording network status, resource contributions, service usage, and value exchanges. Smart contracts are deployed on the blockchain to automatically execute network rules, process transactions, allocate rewards, and manage access rights, enabling trustless coordination.

Cryptoeconomic Incentives: This is the key driving force behind the DePIN model. Projects typically issue native crypto tokens to reward "supply-side" participants who provide physical resources or services to the network. These tokens serve not only as compensation but also as an incentive mechanism aimed at guiding participants to act in ways that optimize the network (e.g., deploying devices in areas that need coverage, ensuring devices are online, and providing high-quality services). Tokens can also be used to pay for network service fees, participate in network governance, or stake for additional rewards. The design of the token economic model (Tokenomics) is crucial for the success of DePIN projects.

Community Governance: Many DePIN projects aim to achieve decentralized governance, allowing token holders or network participants to participate in the decision-making process through voting and other means. This can be realized through decentralized autonomous organizations (DAOs). Community governance aims to ensure the long-term development of the network aligns with the common interests of participants and enhances the network's resistance to censorship and its democratic nature.

Physical Infrastructure Network: This is the core feature that distinguishes DePIN from purely digital Web3 projects. It consists of various physical hardware devices contributed by network participants, such as sensors, cameras, wireless routers, storage disks, GPU computing nodes, charging stations, and smart wearable devices, which are the focus of this report.

Middleware/Off-chain Computing: Due to the complexity of the physical world and the performance limitations of blockchain itself, DePIN systems often require middleware or off-chain computing layers to process raw data from physical devices, validate data, aggregate information, and submit necessary results or proofs to the blockchain. For example, decentralized oracles can connect on-chain smart contracts with off-chain data sources. IoTeX's W3bstream is an example of an off-chain computing infrastructure designed specifically for DePIN.

Messari roughly categorizes DePIN projects into two types:

Physical Resource Networks: Provide services based on hardware resources that depend on specific geographic locations. For example, deploying sensors to collect environmental data (like WeatherXM), deploying cameras or dashcams to collect mapping data (like Hivemapper), and deploying wireless hotspots to provide connectivity services (like Helium). Networks collecting health data from wearable devices also fall into this category.

Digital Resource Networks: Provide interchangeable digital resources that do not depend on specific geographic locations. For example, decentralized storage networks (like Filecoin), decentralized computing networks (like Akash, Render, io.net), and decentralized bandwidth networks (CDNs like Meson).

From a market structure perspective, DePIN is typically described as a three-sided platform:

Supply Side: Individuals or organizations that provide physical infrastructure resources (hardware, data, computing power, etc.), who are the primary recipients of token rewards.

Demand Side: Individuals or businesses that consume or use services provided by the DePIN network, who typically need to pay fees (in fiat currency or tokens).

Network/Protocol: The DePIN project itself, which establishes rules, coordinates supply and demand, distributes rewards, and maintains network operations through blockchain and smart contracts.

This structure differs from traditional two-sided markets (like Uber, which connects drivers and passengers), as the supply side and protocol maintainers in DePIN are typically different participants.

DePIN Flywheel Effect: Guiding Infrastructure

One of the most attractive concepts of DePIN is its "Flywheel Effect," which explains how DePIN effectively guides (bootstraps) the construction of large-scale physical infrastructure networks using token incentives without incurring massive upfront capital investments like traditional models.

This process typically operates as follows:

Token Incentives Attract Early Suppliers: At the project's launch, native tokens are distributed through airdrops, early participation rewards, and other means to incentivize the first batch of "miners" or contributors to deploy the necessary physical hardware (for example, installing a Helium hotspot or purchasing and wearing a Pulse health bracelet).

Network Coverage/Capacity Growth: As the number of suppliers increases, the network's infrastructure coverage expands or resource capacity increases (for example, wireless network coverage extends to more areas, storage network capacity increases, and health data networks accumulate more user data).

Attract Demand Side Users: The enhancement of network capabilities enables it to provide valuable services, beginning to attract end users or business clients (for example, IoT devices paying to transmit data over the Helium network, AI companies renting GPUs from the Render network for model training, and research institutions purchasing anonymous health data on HealthBlocks).

Generate Network Utility/Revenue, Enhance Token Value: The usage by demand-side participants generates actual network utility or direct revenue (which may be paid in fiat currency or tokens). This utility and revenue demonstrate the network's value, supporting or enhancing the market price and demand for the native token. The increase in token value attracts more suppliers: the rise in token value means that suppliers can earn higher returns by contributing resources, which incentivizes existing suppliers to continue maintaining and expanding their contributions and attracts new suppliers to join the network.

Positive Feedback Loop: This process creates a positive, self-reinforcing cycle—more supply leads to better services, better services attract more demand, more demand enhances token value, and higher token value incentivizes more supply.

The key advantage of the DePIN flywheel is that it distributes the enormous costs of infrastructure construction across a broad community of participants and uses tokens as an incentive tool with future value expectations to resolve the "chicken or egg" dilemma in the cold start phase. However, this flywheel is not a perpetual motion machine. Its effective operation heavily relies on a well-designed, sustainable token economic model and ultimately on whether it can successfully attract enough real demand-side participants willing to pay for services. If token incentives are set too high, leading to uncontrolled inflation, or if the network fails to generate sufficient actual utility and revenue to support token value, the flywheel may stagnate or even reverse.

Value Proposition: Why Choose DePIN to Build Physical Infrastructure?

Compared to traditional centralized models, DePIN offers a range of unique value propositions for building and operating physical infrastructure networks:

Cost-Effectiveness: By crowdsourcing resources and reducing intermediaries, DePIN has the potential to significantly lower initial capital expenditures (CapEx) and long-term operating expenses (OpEx) for infrastructure construction. Contributors participate in the network using their existing or relatively low-cost devices, avoiding the massive construction and maintenance costs that centralized entities would incur.

Resilience and Reliability: The decentralized nature of the network means there is no single point of failure. Even if some nodes go offline or fail, the entire network can continue to operate, thereby enhancing the overall resilience and attack resistance of the infrastructure.

Scalability: DePIN networks can achieve organic and rapid expansion by attracting more participants to join and contribute resources to meet growing demand, without the need for large-scale, planned capacity expansion investments like centralized systems.

Openness and Accessibility: DePIN is typically permissionless or has low barriers to entry, allowing any qualified individual or organization to participate in the construction and operation of the network, breaking the monopoly of a few giants in the traditional infrastructure sector. This not only promotes competition and innovation but also has the potential to extend infrastructure services to underdeveloped areas where costs are prohibitively high or unprofitable under traditional models.

Transparency and Trust: Based on the characteristics of blockchain, records of resource contributions, service usage, and reward distributions within the DePIN network are publicly transparent, auditable, and difficult to tamper with, helping to build trust among participants and reduce information asymmetry and potential fraud.

Community Ownership and Incentive Alignment: The DePIN model enables builders and users of the network (through token ownership) to become owners and governors of the network, sharing in the dividends of its growth. The token incentive mechanism aligns individual interests with the overall interests of the network, encouraging participants to contribute to the long-term healthy development of the network.

These value propositions make DePIN an extremely attractive new paradigm, especially suitable for infrastructure sectors that require extensive physical coverage, face high construction costs, or encounter issues of centralized monopolies. However, it is important to note that the degree to which DePIN's value propositions are realized largely depends on the specific project's design, execution, and ability to overcome various challenges discussed in the following chapters.

Chapter Three: The Integration of DePIN and the Smart Wearable Industry: Opportunities and Models

The New Paradigm Brought by DePIN to Smart Wearables

The combination of the DePIN technical paradigm with the smart wearable industry is expected to fundamentally change existing models, particularly bringing key transformative potential in data processing and value distribution.

Data Ownership and Value Return — Addressing "Data Silos" and Value Asymmetry:

Current Pain Points: In the current smart wearable ecosystem, the vast amounts of health, activity, and physiological data generated by users are mostly collected and stored by device manufacturers or application platforms on their centralized servers. Users have very limited ownership and actual control over this data. Data is often locked in specific platform or brand "silos," making it difficult to migrate, integrate, or use for purposes chosen by the user. More importantly, this data has enormous potential value that can be used to drive personalized services, train AI models, conduct market research, assist in drug development, and even influence insurance pricing. However, as the producers of this data, users find it challenging to directly benefit from these derived values, resulting in significant value asymmetry.

DePIN Solution: The DePIN model introduces blockchain technology to provide a new approach to solving this core issue. First, by leveraging the characteristics of blockchain (such as integrating decentralized identity, DID), users can theoretically achieve stronger, verifiable ownership and finer control over the data they generate (for example, managing data access permissions through private keys). Secondly, and more transformationally, the core mechanism of DePIN — the token economic incentive — can directly reward users who contribute high-quality, user-permissioned real-world data (RWD). This means users are no longer just "passive data providers," but rather become "active value co-creators and sharers," able to profit directly from the value of their data. This model is expected to break the monopoly and exploitation of data by platforms, achieving a fairer distribution of value.

Decentralized Health Data Infrastructure — Building an Open and Trustworthy Network:

Current Pain Points: Under the current model, vast amounts of highly sensitive user health data are typically concentrated on the servers of a few large cloud service providers or device manufacturers. This centralized architecture not only brings risks of data breaches and misuse but also poses the possibility of single points of failure (service interruptions), potential censorship risks, and exacerbates interoperability barriers between different platforms and services.

DePIN Solution: The DePIN paradigm can view millions of smart wearable devices as sensing nodes in a distributed health data network. With user consent and privacy protection, data can be stored in decentralized storage networks (such as IPFS, Filecoin, Arweave, etc.) and managed through blockchain for metadata, access permissions, and usage records. This helps build a more resilient (less prone to single-point failure), potentially more censorship-resistant, and more open data infrastructure. Furthermore, by combining advanced privacy computing technologies, such as zero-knowledge proofs (ZKP), federated learning (FL), secure multi-party computation (MPC), and homomorphic encryption (FHE), it is possible to analyze and extract value from aggregated data without exposing users' original sensitive data. This not only better protects user privacy but also provides a technical foundation for breaking data silos and promoting interoperability between different devices, platforms, and applications.

Incentive-Driven Network Effects and Deep User Engagement:

Current Pain Points: In traditional models, after users purchase smart wearable devices, their motivation to continue wearing and using them may diminish as novelty wears off. Beyond the functionality and experience of the product itself, there is a lack of ongoing external incentives to maintain user activity and engagement.

DePIN Solution: The token incentive mechanism provides a powerful tool to address this issue. First, token rewards can serve as a means to acquire new users, such as by offering purchase subsidies or "mining" rewards to lower the initial purchase threshold for users. More importantly, it can incentivize users to continuously wear devices and contribute high-quality, real-world health data. The "Wear-to-Earn" or further "Live-Healthy-to-Earn" models can link users' daily health behaviors (such as reaching step goals, ensuring sleep quality, completing exercise tasks) to direct economic rewards (token rewards). This is crucial for AI health model training and large-scale health research projects that require vast amounts of real, continuous data. This model is expected to attract user groups interested in both Web3 technology and healthy lifestyles, significantly enhancing user stickiness and engagement depth, potentially forming a strong positive feedback loop: "More active users -> Contribute more high-quality data -> Train better AI models and health services -> Attract more new users." Additionally, through governance via DAOs (Decentralized Autonomous Organizations), DePIN projects can allow users to directly participate in network development strategies, protocol upgrade decisions, data usage rules, and value distribution mechanism design, thereby establishing a stronger sense of community belonging and ownership.

Empowering AI-Driven Personalized Health and Precision Medicine:

Current Pain Points: The potential of artificial intelligence in the health field is enormous, but the effectiveness of its models highly depends on large-scale, high-quality, diverse, and longitudinal real-world data (RWD). However, currently, acquiring such data is costly, and the data is scattered across various disconnected "data silos," severely limiting the development of AI health applications.

DePIN Solution: DePIN, through its inherent economic incentive mechanism, has the potential to aggregate larger-scale, more diverse (from different populations, device types, and geographical locations), and longer-duration (because incentives are ongoing) real-world health data (RWD) than ever before. This high-quality, high-density RWD serves as valuable "fuel" for training and optimizing the next generation of AI health algorithms. When these data are combined with powerful AI analytical capabilities, they can drive more precise personalized health risk assessments, early warning signal detection for diseases, customized lifestyle intervention recommendations, and real-time tracking of drug treatment effects. Furthermore, this model even has the potential to support decentralized clinical trials (DCTs) by incentivizing participants to use wearable devices to collect trial data at home or local clinics, thereby reducing trial costs, expanding participant recruitment, and improving data collection frequency and authenticity.

This shift from a product-centric to a network-centric value proposition represents a fundamental change brought by DePIN.

In traditional models, users purchase a product and its accompanying services, with value primarily reflected in the device's functionality and the analysis reports provided by the platform. In the DePIN model, the device purchased by users also serves as a "ticket" or "production tool" for participating in a value network. Users contribute data or resources to the construction and operation of the network, which generates collective value (such as large-scale datasets and network service capabilities) from these contributions and distributes this value to participants in the form of tokens. Therefore, the role of users evolves from being mere "product consumers" to "network participants, contributors, and even co-owners," with the source of value expanding from a single product to the activities and outputs of the entire network.

Exploration of Integration Models

The integration of DePIN and smart wearables can take various forms, with existing products making attempts in these directions:

Hardware-as-a-Node

This is the most basic and direct integration model. Users' smart wearable devices — whether smartwatches, bands, rings, smart clothing, or medical patches — themselves constitute the physical sensing nodes of the DePIN network. These devices are responsible for collecting users' physiological data (heart rate, body temperature, blood oxygen, etc.), activity data (steps, types of exercise, intensity), sleep data, and even environmental data (such as location, noise levels — referencing the Silencio project). The collected data may undergo preliminary processing and analysis on the device (at the edge), and then, with the user's explicit permission, contribute the (possibly anonymized or privacy-processed) data to the DePIN network in exchange for corresponding token rewards.

"X-to-Earn" Economic Model Design

Core Idea: The core of this model is to directly link users' specific behaviors or states with token rewards to incentivize user participation and contribution. Here, "X" can represent various meanings, such as:

Wear-to-Earn: Simply wearing the device continuously and staying online.

Move-to-Earn / Exercise-to-Earn: Rewards based on users' steps, exercise duration, intensity, or achieved exercise goals (similar to the concept of Stepn, but applied to a broader range of health metrics).

Sleep-to-Earn: Rewards based on users' sleep duration, sleep quality scores, HRV recovery status, etc.

Share-Data-to-Earn: Rewards for users choosing to share (privacy-processed) data with research institutions or other third parties.

Live-Healthy-to-Earn: A more comprehensive concept that rewards users for achieving overall health goals or maintaining healthy lifestyle habits.

Designing a token economic model that is sustainable in the long term, effectively incentivizes, and can withstand the risk of economic collapse is key to the success of DePIN x wearable projects and one of the biggest challenges.

Token Issuance Mechanism: What is the total supply? What is the release rate? Are there halving cycles or other inflation control mechanisms? It is necessary to avoid rapid token releases that could lead to excessive early "sell pressure."

Reward Distribution Rules: What dimensions are rewards based on? (For example, wearing duration, data completeness, data quality metrics such as sleep scores/HRV/exercise intensity, achievement of health behaviors, data sharing permissions, etc.). How is the authenticity and validity of contributions verified? (An effective Proof of Physical Work mechanism is needed to prevent cheating). Should rewards be dynamically adjusted to adapt to the network's development stage and user behavior?

Preventing Cheating and Sybil Attacks: How can we effectively prevent users from improperly obtaining large rewards through simulated data, wearing multiple devices (witch attacks/Sybil attacks), etc.? This may require a combination of device authentication (such as Peaq ID), biometric recognition, behavioral pattern analysis, social graph verification, or trusted hardware.

Token Consumption Scenarios/Empowerment: Beyond trading on secondary markets, tokens must have real uses and consumption scenarios within the ecosystem to create endogenous demand and support their value. For example, they can be used to purchase premium membership services, unlock more in-depth health analysis reports, pay for personalized AI coaching fees, participate in platform governance voting, stake for higher rewards or network profit sharing, and redeem health products or services at ecosystem partners.

Value Capture Mechanism: How can external revenues generated by the DePIN network (for example, fees paid by B-end institutions for using aggregated data or analytical services) effectively flow back into the token ecosystem to support the long-term value of the token? Common mechanisms include using protocol revenue to buy back and burn tokens (deflationary model) or distributing revenue to token stakers, etc.

Data Value Capture and Application Closed Loop

The health RWD aggregated by the DePIN network, with user permission and privacy processing, has potential commercial value for B-end institutions across multiple industries. For example:

Research Institutions (Academia, Pharmaceutical Companies): Used for epidemiological research, drug development (such as real-world evidence RWE), clinical trial participant recruitment, and data collection.

Insurance Companies: Used to improve actuarial models, conduct more precise risk assessments, and design personalized health management plans and premiums.

AI Companies: Used to train and optimize health-related AI models.

Employers: Used to support employee health programs and enhance overall well-being. Clearly identifying these potential demand sides and establishing effective cooperation models is key to the commercial sustainability of DePIN projects. Projects like Synapx and Brainstem explicitly aim to connect data suppliers (users) with data demanders (research/medical institutions).

Due to the extreme sensitivity of health data, any data sharing and value exchange must be predicated on robust privacy protection technologies. Technologies such as federated learning, secure multi-party computation (MPC), zero-knowledge proofs (ZKP), differential privacy, trusted execution environments (TEE), or homomorphic encryption (FHE) must be employed. The goal is to achieve aggregated analysis, model training, and value sharing of data without exposing individual raw data, while strictly adhering to data privacy regulations such as GDPR and HIPAA.

An ideal DePIN x wearable ecosystem should form a sustainable value cycle: Data demanders (B-end) pay fees (which can be fiat currency or project tokens) to obtain data insights or use data-based services -> These fees are automatically distributed to data contributors (users), potential node operators, protocol developers, or DAO treasuries through smart contracts in the DePIN network, according to preset agreements -> Token rewards incentivize more users to join the network, continuously wear devices, and contribute high-quality data -> Larger-scale, higher-quality data attracts more B-end demanders and may increase the pricing of data services -> Increased revenue further supports token value and reward distribution, forming a positive cycle.

Integration with RWA (Real World Assets)

Data Assetization: This is a more cutting-edge exploration direction aimed at transforming personal health datasets (or their access and usage rights) that have clear value, are strictly permitted by users, and have undergone privacy processing, into a "data asset" that can be verified on-chain, managed, and even traded under compliance conditions through specific blockchain protocols (possibly combined with NFT or DID technology). DePIN is considered a subset or related field of RWA. This assetization makes the ownership, usage rights, and value flow of data clearer, programmable, and transparent.

Innovative Financial Applications: Based on these verified and authenticated trusted data assets, innovative financial applications may be explored in the future. For example:

Providing individuals with more precise health risk assessments based on their health data verification, thus achieving highly personalized insurance product pricing and underwriting.

Exploring some form of securitization of users' future "data revenue rights" (i.e., expected token rewards from sharing data) or using them as collateral for lending in decentralized finance (DeFi) protocols (though this faces significant compliance and technical challenges).

Creating prediction markets or health index derivatives based on collective health data performance.

Important Note: Health data RWA is still in a very early and highly experimental stage. It faces significant challenges in terms of technological maturity (how to securely and compliantly package and trade data), regulatory compliance (involving complex regulations related to data privacy laws, financial securities laws, etc.), market acceptance, and ethical considerations. Therefore, it is essential to assess its feasibility and potential risks with extreme caution.

Integration of AI and Edge Computing

Edge Intelligence: Deploying lightweight AI models on the smart wearable device side (i.e., edge side) can enable real-time health status analysis, anomaly pattern detection, activity type recognition, and other computations directly on the device. The benefits of this approach include: providing instant feedback to users; reducing reliance on cloud servers for computation, thereby lowering network transmission load and latency; and significantly enhancing user privacy protection since sensitive data is processed locally.

Cloud Intelligence: The global, large-scale data aggregated by the DePIN network (of course, this data must undergo strict privacy protection processing, such as aggregation, anonymization, or using privacy computing technologies) can be used in the cloud to train more complex and powerful AI models. These models can discover deeper collective health patterns, disease risk factors, and potential interventions.

Cloud-Edge Collaboration: Edge intelligence and cloud intelligence can work together. The edge side is responsible for real-time processing, preliminary analysis, and personalized feedback, while the cloud side is responsible for deep training of models, global insights, and knowledge updates, and sends optimized models or rules back to edge devices, forming a dynamically optimized intelligent system.

Physical Perception AI: Combining multimodal data collected by smart wearable devices (including biological signals, motion data, environmental data, and even users' voice commands or interaction information) with advanced AI models can achieve smarter human-computer interaction, more precise situational awareness (e.g., recognizing users' current states and needs), and more adaptive personalized services (e.g., automatically adjusting reminders or suggestions based on users' stress levels). The AI coaching functions mentioned in projects like CUDIS and WELL3 reflect this direction.

Potential for Integration of Different Wearable Device Forms with DePIN

Smartwatches/Bands

Advantages: The user base is the largest, with high market penetration; relatively rich functionality, usually equipped with displays and various sensors (motion, heart rate, sleep, GPS, etc.), providing multidimensional data; certain interactive capabilities, making it easy for users to set up and view information. They are an important entry point for the DePIN network to acquire users and diverse data.

Challenges: Balancing the increase of DePIN-related tasks (such as continuous connectivity, data encrypted uploads, and possible on-chain interactions) with maintaining acceptable battery life for users is a key technical challenge.

Smart Rings

Advantages: The biggest feature is the unobtrusive wear, leading to high user compliance, especially suitable for continuous 24/7 monitoring, particularly for high-quality collection of nighttime sleep data (such as temperature, HRV, sleep stages). This perfectly aligns with the DePIN network's demand for continuous, passive, high-quality data streams. Additionally, the ring form is also suitable for integrating payment, identity authentication, and other functions, which can be combined with DePIN's value exchange or identity verification mechanisms.

Disadvantages: Interactive capabilities are very limited (usually no screen), functionality is relatively singular, mainly focused on health tracking; battery capacity is smaller compared to watches, making power management extremely demanding.

Smart Clothing/Patches

Advantages: Being closer to the body, the sensor positions are more stable, potentially allowing for more accurate physiological signals than wrist-worn devices, such as multi-lead electrocardiograms (ECG), electromyography (EMG), respiratory rates, etc. Therefore, they are particularly suitable for applications requiring high-precision data in medical-grade monitoring scenarios or professional sports training analysis. They can play a key role in specific vertical DePIN networks, such as data collection networks for decentralized clinical trials (DCT) or management networks for specific chronic diseases (e.g., cardiovascular diseases).

Challenges: Comfort of wear, durability (e.g., performance after multiple washes), cost, and user acceptance are major obstacles.

Hearable Devices/VR/AR

Advantages: They can integrate biological signals (such as some headphones exploring heart rate monitoring, and VR/AR headsets potentially integrating EEG monitoring) with users' environmental sound information, interaction behavior data, visual attention data, etc., providing unique multimodal data dimensions for DePIN applications in scenarios such as the metaverse, immersive health experiences (e.g., meditation guidance, virtual rehabilitation training), and professional skills training.

Challenges: Power consumption issues are more pronounced; wearing duration is usually limited (especially for VR/AR); user acceptance and the popularity of application scenarios still need improvement.

Different forms of wearable devices exhibit significant differences in physical characteristics, sensor capabilities, battery life, wearing methods, and user interaction modes. These differences determine their respective advantages and disadvantages in collecting specific types of data. For example, rings are particularly suitable for accurately measuring temperature and nighttime HRV due to their stable placement on the finger, while patches are better at capturing multi-lead ECG signals. Since the DePIN network typically requires continuous and reliable data input to maintain its value and functionality, it is foreseeable that optimized DePIN networks targeting specific data types or application scenarios may emerge in the future, with the main data contributors likely concentrated on the device forms best suited for those scenarios. For instance, a DePIN network focused on high-precision sleep analysis may primarily consist of smart ring users, while a DePIN network serving remote heart disease monitoring may rely more on smart patches or watches with medical-grade ECG capabilities.

This specialization of data collection based on device form may be an important direction for the future development of DePIN x wearables.

Chapter 4: Market Landscape and Case Analysis

This chapter aims to analyze representative projects at the intersection of DePIN and smart wearables, examine the competitive landscape, and delve into the early explorations and challenges faced by DePIN applications, using the rapidly developing smart ring market as an example.

DePIN x Smart Wearable Projects

Currently, projects that explicitly combine the DePIN concept with smart wearable hardware are still in the early stages, but there are some noteworthy explorers.

CUDIS Ring (Solana Ecosystem):

Positioning and Product Logic: CUDIS positions itself as the first blockchain-driven DePIN smart ring, aiming to promote healthy lifestyles through gamification and community incentives ($CUDIS token). Users wear the ring to track health metrics (heart rate, blood oxygen, sleep, activity) and earn tokens by completing health tasks and sharing data (with user authorization). The core idea is that users own and can selectively monetize their health data, building a user co-created health data ecosystem.

Economic Model: The native token $CUDIS has a total supply of 1 billion. Distribution includes user mining rewards (50%), community and ecosystem development (held by the foundation), and team and early investors (with lock-up periods). Users earn $CUDIS through daily activities, health challenges, and community contributions. Tokens can be used to purchase services within the platform and participate in governance voting.

Market Performance and Feedback: CUDIS claims to have achieved over $4 million in ring sales, selling more than 15,000 rings and having over 100,000 community members. The project completed a $5 million funding round in September 2024. However, public user feedback is polarized. Some users appreciate its concept and potential benefits, while others express concerns about the long-term value and sustainability of its token. More importantly, some users reported serious accuracy issues, particularly with step counts and sleep monitoring data being "severely inaccurate," leading to a lack of trust in the measurement results.

HealthBlocks (IoTeX Ecosystem):

Positioning and Model: HealthBlocks is a decentralized health data platform built on the IoTeX blockchain, aiming to connect various health monitoring devices (not limited to specific brands or forms, including watches, bands, etc.), allowing users to securely store, manage, and (with authorization) share their health data and earn token rewards. It focuses more on building a universal, interoperable health data infrastructure layer rather than selling proprietary hardware.

Project Progress and Scale: HealthBlocks is one of the more well-known DePIN projects within the IoTeX ecosystem. IoTeX, as an L1 platform focused on DePIN, experienced significant growth in 2024, with a substantial increase in transaction volume, active accounts, and the number of projects built. The IoTeX ecosystem has over 250 projects, more than 50 of which are DePIN projects. However, there is currently a lack of publicly available data on HealthBlocks' specific user scale, activity, or the number of connected devices, with most information describing the overall IoTeX ecosystem.

Pulse (Solana Ecosystem):

Positioning and Model: Pulse positions itself as an advanced health tracking wearable DePIN project based on Solana, emphasizing medical-grade biometric data collection, user data ownership, AI-driven personalized health insights (sleep, longevity, nutrition), and incentivizing healthy behaviors through cryptoeconomic rewards. Its goal is to build a "digital twin" of the user on-chain.

Products and Technology: It offers its own branded Pulse wearable devices, claiming to continuously monitor heart rate, HRV, sleep stages, blood oxygen, temperature, stress, exercise, and metabolic indicators. It utilizes Solana for decentralized data storage and provides personalized recommendations through an AI engine while emphasizing user control over data and privacy protection.

Project Progress and Scale: After its launch, the first five batches of pre-sale devices sold out quickly, indicating some market interest. It completed a $1.8 million pre-seed funding round by the end of 2024 and raised an additional $500,000 on crypto fundraising platforms Echo and Legion. In collaboration with the DeSci (Decentralized Science) platform pump.science, it launched the first study on the efficacy of supplements conducted on-chain using wearable devices, with participants wearing Pulse devices to collect data. This indicates that Pulse is actively exploring the application value of its data in health research.

WatchX Network (IoTeX Ecosystem):

Positioning and Model: WatchX positions itself as an AI DePIN ecosystem based on smartwatches, supported by the IoTeX Foundation and others. Its smartwatches integrate multi-chain wallets, AI health finance (HealthFi), and dApps, serving as management hubs and DePIN nodes. Users earn points by completing health activities (running, cycling, uploading health data), which can be redeemed for benefits, NFT gear, or crypto assets. It introduces elements of a "metahuman" nurturing game. It emphasizes biometric recognition, self-custody privacy, and large-scale adoption of Web3.

Products and Technology: It offers several smartwatch hardware options, such as the high-end "Pioneer" version (titanium alloy, sapphire glass, solar charging, long battery life) and the mass-market "Fusion" version (AMOLED screen, GPS, microphone/speaker). The watches run on WatchX OS, featuring standard health monitoring functions (heart rate, blood oxygen, sleep, activity tracking), supporting Bluetooth connectivity and IP68 waterproofing. They include a non-custodial crypto wallet and use NFTs as users' on-chain identity credentials. The accompanying WatchX mobile app is available on platforms like iOS.

Project Progress and Scale: The project has an active GitHub repository, indicating ongoing development work. Its app has been launched in app stores, and hardware products (such as the Fusion watch) are available for purchase through retail channels (like HeliumMart). However, specific data on the actual number of users, community size, or market traction remains unclear.

The diversity of these projects reflects that the combination of DePIN and smart wearables is still in a very early exploratory stage.

They differ in hardware strategies (in-house development vs. connecting third-party devices), incentive models (gamification vs. direct rewards), technology platforms (Solana vs. IoTeX), and target users (general public vs. vertical fields). While some projects have shown initial market interest and fundraising capabilities, they generally face challenges related to accuracy, practicality, and the sustainability of their economic models as pointed out in user feedback. No project has yet proven successful in crossing the chasm to achieve large-scale, sustainable operations.

Potential Strategies of Traditional Giants

In the face of the emerging DePIN paradigm, traditional smart wearable giants (Apple, Samsung, Google) are unlikely to quickly and thoroughly embrace a fully decentralized model, as this fundamentally conflicts with their existing, highly successful centralized business models and data strategies. Their potential strategies may evolve in phases.

Short-term (1–2 years):