The "pledge gold shovel" TIA, which is now largely ignored, is once again facing a community opinion crisis. During this period of prolonged price decline and marginalization of the narrative, Celestia's network revenue has continued to languish, and the feasibility of the DA track has also come under challenge. Against this backdrop, co-founder John Adler has proposed a disruptive governance proposal.

Canceling Staking, Celestia Aims to Overhaul "PoS"

Co-founder John Adler recently put forward a disruptive governance proposal advocating for the network to completely abandon the current Proof-of-Stake (PoS) mechanism in favor of a "Proof-of-Governance" (PoG) model. This proposal has sparked heated discussions in the crypto community, directly addressing the core concepts of blockchain governance structures.

If adopted, the Celestia network will undergo a series of structural restructurings: first, the issuance of TIA tokens will be reduced by about 20 times, significantly compressing circulating inflation, with a corresponding reduction ratio of up to 95%. Secondly, existing delegated staking and liquid staking contracts will be completely abolished, and the on-chain governance mechanism will be terminated simultaneously.

The newly issued TIA will be fully paid to validators as off-chain incentives for running nodes; validators will no longer be elected through token voting but will be decided through an off-chain governance mechanism. Additionally, Celestia will adopt a fee-burning mechanism to reward token holders, with approximately $100 to $300 of protocol revenue being directly used to support TIA's value daily.

Adler even advocates for the complete removal of the concept of "staking." He believes that in the absence of token issuance rewards and without relying on staking votes to elect validators, the act of "staking" becomes redundant, and LST loses its basis for existence, with TIA itself becoming a direct vehicle for value capture.

The essence of Adler's proposal is to address the inflationary pressure causing TIA's price to decline over time by constructing a more scarce and compact token economic model, injecting foundational logic for the network's long-term value.

However, this proposal also challenges several assumptions that are considered "self-evident" in Ethereum's mainstream consensus, such as whether the economic security of blockchain truly relies on penalty mechanisms (slashing), whether PoS is essentially a permissioned "Proof of Authority" mechanism (a variant of PoA), and whether blockchain systems can operate sustainably through a "no-governance profit model." If adopted, this proposal will not only reconstruct Celestia's economic model but may also pose a challenge to the current staking governance logic dominated by Ethereum.

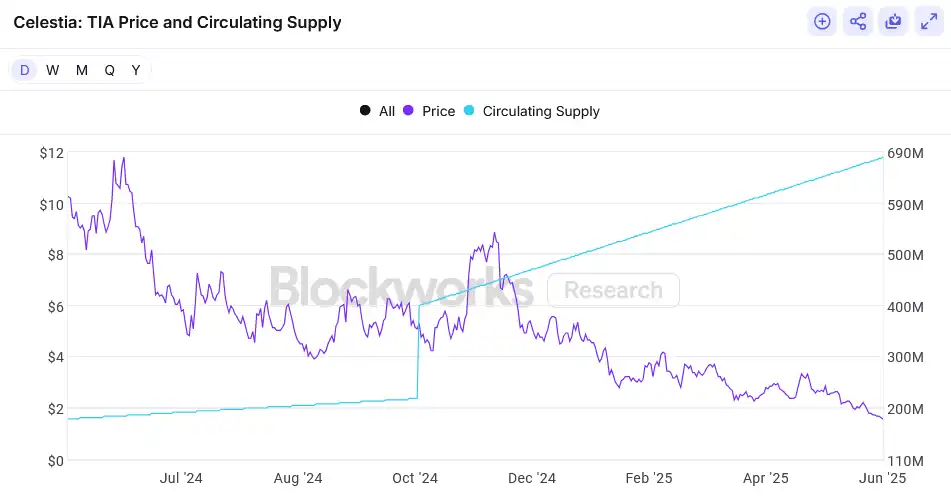

Source: Blockworks Research.

However, just as this governance proposal aimed at "rebuilding the token economic foundation" has yet to be implemented, the community has been hit with reports of the Celestia team cashing out significantly, leading to divergent interpretations of the proposal's original intent. On one hand, the project team emphasizes that the PoG model is expected to curb inflation, repair the token model, and restore market confidence; on the other hand, on-chain data shows that several core team members quickly completed large cash-out operations after the unlocking window opened, totaling over $100 million, raising market skepticism.

Is this deflationary reform aimed at TIA's long-term value, or is it a cover for the team's "high-position offloading"? Against the backdrop of TIA's 92% decline and the continuous loss of user trust, Celestia's "modular vision" is facing an unprecedented trust crisis.

Is Selling the Only Way?

Community user @0xCircusLover tweeted accusations of serious opacity in the Celestia core team's actions regarding token unlocking, fund operations, and market promotion. This revelation has been described by some observers as an exposure of Celestia's "criminal model," triggering strong doubts about the project's internal governance and integrity.

According to the disclosure, Celestia executives completed the unlocking of TIA tokens as early as early October 2024, with team members following suit shortly thereafter. In the subsequent months, several core figures were reported to have realized large cash-outs through over-the-counter (OTC) transactions or resource exchanges. For example, project co-founder Mustafa was accused of cashing out over $25 million through OTC channels and has since relocated to Dubai, while another key figure, Andy, was alleged to have accepted compensation to promote TIA, and Yaz was dismissed and exited the crypto space due to sexual harassment allegations. Users claim to possess information about the victims and evidence of the transactions, intending to release complete materials soon.

Additionally, it was mentioned that Celestia had paid a seven-figure sum to the well-known institution Abstract to "detach" from its competitor Eigen and had paid media figures Jon Charb and Bankless to maintain a positive image for the project. This series of financial maneuvers has been accused by the whistleblower as typical "paid promotion" operations.

Another focal point of controversy centers on the role of Bankless host David, with the community questioning his frequent advocacy for TIA despite lacking actual experience using Celestia's data availability services or building protocols, and his contradictory statements regarding whether he holds TIA tokens have raised widespread doubts about the impartiality of his remarks.

Although this revelation has yet to receive an official response, it has already triggered a trust crisis within certain circles, especially given the further amplifying effect under the backdrop of TIA's current market price pressure and ongoing employee sell-offs. Celestia once gained popularity with its narrative of "modular data availability," but now, the series of questions surrounding its core team's governance, public opinion manipulation, and fund flows is plunging this once-promising project into an unprecedented public relations crisis.

"The entire crypto space is actually filled with evidence, but no one is willing to talk about it publicly because 'they are too big.'"

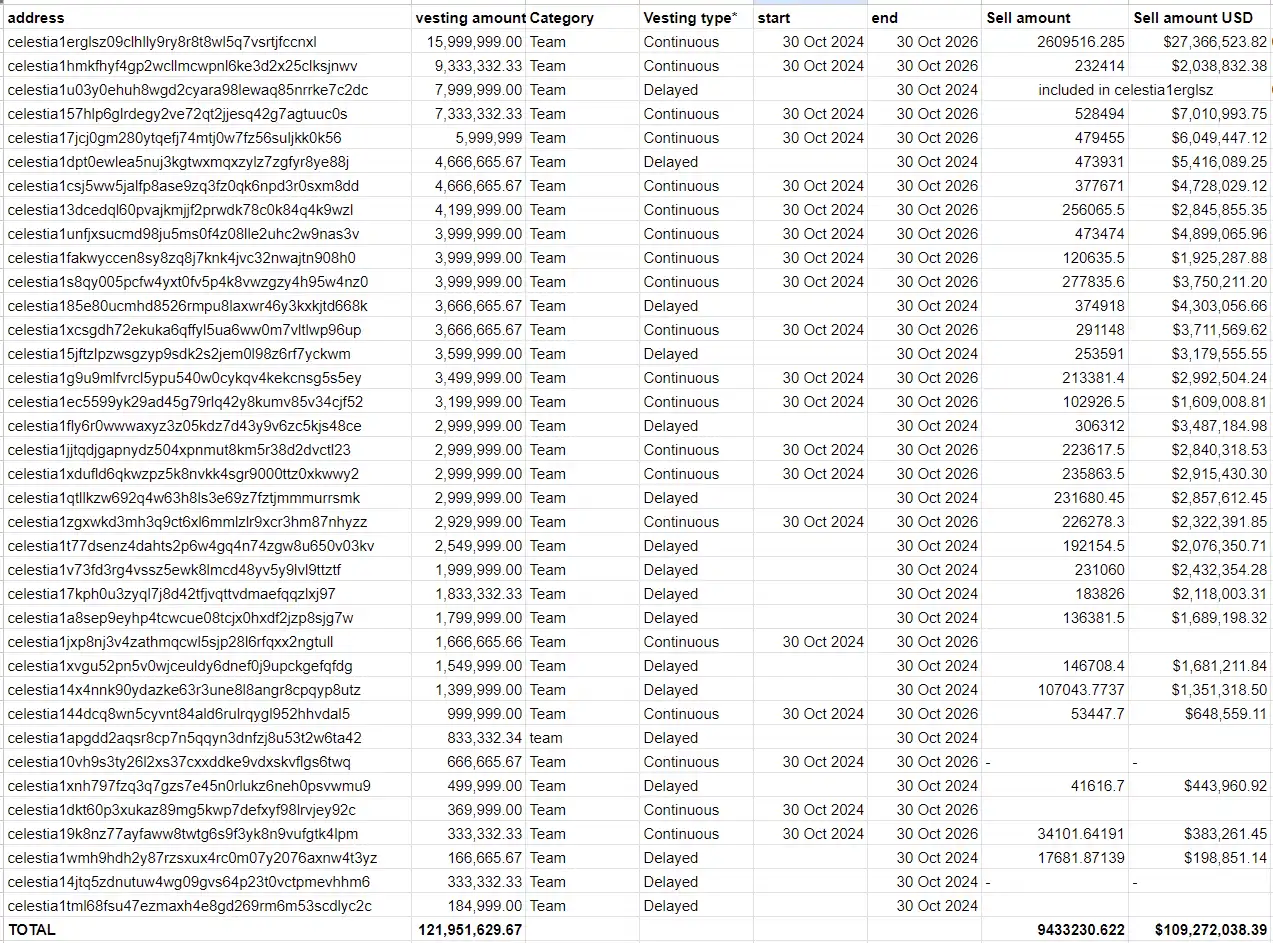

Previously, crypto KOL Mosi provided a data table on the internal team’s token distribution and cash-out activities, showing that team members had sold approximately 9.43 million TIA, with an estimated total cash-out amount of up to $109 million based on the market price at the time. These tokens all belong to the "Team" category, owned by early core members and contributors.

The largest selling address is celestia1erglsz…, which has sold 2,609,516.29 TIA, corresponding to $27,368,523.82 in cash. Multiple addresses have sold amounts exceeding one million dollars, indicating that the team was actively cashing out at the early stage of token unlocking.

Below this tweet, a user quoted Celestia COO Nick White's statement to mock, "I have never sold a single TIA," echoing the $100 million in the image above.

In October last year, Celestia announced "completion of $100 million financing" just before a significant unlocking, which once sparked optimistic expectations in the community regarding its financial strength. However, according to crypto investor Sisyphus, this financing was actually an OTC transaction completed months earlier, with the involved tokens set to unlock in October. Such behavior has been viewed by some community members as typical information manipulation: "first offload OTC, then package it as good news, and finally guide retail investors to take over before the unlocking window."

Related Reading: "Celestia suspected of 'raising prices to offload,' packaging token sales as financing before large unlock"

Although Celestia's current valuation is marked by outsiders at $3.5 billion, its actual revenue is far from supporting such inflated valuation. According to publicly available data, Celestia's average daily protocol revenue is less than $100, with an annual potential of only around $5 million. Industry insiders generally point out that Celestia's market pricing resembles a prepayment for "future narratives" rather than being based on existing usage data or business models. Because of this, once market sentiment cools, its valuation bubble is likely to face pressure.

In the face of various accusations and public opinion storms surrounding Celestia, the founder publicly stated that despite the current market being filled with "increasingly outrageous FUD, all founding members, early employees, and core engineers are still on board." He also revealed that Celestia currently has over $100 million in reserves, with sufficient cash flow to support operations for over six years.

"In this industry, to survive, every project must weather storms. Almost all tokens will experience a 95% drop at some point in their lifecycle; this is the norm, not the exception," Mustafa wrote in a tweet. Now, TIA has dropped 92% from its peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。