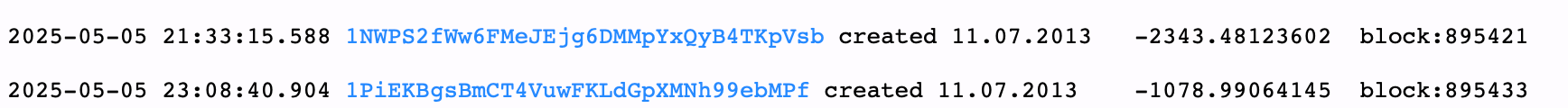

Data compiled on May 5, 2025, reveals two separate transactions (1,2) originating from wallets established in July 2013. The initial movement involved 2,343.481 BTC, transacted at block height 895,421.

One Pay-to-Public-Key-Hash (P2PKH) address, first activated on July 11, 2013, executed 31 outputs, with 30 routed to a newly generated Pay-to-Witness-Public-Key-Hash (P2WPKH) wallet. The 2,343 BTC—valued at $220.83 million—remains untouched in the destination wallet at the time of publication.

Source: btcparser.com

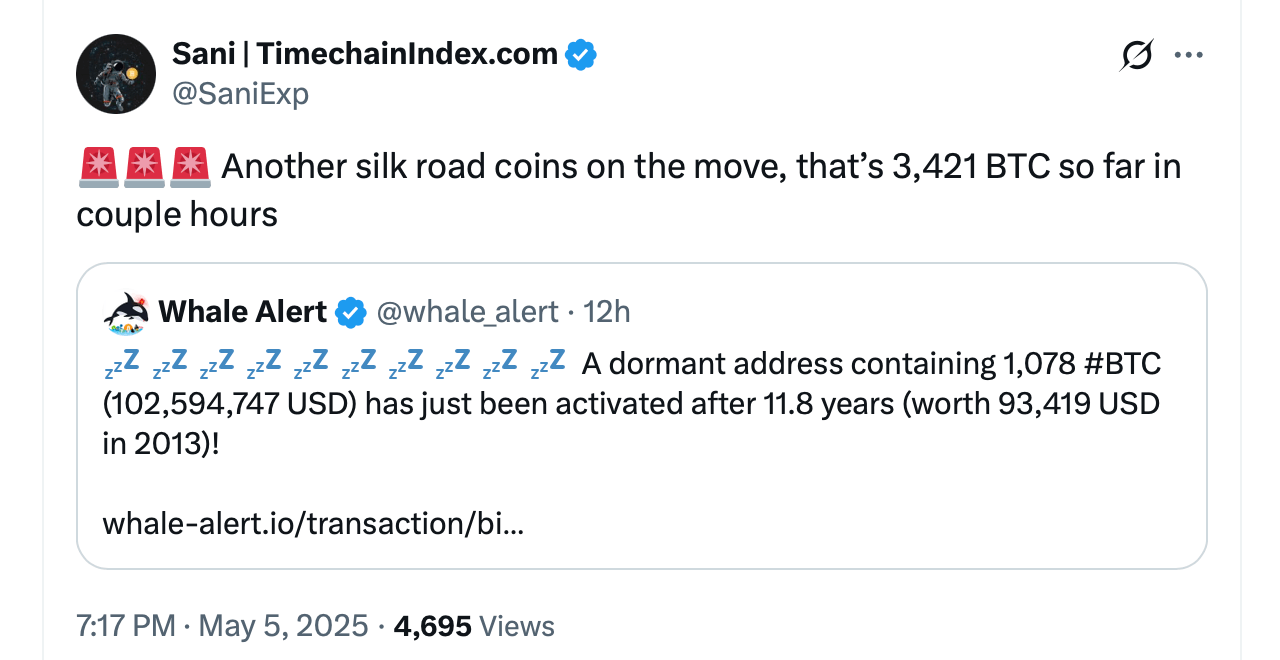

The specific transaction was identified by both btcparser.com and Whale Alert. These blockchain parsing tools also flagged a second movement involving 1,078.99 BTC. This wallet, too, was initialized on July 11, 2013, with the funds transferred at block height 895,433.

The original Pay-to-Public-Key-Hash (P2PKH) address executed 27 outputs, culminating in a final output directed to an unfamiliar, newly generated Pay-to-Witness-Public-Key-Hash (P2WPKH) wallet. The 1,078 BTC—now valued at more than $101 million—remains stationed in that P2WPKH address, mirroring the behavior of the prior transfer.

Beyond these substantial transactions, Sani, the architect behind timechainindex.com, revealed that the bitcoins in question trace back to the infamous darknet marketplace, the Silk Road. “After checking some of the origins, they linked back to [the] Silk Road, withdrawn during 2012,” Sani stated on the social media platform X.

Observers now watch the repurposed P2WPKH addresses like forensic time capsules, gauging whether the funds signal renewed activity or a cautious reshuffle ahead of heightened scrutiny. Their provenance from the Silk Road adds intrigue, reminding the market that bitcoin’s early, shadowy chapters still ripple through modern ledgers, shaping narratives on anonymity, restitution, and the persistence of blockchain memory for years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。