Original: Galaxy

Translator: Deng Chain Community

Editor’s Note: This article analyzes the "2025 U.S. Stablecoin Innovation Act" (GENIUS Act) proposed by the U.S. Senate, which aims to establish a comprehensive framework for the issuance and regulation of stablecoins to promote innovation, protect consumers, maintain the safety of the financial system, and solidify the dollar's dominance globally. The article details the key provisions of the bill, the regulatory framework, and the revisions made since its passage by the Senate Banking Committee, as well as discussing the criticisms from Democrats regarding national security, anti-money laundering, and consumer protection concerns.

Updates on the Senate Stablecoin Bill

Latest Developments on the GENIUS Act

This report was initially sent privately to Galaxy clients and counterparties. Engage with Galaxy for investment or trading to receive high-quality research reports directly upon release. - Alex Thorn

Introduction

As of the writing of this article, stablecoins in circulation globally exceed $243 billion. Of this, over $218 billion (90%) is fully collateralized and denominated in U.S. dollars. By 2025, these stablecoins, valued at over $700 billion, are transacting in over 120 million transactions monthly. Stablecoins are widely used for cross-border payments, with transaction costs being only a fraction of traditional remittances. However, they currently exist primarily in a legal gray area in the U.S., where existing companies are not sufficiently regulated to truly develop within the traditional system, while traditional participants face excessive regulatory uncertainty that prevents them from utilizing cryptocurrency channels.

The "2025 U.S. Stablecoin National Innovation Guidance and Establishment Act" (the "GENIUS Act") is the Senate's stablecoin authorization and regulatory bill, aimed at bringing clarity and certainty to this gray area. It was introduced by Senator Bill Hagerty (R-TN) and co-sponsored by Senators Tim Scott (R-SC), Kirsten Gillibrand (D-NY), Cynthia Lummis (R-WY), and Angela Alsobrooks (D-MD).

The bill will establish a robust oversight and regulatory mechanism for stablecoins and issuers in the U.S., creating pathways for innovation and enhancing the dollar's issuance and reserve status globally. Stablecoins issued under this framework will be subject to strict federal standards, regardless of whether they are supervised by federal banking regulators, U.S. states, or foreign issuers. The Senate Banking Committee voted to advance the bill from committee with a vote of 18 to 6 (including 5 Democrats) in March.

On Thursday, May 1, an updated draft was released (published), which includes several substantive updates enhancing the language regarding national security, financial system safety, and regulatory accountability. On Saturday, May 3, nine Democrats issued a statement saying they would oppose cloture in the House unless additional improvements in five areas were made.

This note outlines the GENIUS Act, explains the regulatory framework it will create, and highlights the main differences between the latest version and the one passed by the Senate Banking Committee.

Contents of the GENIUS Act

The GENIUS Act creates a comprehensive framework to regulate stablecoin issuers located in the U.S. or whose stablecoins circulate or trade within the U.S. Currently, stablecoin issuers typically register as money services businesses (MSBs) with the Treasury's FinCEN and/or hold certain state licenses, but there is no national, comprehensive regulatory oversight system to manage collateral handling, AML/CFT compliance, creation and redemption mechanisms, oversight, consumer safety, bankruptcy isolation, or many other aspects. Essentially, dollar-backed stablecoins have almost no regulation in the U.S.

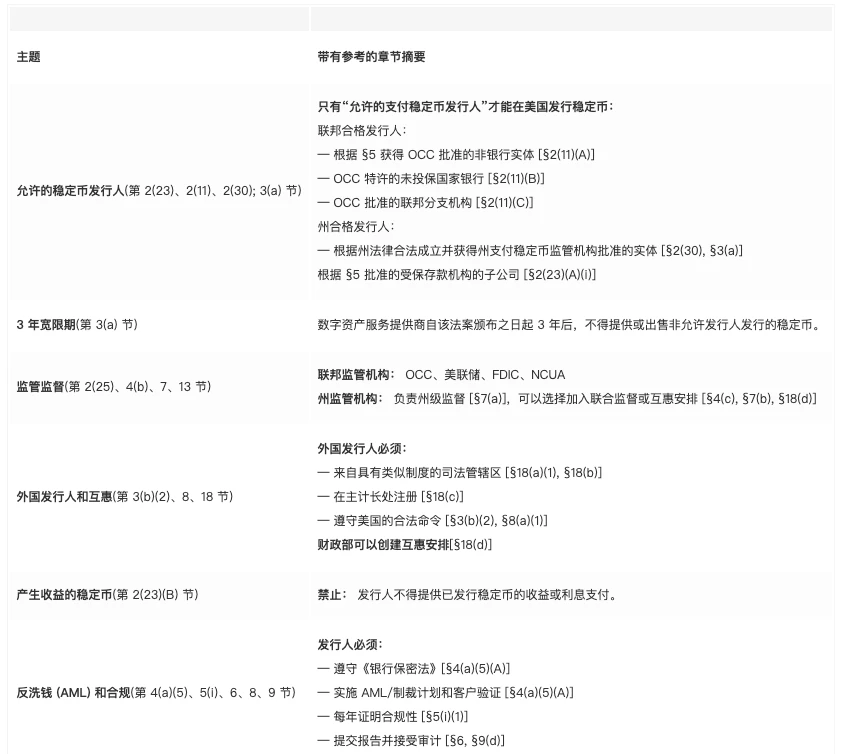

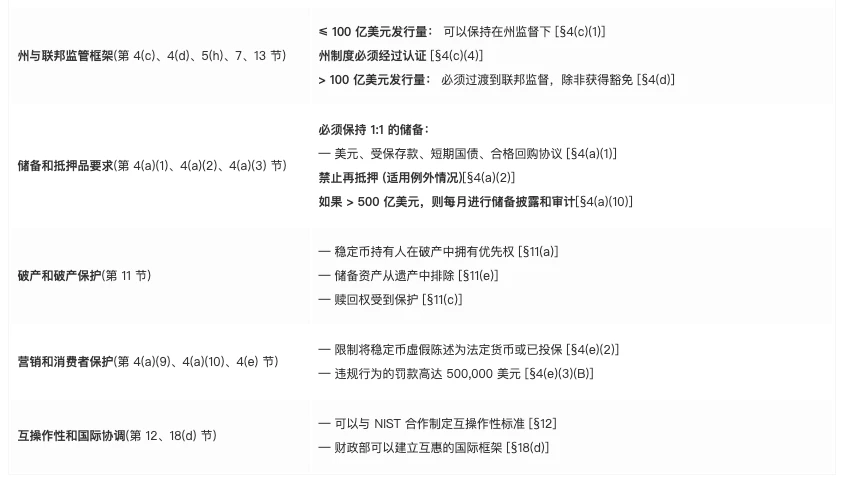

The table below describes the framework established in the latest version of the GENIUS Act released on Thursday, May 1.

Interpretation of GENIUS Act Provisions

Broadly speaking, the bill creates a highly regulated framework for stablecoin issuance in the U.S., which:

Protects consumers by requiring bank-like regulation of issuers (regardless of whether they are banks themselves). It has strict short-term collateral requirements that ensure the stability of stablecoin reserves comparable to money market funds. Additionally, in the event of issuer bankruptcy, stablecoin holders have priority, with reserve assets treated as "bankruptcy isolation" in any bankruptcy proceedings.

Protects the safety and soundness of the financial system by placing the Office of the Comptroller of the Currency (OCC) in the primary regulatory oversight position for stablecoin issuers. Whether bank or non-bank, stablecoin issuers must register with the OCC or with a state whose regulation is deemed comparable to federal minimum standards. The liquidity of collateral reserves and their full reserve backing ensure that stablecoins can compete with money market funds.

Allows innovation to thrive. Given the transparency, speed, and efficiency of public blockchains, stablecoins have tremendous utility and represent a foothold for settling financial transactions using such blockchains. They are widely used by individuals, businesses, and nation-states around the world and represent a significant improvement over current dollar transfer financial rails. The bill grants U.S. "digital asset service providers" (essentially U.S. trading firms and exchanges) a three-year grace period to allow trading of existing but unregistered stablecoins, enabling the industry and market to transition to the new regime without disruption.

Consolidates and expands the dollar's dominance. Despite facing resistance due to international trade and geopolitical developments, the dollar has no competitors in cyberspace. Currently, over 99% of the stablecoins in circulation are denominated in dollars. Bringing stablecoins under the regulatory umbrella of the world's most advanced and trusted capital markets regulatory system will increase their usage and help export the dollar globally.

Supports U.S. Treasury issuance. By requiring full reserves that are almost entirely composed of U.S. Treasuries, the growth of stablecoins means an increase in the U.S. government's borrowing capacity.

Criticism from Democrats

Nine Democrats have stated they will vote against cloture on the GENIUS Act, including six members of the Senate Banking Committee, five of whom previously voted to advance the bill from committee.

In a statement released Saturday evening, the nine Democrats wrote: "However, the current version of the bill still has many issues that must be addressed, including stronger provisions regarding anti-money laundering, foreign issuers, national security, maintaining the safety and soundness of our financial system, and accountability for those who do not comply with the bill's requirements. While we are eager to continue working with our colleagues to address these issues, we will not be able to vote for cloture if the current version of the bill is submitted to the House."

Politico reported the statement under the headline "Democrats Shift Stance Against Senate Cryptocurrency Bill", although Senator Gallego denied such a shift, stating that "this is not a change made by Democrats out of thin air," and that "the bill introduced for House consideration deviates from much of the progress we have made and does not include other improvements we are seeking."

Updates to the Bill Since Markup

Below, we provide an analysis of the changes made to the latest draft of the bill (post-markup) compared to the version that passed the Senate Banking Committee. We categorize the changes based on the five areas of concern expressed by Gallego and the Democrats: 1) anti-money laundering, 2) foreign issuers, 3) national security, 4) maintaining the safety and soundness of our financial system, and 5) accountability for non-compliance with the bill.

National Security

- Compliance with lawful orders (Section 4(a)(6))

Requires stablecoin issuers to demonstrate the technical capability to comply with U.S. lawful orders (e.g., freezing, destroying, blocking tokens).

- Definition of "lawful order"

Now includes clarity requirements and mandates judicial or administrative review.

- Treasury coordination requirements

Where feasible, the Treasury must coordinate with issuers when blocking digital assets.

- Exemptions for intelligence and law enforcement agencies (Section 8(e)(3))

Exempts U.S. intelligence and law enforcement actions from compliance with key restrictions.

- National security exemption (Section 8(e)(2))

If national security requires, the Treasury may waive secondary trading restrictions after consulting with the Director of National Intelligence and the State Department.

Foreign Issuers

- Restrictions on Foreign Issuers (Section 3)

Foreign issuers are prohibited from offering stablecoins to U.S. persons unless they meet new requirements (e.g., comparable foreign regulations, U.S. reserves, registration).

- Reciprocity Mechanism (Sections 16 and 18)

The Treasury may determine that a foreign jurisdiction has equivalent regulatory standards, allowing issuers to participate under the following conditions: they must register with U.S. regulators; they must comply with U.S. lawful orders; they must hold U.S. custodied reserves for U.S. users.

- 90-Day Safe Harbor for Revocation

If the Treasury revokes comparability status, a 90-day grace period allows the market to adjust before restrictions take effect.

- Ban on Secondary Trading (Section 8(c))

After designation, trading of non-compliant foreign stablecoins within the U.S. is prohibited - enforced unless the Treasury grants an exemption.

Anti-Money Laundering (AML)

- Expanded AML Program Requirements (Section 4(a)(5))

Issuers must: implement AML/CIP/sanctions compliance, monitor and report suspicious activities, maintain records, and conduct enhanced due diligence.

- Annual AML Certification (Section 5(i))

Officials must certify AML compliance annually; false certifications trigger criminal liability and revocation risk.

- New Chapter on AML Innovations (Section 9)

The Treasury must research novel tools (e.g., AI, blockchain forensics) to improve AML compliance; FinCEN needs to follow up with guidance or rulemaking.

- Foreign Issuer AML Designation (Section 8(b))

If a foreign issuer fails to comply with AML-related lawful orders, the Treasury must designate it as non-compliant.

Robustness and Safety of the Financial System

- Reserve and Asset Backing (Section 4(a)(1))

Strengthened 1:1 asset backing requirements; assets must be high quality and highly liquid.

- Bankruptcy Protection (Section 11)

Establishes that stablecoin holders have priority claims over other creditors; mandates timely redemption in the event of issuer insolvency.

- Federal Assessment of Financial Risks (Section 15)

Increases the requirement for the FSOC to assess risks associated with stablecoins in its annual financial stability report.

- State-Federal System Coordination (Section 7)

Strengthens the Treasury's oversight of state-regulated issuers by requiring federal certification of "substantially similar" state systems.

- Prohibition on Yield-Generating Stablecoins (Section 2(23))

Permitted stablecoin issuers are not allowed to offer yields or interest on their stablecoins.

Accountability and Enforcement

- Civil Penalties for Domestic Violations (Section 6(c)(5))

Unauthorized issuance incurs a maximum fine of $100,000 per day; knowing violations incur a fine of $200,000 per day; accountability post-termination lasts up to six years.

- Penalties for Foreign Issuer Violations (Section 8(c)(4))

After designation, incurs a maximum fine of $1,000,000 per day; the Treasury may seek injunctions to stop U.S. trading.

- Judicial Review of Treasury Actions (Section 8(d))

Allows foreign issuers to appeal non-compliance designations to the D.C. Circuit Court.

- Enhanced Powers for Regulators (Section 6)

Empowers federal regulators to revoke, remove officials, issue cease-and-desist orders, and utilize other supervisory tools.

Each of the above changes was made in the weeks following the committee's overwhelming vote (18-6, with 5 Democrats joining Republicans to pass) on the bill, and many changes reflect specific requests made by members of the Senate Banking Committee who either voted against the bill in committee or called for such changes before the bill was handed over for House consideration. Our analysis indicates that nearly all changes make the bill more stringent for stablecoin issuers compared to the version passed by the Senate Banking Committee.

Conclusion

Overall, the latest form of the GENIUS Act represents a powerful victory that promotes innovation, protects consumers, and benefits both the cryptocurrency industry and traditional finance. It creates a reasonable pathway for registration while imposing strict oversight and regulatory requirements, along with severe penalties for non-compliance. The GENIUS Act will facilitate the use of the dollar both domestically and internationally, making it easier for individuals and businesses to conduct everyday transactions in domestic, cross-border, or international trade. All stakeholders gain something significant here: the cryptocurrency industry receives a viable pathway while being controlled, it protects the financial system, and it helps the U.S. succeed in a geopolitical and ever-changing global economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。