撰文:@defi_monk

编译:白话区块链

华尔街正在迎来加密热潮。

传统金融已经用尽了增长叙事。每个人都过度投资于人工智能,而软件公司的吸引力远不如 2000 年代和 2010 年代那样令人兴奋。

对于那些筹集资金以投资于具有巨大市场潜力的创新故事的成长型投资者来说,他们深知大多数 AI 股票的交易估值过高,而其他「成长型」叙事已经难以找到。即便是曾经备受推崇的 FAANG 股票,也正在逐渐转变为注重质量、利润最大化、年化收益率在 15% 左右的「复合增长」类股票。

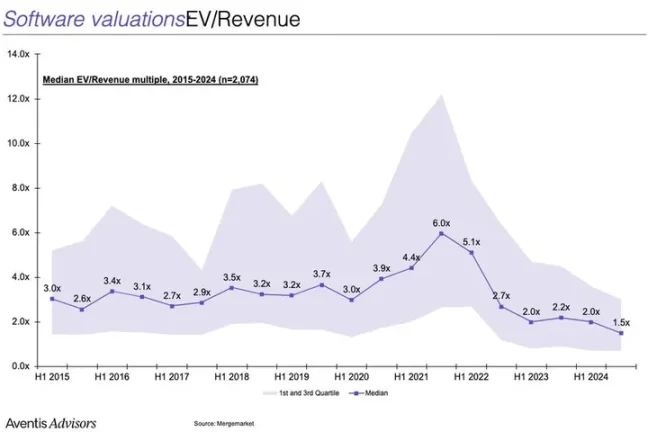

作为参考,软件公司的中位企业价值 / 收入(EV/Rev)倍数已下降到 2.0 倍以下。

加密资产登场

BTC 突破历史新高,美国总统在新闻发布会上极力推销加密资产,监管顺风推动了这一资产类别自 2021 年以来首次重回聚光灯下。

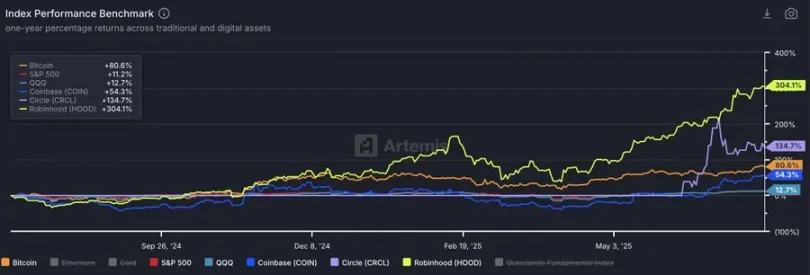

BTC、COIN、HOOD、CIRCL 与 SPY 和 QQQ 的对比(来源:Artemis)

但这一次,不是 NFT 和狗狗币。这一次,是数字黄金、稳定币、「代币化」和支付改革。Stripe 和 Robinhood 宣称加密资产将成为他们下一阶段增长的主要优先级。COIN 进入了标普 500。Circle 向世界展示了加密资产是一个足够激动人心的增长故事,成长型股票可以再次无视盈利倍数。

这一切对 ETH 意味着什么?

对于我们这些加密资产原生玩家来说,智能合约平台的竞争格局似乎非常分散。有 Solana、Hyperliquid,还有十几种新的高性能链和 Rollup。

我们知道,Ethereum 的领先地位正面临真正的挑战,也面临着生存威胁。我们知道它尚未解决价值累积的问题。

但我高度怀疑华尔街是否了解这些。事实上,我敢说大多数华尔街的「门外汉」几乎不知道 Solana 的存在。XRP、Litecoin、Chainlink、Cardano 和 Dogecoin 可能比 SOL 更具外部知名度。别忘了,这些人已经好几年没有关注我们的整个资产类别了。

华尔街知道的是,ETH 经得起时间考验,久经沙场,多年来一直是 BTC 的主要「跟随者」。华尔街看到的是,它是唯一一种除 BTC 外拥有流动 ETF 的加密资产。华尔街喜欢的是,有明确催化剂的经典相对价值投资机会。

这些西装革履的投资者可能了解不多,但他们知道 Coinbase、Kraken,并且现在 Robinhood 也决定「在 Ethereum 上构建」。稍作尽调,他们就能发现 Ethereum 拥有链上最大的稳定币池。他们会开始做「月球数学」,很快意识到虽然 BTC 创下新高,但 ETH 仍比 2021 年的高点低 30% 以上。

你可能认为相对表现不佳是看跌信号,但这些人的投资方式不同。他们更愿意买入价格较低、目标明确的资产,而不是追高那些让他们怀疑「是不是已经太晚」的图表。

我认为他们已经入场了。投资授权不是问题,任何基金只要有合适的激励措施都可以推动加密资产投资。尽管加密社区过去一年多来一直发誓再也不碰 ETH,但这个代币已经连续一个月表现优异。

年初至今,SOL 对 ETH 的汇率下跌了近 9%。ETH 的市值占比在 5 月份触底,此后出现了自 2023 年中以来最长的上升趋势。

如果整个加密社区都认为 ETH 是「被诅咒的币」,它为何还能表现优异?

它正在吸引新买家

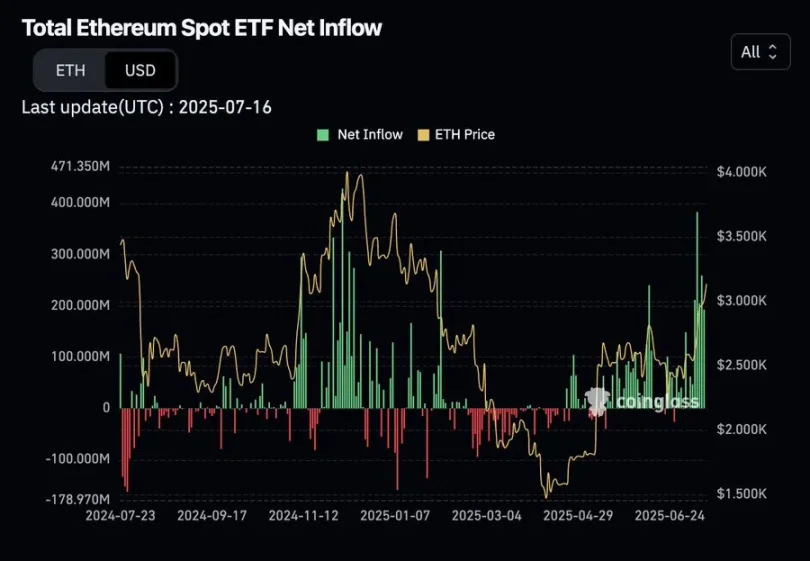

自 3 月以来,現货 ETF 的资金流入一直在持续上升。

来源:Coinglass

ETH 的「微策略」模仿者也在发力,为市场早期引入了结构性杠杆。

甚至一些加密原生参与者可能已经意识到自己对 ETH 的敞口不足,开始进行轮换,可能从过去两年表现优异的 BTC 和 SOL 头寸中撤出。

我并不是说 Ethereum 已经解决了任何问题。我认为现在的情况是,ETH 作为资产将开始与 Ethereum 网络脱钩。

小结

外部买家正在为 ETH 资产带来范式转变,挑战我们对其「只跌不涨」的看法。空头最终会被清算。然后,我们的加密原生资本将决定追逐热潮,在市场对 ETH 的全面投机热潮达到顶峰之前。

如果这种情况发生,新高并不遥远。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。