May Day Holiday Review: Downward Trend Unbroken, but Bearish Momentum Gradually Released

During the May Day holiday in 2025, Bitcoin exhibited a weak oscillation pattern after a high-level consolidation followed by a decline.

Since the local high of 97865 USDT reached at the end of April, BTC fell to a low of 93000 USD between May 1 and May 5. During the holiday, trading volume significantly shrank, overall volatility eased, and market sentiment remained cautious and watchful.

From the candlestick chart, BTC attempted to break through the 98000 level twice without success, forming a top resembling an "M-shaped" pattern. The neckline support area is between 94000 and 94400, and yesterday's price (May 5) first broke this key support and formed a failed rebound. The current price (morning of May 6) hovers below the MA60 (approximately 94600), with an overall technical structure leaning bearish. If it loses the MA200 moving average (currently reported at 95289), the mid-term trend may weaken significantly.

On the hourly level, the price has been moving within a descending channel since May 3, with the focus gradually shifting downward, and no clear stop-loss pattern has formed in the short term. The current resistance area is concentrated between 95000 and 95400, while the support area is between 92000 and 92800.

Technical Indicator Analysis: Bearish Momentum Being Released, Short-term Rebound May Be Imminent

(1) MACD: Bearish momentum slowing, DIF and DEA likely to "golden cross"

The current MACD indicator remains in the negative range, but since May 5, the bearish red bars have shrunk, and the DIF line has begun to turn upward, indicating that a short-term oversold rebound may be brewing. If the MACD forms a bottom "golden cross" within this week, it will signal the first round of reversal.

(2) RSI (14-day): Neutral to weak, not yet out of the adjustment zone

The RSI currently reports at 43.3, in a neutral to weak range, but has not created a new low, indicating that the price pullback has not been accompanied by extreme panic. If the RSI rebounds and breaks through the 50 mark, it may trigger a short-term technical recovery.

(3) KDJ: J value close to 0, technically oversold, rebound possible at any time

The KDJ indicator shows that the J value hit a low of 6.7 on May 5, indicating a deeply oversold state. The current K and D values have also shown multiple instances of convergence; if they strengthen again after a slight rise in the market, KDJ will issue the first round of buy signals.

(4) OBV: Volume consolidation, lack of active buying

The OBV volume indicator has shown a continuous downward trend since May 1, with no effective replenishment, indicating that bulls have not yet initiated large-scale positions. Attention should be paid to whether it can break through the 95000 level with volume; otherwise, the rebound strength will be limited.

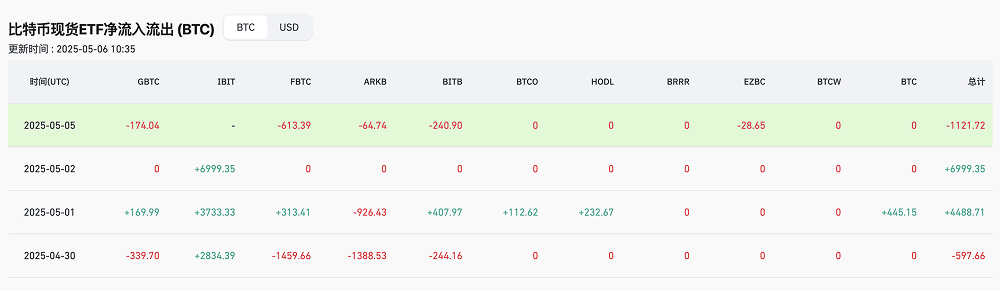

ETF Fund Flow Anomalies: Institutions "Cautiously Increasing Holdings," IBIT Maintains Stable Capital Inflow

According to Coinglass data, from April 29 to May 3, IBIT (BlackRock's Bitcoin spot ETF) continued to see net inflows, averaging about 150 million USD per day, indicating that long-term institutional buying remains strong. However, other ETF products have seen net outflows for several days, with traditional strong products like GBTC, FBTC, and ARKB experiencing varying degrees of redemption pressure.

From an overall structural perspective, IBIT has become the only major ETF that maintains continuous positive inflows during the oscillating market, reflecting that mainstream funds still prefer products with strong liquidity, low management fees, and significant head effects. Meanwhile, the divergence between ETF net inflows and spot exchange fund flows also suggests that short-term price fluctuations are more influenced by the futures and derivatives markets.

Market Structure and Capital Game: Bears Have Not Fully Taken Control, Signs of Buying Layout Emerging

Observing the right-side volume profile distribution chart:

- The high-density trading area is concentrated between 94600 and 95600, forming a short-term pressure zone.

- Support is located between 90500 and 92000; if effectively broken, it will test the previous low of 89200.

- Bulls still have attempts to defend the 94400 line, but the volume is insufficient. If it cannot return above 95000 in the next 24 hours, it will enter a new downward channel.

From the derivatives market data, during the holiday, BTC contract open interest did not see a significant decrease, with the short position ratio on Bitfinex and Binance rising to 58%, indicating a clear bearish bias in short-term funds. However, the funding rate remains neutral, with no extreme long-short divergence, suggesting that the trend can still reverse.

May 6 Trend Outlook: Observe the Battle for the 95000 Level, Focus on Three Trigger Conditions

Today's key technical levels:

- Upper resistance levels: 95000 / 95600 / 96200

- Lower support levels: 94400 / 92800 / 90500

If Bitcoin returns to 95000 and increases in volume before the U.S. stock market opens today (before 20:30 Beijing time), a short-term reversal structure will be established, targeting 97000; conversely, if the price falls below the MA200 and breaks 94000, further risks of dropping to around 90000 should be guarded against.

Three trigger conditions:

- Federal Reserve statements and macro interest rate clues: The FOMC meeting minutes are set to be released this week, and the market is watching for hints of delayed rate cuts or early tightening. A hawkish stance will put short-term pressure on BTC.

- Performance of the U.S. tech sector: If the Nasdaq continues to rebound, it may encourage digital assets to warm up in sync, especially crypto assets linked to AI concepts will strengthen first.

- Changes in ETF fund flows: If IBIT sees a restart of inflows and significantly rises this evening, it will become a strong reversal signal.

Conclusion: After Phase Risk Release, May Still Holds a Mid-term Bullish Foundation

Although Bitcoin's performance was weak during the May Day holiday, the technical aspect is nearing support limits, combined with continuous inflows into institutional ETFs and signs of profit-taking from some derivatives shorts, a stronger rebound window may emerge in mid to late May.

If it stabilizes above the 95000 level this week, BTC is expected to restart its upward target to 98500 or even challenge the year's high of 102000. Conversely, if it falls below the MA200 and loses 92800, it will enter a phase of adjustment, targeting the 89000 area. Investors are advised to closely monitor Federal Reserve policies and ETF trends, and to manage leverage and positions reasonably to cope with the current high volatility market.

This article represents the author's personal views and does not reflect the stance and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。