Bitcoin ETFs Keep Winning Streak Alive As Ether ETFs Follow with $106 Million

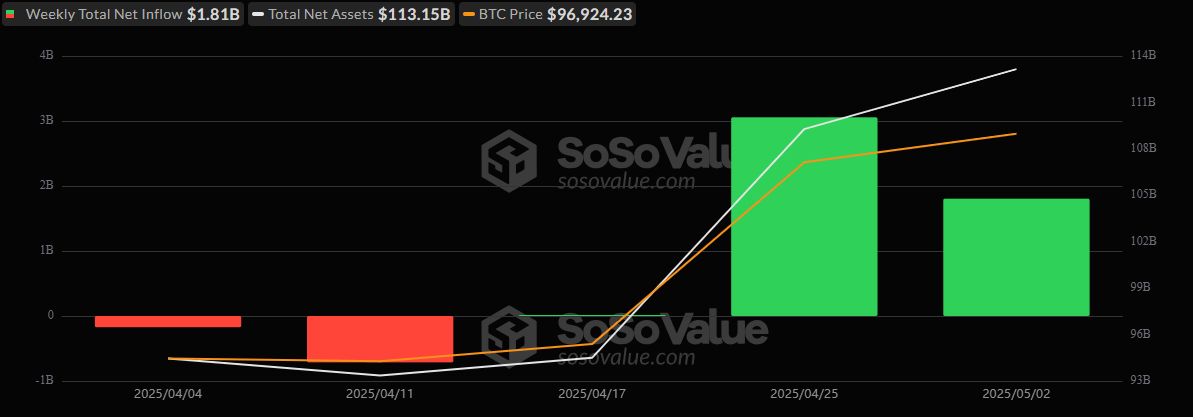

The streak continues for crypto ETFs. Bitcoin ETFs closed their 3rd consecutive week of inflows, attracting a massive $1.81 billion between April 28 and May 2, even with a midweek hiccup.

The bulk of that came from Blackrock’s IBIT, which once again ran away with the week, pulling in a staggering $2.48 billion on its own. Friday, May 2, delivered the strongest single-day net inflow of the week at $674.91 million, while Wednesday marked the only day of net outflows.

Despite several major ETFs seeing red for the week: Ark 21shares’ ARKB (-$457.64 million), Fidelity’s FBTC (-$201.09 million), Grayscale’s GBTC (-$58.61 million), and Bitwise’s BITB (-$30.15 million), the sheer scale of IBIT’s haul kept the overall picture firmly bullish along with modest contributions from Grayscale’s Mini BTC Trust with $41.92 million, Vaneck’s HODL with $19.19 million, and Invesco’s BTCO with $10.61 million.

Source: Sosovalue

Ether ETFs also turned in a solid second week of recovery with $106.75 million in net inflows. Blackrock’s ETHA led the way with $87.57 million, followed by Fidelity’s FETH at $37.79 million, and Grayscale’s Mini ETH Trust at $11.98 million. On the downside, Grayscale’s ETHE and Bitwise’s ETHW saw outflows of $26.21 million and $4.37 million, respectively.

In both camps, Blackrock’s role as market engine is clear. The spotlight isn’t just on the crypto, it’s on who’s capturing the capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。