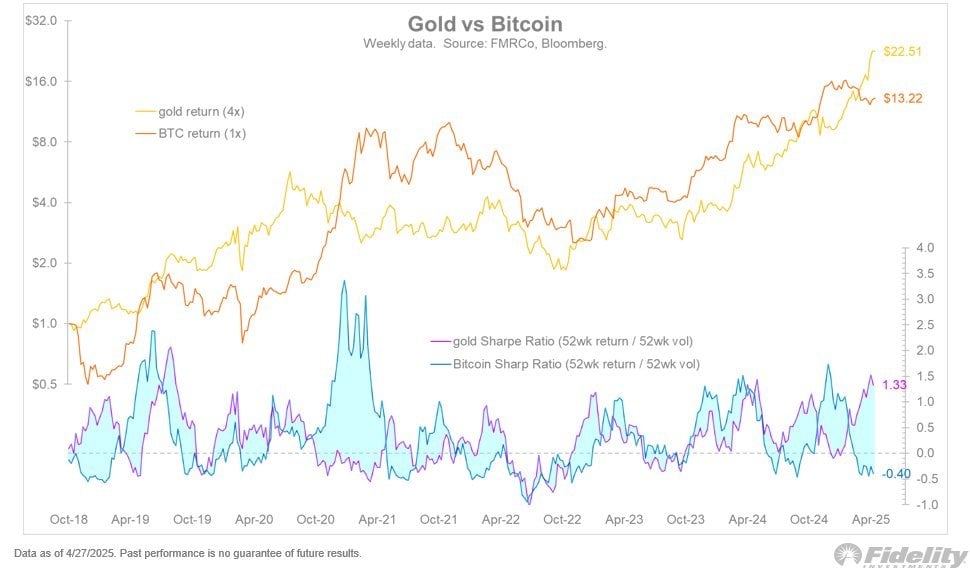

Fidelity Investments’ director of global macro, Jurrien Timmer, offered a comprehensive take on the dynamic between bitcoin and gold on April 27 through a series of posts on social media platform X. Citing data from Fidelity Management & Research Company (FMR Co) and Bloomberg, Timmer analyzed the shifting Sharpe Ratios of the two assets—an indicator that measures return adjusted for risk—and pointed to a potential turning point in their relative performance.

“Ironically, gold and bitcoin are negatively correlated to each other. As the chart below shows, both assets have been taking turns lately, as measured by their Sharpe Ratios,” he opined, adding:

From the looks of it, it may well be bitcoin’s turn to take the lead, given that its Sharpe Ratio is -0.40 while gold’s is 1.33. So perhaps we are due for a baton-pass from gold to bitcoin.

The chart shared alongside the commentary shows that gold has recently delivered a return of $22.51 compared to bitcoin’s $13.22, with gold’s performance scaled by a 4x multiplier to reflect its lower volatility versus bitcoin’s unscaled 1x return.

The Fidelity director of global macro recently encouraged investors to consider both assets as part of a unified strategy rather than oppositional choices. “Why choose between gold and bitcoin when you can have both? I see them as different players on the same team.” He suggested a starting portfolio mix of four parts gold to one part bitcoin, noting the volatility differential: “Gold’s volatility is one quarter of bitcoin’s, even though they have similar Sharpe Ratios.” He further explained how he views valuation through a normalized lens:

If we compare the historic price of bitcoin to gold on a 1:1 basis we see that bitcoin has dominated. But if we compare bitcoin to gold on a 1:4 basis, we see that the two assets are more alike.

In addition to performance metrics, Timmer commented on the psychological and behavioral aspects of investing in bitcoin. He described its volatility and unpredictability as fundamental characteristics: “Bitcoin is slightly different than gold, since it has this Dr Jekyll & Mr. Hyde personality.” According to Timmer, bitcoin thrives when both money supply (M2) and equities are expanding—leveraging its dual appeal as a speculative asset and a store of value. Gold, on the other hand, he remarked, is “just one thing,” offering more stability. Timmer acknowledged the legitimacy of bitcoin in today’s monetary landscape, describing it as “a modern day invention that is aspiring to be hard money in an easy money era.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。