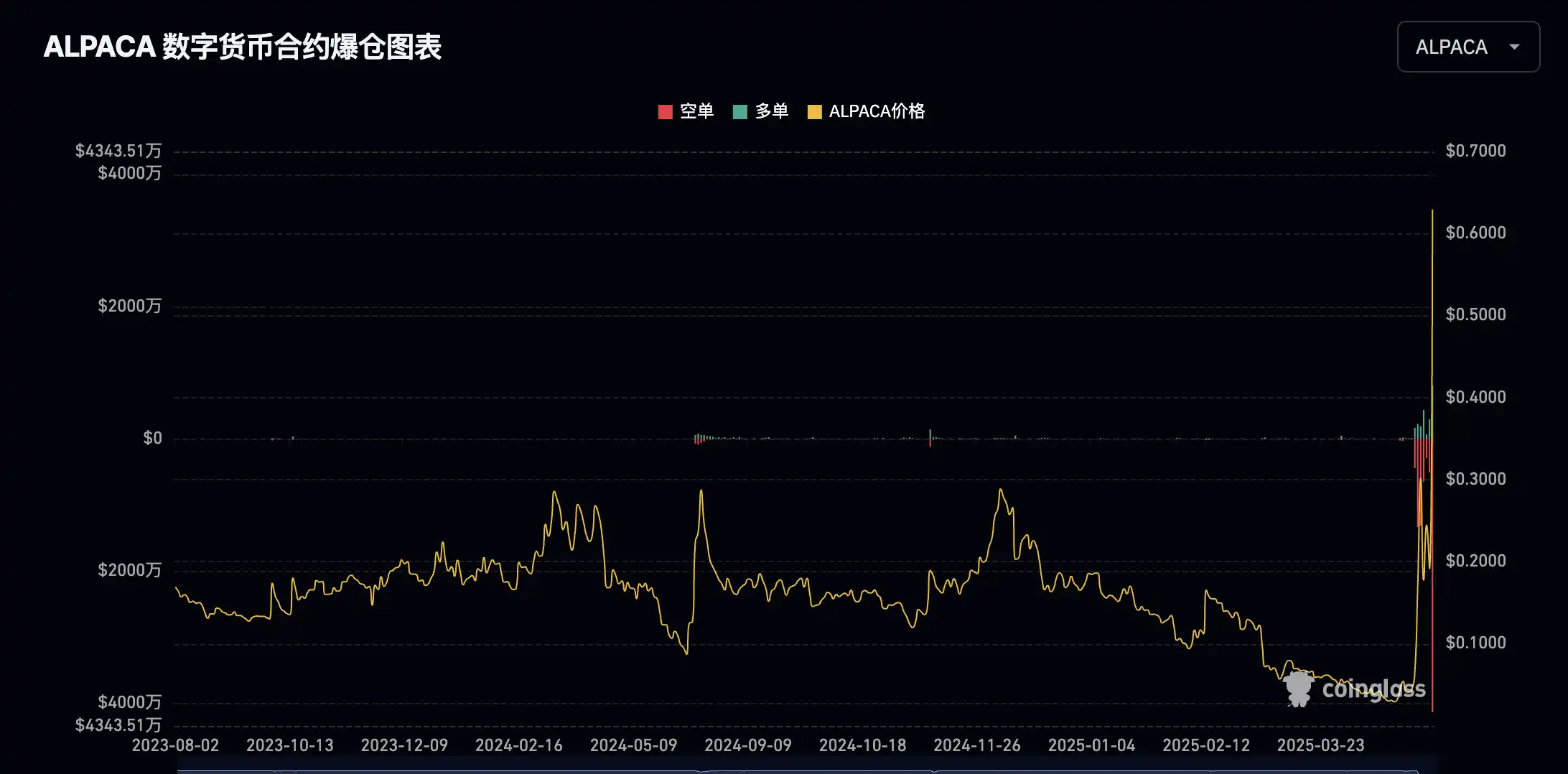

On April 24, Binance announced that it would delist four tokens, including Alpaca Finance ($ALPACA), on May 2, and that perpetual contract trading for these pairs would be delisted at 00:00 Beijing time on May 1, 2025. In the week that followed, just on the last day before the delisting of perpetual contracts, ALPACA surged onto the liquidation heatmap, with a total of $52.21 million evaporating in ALPACA's contract trading over the past 24 hours, which is more than the total liquidation amount for this token over the past two years.

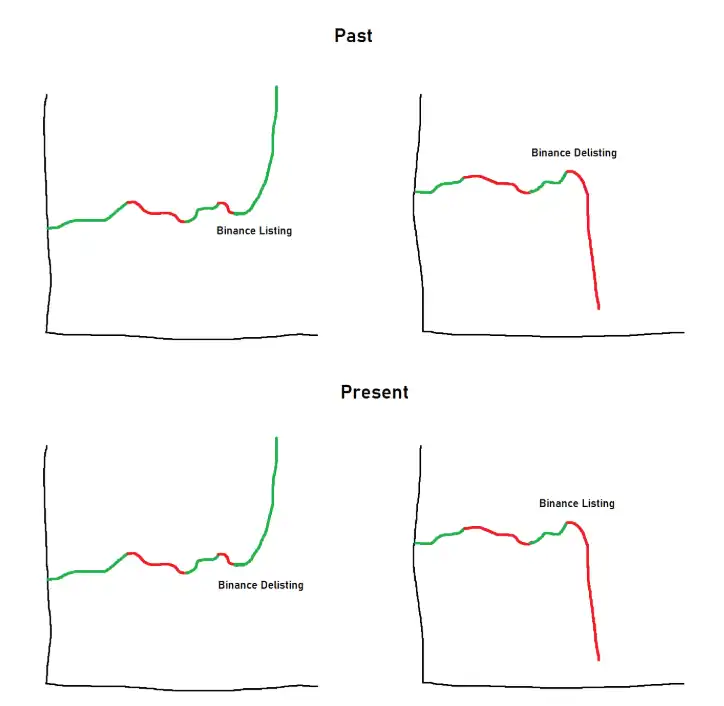

In the past, when a token was listed on Binance, many traders would buy immediately, following the "Buy the News" strategy. However, as the listing effect of Binance gradually weakened, traders found another path: shorting the tokens that Binance was about to delist, following the "Sell the News" strategy. This situation often had a high win rate until traders encountered the alpaca, ALPACA, on their shorting journey.

The Dual Kill Path of ALPACA

Every thrilling game orchestrated by market makers requires careful preparation. Before Binance's official announcement, $ALPACA was preliminarily listed as the 7th project in the second batch of "Voting for Delisting" on April 10, causing its price to plummet nearly by half. However, in the five days leading up to Binance's official announcement, from April 19 to April 23, trading suddenly surged.

The story's origin can be traced back to Binance's initiation of the second batch of "Voting for Delisting," where ALPACA entered the delisting candidate list, ranking 7th among 17 projects. Binance completed the voting and delisting statistics, and $ALPACA was listed among the projects to be delisted. The market did not react significantly, and the price did not fluctuate greatly, but trading volume expanded unusually, with the community suspecting that "controlling funds" had entered.

On April 24, Binance officially announced that it would delist the $ALPACA spot trading pair on May 2 and liquidate contract trading on April 30. Following the news, the spot price of $ALPACA dropped from $0.0329 to $0.029, with a market cap of only about $5 million. However, what followed were two "rollercoaster" rides, with the price surging from $0.029 to $0.0857 within an hour, an increase of about 195%, before quickly dropping back to $0.04 within three hours. Shorts were caught off guard, and the open interest (OI) rapidly increased, initiating a "long-short meat grinder" mode.

On April 25, Alpaca Finance officially announced that trading volume had exceeded 1 billion tokens in the past 24 hours, and market makers had suggested "increasing issuance to stabilize liquidity," which would return to the treasury after trading volume decreased. However, as public opinion began to ferment, opposing voices filled the community, leading Alpaca Finance to delete the previous tweet and release a new tweet that evening at 9 PM announcing the cancellation of the increased issuance due to community opposition.

On April 26, Binance modified the contract funding fee rate rules, shortening the cap rate cycle to settle every hour, with a maximum of ±2%. Some high-leverage accounts, continuously shorting while bearing extremely high fees, were liquidated, with millions of dollars disappearing within hours, and $13 million in short positions vanished within 24 hours on this token with a market cap of less than $30 million.

At this point, the short squeeze market was fully ignited, with the price skyrocketing nearly 12 times from the lowest point of $0.029 to $0.3477 within three days. The contract open interest surged significantly, especially with a notable increase in short positions, resembling a miniature version of the GME Wall Street battle against retail investors, except this time the retail investors' opponents had the ability to continuously issue more tokens.

From April 26 to April 29, the days were relatively calm, with the coin price fluctuating between $0.2 and $0.34. On April 29, Binance announced an increase in the fee rate cap to ±4%. Theoretically, such a high fee would severely impact shorts; if the -4% rate were maintained, short sellers would incur a "sunk cost" of 96% of their principal after 24 hours. However, remarkably, the coin price plummeted from $0.27 to $0.067.

On April 30, with only 24 hours left before the contract liquidation, the price continued to fluctuate violently. ALPACA's attention peaked, with its highest price reaching $1.2. From a week before the announcement of delisting to the eve of contract delisting, ALPACA's price increased 40 times, creating an independent market for the tokens being delisted by Binance. The total liquidation amount across the network reached $50 million, with the price surge underpinned by $42 million in "short fuel."

Community Discussion

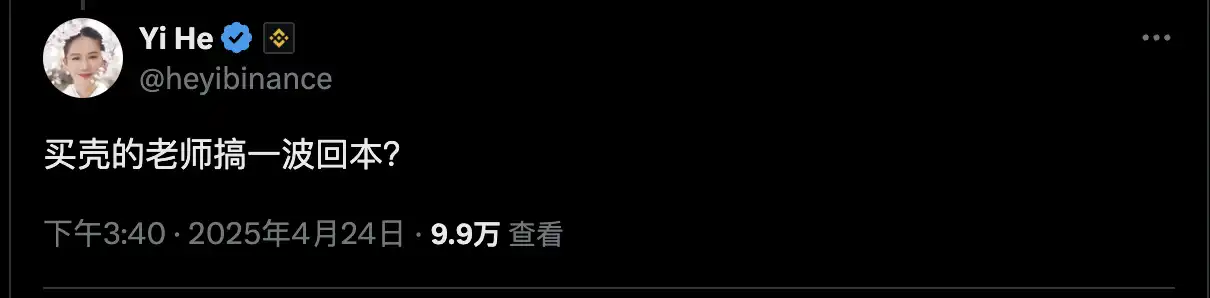

Is the shell-buying teacher trying to recover losses?

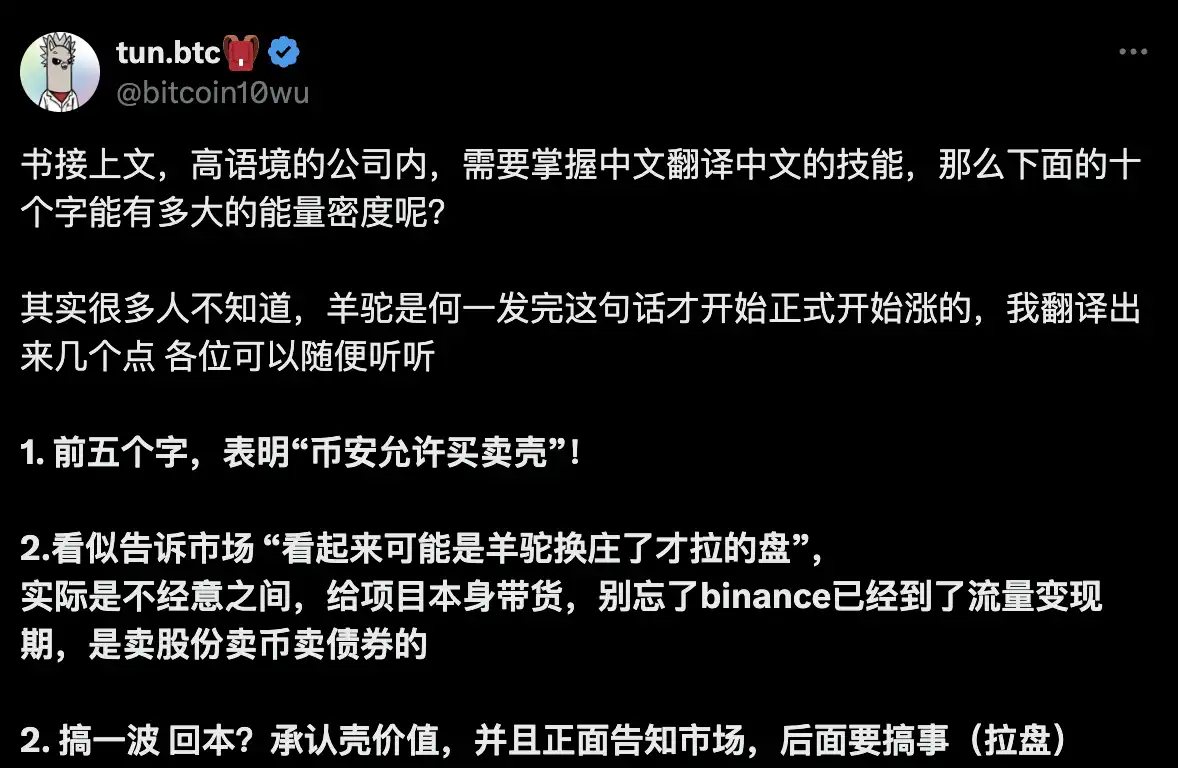

After ALPACA's first surge, Binance co-founder Heyi replied to a netizen, "Is the shell-buying teacher trying to recover losses?" This sparked endless speculation among community members.

KOL Tunbtc believes that Heyi's response was the starting point for ALPACA's surge, stating, "Large holders of the alpaca's native token leveraged the transfer of spot tokens, trading rights, and distribution rights to gain entry into Binance's deep-water core interest circle, allowing them to harvest market liquidity before delisting and slaughter their opponents." Through transaction fees, contract liquidations, and spot volatility, they turned user attention into profit.

He called for Binance to thoroughly investigate the matter and clarify which market maker was manipulating the K-line, as ALPACA was allowed to surge 18 times within 24 hours, resulting in users being liquidated for tens of millions of dollars, while a previous GPS surge of 500% was urgently halted, expressing that "this is all quite intriguing."

Wenze, the founder of Beta Capital, believes that bypassing the formal listing process and renaming to restart touches the bottom line of Binance's maintenance of listing credibility and brand compliance. Binance sometimes has a high tolerance for market fluctuations; OM issuance merely lowers the collateral rate, and many projects' reckless market-making is limited to leverage. However, once a project is identified as a "shell project," it is easily labeled for observation and subjected to voting for delisting, ultimately leading to its removal rather than being handled with gentler measures.

The Market Makers Behind the Scenes

Well-known KOL Rui "YeruiZhang" compared the ALPACA incident to "crazy revenge against an ex" and shared a rumor claiming that the original market maker of ALPACA was a team that controlled BSC MEV for a period and expressed dissatisfaction with Binance's current management for some reasons. Commenters speculated that it was the BSC whale 48CLUB, and Ian from 48CLUB even personally appeared to enjoy "his own melon."

"Delisting Concept"

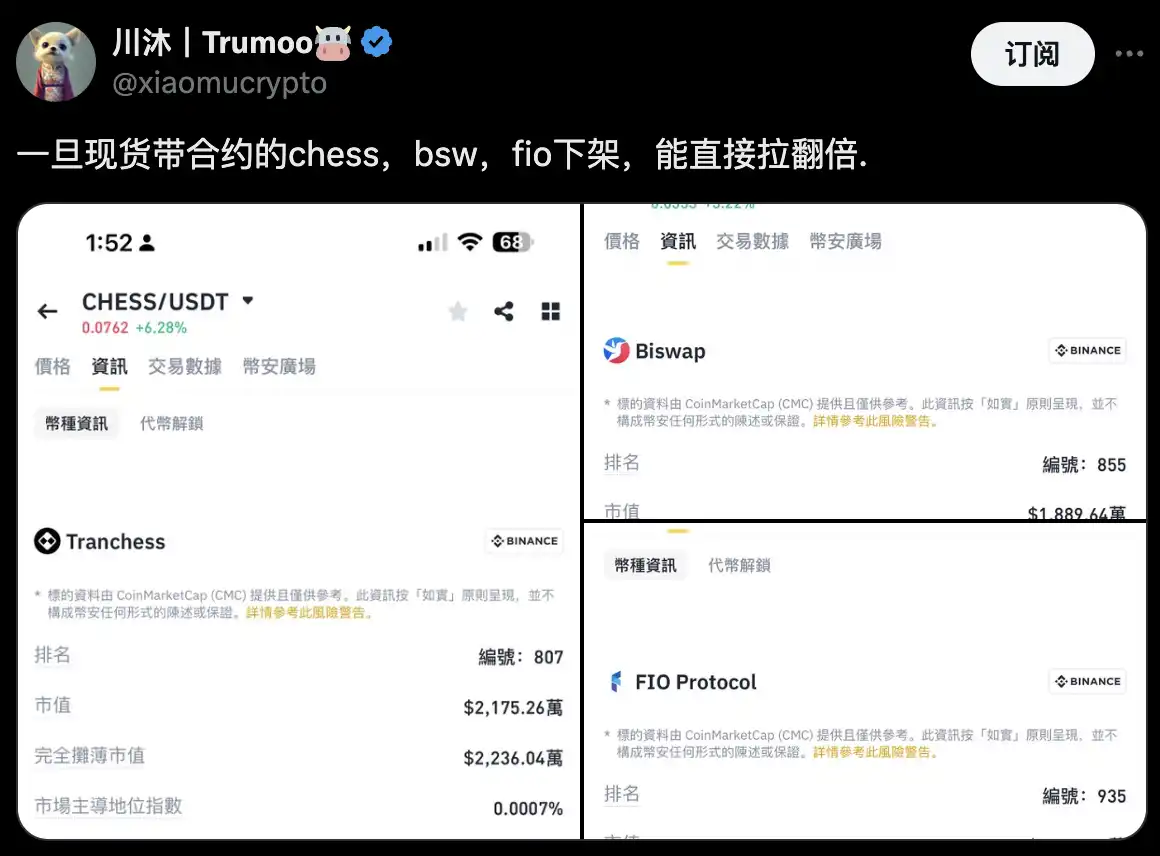

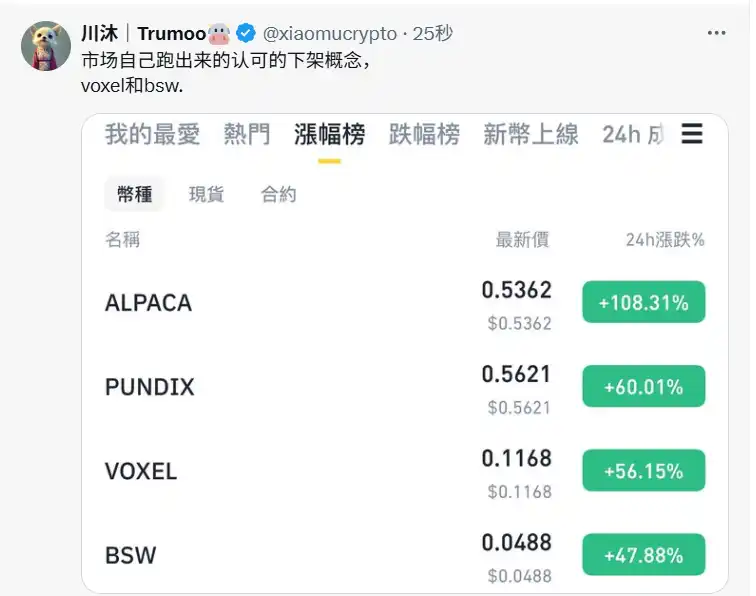

With the recent surge of VOXEL and the wealth effect and discussion surrounding ALPACA, an increasing number of "delisting concepts" have emerged. These are not necessarily tokens that have been confirmed for delisting but share some common characteristics with tokens that are likely to be delisted.

Well-known KOL Chuanmo recently shared his logic for selecting tokens of this type on Twitter, listing several tokens that have seen varying degrees of increase after his publication.

His strategy for selecting "delisting concepts" involves arranging small-cap tokens from Bybit and Binance starting from the lowest market cap, where almost 100% of those with the largest holding/market cap ratio increase. He buys three tokens daily based on this ranking with a fixed amount, continuously removing those that do not meet the criteria and buying new top three tokens.

Many members of the community have already tested this strategy, and many have created some auxiliary tools. The big dreamer Disney "discountifu" has created a dashboard, and Vivek10, who sleeps at 10 PM "vivekw_eth," has developed a monitoring push system that allows users to copy a link and directly push it to WeChat. However, it is currently deployed locally rather than on a server, making it somewhat unstable.

But please be cautious when using tools made for free by community members. Even though there are many enthusiastic contributors within the community, there are also many uncertainties in this dark forest.

In an increasingly competitive market, retail investors not only have to contend with market makers and other retail investors but also bear many unstable factors. The recent ALPACA incident has sounded an alarm for us: whether in primary or secondary markets, listing on top exchanges or engaging in "delisting concepts," we need to make reasonable asset allocations amidst FOMO emotions to protect our principal and reach the other shore.

All tokens mentioned above do not constitute financial investment advice "NFA."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。