Source: Cointelegraph

Original: “Why is Ethereum (ETH) Price Down Today?”

Key Points:

The price of Ethereum has dropped over 4% in the past 24 hours, reaching approximately $2575 on May 15. The decline in ETH aligns with the downward trend in the broader cryptocurrency market, with the total market capitalization decreasing by about 2.40% to $3.3 trillion.

ETH/USD four-hour chart. Source: Cointelegraph/TradingView

Let’s take a look at some factors driving the decline in Ethereum's price today.

According to CoinGlass, Ethereum's open interest (OI) has decreased by 4.5% in the past 24 hours to $31.52 billion. The drop in open interest indicates a reduction in trader confidence and liquidity, with investors exiting the market, pushing prices down.

ETH derivatives data. Source: CoinGlass

The pullback in ETH prices triggered liquidations, with long positions worth $64.6 million being forcibly closed that day, while the liquidation amount for short positions was approximately $21 million.

The broader cryptocurrency market also experienced significant deleveraging events, with the total liquidation amount across all assets reaching $312 million.

Cryptocurrency market liquidations (24 hours). Source: CoinGlass

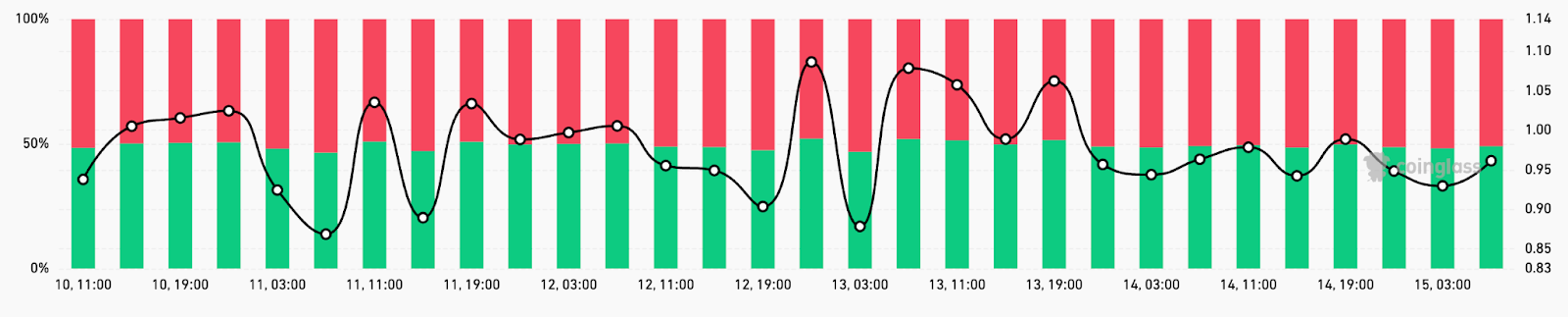

The combination of forced selling and low market participation has intensified the bearish momentum for Ethereum. The long-short ratio over 24 hours is 0.9558, with trading volume down by 32.5%, indicating a weakening bullish sentiment.

ETH long-short ratio chart. Source: CoinGlass

According to data from Cointelegraph Markets Pro and TradingView, Ethereum's remarkable surge over the past week has pushed its relative strength index (RSI) above 70 on both short and long time frame charts, indicating it is in overbought territory.

CoinGlass's RSI heatmap shows that ETH's RSI is 71 and 73 on the 12-hour and daily time frames, respectively.

ETH/USD daily chart. Source: Cointelegraph/TradingView

Ethereum's price also faces strong resistance in the range of $2600 to $2800. Notably, this is where the 200-day simple moving average (SMA) currently resides.

Renowned crypto analyst Michael van de Poppe stated that Ethereum needs to break through this resistance to increase its chances of setting a new high in 2025.

“If this happens with ETH, it would signal significant upside potential for the entire altcoin market.”

Source: Michael van de Poppe

The short-term downside target is between $2100 and $2230, which according to Van de Poppe, could provide a good entry point for late-stage investors.

As reported by Cointelegraph, Ethereum's dominance in the crypto market has reached its most overheated level since May 2021, a level that historically tends to precede significant pullbacks.

Related: Three Reasons Ethereum (ETH) Price Could Soar to $5000 by 2025

This article does not contain investment advice or recommendations. Every investment and trading action involves risks, and readers should conduct their own research before making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。