Original | Odaily Planet Daily (@OdailyChina)

Author | CryptoLeo (@LeoAndCrypto)

After the crypto summit, the market has once again entered a hellish mode. Apart from the occasional performances of the whale brother on Hyperliquid with 50x leverage, it seems no one is winning. There are no short-term positive news, and the altcoin season is still a long way off. During this period, the most important thing for users is to pursue returns while ensuring their assets do not depreciate, such as participating in new listings on exchanges, dollar-cost averaging into potential coins, earning rewards, and wealth management.

Recently, Odaily Planet Daily discovered a synthetic dollar stablecoin protocol, Falcon Finance, which offers an attractive 22.6% APY.

Falcon Finance is not an unknown entity; the protocol was launched by DWF Labs partner Andrei Grachev. Previously, in January, Andrei Grachev announced the launch of the synthetic dollar stablecoin protocol Falcon Finance, and soon after, its beta app went live in February. Its official documentation shows that Falcon is a platform that transforms synthetic dollars into sustainable yield opportunities, focusing on exploring the true yield potential of crypto assets for users and institutions.

Stable APY in a High Volatility Market: Falcon Finance's Yield Strategy and Dual Token System

Falcon's operational mechanism aligns well with the current volatile market. It employs a comprehensive and sustainable approach to generate yields, rather than relying solely on delta-neutral strategies and positive funding rate arbitrage.

1. More than just stablecoins, accepting more potential tokens as collateral

Falcon Finance not only supports stablecoins like USDT, USDC, and FDUSD as collateral but also accepts other mainstream assets and potential tokens in the market. According to its official app, Falcon Finance currently supports 13 non-stablecoins, including BTC, ETH, XRP, SOL, TRX, POL, NEAR, DEXE, and TON, totaling 16 tokens as collateral, with plans to add more based on liquidity and token potential in the future.

2. Yield exploration: a combination strategy of funding rate arbitrage and cross-exchange price arbitrage

With more diversified collateral support, Falcon Finance's main sources of yield currently come from funding rate arbitrage (similar to Ethena, going long on spot while shorting contracts and selling spot while going long on contracts, where the long/short will receive funding fees depending on the positive/negative funding rates) and cross-exchange price arbitrage.

Firstly, it ensures yield stability under different systems through positive funding rate arbitrage and staking of stablecoins, combined with negative funding rate arbitrage and short-term staking of altcoins.

Another institutional yield generation strategy employed by Falcon Finance is cross-exchange price arbitrage, where its institutional-grade infrastructure can effectively execute strategies such as CEX-to-CEX and DEX-to-CEX arbitrage.

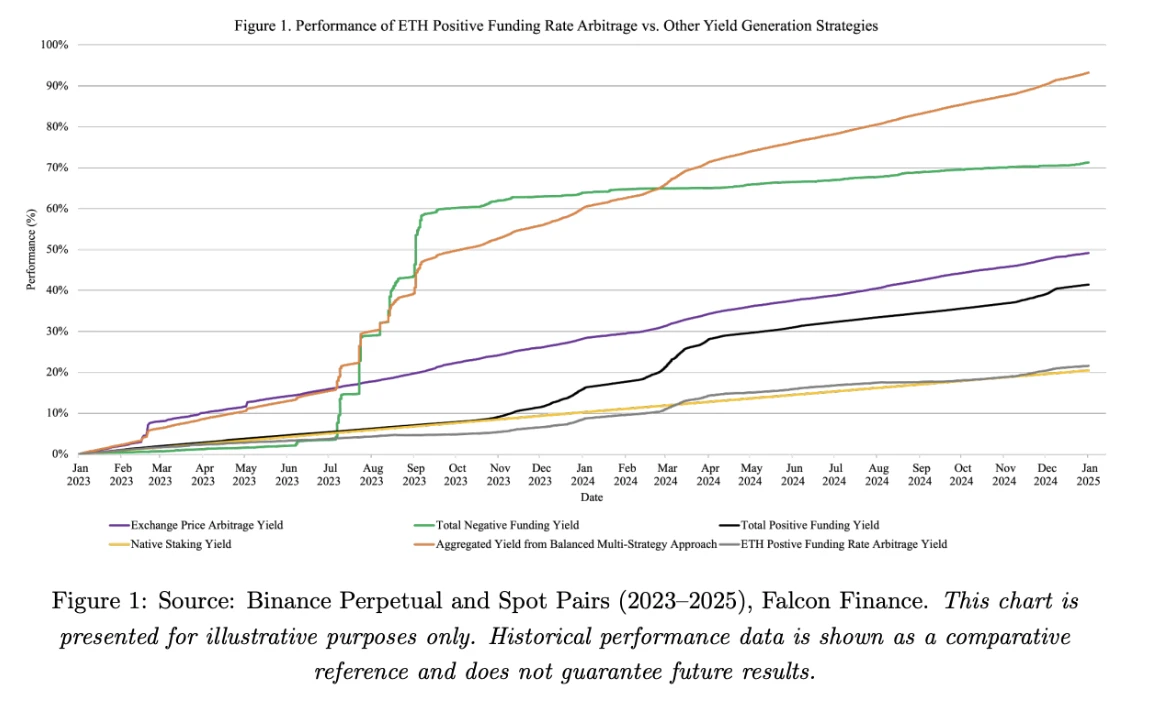

As shown in the above image, the chart compares the data of ETH positive funding rate arbitrage and other yield strategies from 2023 to 2025 (orange represents the expected combination strategy used by Falcon, including different strategies for altcoins and stablecoins), which includes funding rate arbitrage, exchange price arbitrage (Binance), and staking yields. It is clear that the potential performance of this strategy's yield under various market conditions.

3. The dual-token system of over-collateralized stablecoin USDf and yield-bearing token sUSDf

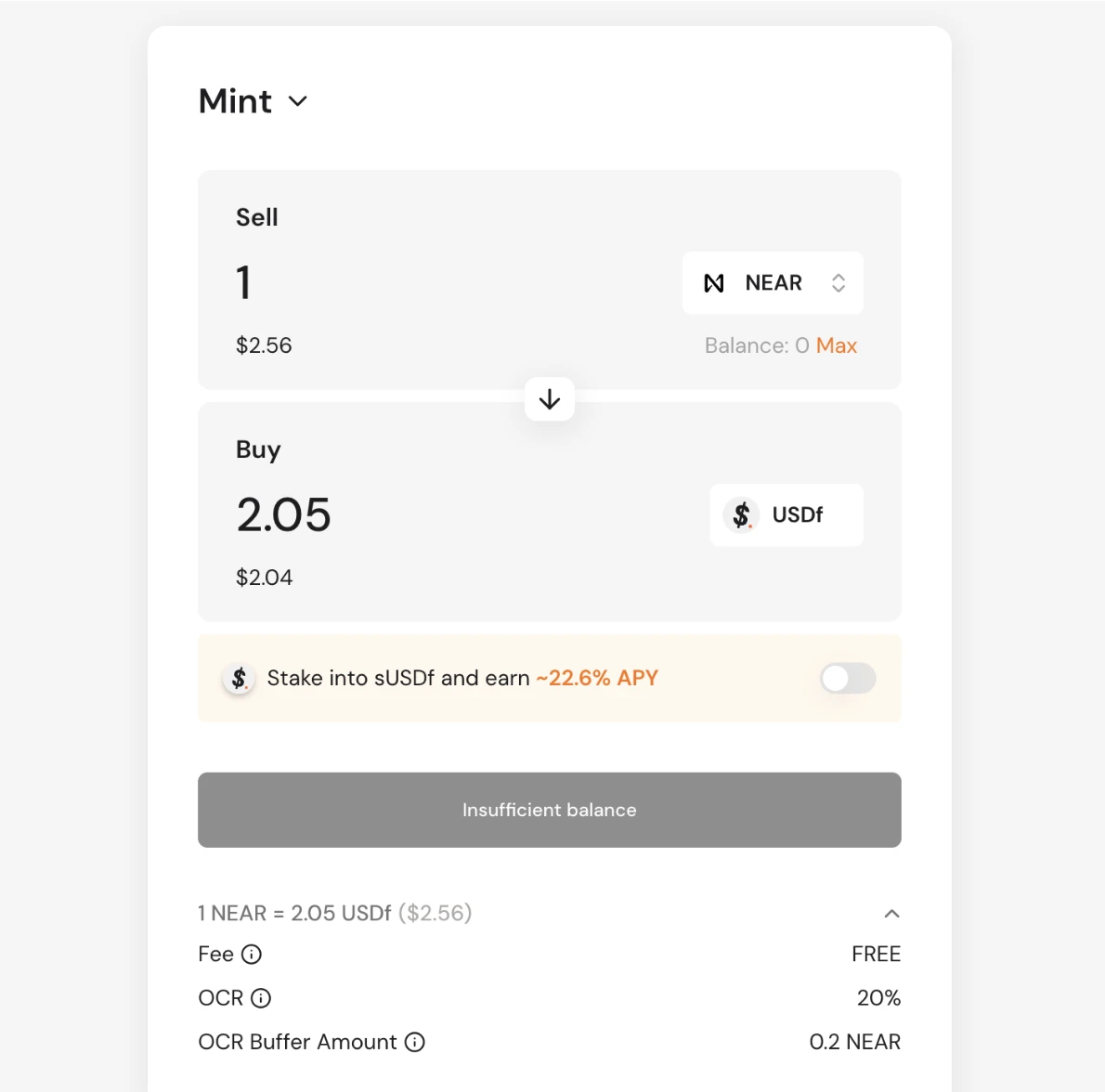

The two most important tokens of Falcon Finance are USDf and sUSDf. USDf is an over-collateralized stablecoin generated after users deposit collateral, supporting a 1:1 mint of USDf for deposited stablecoins. For non-stablecoin deposits, an over-collateralization ratio is used to ensure that each created USDf has sufficient collateral backing.

Additionally, when redeeming assets, if the market price of the collateral is less than or equal to its initial price, users can redeem all of the over-collateralized portion (Overcollateralized Buffer) of the initial collateral. However, if the market price of the collateral is higher than its initial price, users can only redeem an amount equivalent to the total value of the initial price of the over-collateralized portion. (If the token price drops, the entire over-collateralized portion can be redeemed; if the price rises, only the portion equivalent to the initial value can be redeemed.)

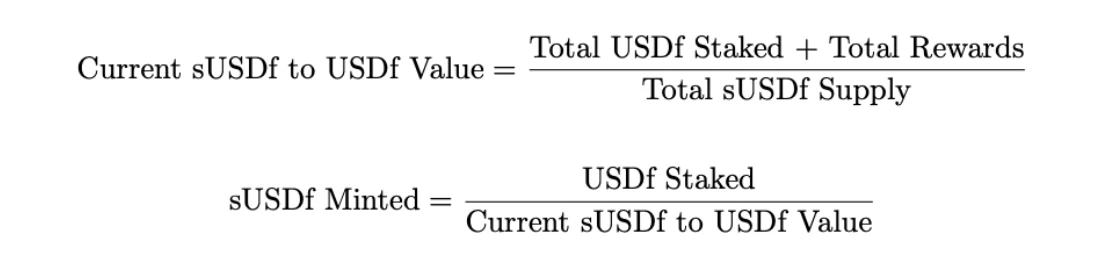

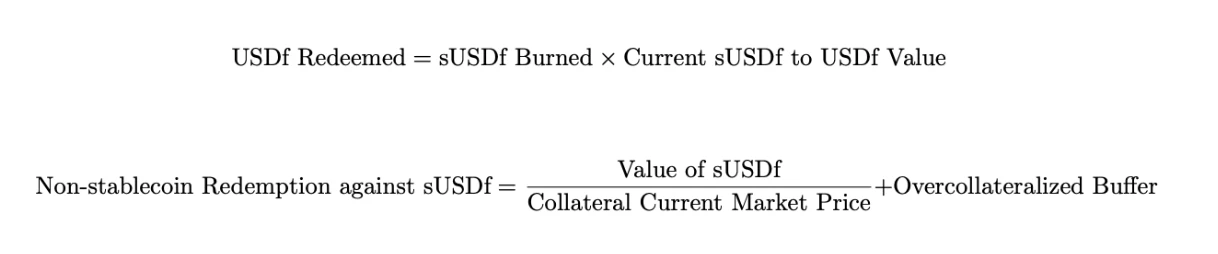

After minting USDf, users can stake it to earn sUSDf, using the ERC-4626 vault standard for yield distribution to ensure transparency and efficiency. However, the amount of sUSDf received after staking USDf is not the same; the amount after staking is calculated based on the current sUSDf-to-USDf Value, which reflects the ratio of the total supply of sUSDf to the total USDf and accumulated USDf protocol yield. The specifics are shown in the image below.

In other words, the initial sUSDf may all come from staking USDf, but as the rewards generated from staking USDf increase, the sUSDf-to-USDf Value will exceed 1, and the value of sUSDf will rise over time. The protocol will distribute the yield from the combination strategy to the staking pool and then allocate it to users based on the ratio of their staked USDf to the total staked USDf.

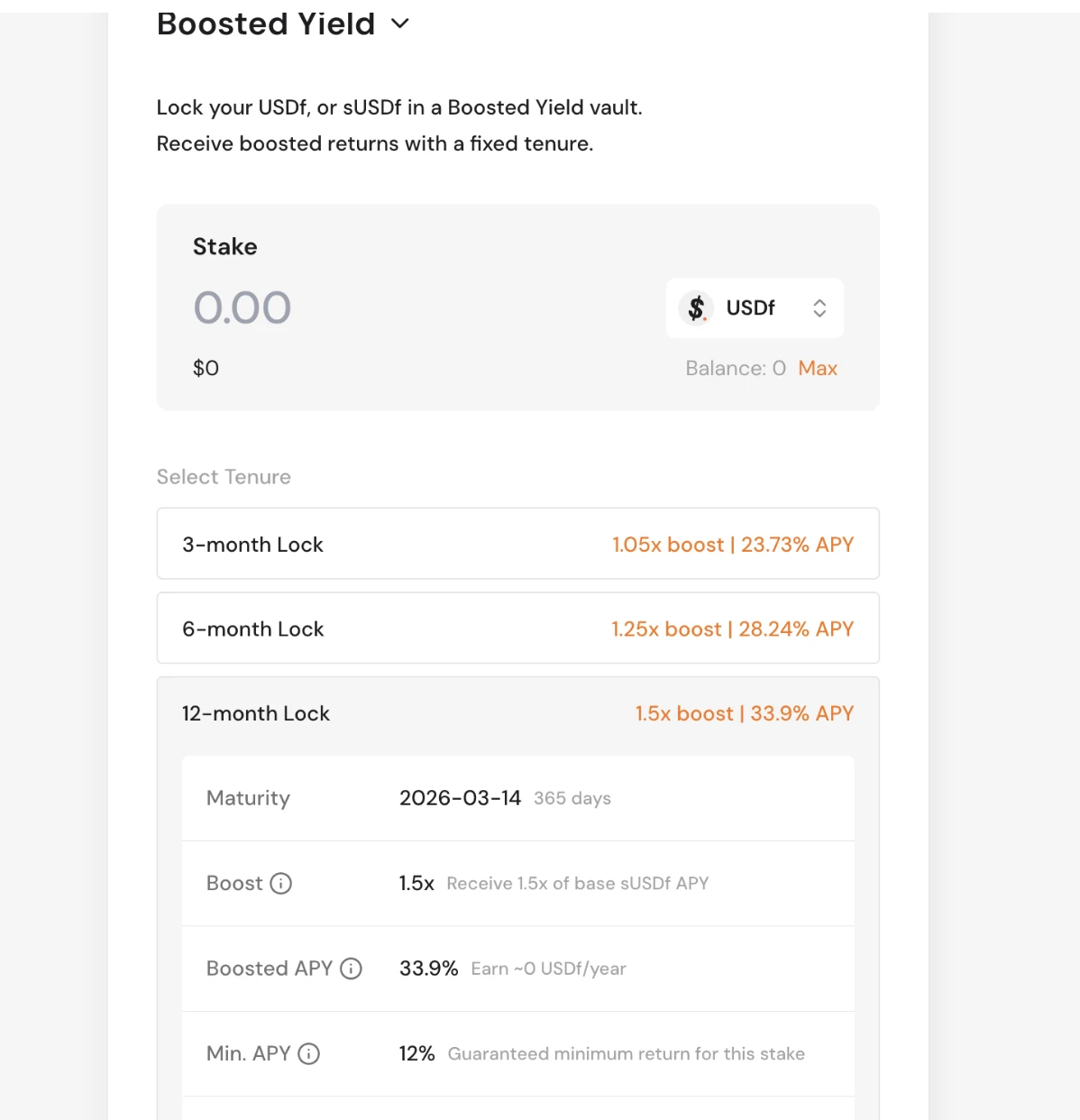

sUSDf also supports token re-staking. After re-staking sUSDf, the system will generate an ERC-721 NFT based on the quantity of sUSDf and the lock-up period, with longer lock-up periods yielding higher returns. Similarly, the mechanism for redeeming sUSDf for USDf is the same as staking USDf for sUSDf (reverse process).

Dual-layer monitoring system, audit reports, and insurance fund ensure protocol transparency and security

In terms of security, Falcon Finance employs a dual-layer monitoring system combined with human oversight to monitor and manage positions, utilizing its advanced trading infrastructure to mitigate risks during market volatility. Additionally, the protocol protects users' asset security through various means, including offline storage, multi-party computation, and multi-signature schemes. The protocol also provides real-time asset status information and comprehensive reserve information, including Total Value Locked (TVL), the number of sUSDf issued and collateralized, and the number of USDf.

Furthermore, Falcon Finance will publish quarterly and annual audits conducted by independent third-party companies. Quarterly audits cover detailed proof of reserves (POR), integrating on-chain and off-chain data, including aggregated metrics from DEX, CEX, and wallets.

Moreover, from the monthly profits, in addition to being distributed to users, a portion will be allocated to the insurance fund it has set up, which will increase with the adoption of the protocol and the growth of TVL. The insurance fund can alleviate periods of zero or negative yields in special market conditions. If the market conditions worsen, Falcon Finance may increase reserves to ensure the stability of the protocol.

This insurance fund consists of stablecoins, used to compensate for unforeseen risks and mitigate potential losses. The fund is held in a multi-signature address managed by both internal members of Falcon Finance and external contributors.

How to Participate in Falcon Finance

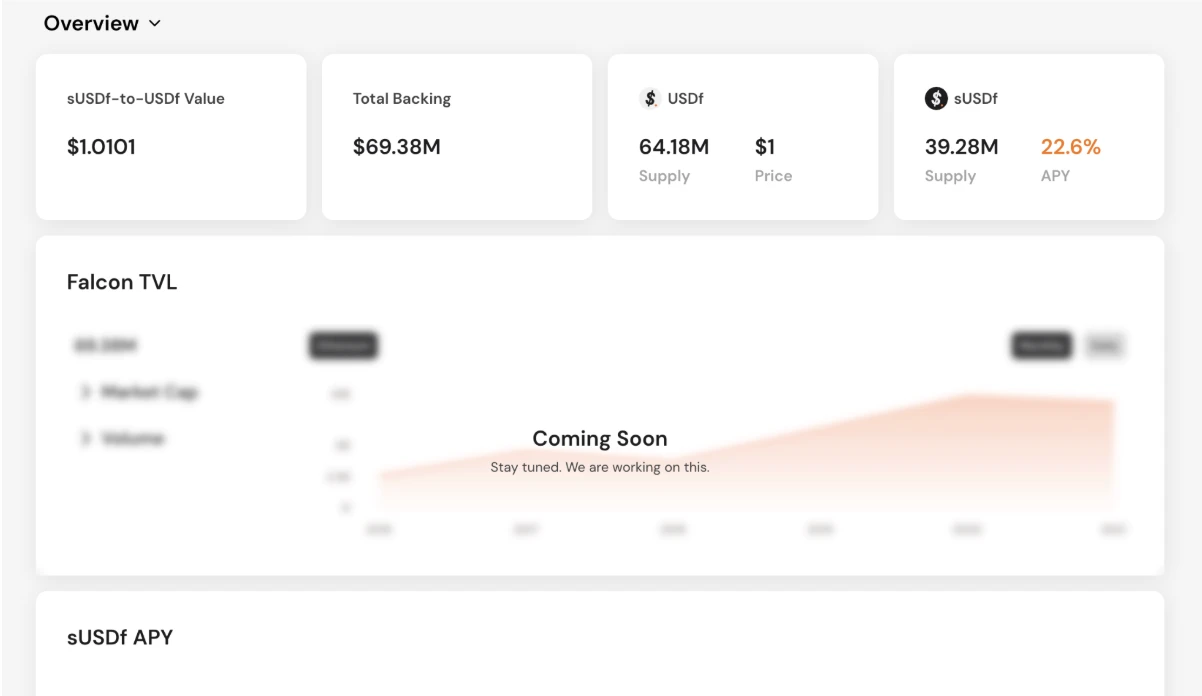

Currently, Falcon Finance is still in its beta testing phase, and data such as TVL is not yet displayed. The current supply of USDf is 64.18 million, and the supply of sUSDf is 39.28 million.

The gameplay is also very simple:

- Apply for its beta version qualification, filling in relevant information such as email, Twitter, TG, etc., one-click access;

- After completing KYC verification, select the chain and assets (the 16 tokens mentioned earlier) and deposit;

- After confirming the deposited assets, choose to mint as USDf (for example, deposit 1 NEAR, with 0.2 NEAR as the over-collateralized portion), and you can also choose to mint and stake as sUSDf;

- Staking USDf is divided into basic staking (which can be unstaked at any time) and locked staking (USDf and sUSDf) Boosted Yield, with durations of 3 months, 6 months, and 1 year. The longer the duration, the higher the APY (APY is an estimated value calculated based on weekly protocol earnings). The current basic staking APY is 22.6%, and the locked staking APY is shown in the image below. Additionally, locked staking has a guaranteed minimum APY (currently 12%), ensuring that no matter how much the market fluctuates, users can still receive a low guarantee.

For the current Beta version, USDf has been deployed on Ethereum. As mentioned earlier, Falcon Finance went from Andrei Grachev's announcement of the protocol to the early testing version in less than a month, and future multi-chain deployment of USDf and dynamic display of interface data will be completed soon.

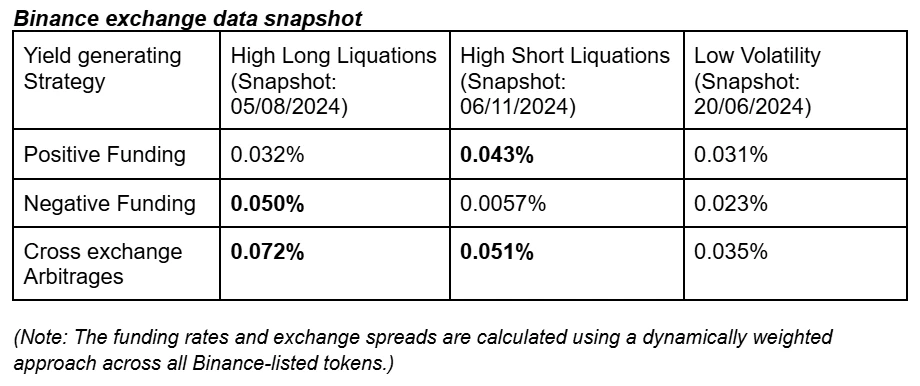

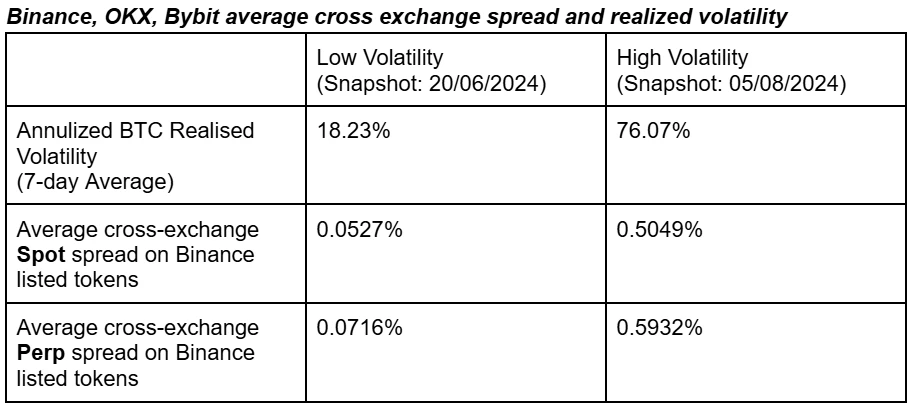

Moreover, the current altcoin market conditions and high volatility are also very suitable for Falcon Finance's negative funding rate arbitrage and cross-exchange price arbitrage strategies. The following image compares the cross-exchange spot, contract price differences, and funding rates between Binance and other CEXs in a high volatility market:

Overall, Falcon Finance reasonably utilizes market volatility and transforms it into yield. Through dynamic position management, funding rate strategies, cross-exchange arbitrage, and an insurance fund, it provides users with higher APY (with a low guarantee for locked staking) and security. Falcon Finance can be positioned similarly to Ethena Labs, or it can be seen as an advanced version of Ethena Labs. Its stable yield strategy and dual-token mechanism also ensure that Falcon Finance can achieve good development in both bull and bear markets.

Reference: https://falcon.finance/whitepaper.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。