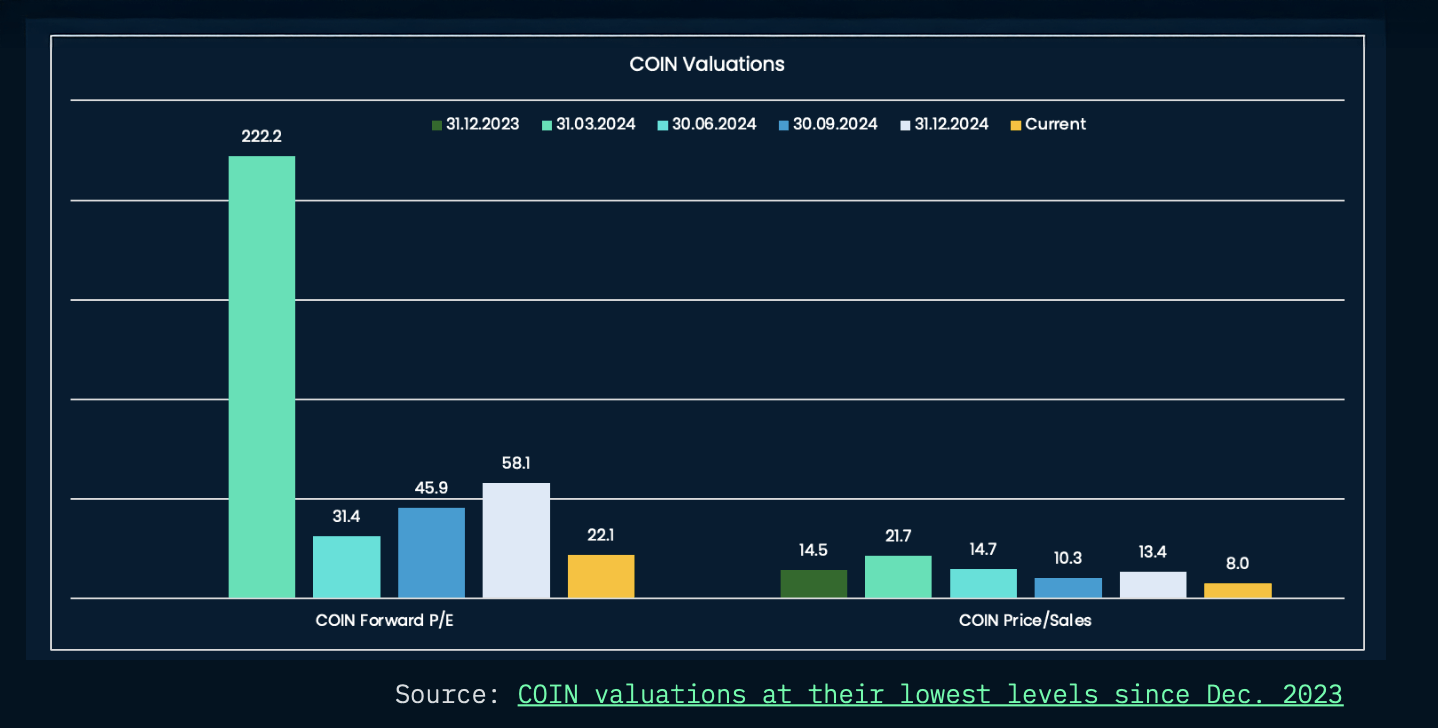

Blockchain analytics firm Nansen has released a research report painting Coinbase (Nasdaq: COIN) as a compelling long-term investment despite anticipated near-term revenue declines, driven by regulatory progress and an expanding product ecosystem. The stock, down sharply from late 2024 highs, now trades at valuations last seen in late 2023, per the analysis.

Source: Nansen Research report

Nansen highlights the dismissal of the SEC’s investigation into Coinbase as a pivotal regulatory win, clearing the path for clearer token classification rules. The agency’s collaboration with the CFTC and the Crypto Czar David Sacks is expected to foster a friendlier environment for centralized exchanges, potentially accelerating institutional adoption. “Coinbase’s management appears especially well positioned to help shape the crypto regulatory agenda, given its proximity to the US administration,” the report notes.

The report emphasizes Coinbase’s diversification beyond volatile spot trading, which accounts for 60% of revenues. Key growth areas include stablecoin partnerships with firms like Circle, bitcoin-backed loans via the Morpho platform, and plans to expand derivatives offerings. Stablecoin revenue surged 30% year-over-year in 2024, while yield products aim to boost customer retention through passive income streams.

Nansen estimates Q1 2025 revenue could contract 14% quarterly, with operating income halving, reflecting broader crypto market declines. However, the stock’s 46% drawdown from December 2024 highs suggests markets may have priced in these challenges. COIN’s price-to-sales ratio of 8.0 is near historic lows, despite margins rivaling top tech firms.

Risks remain, including COIN’s high correlation to crypto prices and recession fears. A U.S. downturn could trigger an 86% drop, mirroring 2023 lows. However, Nansen notes stable labor data and consumer spending as counterweights, projecting 1.7% GDP growth in 2025.

The firm advises a cautious entry, starting with modest allocations ahead of Q2 earnings. “COIN’s price levels attractive relative to its fundamental drivers: building a full-fledged crypto product suite and shaping the U.S. regulatory agenda,” Nansen‘s report concludes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。