Source: Cointelegraph Original: "{title}"

According to Jean Rausis, co-founder of the decentralized trading platform Smardex, the recently introduced "GENIUS Stablecoin Act" in the United States is merely a disguise attempting to introduce central bank digital currency (CBDC) control through privatization methods.

Rausis stated in a declaration shared with Cointelegraph that the U.S. government will penalize stablecoin issuers who do not comply with the new regulatory framework, similar to the European Union's Markets in Crypto-Assets Regulation (MiCA). The executive added:

"The government realizes that if they control stablecoins, they can control financial transactions. Collaborating with centralized stablecoin issuers means they can freeze funds whenever they want—this is essentially what central bank digital currency can do. So why bother creating a central bank digital currency?"

"When stablecoins are under government control, the outcome is the same, but it is additionally cloaked in a false guise of decentralization," the executive continued.

Rausis concluded that algorithmic stablecoins and synthetic dollars, as decentralized alternatives to centralized stablecoins, will prove to be a valuable line of defense against the government's increasingly tightening control over cryptocurrencies.

Homepage of the "GENIUS Act." Source: U.S. Senate

Revised "GENIUS Act" Includes Stricter Provisions

The "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (referred to as the GENIUS Act), introduced by Tennessee Senator Bill Hagerty on February 4, proposes a comprehensive framework for over-collateralized stablecoins like Tether's USDT and Circle's USDC.

On March 13, the bill was revised to include stricter anti-money laundering provisions, reserve requirements, liquidity terms, and sanctions review measures.

These new provisions are likely to give U.S.-based stablecoin issuers an advantage over their overseas counterparts.

At a recent White House cryptocurrency summit, U.S. Treasury Secretary Scott Bessent stated that the U.S. will utilize stablecoins to ensure the dollar's dominance in the payment sector and maintain its role as the global reserve currency.

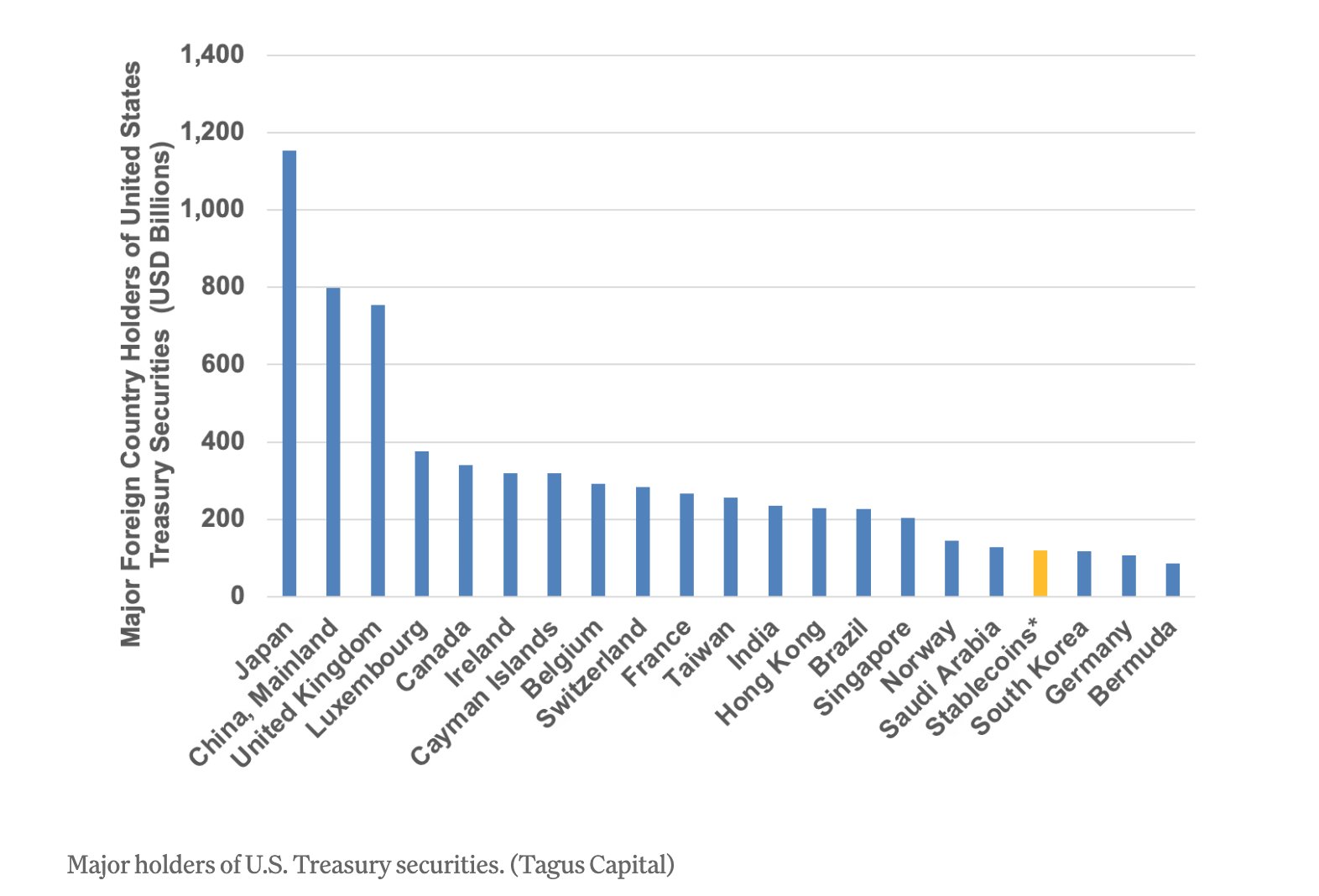

Largest holder of U.S. Treasury bonds. Source: Peter Ryan

Centralized stablecoin issuers rely on U.S. bank deposits and short-term cash equivalents like U.S. Treasury bonds to support their digital fiat currency tokens, which increases the demand for dollars and U.S. debt instruments.

Stablecoin issuers hold over $120 billion in U.S. Treasury bonds—making them the 18th largest purchasers of U.S. Treasury bonds globally.

Related: Paxos CEO urges U.S. lawmakers to establish cross-border stablecoin regulatory rules.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。