Rules are key.

Author: Three Sigma

Compiled by: Deep Tide TechFlow

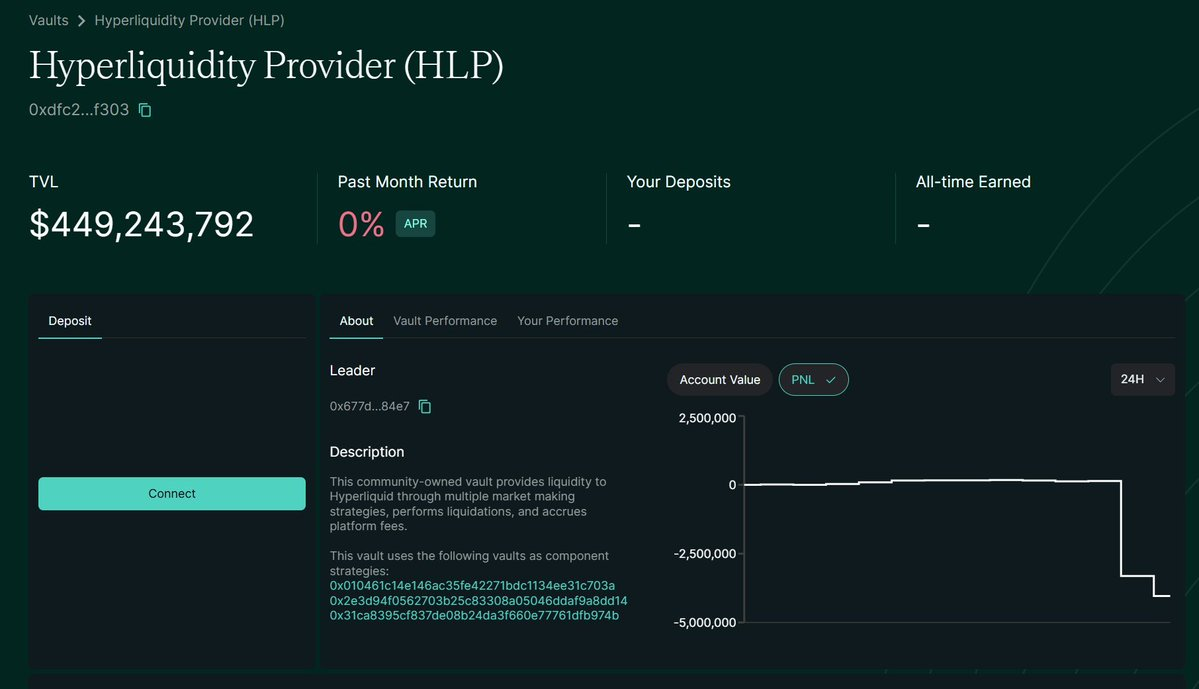

A trader vs. Hyperliquid's HLP vault.

$4 million loss.

No exploits, no attacks, just the brutal game of liquidity mechanisms.

Here’s the timeline of events:

What happened?

A trader leveraged $10 million USDC into a $271 million ETH long position, then withdrew the collateral, forcing HLP (Hyperliquid Liquidity Provider) to take over the trade.

The trader ultimately made a profit of $1.8 million, while HLP incurred a loss of $4 million.

Let’s take a closer look at the specific operations.

Step 1: Setup

If you are making a large trade, you face a problem: how to exit without affecting your position?

Market selling = slippage = ruining your own trade.

This trader found a way to completely liquidate without taking a loss themselves.

Step 2: Withdrawal Operation

The trader did not sell ETH through the order book but withdrew the collateral, reducing margin to force Hyperliquid to liquidate their position.

HLP—the liquidity vault of the protocol—took on this $286 million ETH long position, exposing itself to risk.

Step 3: Perfect Short Hedge

The trader knew that HLP's forced liquidation would drive down the ETH price, so they executed a two-way operation.

By hedging on another exchange (like Binance), they made HLP bear the long risk while profiting from the short.

This was not an accident, but a meticulously planned trade.

Is this exploiting a loophole?

Hyperliquid stated it is not, as HLP was not forced to take the order like GLP, and other market makers also participated in the liquidation.

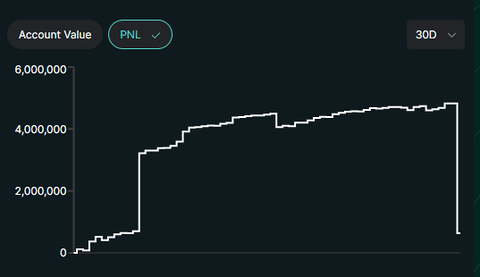

HLP “only” lost $4 million, about a month’s profit, but this did not undermine the system. The vault overall remains profitable.

Why did HLP lose $4 million?

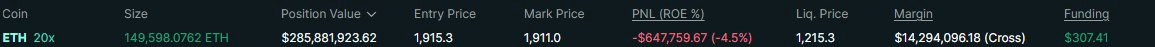

HLP is not a single vault but is divided into three parts:

1️⃣ HLP Liquidators—buying the liquidated positions

2️⃣ HLP Strategy A—$145 million ETH short

3️⃣ HLP Strategy B—$145 million ETH short

On the user interface, you can only see the net position.

When large positions are liquidated:

HLP Liquidators held $290 million in ETH long

Strategies A and B executed short hedges

They failed to fully match the entry price, leading to a $4 million slippage loss.

This is not a socialized loss but slippage incurred during execution.

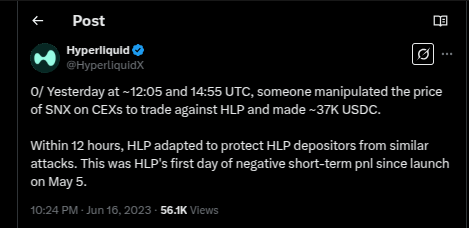

Hyperliquid is not the first to be targeted

In June 2023, an attacker profited $37,000 USDC from HLP by manipulating the SNX price on a centralized exchange (CEX).

HLP had to quickly adjust its pricing model to defend against future attacks.

Will this happen again?

Hyperliquid has taken the following actions:

Maximum leverage reduced to 40x (BTC) and 25x (ETH)

Increased margin requirements for large positions

More HLP risk adjustments will follow

The real question is, when the most astute traders always seem to get ahead, should the protocol still rely on the liquidation mechanism?

Final Conclusion: Rules are Key

This is not a code vulnerability, but it can be considered a mechanism flaw.

Traders do not directly damage smart contracts, but they can still harm the protocol through loopholes in the rules.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。