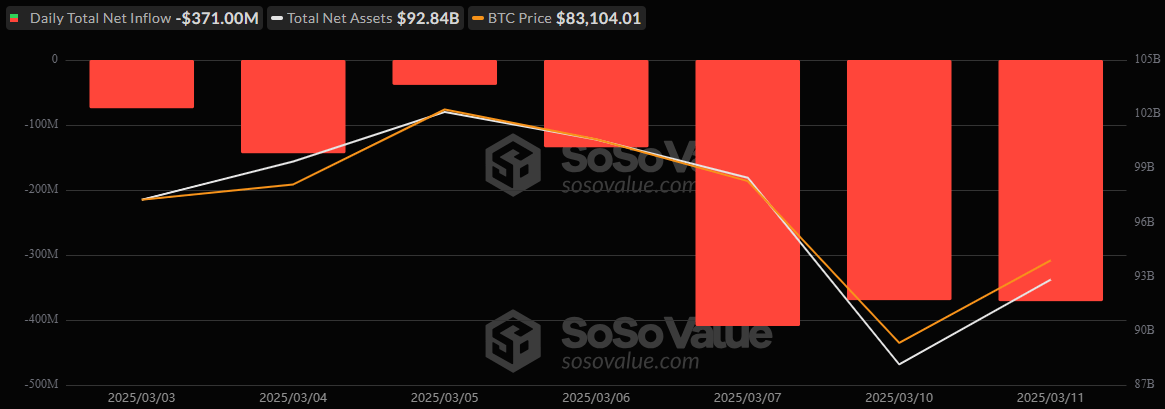

Investors continued to reassess their positions in bitcoin and ether funds with data from Sosovalue revealing that bitcoin exchange-traded funds (ETFs) endured net outflows totaling $371 million on Tuesday, Mar. 11, marking the 7th consecutive day of withdrawals. Ether ETFs weren’t spared either, recording net outflows of $21.57 million, extending their streak to five successive days.

A significant portion of the bitcoin ETF outflows was attributed to Blackrock’s IBIT, which saw $151.26 million exit the fund. Fidelity’s FBTC wasn’t far behind, with outflows amounting to $107.10 million.

Grayscale’s GBTC also faced substantial redemptions, losing $35.49 million. Other notable outflows included Franklin’s EZBC ($33.73 million), Wisdomtree’s BTCW ($15.43 million), Invesco’s BTCO ($14.93 million), Bitwise’s BITB ($9.05 million), Valkyrie’s BRRR ($3.41 million), and Vaneck’s HODL ($588,030).

In the ether ETF space, Blackrock’s ETHA bore the brunt of the outflows, with investors pulling $11.82 million from the fund. Fidelity’s FETH wasn’t immune either, experiencing outflows of $9.75 million.

Consecutive days of net outflows could indicate a reevaluation of risk or profit-taking strategies. With 7 days of successive outflows for bitcoin ETFs, the last 3 days have seen outflows of over $300 million while ether ETFs have seen 5 days of successive outflows with all outflows over $20 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。