Despite the inclusion of several large-cap altcoins in Trump's cryptocurrency reserve plan, Bitwise Chief Investment Officer Matt Hougan stated that the reserve will ultimately be "almost entirely composed of Bitcoin."

In a market report on March 5, Hougan explained, "Market participants reacted negatively to this announcement because the proposed reserve includes not only Bitcoin." He added, "The inclusion of small-cap assets complicates things unnecessarily."

On March 2, Trump initially stated that the reserve would include Solana (SOL), XRP (XRP), and Cardano (ADA), later adding that Bitcoin (BTC) and Ethereum (ETH) would be the "core" of the reserve. Hougan remarked, "Once the dust settles, I guess the final reserve will be almost entirely composed of Bitcoin, and its scale will exceed people's expectations."

Bitcoin's price initially rose after the announcement of its inclusion in the reserve but then fell below $83,000, only recovering to above $90,000 in the past day, partly due to Trump delaying tariffs on auto parts from Canada and Mexico.

Trump's abandonment of a Bitcoin-only reserve approach has raised concerns among some cryptocurrency commentators, who believe Bitcoin is the only cryptocurrency suitable for inclusion in the reserve. Coinbase CEO Brian Armstrong considers Bitcoin to be the "successor to gold."

Hougan stated, "The inclusion of speculative assets like Cardano feels more like penny-pinching rather than a strategic decision." He added, "Although the launch method is flawed, I think the market 'misread the situation,' but ultimately this approach is bullish."

Hougan noted that, like the tariff issue, Trump's initial proposal "is rarely the final solution," and opinions from industry leaders at the upcoming White House cryptocurrency summit may lead to changes in the reserve's composition.

U.S. Secretary of Commerce Howard Lutnick hinted that Bitcoin might receive special status in the reserve, and "other cryptocurrency tokens, I believe, will be treated in different ways—positively, but differently."

Hougan also mentioned a smaller but unlikely scenario where pressure to overturn this idea could lead to the reserve being canceled or limited to assets already seized by the government.

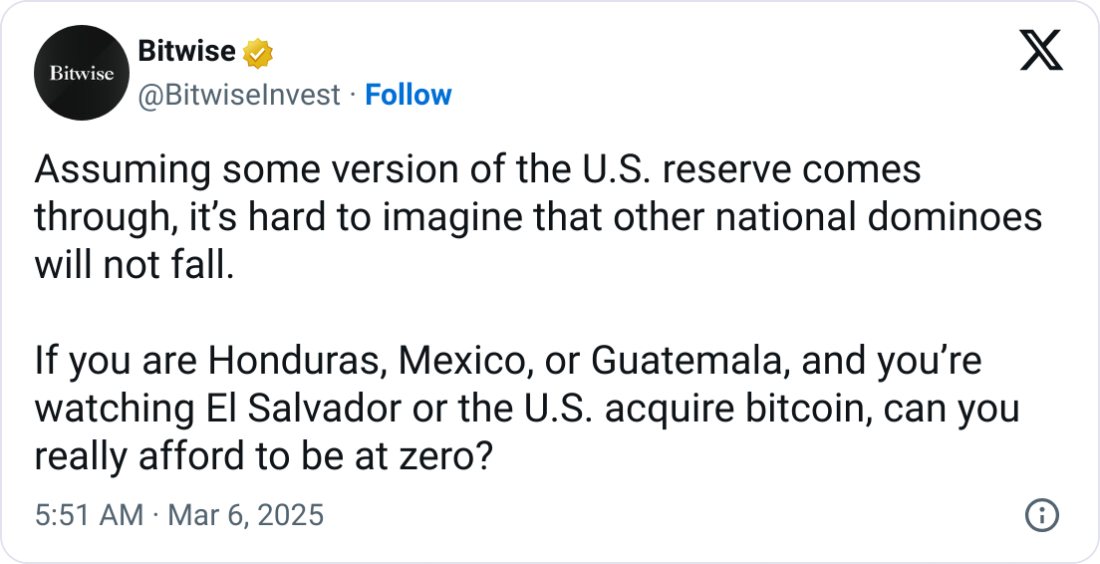

Source: Bitwise

Hougan further stated that even if a Democrat takes over after Trump, it is unlikely that the U.S. will sell any purchased cryptocurrencies. He said any cryptocurrency "will be held long-term," similar to the U.S. gold reserves.

He remarked, "Democratic leaders do not want to alienate voters, and there is almost no benefit to them."

He added, "A significant portion of people love cryptocurrency, while relatively few hate it. We saw this in the last election, where the GOP won many votes by being pro-cryptocurrency, while the Democrats' hostility did not yield many votes." Hougan stated that the market's initial bullish sentiment "makes me feel it is correct… I believe the market will ultimately realize this."

Related: The Bitcoin Strategic Reserve Craze: A New Hope for the Economy or a High-Risk Gamble?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。