Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Just one day after "Crypto Grandmaster" Trump made a high-profile "call" to establish a strategic reserve for cryptocurrencies (see details in “Crypto Market V-Shaped Reversal: The 'Trump Effect' Strikes Again”), the cryptocurrency market experienced a sudden shift, with prices plummeting overnight, catching many off guard with the rapid "bull/bear transition."

According to OKX market data, BTC briefly fell below 83,000 USDT (hitting a low of 82,600 USDT), erasing all gains made after Trump's "call." As of around 10:00 (same below), it was reported at 83,333.9 USDT, with a 24-hour decline of 10.43%.

The altcoin market fared even worse.

The two major altcoins, ETH and SOL, both dropped over 10%, with ETH falling below 2,100 USDT, currently reported at 2,025.83 USDT, with a 24-hour decline of 16.28%; SOL fell below 140 USDT, currently reported at 136.3 USDT, with a 24-hour decline of 21.05%.

XRP and ADA, which were previously highlighted by Trump, also performed poorly, with XRP currently reported at 2.28 USDT, with a 24-hour decline of 18.7%; ADA currently reported at 0.78 USDT, with a 24-hour decline of 27.55%.

The situation for other altcoins is even worse; maintaining a decline within 20% is considered "excellent," as most coins have generally fallen below the lows seen during the previous day's crash.

Data from Alternative shows that today's Fear and Greed Index has dropped from 33 to 15, returning to an "extreme fear" state.

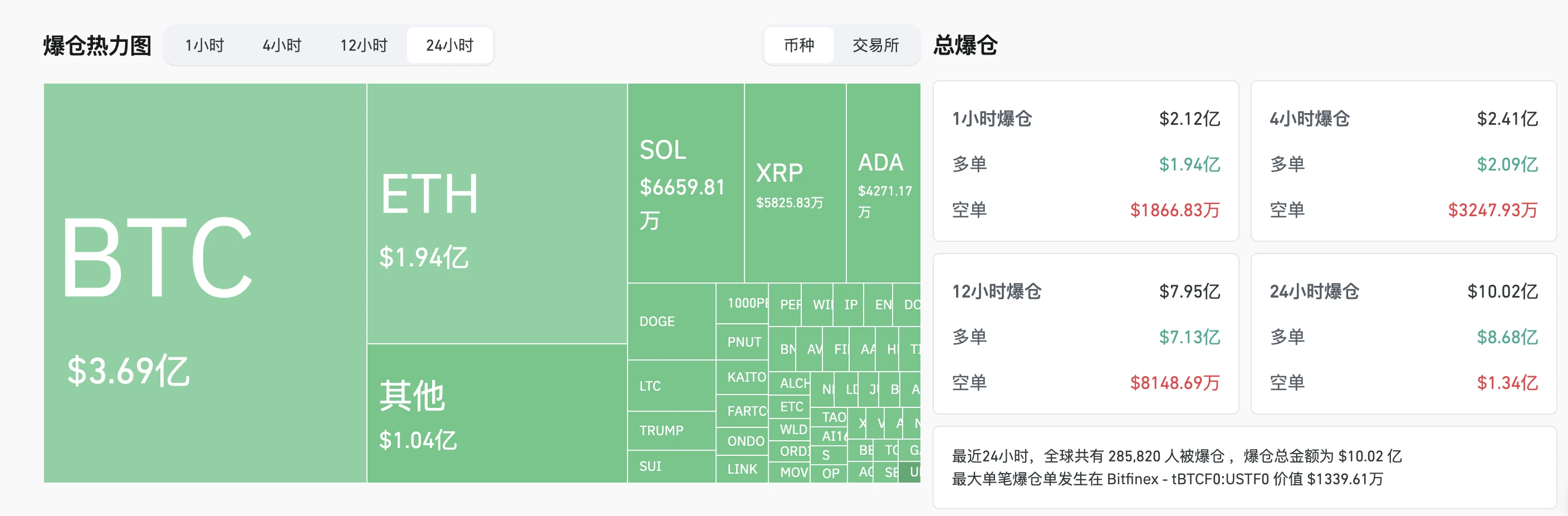

In terms of derivatives data, Coinglass reports that over the past 24 hours, the total liquidation across the network reached 1 billion USD, with the vast majority being long liquidations, amounting to 868 million USD. In terms of specific coins, BTC saw liquidations of 369 million USD, and ETH saw liquidations of 194 million USD.

Analysis of the Plunge

Regarding the reasons for the plunge, there are various opinions in the market, but they can generally be categorized into three types.

"Difficulty in Implementing Strategic Reserves" Theory

Currently, many institutions and big players attribute the plunge to the "difficulty in implementing cryptocurrency strategic reserves," with some even warning of the potential for further short-term declines during yesterday's surge.

Arthur Hayes, a recent "bearish commentator," remarked yesterday on the "cryptocurrency strategic reserve," stating: "There’s nothing new here, just empty talk. Let’s talk again when the crypto working group gets congressional approval to borrow money or re-evaluate gold prices. Without these, they have no money to buy Bitcoin and altcoins."

Andrew Tu, sales director at market maker Efficient Frontier, also stated that the details of the cryptocurrency strategic reserve plan remain unknown, including how much the U.S. government will actually purchase and how the funding for these purchases will be provided.

Nansen's chief research analyst, Aurelie Barthere, also warned yesterday that the lengthy approval process required to establish a U.S. cryptocurrency reserve may mean that this surge is only temporary.

"Tariff Policy" Theory

In addition to discussions related to "strategic reserves," some professionals attribute the decline to Trump's tariff policy.

Yesterday, Trump announced a 25% tariff on goods from Mexico and Canada, raising concerns about a North American trade war, which led to turmoil in the financial markets and subsequently affected the cryptocurrency market.

It is worth mentioning that last night, the White House had previously hinted that "Trump would make a statement regarding investments," which caused a stir in the crypto market, but ultimately the result was Trump announcing "tariffs on imported agricultural products starting April 2"… This disappointment somewhat dampened market sentiment.

"Correlation with U.S. Stocks" Theory

As the mainstreaming of cryptocurrencies progresses, the correlation between the market and U.S. stocks has become increasingly strong. Yesterday, the Dow Jones fell by 1.48%, the Nasdaq dropped by 2.64%, and the S&P 500 index declined by 1.76%; among tech giants, Nvidia plummeted by 8.69%, Amazon fell over 3%, and Tesla, Google, and Microsoft all dropped over 2%. In such a context, BTC is hard to escape the downturn.

Andrew Tu mentioned earlier that if the stock market also declines, it could lead to a further drop in cryptocurrency prices.

Bitfinex's latest report also stated that broader macro conditions (including the performance of the S&P 500 index) will severely impact Bitcoin's trajectory in the coming weeks, and the market remains fragile; without new institutional capital inflows, sustained bullish momentum may be difficult to achieve.

How Will the Market Develop?

To be honest, in this volatile market where technical analysis is overshadowed by a single person's call, the difficulty of predicting future trends is rising sharply, and the persuasive power of various theories seems weak.

Some recent predictions have been quite accurate, such as Arthur Hayes, who has been bearish since 70,000 and maintained his bearish stance during yesterday's brief frenzy. This morning, he published a lengthy prediction about the future market (the full content will be translated and released later), with the core content as follows:

I firmly believe we are still in a bull market cycle, so the worst bottom will be the historical high of the previous cycle at 70,000 USD. I am not sure if we will drop that low. A positive signal for dollar liquidity is that the U.S. Treasury's general account is declining, which acts as a liquidity injection.

If this rally is just a "dead cat bounce," I expect Bitcoin to fall back to around 80,000 USD, giving us another entry opportunity. If the S&P 500 index or Nasdaq 100 index drops 20% to 30% from their historical highs, coupled with a major financial institution on the brink of bankruptcy, we may experience a synchronized adjustment in global markets. At that time, all risk assets will be sold off together, and Bitcoin may again fall below 80,000 USD, or even retrace to 70,000 USD.

Regardless of how the market changes, we will cautiously buy on dips, avoid leverage, and patiently wait for the final violent fluctuations in the fiat financial market. Once the global economy, led by the U.S., begins to recover, Bitcoin is expected to break through 1 million USD or even higher.

However, given the current situation, believing in any predictive theory seems less effective than closely following that "insider whale" who went from "50x long" to "suddenly shorting" (address: 0xe4d31c2541A9cE596419879B1A46Ffc7cD202c62). This whale has accurately "predicted" the market's violent fluctuations in different directions with extremely high leverage over the past two days; it's hard to believe there isn't more to the story behind this.

The market is becoming increasingly difficult; please operate cautiously, keep your bullets, and restrain leverage, as staying at the table is the only way to have a chance to laugh last.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。