From Cross-Border Payment Innovation to the Transformation of Capital Narrative.

Author: YettaS

Yesterday, the President's statement once again propelled $XRP, briefly surpassing $ETH to become the second in FDV. Although it has long been well-known, few people understand what it actually does. Is Ripple a massive scam? If not, why do we hardly see its real users in our daily lives? What is the actual scale of Ripple's business, and is it sufficient to support its current value? If not, what does it rely on?

This article will help you dissect Ripple's business logic, confront its challenges and controversies, from its cross-border payment innovations to the core role of XRP as a bridge, aiding us in deeply understanding how to turn "populism" into a feast of capital and technology in this industry.

What Kind of Business is Ripple?

Ripple is in the cross-border payment business. The traditional cross-border payment process is divided into information flow and capital flow. On the information flow level, SWIFT standardizes the requirements of various remittance countries; on the capital flow level, the initiating bank and the receiving bank complete the clearing and settlement. If there is no direct relationship between the two, funds need to be transferred through corresponding banks or central banks, and most fund transfers require multiple intermediary banks. This leads to issues such as: 1. Long processing times, 2. High costs, 3. Low transparency.

Crypto is very suitable for solving the transfer and settlement of funds.

Let’s first discuss the solution under stablecoins: local OTC/payment companies receive foreign exchange, which they convert into USD at banks. The USD then needs to be exchanged for USDT through an OTC like Cumberland, and the transfer is completed on-chain with USDT. At the receiving end, there must be another OTC conversion from USDT to USD, followed by a bank exchange into the local currency. In this solution, the transfer and settlement of USDT become very simple, but the difficulty and moat lie in the entire OTC network. If using USDC, the process is a bit more convenient, as it can be done directly at compliant venues with Circle for deposits and withdrawals.

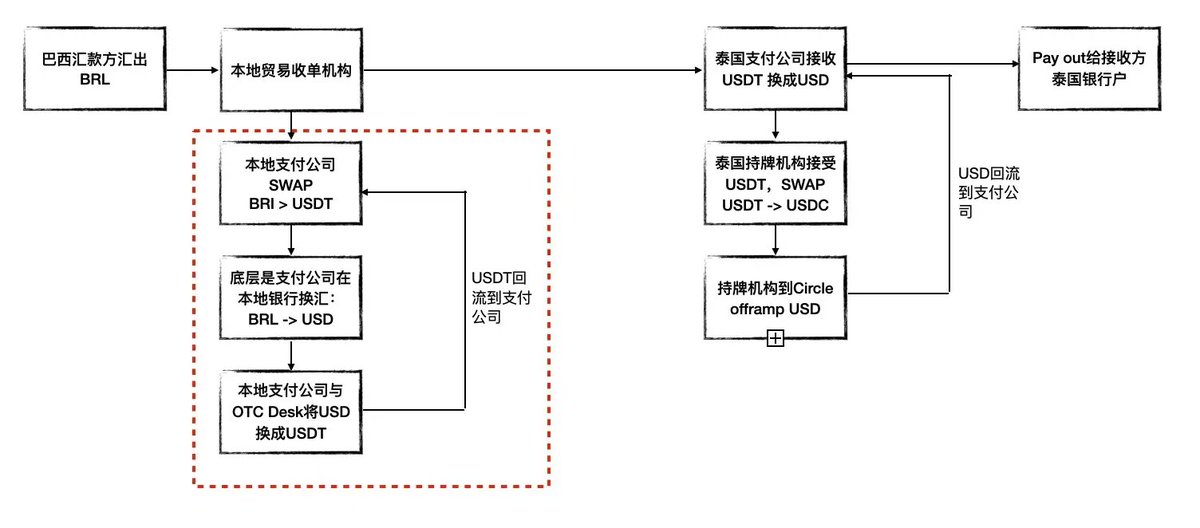

The following diagram illustrates the process with one end as USDT and the other as USDC. In fact, the red box in the diagram is the key to the entire stablecoin cross-border payment, which is that there are always OTCs available to provide USDT deposits and withdrawals. The amount of funds they occupy is not small, making this the "most costly" part of cross-border payments, and thus the area where Tether has the strongest moat. This is precisely what I mentioned in "Consensus in the Crevice: Tether and the New Global Financial Order": various channels and exchange platforms have become Tether's workers helping it expand its network globally.

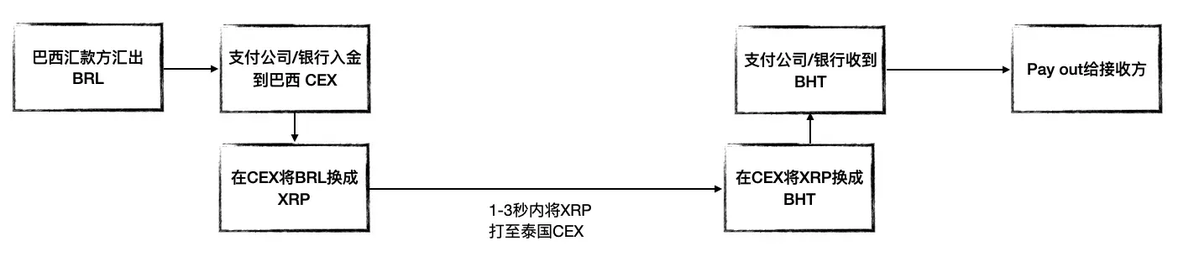

Ripple actually offers a simpler solution than stablecoins. Its process involves converting foreign currency into XRP through local banks or payment institutions, sending XRP to the receiving country's CEX, and then converting XRP into the local currency. The following diagram uses Brazil to Thailand as an example, with the currency chain being BRL -> XRP -> BHT. In other words, Ripple uses XRP as a bridge currency to recreate a foreign exchange market.

Ripple provides a very clever and efficient cross-border payment solution. In traditional SWIFT or stablecoin cross-border payment scenarios, the occupation of funds has always been a pain point. Each time a currency exchange occurs, banks or OTCs typically need to pre-fund their accounts with sufficient funds to ensure the smooth completion of the entire payment process. For example, in the stablecoin scenario, banks need to have enough USD for currency exchange, and OTCs need to pre-stock USDT. This pre-funding is not only cumbersome but also significantly reduces the efficiency of fund usage. However, Ripple's advantage lies in its clever use of the liquidity mechanism of CEXs, avoiding the pain point of cash pre-positioning. By directly exchanging assets on CEXs, this is what it proposes as On-Demand Liquidity.

What is the Key to Recreating this Foreign Exchange Market?

Ripple is not just running an ordinary business; it is more like promoting a completely new model of cross-border remittance. From a compliance perspective, the policy environment and transaction models that can be adopted vary across different regions, and Ripple, through its own efforts, attempts to single-handedly drive this new market transformation.

There are two key elements in Ripple's development path:

Bank BD: Getting banks to be willing to use XRP for cross-border payment solutions.

CEX Market Depth: Ensuring that XRP trading markets in various regions have sufficient liquidity to support global currency exchange.

To this end, Ripple has been quite active.

First, regarding the first point. Before 2017, Ripple did not directly engage in many currency-related businesses. Its initial goal was to replace SWIFT, leveraging its advantages in the information layer to collaborate with numerous banks and promote market education. Through this approach, Ripple gradually made major banks in various regions its strategic partners. For instance, in September 2016, SBI (Strategic Business Innovator) acquired 10.5% of Ripple for $55 million. In the same year, Ripple also received investment from SCB (Siam Commercial Bank). By 2017, Cuallix became the first financial institution to attempt to promote XRP as a bridge currency, and with the pandemic, the business using XRP as a bridge currency began to expand significantly.

This also explains why it is hard to find real use cases for Ripple, as Ripple's cross-border payment solutions are not directly exposed to ordinary users or merchants. It mainly operates through bank channels, and merchants or remittance recipients do not need to know the pathways used by banks for remittances. In fact, as long as banks are willing to allocate a small portion of their business to Ripple, it is enough to support the entire business model.

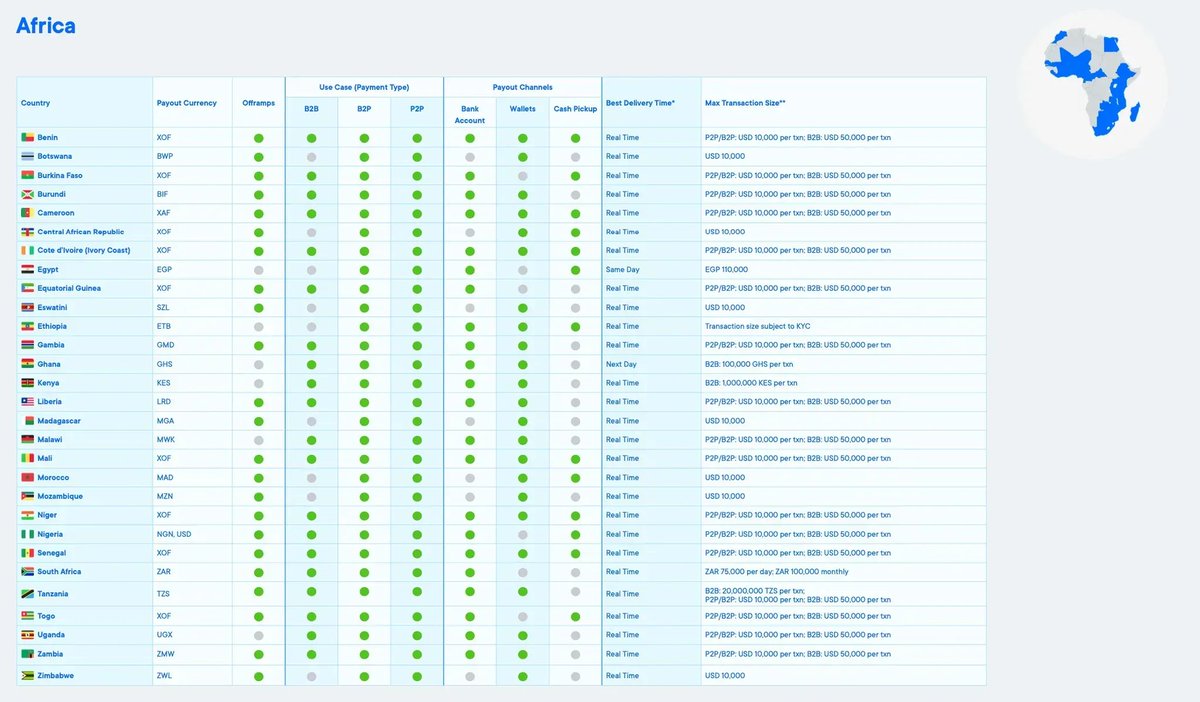

Now, regarding the second point. Ripple must establish a global CEX network to ensure the trading depth of XRP, allowing for 24/7 trading, minimal slippage, and smooth deposits and withdrawals. On this front, Ripple has also put in considerable effort. For example, in 2019, Ripple invested in Mexico's first CEX, Bitso, and gradually expanded its market influence to Brazil and Argentina. At the same time, the mainstream exchange in the Philippines, Coins.ph, became an authorized partner of Ripple, becoming its preferred CEX for XRP payments, further enhancing Ripple's market penetration.

Ripple is actually a highly BD-driven business. A quick look at LinkedIn reveals that Ripple has a large number of BD and marketing teams, all with high-end backgrounds in consulting and investment banking, which is not something an average person can sustain.

How is Ripple Performing in This Business?

In 2023, the global cross-border payment volume is approximately 190 trillion. In comparison, Ripple's cross-border transaction volume to date is about 35 million transactions, with a transaction value of around $70 billion, which is minuscule compared to the global cross-border payment volume.

I interviewed a local OTC trader in Latin America, and their annual cross-border transaction volume is about $1 to $1.5 billion, and this is just one ordinary OTC desk. In this light, Ripple's transaction scale is also insignificant compared to the market influence of stablecoin payments.

According to industry norms, cross-border payment fees typically range from 1% to 2%. Based on this, if Ripple were to rely solely on cross-border payment business income for profitability, it would clearly be a drop in the bucket.

Moreover, in the early days, Ripple had to provide substantial subsidies to encourage banks and payment companies to use its solutions. For instance, in one quarter of 2020, Ripple paid $15 million in subsidies to the former second-largest remittance company, MoneyGram, incentivizing them to use the Ripple network.

What’s Next for Ripple—Expanding Custody and Stablecoins

Unlike Tether, which directly leverages the global liquidity of the dollar to promote the expansion of dollar hegemony, Ripple's ecosystem entirely relies on building its own network and forming alliances to maintain its operations, making the bottleneck of this payment business quite evident. Therefore, Ripple must consider how to break through this bottleneck. Leveraging its advantages with enterprise clients, Ripple has chosen three business lines for expansion—Payment, Custody, and Stablecoin.

In May 2023, Ripple acquired the Swiss custody provider Metaco for $250 million.

In June 2024, Ripple acquired Standard Custody, which holds nearly 40 currency payment-related licenses in the U.S., a Major Payment Institution license (MPI) from the Monetary Authority of Singapore (MAS), and a VASP (Virtual Asset Service Provider) registration from the Central Bank of Ireland. Its CEO, Jack McDonald, also serves as Ripple's Senior Vice President of Stablecoins, effectively paving the way for Ripple to issue stablecoins.

In December 2024, Ripple officially launched the RLUSD stablecoin and received approval from the New York Department of Financial Services (NYDFS).

At this point, Ripple can be viewed as a normal Fintech company, with its three business lines clearly delineated.

How Crypto Has Helped Ripple

If the business itself does not generate much profit, then how does Ripple make money? The answer is simple: selling tokens.

Ripple's long-standing lawsuit with the SEC arose from its token sales. The SEC accused Ripple of selling over $1.3 billion in XRP to 1,278 institutions to finance the company. The SEC contends that XRP is an unregistered security, which violates federal securities laws, and has sought up to $2 billion in penalties from Ripple. Ultimately, in August 2023, the court ruled that Ripple only needed to pay approximately $125 million, but the judge also noted that its "On-Demand Liquidity" service might be overstepping.

Why is Ripple able to sell such a large amount of tokens?

As mentioned earlier, On-Demand Liquidity (ODL) is the core of Ripple's cross-border payment solution. As long as the liquidity of XRP is ensured, parties do not need to pre-fund, and they can achieve currency exchange through XRP. Based on this, ODL provides Ripple with continuous liquidity support for monetization, as Ripple itself is the largest holder of XRP. Moreover, as a bridge currency for cross-border payments, XRP should clearly be defined as a currency rather than a security.

On-Demand Liquidity is actually a clever three-in-one solution for Ripple's business.

Ripple tightly binds business demand with the circulation of XRP. The liquidity of XRP in business scenarios not only provides a foundation for Ripple's narrative but also makes its operations in the capital market more adept.

An Experiment in High-End Financial Populism

Ripple's business model has gradually shifted from product-driven to capital operations, evolving into a "market consensus-driven" profit model. This is why we jokingly refer to Ripple as a blue-chip meme, only fluctuating with favorable policy news.

In my view, Ripple's business logic is a sophisticated "financial populism experiment." By packaging the pain points of cross-border payments, it attracts participation from mainstream financial institutions while leveraging the cognitive biases of crypto retail to amplify the strategic significance of its business. This has allowed Ripple's commercial operations to diverge from the simple "business-driven profit" path of traditional Fintech companies, entering a high-risk, high-reward domain that relies more on "market narratives" and "capital logic."

We cannot know the original intentions of the project team—whether they aimed to use capital operations to obtain initial funding to drive industry progress or to leverage a product of certain value to play a game of capital arbitrage. However, it is undeniable that Ripple has a remarkable grasp of financial populism.

In financial markets, value creation and value perception are often not entirely aligned, especially in the highly speculative environment of crypto, where "market consensus" itself can constitute a business model. Ripple is a typical case of this model. It does not rely entirely on product growth to drive revenue like traditional Fintech, nor does it depend solely on liquidity bubbles like pure crypto speculation projects. Instead, it skillfully navigates between compliant financial systems, using institutional endorsements to build credibility while leveraging policies and market sentiment to amplify its narrative.

Is Ripple truly creating value, or is it manufacturing belief? The core of high-end financial populism often lies in this ambiguous boundary.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。