Author: Jaleel Jia Liu, BlockBeats

Time rewinds to January 17, just two days before the new pro-cryptocurrency president of the United States takes office.

On this day, Trump unexpectedly announced the launch of a cryptocurrency MEME coin named $TRUMP on his social platform Truth Social, without any prior warning.

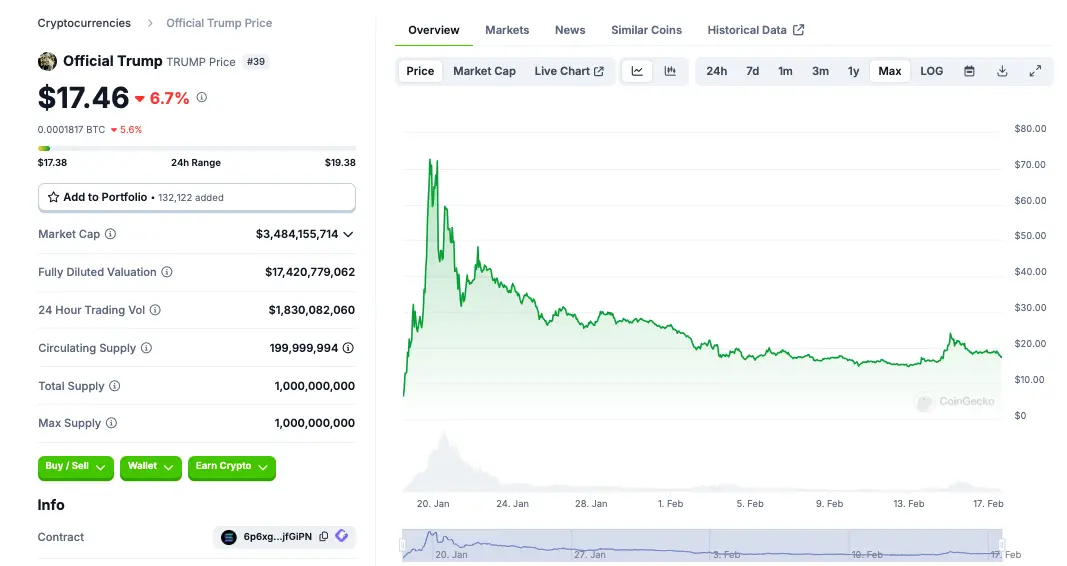

In a matter of seconds, $TRUMP ignited the start of the 2025 cryptocurrency market, becoming the most powerful celebrity coin in history. Within 24 hours of its launch, it was given the green light and quickly listed on top trading platforms like Coinbase and Binance, with a 24-hour trading volume exceeding $10 billion, more than three times that of Bitcoin.

Aside from conspiracy groups, the 24-hour online trading pioneers in the cryptocurrency space were the first to profit from $TRUMP. Even amidst various suspicions that "Trump's official account must have been hacked," a group represented by 0xsun quickly acted on their years of accumulated on-chain data monitoring capabilities to buy in early. Around the 10th minute after $TRUMP was issued, 0xSun began purchasing, acquiring $600,000 worth within half an hour at an average cost of only $0.6, netting over $27.5 million in profit, achieving legendary status in one battle.

However, the problem is that the MEME coin market is a typical zero-sum market, lacking the support of technological innovation, fundamentals, or any value creation, with only the timing of entry distinguishing early from late buyers. Therefore, not everyone can be as lucky as 0xsun. As the hype faded and the issuance of Trump's wife coin indirectly increased the supply of $TRUMP, the price of $TRUMP fell from a high of $72 to around $17.

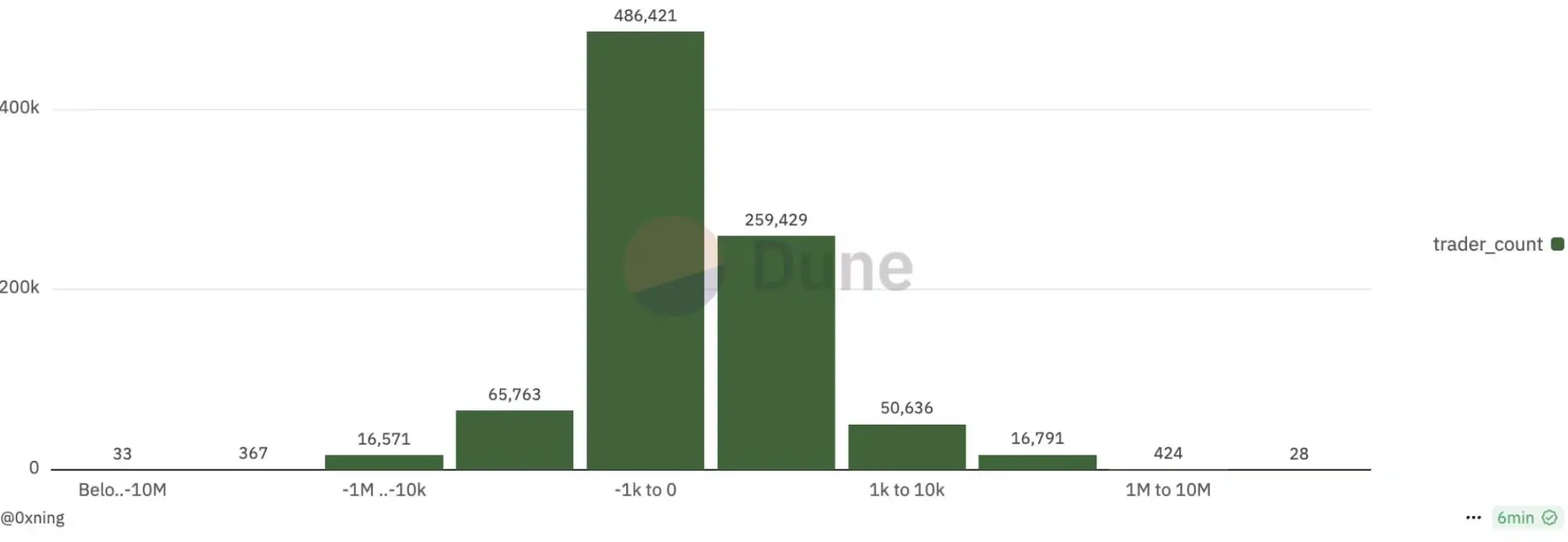

According to early statistics, the data on profitable addresses showed a clear normal distribution, with 560,000 addresses in the red and only 300,000 realizing profits.

Data Source: Dune

PHD Student KOHA Also Can't Escape Being Stuck

The market is not always friendly to everyone. KOHA is one of the 560,000 people who are stuck.

KOHA is a Canadian PhD student in a STEM field who occasionally invests in U.S. stocks. In 2024, he made a small profit by betting on Trump's election and buying shares of Trump's company, DJT, in advance. This success gave him confidence in Trump's business model, leading him to mistakenly believe that $TRUMP would have long-term value like DJT stock.

However, the pace of the cryptocurrency market is much faster than that of U.S. stocks.

When $TRUMP was issued, it was Saturday morning in Beijing time, but it was late Friday night in the U.S. and Canada. Like many locals who were resting, KOHA did not pay attention to this event immediately. By the time he learned about the issuance of $TRUMP, it was already the next day for KOHA.

Due to Trump's frequent unfriendly policy adjustments towards the study abroad community and the close relationship between Canada and the U.S., lucky KOHA found himself in an environment that closely monitored Trump's actions. The next day, when KOHA learned about Trump's coin issuance in a study group, $TRUMP had already risen from its initial price to $28.

He immediately took action, trying to buy $TRUMP through the Moonshot platform, but due to identity verification, uploading his driver's license, and learning how to purchase, he lost some time. By the time he successfully bought in, the price had already risen to $30. Nevertheless, he hardly hesitated and decided to enter the market.

"This four-year term has just begun, and Trump is very centralized in this regime. The U.S. president can only serve two terms, so everyone agrees that the second term is for making money and doing business. The whole world wants to do business with him, and $TRUMP is a pathway and threshold for anyone who wants to do business with him," KOHA's logic is simple.

In KOHA's view, the more people who want to establish a connection with Trump through this pathway, the higher the price of Trump coin will be. "This market is clearly much easier to manipulate than DJT, and there's no need to report to the SEC for sales. The total supply is 1 billion, with only 200 million in circulation, while 80% of the tokens are still held in my hands. I immediately sold all my DJT and bought $TRUMP coins."

KOHA is not the only investor who believes that Trump's business model can be replicated in the cryptocurrency market. In fact, many believe that Trump's issuance of $TRUMP is part of his financial strategy.

"Trump cannot integrate into this system, nor can he merge with it. His falling out with his daughter Ivanka is actually a reflection of the two factions in financial ideology and the falling out between capital, even bloodlines cannot merge." KOHA analyzed, in his view, the traditional financial market is controlled by Wall Street and the Jewish capital of the Democratic Party, and Trump has always been unable to integrate into this system. His only way out is to take a different path, leveraging the decentralized nature of virtual currency to establish his own financial order.

KOHA's understanding of the cryptocurrency industry is "the unexpected beneficiaries of the falling out between two capitals." And Trump has indeed shown a friendly attitude in policy: relaxing cryptocurrency regulations to provide a freer trading environment; Bitcoin breaking $75,000, leading to a bull market frenzy in the entire cryptocurrency market; Republican lawmakers pushing for the establishment of a Bitcoin strategic reserve, further boosting market confidence. All these factors gave KOHA a grand investment narrative, leading him to believe that $TRUMP is a long-term asset.

When KOHA discovered that $TRUMP was continuously rising, he increased his position again at $40, but by the following Monday, $TRUMP had transitioned from the FOMO (fear of missing out) phase to the profit-taking phase. Market liquidity decreased, buy orders diminished, and the coins in KOHA's hands gradually turned into trapped liquidity, with an average price of $36.

This Round of Cycles is a Clear Gamble

Like KOHA, Li Yi is also stuck.

However, unlike KOHA, who has no experience in the cryptocurrency market and doesn't even know the major trading platforms, Li Yi has been navigating this market for some time. Compared to newcomers who are unfamiliar with trading platforms, Li Yi at least knows where to trade and understands that the logic of the cryptocurrency market is not important; emotion is the only determining factor. Li Yi mingles in various cryptocurrency trading groups, constantly monitoring market dynamics and closely following some traders who call themselves "crypto veterans."

He indeed made some money.

In the early market of $TRUMP, he completed a buy at the low of $17 with the operation of "if you lack insight, you must follow," and successfully sold after the price skyrocketed, making a profit. However, after making money, he became somewhat overconfident.

After making a profit, Li Yi did not choose to exit but began searching for "the next $TRUMP."

Sure enough, the Trump family did not disappoint Li Yi. Two days after the issuance of Trump coin, the Trump wife coin Melania coin ($MELANIA) was issued. Meanwhile, the concept of "family coins" began to gain popularity in cryptocurrency trading groups.

Although it did not receive official support, the name of Trump's youngest son Barron was used by the community under the banner of "Trump family," boasting of being "the future president's coin" against the backdrop of the soaring price of $TRUMP. There were even rumors that Trump's family nanny had issued a coin, quickly attracting a batch of funds into the market. And Li Yi was one of them.

He naively believed that the logic of these coins was the same as that of $TRUMP and that they could surge like $TRUMP. Thus, he invested most of his profits into the wife coin and son coin.

But the market did not give him a second chance.

The other family coins quickly went to zero, and Li Yi's principal was trapped, with profits evaporating instantly. Currently, he is inquiring about how to buy World Liberty Financial (WLFI, a decentralized financial project of the Trump family), trying to recover his losses through a new speculative project. "I'll take another gamble; WLFI might continue the legitimacy of Trump coin," Li Yi said.

In this round of cycles, the biggest change is that everyone has laid their cards on the table.

No more packaging is needed, no more pretending to be a project with technological innovation, and no need to spend $5,000 to hire someone to write a fancy English white paper, piling up a bunch of obscure new concepts.

The gameplay of this bull market is simple and crude—directly trading on emotions, celebrities, topics, and cognitive differences. Utilizing FOMO emotions, a series of new altcoins are created, harvesting the fantasies of new investors.

In the past, new chain project factories would put in some effort to disguise themselves as seemingly innovative projects. Looking back at the early launches of new chains like BSC, Aptos, and Arbitrum, the market experienced the same scene—a swarm of anonymous "innovation project factories" rushed in, utilizing the new chain effect to harvest TVL and users. Once the market heat faded, they would directly shut down communities and websites, disappearing with the funds.

Behind these projects are often a group of familiar faces, just changing their vests and modifying a few codes to become new popular coins. They started as the first batch of popular projects on a new public chain, anonymous and mysterious, with no well-known investors backing them and no major companies auditing them, yet they were always praised by KOLs, creating waves of wealth myths through the FOMO emotions of the community.

But now, the market seems to have reached another consensus: this is a new gambling game, a wealth transfer game.

No one talks about "technological revolution" anymore, no one talks about "changing the world," and everyone tacitly understands—if you lose this round, just wait for the next gambling game. If you're willing to gamble and accept the loss, come on in; the cryptocurrency space is meant for this. It is said that even the guys in the nightclubs of Hangzhou know to short altcoins now.

And Li Yi is just another participant in this wealth transfer game.

Those Who Short Are the Winners?

Among the newcomers to the cryptocurrency space who entered through Trump coin, only Professor L walked away with profits.

In the storm of $TRUMP coin, most people were betting on the rise, desperately pushing the price up, only to get stuck at the highs. However, some chose the opposite direction—shorting—and successfully profited against the market frenzy.

Professor L, a finance professor and also a seasoned futures trader. He has long studied market structures and knows that the price volatility of cryptocurrencies is far more severe than that of traditional financial markets. As a MEME coin, $TRUMP has no fundamental support and relies entirely on market sentiment, which means it is likely to skyrocket in the short term before plummeting.

But his trading strategy is not simply betting on a market downturn; it is a fundamental "hedging" strategy in futures trading:

He used $50,000 to buy spot to ensure he wouldn't miss out on the profits from a rise. At the same time, he shorted $TRUMP contracts with $10,000 at 5x leverage as a risk hedge. If $TRUMP continues to rise, his spot gains can cover the losses from the contracts. If $TRUMP plummets, his short position can offset the losses and even yield excess returns.

Professor L does not agree with many retail investors' gambling-style leveraged trading, stating, "The essence of contracts is to diversify risk, not to amplify returns." However, most people do not understand this principle.

At the same time, Professor L strongly agrees with Peter Lynch's view: "Large funds that short do not sell short at the peak; instead, they wait until the market has halved and retail investors say the decline has stopped and start bottom-fishing. Shorting funds prefer to do so at such positions." This is precisely why Professor L chose not to rush to close his short position during the rapid decline after the surge of $TRUMP.

In cryptocurrency trading groups, there are always people boasting about their high-leverage achievements: "I opened a 50x leverage short today and made $2,000!" "I got liquidated on my long position yesterday, but my short position made it back today!" But the reality is that this strategy is ultimately gambling.

Professor L's success stands in stark contrast to those retail investors who blindly open high leverage and gamble on fate. The market's extreme volatility, combined with high leverage, can lead to an account being wiped out in an instant with just one reverse trend. Many retail investors, at the peak of $TRUMP, frantically opened long positions, fantasizing about the price continuing to soar, only to be caught off guard by the market and face liquidation.

Ultimately, when the price of $TRUMP retreated from its peak, Professor L's hedging strategy allowed him to profit steadily. Unlike 0xSun, who reaped rewards through speed, or Li Yi, who was trapped by FOMO emotions, he survived the extreme conditions of the cryptocurrency market and made stable profits through rational risk management.

How Many Pits Must Newcomers to the Cryptocurrency Market Step In?

In this wave of Trump coin frenzy, it wasn't just inexperienced novices entering the market; there were also many seasoned players from traditional investment markets. They had previously navigated the A-shares, commodity futures, and even tea speculation markets, witnessing various capital games.

Professor L is fortunate, but not all veterans can replicate their past successes in the cryptocurrency market based on their previous experiences. In other words, they must step into many pits before they officially start trading.

"A-shares have short bull and long bear markets; trading small and poor stocks is the way to survive." This is the consensus among many domestic stock investors, including "Su Bing Ge." For a long time, the speculative style of A-shares has accustomed him to short-term swing trading, picking up low-priced stocks, and gambling on market sentiment.

When Su Bing Ge saw $TRUMP, a coin with a strong speculative concept, he immediately felt a sense of familiarity—"Isn't this just a small-cap stock with high control?" So, he decided to "take a gamble."

Buying over 4,000 RMB worth of $TRUMP at a high of $69, Su Bing Ge tried to calculate the possibility of breaking even. As the coin price continued to fall, during an interview with BlockBeats, the price of $TRUMP was $26 each, which meant that if it rose by 5%, he would need to invest an additional 50,000 RMB to bring down his cost price. But he knew this was just a "retail investor's fantasy."

After being trapped, Su Bing Ge realized that the rules of the cryptocurrency market are far more brutal than those of A-shares: "There are no price limits, capital flows in and out without any rules, and manipulators can wash the market in an instant; there is no regulation, market makers can withdraw liquidity at any time, controlling the market at will; there are no time windows, trading is 24/7, and retail investors have no chance to catch their breath." Su Bing Ge, filled with emotion, felt like he could rant for three days and nights.

Many investors accustomed to short-term strategies in A-shares not only failed to make money in $TRUMP but also lost their principal by attempting to trade in and out repeatedly.

However, the cryptocurrency market is a place that devours people without spitting out bones. After overcoming the discomfort of traditional stock trading and cryptocurrency trading, Su Bing Ge discovered that he had stepped into another pit.

"When I felt hopeless about breaking even and was ready to cut my losses, I found out that I had bought a fake coin." Before the spot trading platform went live, Su Bing Ge followed the operations of the big players in the trading group and used a web3 wallet from a certain trading platform to buy his first $TRUMP.

Since he had never used a web3 wallet before, he had always just watched the quotes in the group. After buying, he didn't check back until he was ready to sell, only to discover that his money had never entered the real market but had been swallowed by a "fake coin contract" deployed by hackers.

And this is still a relatively straightforward way of being scammed in the cryptocurrency market; there are even more pits waiting for "Su Bing Ge."

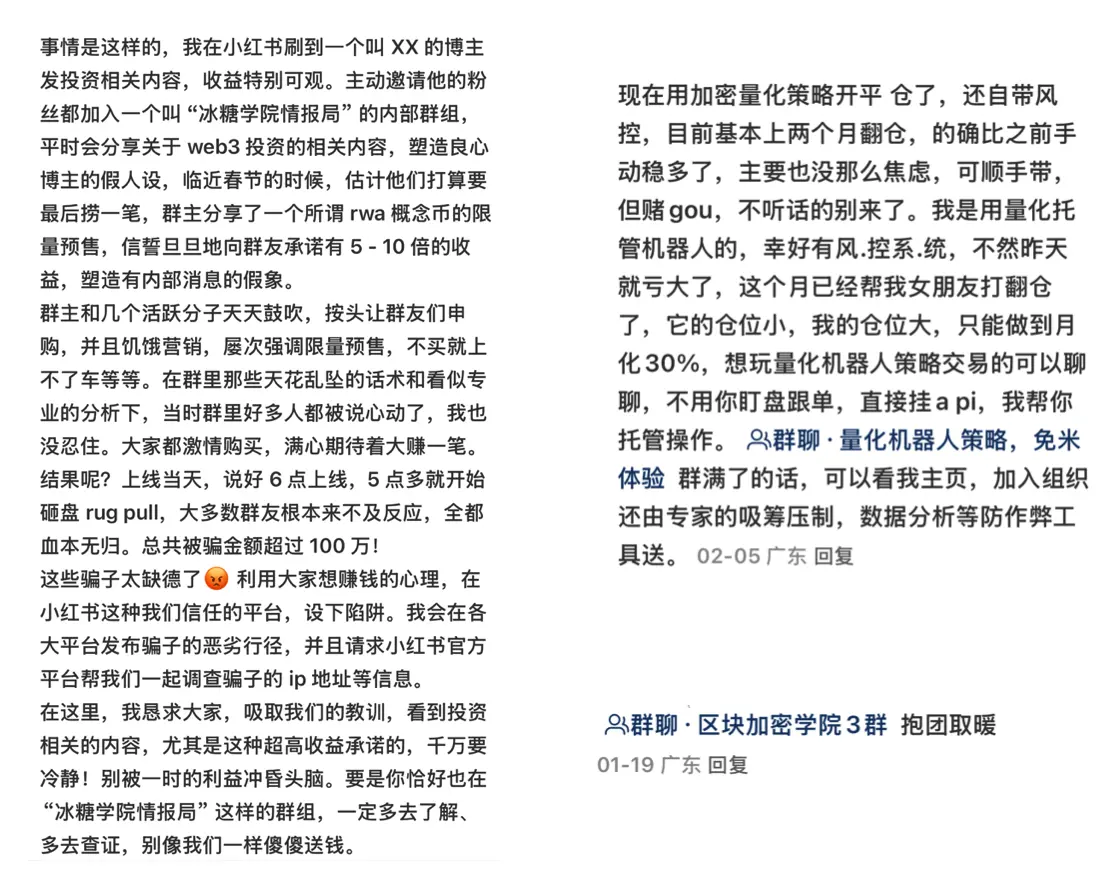

The mixed-quality paid cryptocurrency trading groups are like boiling frogs in warm water. Initially free, they attract users with photos of female influencers, screenshots of making money, or pictures of buying cars and houses. The big players inside enthusiastically teach newcomers how to open trading accounts and how to trade, and at this step, the big players can receive a commission from the trading platform as a tuition fee.

Using retail investors' funds to push orders and brush transaction fees is still acceptable; the most direct method is to lead trades and harvest retail investors. They claim to have "precise insider information," but in reality, these are all pre-designed harvesting schemes. Currently, the most common scams on Xiaohongshu are the so-called "quantitative trading strategies," claiming to achieve a monthly return of 30%.

The cryptocurrency market is a completely different world. The games here are high-frequency confrontations measured in "seconds," where every second missed can mean huge losses. Worse still, many seasoned players, relying on substantial capital, often adopt a "large capital heavy bet" strategy, only to become targets at the "top" of the market. Those who control the market had already prepared before they entered, waiting for these "big fish" to take the bait and quickly absorb their funds.

In this smoke-free PVP showdown, the flow of capital and market control is always in the hands of a few. For those still stuck in traditional market thinking, the rules of the cryptocurrency market often catch them off guard. Because here, risk and opportunity coexist, but more often, it is risk that prevails.

When these seasoned players come to their senses, they find that not only have they failed to earn a substantial fortune in the cryptocurrency market through years of experience, but they have also become typical examples of "being harvested upon entry." The rules of thumb they once relied on have become utterly useless in this brand-new market.

And all of this is the tuition they must pay to enter this industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。