Author: Alvis, Mars Finance

If Bitcoin doesn't have new ecological hotspots now, it will truly be "finished." The survival pressure on miners is nearing its limit, with transaction fees plummeting and costs soaring, many small miners are already considering shutting down. Once miners start to exit, hash power will decline, block generation will slow down, and the network's security will also be threatened. Moreover, in the context of price instability, if there is no new ecological development to drive demand growth, Bitcoin will fall into a vicious cycle.

Shrinking Income: Miners' Profits Under Multiple Pressures

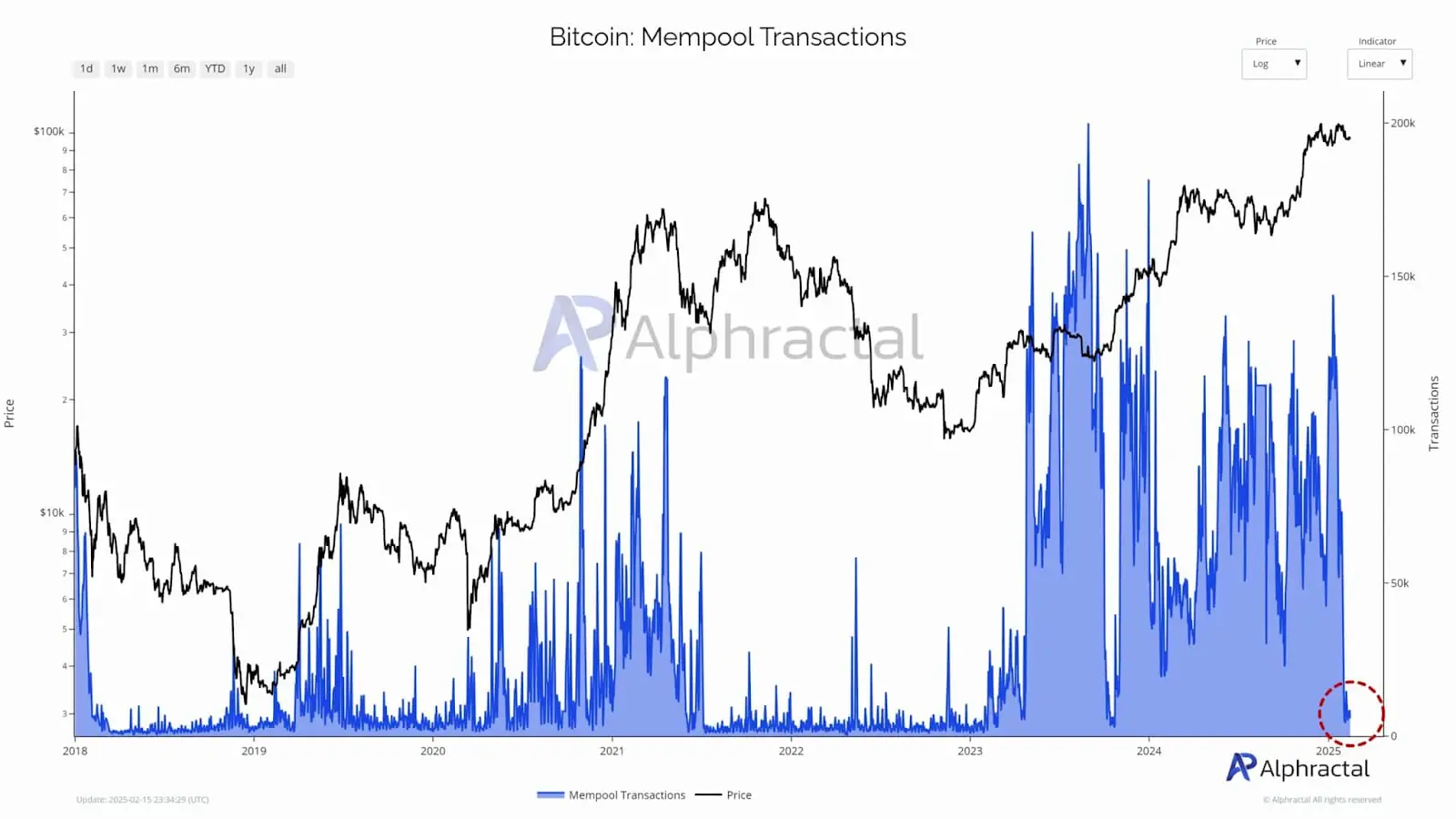

The profitability of Bitcoin mining has significantly deteriorated, with multiple key indicators showing a weakening in profitability. First, the unconfirmed transaction Bitcoin memory pool has dropped to a multi-year low, indicating a decrease in network demand, which directly affects miners' transaction fee income. Historically, a reduction in trading activity usually leads to a bear market, which may not necessarily mean a price drop but could imply structural changes in the network.

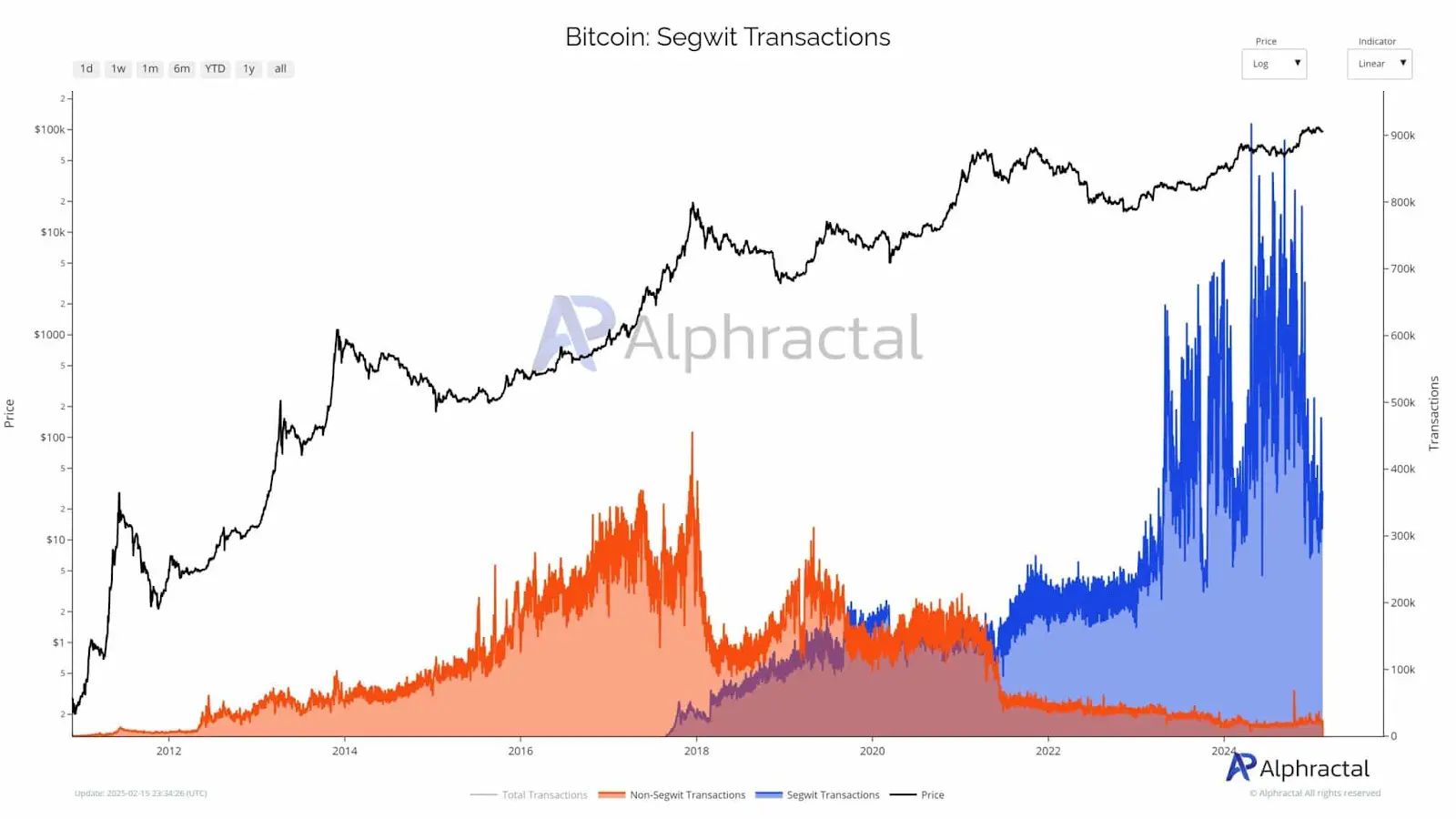

Additionally, the gradual decline of SegWit transaction types has reduced network efficiency, further increasing the demand for block space and compressing miners' income margins. Although Bitcoin prices have risen, the trend of declining earnings highlights the impact of rising network difficulty and intensified competition.

Accelerating Industry Consolidation: Small Miners Face Exit Risks

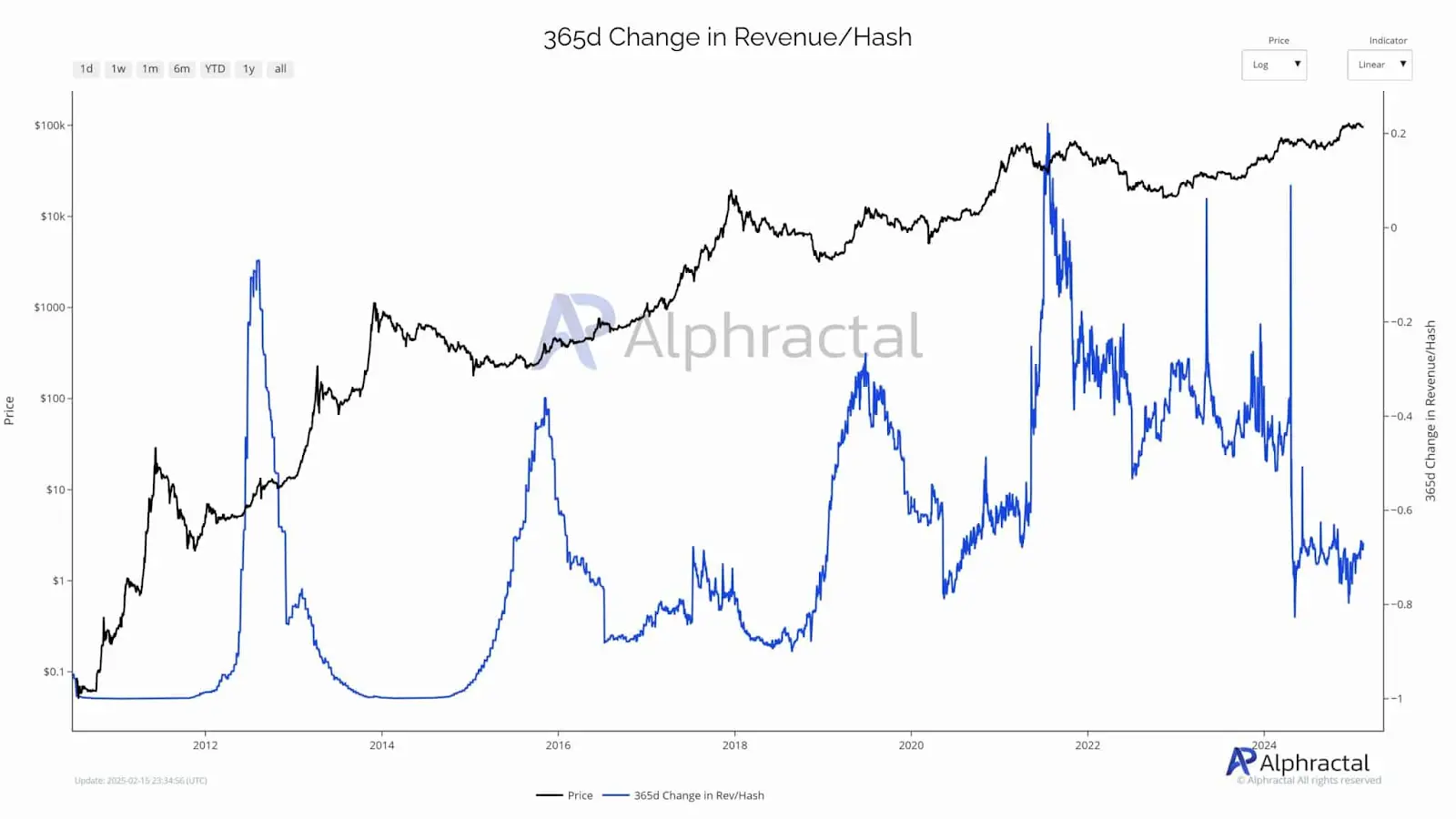

The key indicator of miners' income/hash rate is at a historical low, and the decreasing earnings indicate that rising network difficulty and intensified competition are eroding profitability.

With the halving of block rewards, small miners, in particular, are under survival pressure. The decline in profitability and reduced transaction fee income puts small enterprises at risk of exiting the market, accelerating the pace of industry consolidation. In the future, only large miners with strong capital and advanced technology will be able to maintain competitiveness, leading to increased market concentration.

Increased Network Difficulty: Rising Costs Force Miners to Seek Survival Solutions

The Bitcoin network difficulty has reached a new high, putting greater cost pressure on miners. With rising energy and hardware costs, especially for small miners with outdated equipment, survival pressure has intensified. Some miners are turning to low-cost, sustainable energy sources, such as hydropower or geothermal energy, while others are seeking breakthroughs through diversified income sources or mergers and acquisitions.

This trend may accelerate the centralization of the industry, with the most capital-rich and efficient miners dominating, thereby impacting Bitcoin's decentralized characteristics. In the future, the geographical distribution of miners and mining security models may change, raising concerns about network security.

Market Rebalancing: Higher Industry Thresholds

As operating costs continue to rise, inefficient miners will be eliminated, and the industry will undergo a natural "rebalancing." This change may exacerbate industry centralization, with only large miners able to survive in fierce competition, further solidifying Bitcoin mining as a high-threshold industry.

However, market centralization also raises questions about the decentralized spirit of Bitcoin. The reduction in dominant miners may lead to network security being concentrated in the hands of a few miners, which could affect the long-term stability and censorship resistance of the network.

Impact on Bitcoin

In the short term, Bitcoin miners face dual pressures from declining transaction fees and rising costs, which may lead to small miners exiting the market, resulting in a decrease in network hash power and a tightening of Bitcoin supply. The compression of miners' income may affect market confidence in Bitcoin, leading to increased price volatility in the short term, and the network's decentralized characteristics may be threatened, increasing security risks.

In the long term, with technological innovation and energy cost optimization, miners may regain some profitability and reduce operating costs, which will help alleviate profit pressure and stabilize the market. Although there may be short-term risks of price decline, with sustained demand growth and tightening supply, Bitcoin prices may trend upward in the long term, especially as market demand for Bitcoin steadily increases.

Bitcoin urgently needs a new ecosystem, clearly not just speculative trading of "buying and buying," but more application scenarios, smart contracts, decentralized applications, and even a new financial system to support it.

If Bitcoin does not have a sufficiently strong ecological chain, once miners can no longer maintain profitability, the operation of the entire network will become difficult, and market trust in Bitcoin will wane. The exit of miners may become a "crisis" in Bitcoin's prospects, while the prosperity of ecological construction is the key to Bitcoin's future survival.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。