Analysis indicates that Musk's move is not really aimed at directly acquiring the nonprofit entity of OpenAI, but rather targeting the for-profit assets that Altman must purchase to restructure the company.

Written by: Ye Zhen, Wall Street Insights

Musk's "ridiculously low" offer for OpenAI has brought significant uncertainty to Altman's carefully planned company transformation.

On Monday, the Wall Street Journal reported that a consortium led by Musk made a $97.4 billion acquisition offer to OpenAI, intending to merge OpenAI with its AI company xAI.

In response to this sudden acquisition offer, Altman quickly replied on the social media platform X, stating his rejection and jokingly said, "No thanks, but if you're willing, we can buy Twitter for $9.74 billion." Musk immediately retorted, "Fraud."

The $97.4 billion offer has little chance of success for OpenAI, which may be valued at nearly $100 billion. What exactly is Musk up to?

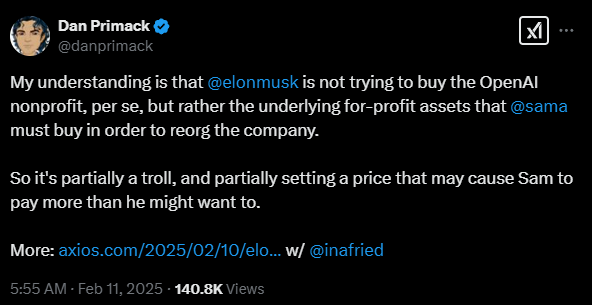

Axios finance editor Dan Primack pointed out on social media that Musk's move is not really about directly acquiring OpenAI's nonprofit entity, but rather targeting the for-profit assets that Altman must purchase to restructure the company.

Primack believes this move is a two-pronged strategy: on one hand, it is a deliberate provocation and disruption; on the other hand, it sets a price benchmark that may force Altman to pay a higher price than expected to complete OpenAI's transformation.

A Roadblock on OpenAI's Transformation Path?

To understand the cleverness of Musk's move, one must first grasp the complex transformation that OpenAI is undergoing.

In 2015, Altman, Musk, and others co-founded OpenAI, which was initially a nonprofit organization. In 2019, after Musk left the company and Altman became CEO, OpenAI established a for-profit subsidiary to raise funds from investors like Microsoft.

Now, Altman is planning to transform this subsidiary into a traditional for-profit company and spin off the original nonprofit entity. According to OpenAI's plan, its nonprofit department will continue to focus on health, education, and scientific charitable work, while the for-profit department will transition into a Delaware Public Benefit Corporation (PBC), pursuing commercial profits. After the restructuring, the nonprofit department will hold shares in the newly established public benefit company (PBC).

Previous reports indicated that OpenAI was discussing a valuation of $30 billion for its nonprofit department.

On January 7, Musk's lawyer Marc Toberoff sent a letter to the attorneys general of California (where OpenAI's headquarters is located) and Delaware (where OpenAI is registered), requesting a public bidding process to determine the fair market value of its charitable organization. Musk and other critics believe that OpenAI may be undervaluing its worth when spinning off the nonprofit entity.

The crux of the issue lies here. Musk's lawyer Marc Toberoff stated that Musk's investment consortium is prepared to match or exceed any higher bids. This means that if Altman insists on fully transforming OpenAI into a for-profit enterprise, the nonprofit entity must receive fair compensation. Musk's offer sets a very high benchmark for this "fair compensation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。