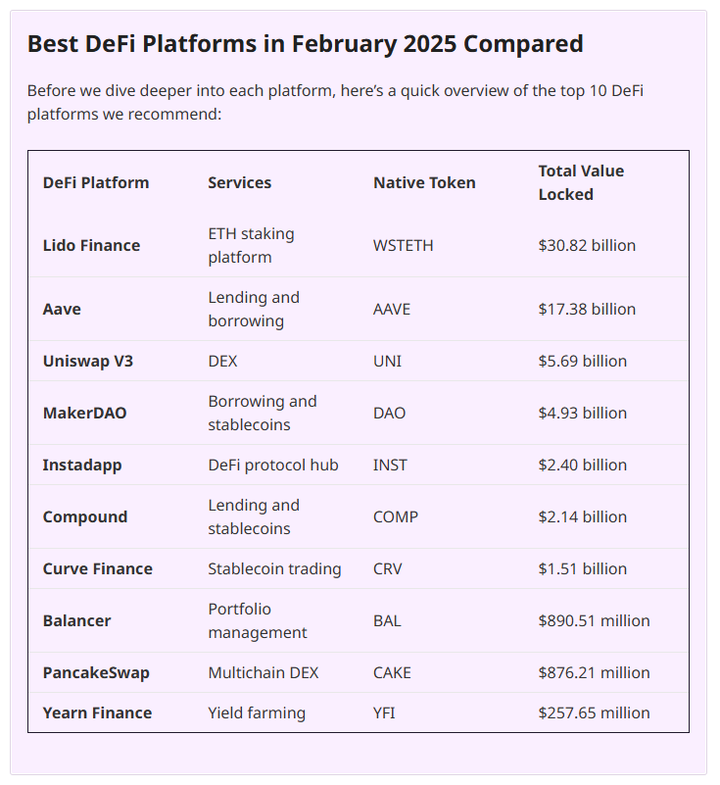

This article introduces several DeFi platforms that are currently experiencing good development momentum, such as Lido, Aave, Uniswap, etc., and discusses their service content, basic principles, and security to help users choose the DeFi platform that best suits their needs.

Author: Alan Draper

Translation: Baihua Blockchain

The financial world has remained relatively stable until the emergence of decentralized finance (DeFi), which has brought significant changes. DeFi has redefined finance through decentralized lending and ownership, and has the potential to change various aspects of daily life.

Today, we will explore leading DeFi platforms such as Aave, Lido, Compound, and Uniswap, analyzing their service content, basic principles of DeFi, security, and how to choose the DeFi platform that best meets your needs.

Best DeFi Platform Review - In-depth Understanding. In this section, we will briefly review each DeFi platform to help you understand their services and advantages. Our goal is to enable you to better assess whether each platform is suitable for you after understanding their characteristics.

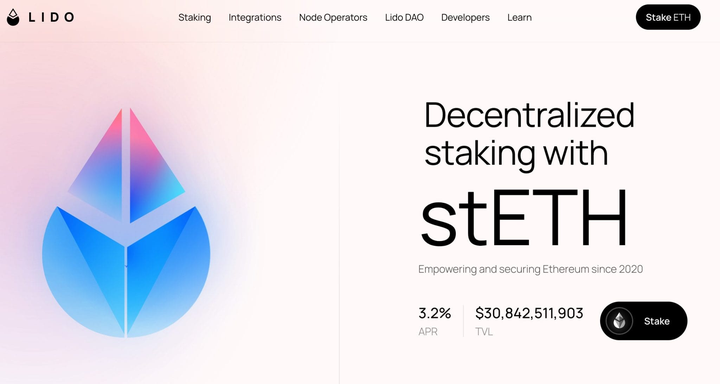

1. Lido Finance – Best DeFi Staking Platform, Connecting Over 100 Applications

Lido Finance is a decentralized finance platform focused on staking, operated by a mission-driven decentralized autonomous organization (DAO), where all decisions are made by LDO (the platform's native token) holders through public voting.

The platform is known for its high security and application of cutting-edge technology. Lido focuses on Ethereum staking, specifically stETH (the Ethereum version launched by Lido), which is used to pay rewards to users who stake ETH. You can unstake any stETH at any time and exchange it for ETH at a 1:1 ratio.

Lido now also allows users to stake MATIC under the same system through stMATIC. Staking ETH or MATIC does not require locking assets, and the entire service is completely non-custodial.

If you wish to hold stETH, please note that Lido connects to over 100 applications, allowing you to use it for lending, as collateral, and more. Recently, Lido has been expanding its service offerings, and in addition to ETH staking, it may include other assets, further enriching its staking ecosystem to attract more users.

DeFi Services: Staking Total Value Locked: $30.82 billion

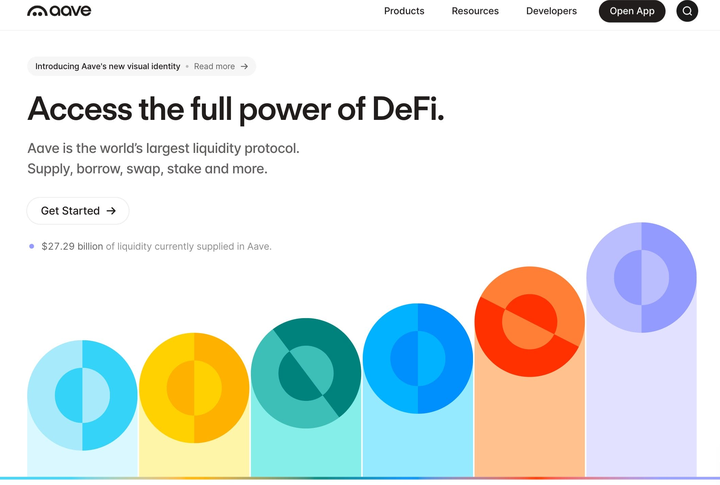

2. Aave – Best DeFi Lending Platform with One of the Longest Operating Records

Aave is one of the leaders in the DeFi space, providing cryptocurrency lending services. It also allows you to earn passive income by staking the AAVE native token (annual interest rate of 4.60%), GHO (annual interest rate of 5.30%), and ABPT (annual interest rate of 11.70%).

In terms of lending services, Aave supports about 30 cryptocurrencies, including ETH, WBTC, wstETH, USDT, USDC, AAVE, DAI, and LINK.

Additionally, Aave is known for its innovation in the DeFi space. Since its launch in 2017, it has achieved significant expansion, becoming one of the longest-operating DeFi platforms. Although Aave's total value locked (TVL) is not the highest, its trading volume is the largest across the DeFi space.

Aave is completely non-custodial, open-source, and governed by the community. Furthermore, borrowers and lenders can determine and execute loan terms through smart contracts. At the end of 2024, Aave launched Aave V3 on the zkSync Era mainnet, enhancing trading efficiency.

If you want to learn more, you can read our Aave usage guide.

DeFi Services: Lending, Staking Total Value Locked: $17.38 billion

3. Uniswap – Largest Decentralized Exchange and Best DeFi Trading Platform

Uniswap is currently the largest decentralized exchange (DEX) in the market and a top trading platform in the DeFi space, with over 1500 trading pairs.

More importantly, Uniswap's powerful DeFi platform offers multiple services, including token swaps, earning yields by providing liquidity, and building dApps using the Uniswap protocol. It also integrates with over 300 applications (such as wallets, dApps, and aggregators).

Although Uniswap may not be the largest DeFi platform overall, it is unparalleled in the decentralized exchange (DEX) space. Users can trade on a completely transparent, decentralized platform without any intermediaries, completing transactions through smart contracts. Recently, the platform has focused on enhancing liquidity provision and user experience, particularly through its V3 model, which allows for the use of concentrated liquidity pools.

For a DEX, learning how to trade on Uniswap is relatively simple, as the site features a user-friendly and streamlined design. Uniswap is known for continuously introducing new tokens, so if you are interested in trading the latest cryptocurrencies, be sure to check out the popular newly listed tokens on Uniswap to enhance your portfolio.

DeFi Services: Trading and Lending Total Value Locked: $5.69 billion

4. MakerDAO – Lending Platform Offering DAI Stablecoin

MakerDAO is a large decentralized collateralized debt position (CDP) platform based on Ethereum. In other words, it allows users to borrow against cryptocurrencies. Users can initiate a CDP by using ETH or other Ethereum-based assets as collateral.

The main goal of MakerDAO is to ensure that its stablecoin DAI—one of the most popular and widely used stablecoins in the world—maintains its peg to the US dollar.

MKR is the native token of Maker, used to facilitate users' interest payments. Whenever a CDP on the platform is liquidated, the paid DAI and MKR are burned. The community actively discusses governance changes to improve risk management and collateral strategies.

In addition to its secure and transparent operations, MakerDAO's inclusion in this list is also due to its close connection with DAI and its long-term stability in the market. It has remained resilient despite all market fluctuations.

DeFi Services: Lending Total Value Locked: $4.93 billion

5. Instadapp – Easy Access to DeFi Protocols

Instadapp is a decentralized finance application based on Ethereum, designed to provide users with a convenient way to interact with other DeFi protocols.

Its DeFi smart layer allows users to use various DeFi platforms in one place. In other words, through Instadapp, you do not need to download multiple standalone applications for staking, lending, or any other activities.

Instadapp offers a comprehensive suite of DeFi tools, including Instadapp Lite and Instadapp Pro, as well as the Web3 Avocado smart wallet and Fluid lending platform. Although it may not sound very intuitive, Instadapp Pro is actually completely free.

Despite this, the platform has yet to attract a wide DeFi user base, but it is working to improve its user interface and features to simplify multi-protocol interactions. Its lower popularity may be the reason for its relatively low TVL.

DeFi Services: Lending, Staking Total Value Locked: $2.85 billion

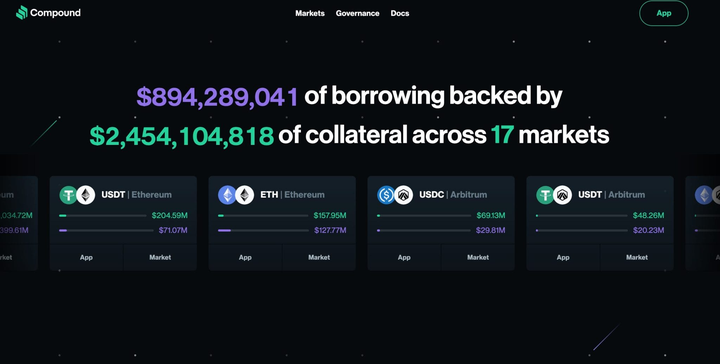

6. Compound – Lending Platform with Strong Stablecoin Support

Compound.finance is a decentralized cryptocurrency lending market. According to the latest data, it covers 16 markets, including cryptocurrencies like ETH, USDT, USDC, OP, and MATIC.

With the addition of USDT and USDC, the platform clearly has excellent support for lending stablecoins.

Compound is based on Ethereum and fully supports borrowing or lending against collateral. Interest rates are usually very favorable but are still influenced by supply and demand. Although the platform may not be as large as Curve or Maker, it provides significant value to most crypto users.

Compound has a native token (COMP) that users can hold to participate in the governance of the decentralized protocol. Change proposals are published on the Compound website, and users can participate in voting.

DeFi Services: Lending Total Value Locked: $2.45 billion

7. Curve Finance – DEX Focused on Stablecoin Trading

Curve Finance is a decentralized finance platform that offers trading, lending, and borrowing services. This DEX has quickly become one of the leaders in the DeFi space, focusing on stablecoin trading, which sets it apart in the competition. If you are looking for low fees and low slippage trading, Curve is the ideal choice.

The Curve platform uses automated market makers (AMM) to help maintain the peg of stablecoins. This allows users to trade with minimal price impact. Curve maintains market liquidity by automatically buying and selling digital assets and profiting from the bid-ask spread.

The total deposits on the Curve platform currently exceed $1.78 billion, with daily trading volumes typically exceeding $100 million, maintaining its position as a leading platform for stablecoin trading with significant TVL. For a platform launched in 2020, this is no small achievement.

Another unique selling point of this DeFi platform is its standout website design, which gives a retro feel while incorporating advanced Web3 features.

DeFi Services: Lending, Trading

Total Value Locked: $1.84 billion

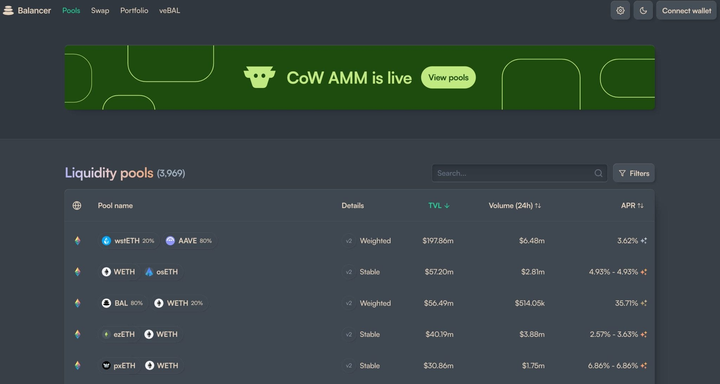

8. Balancer – DeFi and DEX Platform Offering Automated Portfolio Management

Balancer is a suite of automated market maker (AMM) products that belongs to a decentralized trading platform (DEX) that uses algorithms to facilitate token trading. Unlike trading with other traders, you can handle all transactions through AMM.

In addition, Balancer allows users to earn passive income through the platform's yield pools. Currently, Balancer has over 240,000 liquidity providers; although this number is not huge, the DeFi platform is still rapidly growing.

Balancer creates and manages various liquidity pools, each consisting of multiple tokens, enabling portfolio management. Recently, the platform has focused on enhancing its automated market maker (AMM) capabilities and expanding liquidity incentives.

Like other DeFi platforms, Balancer also allows users to buy and hold the native token BAL to participate in the governance of the protocol.

DeFi Services: Automated Portfolio Management, Trading, Yield Farming

Total Value Locked: $890.51 million

9. PancakeSwap – Integrated DEX Offering DeFi Services Including Staking

PancakeSwap is one of the most unique DEXs you will encounter, standing out with its distinctive design and vibrant colors. But don’t let its quirky appearance distract you; it remains one of the world’s leading multi-chain decentralized trading platforms.

PancakeSwap is an integrated DEX that offers services including trading, staking, yield farming, and even a game marketplace launched at the end of 2023.

PancakeSwap's popularity is attributed to its operation on the BNB chain, which allows for fast confirmation times and lower user fees.

The earning potential is rich and diverse; you can trade, stake the platform's native token CAKE with an annual yield of up to 25.63%, join liquidity pools and farming pools, and explore more options, including gaming options through the game marketplace and NFTs.

Although PancakeSwap has not been around for long, it has already established dominance in the DEX market on BSC. Additionally, due to its connection with the BNB chain, it is particularly ideal for BNB users.

DeFi Services: Trading, Yield Farming, Staking

Total Value Locked: $876.21 million

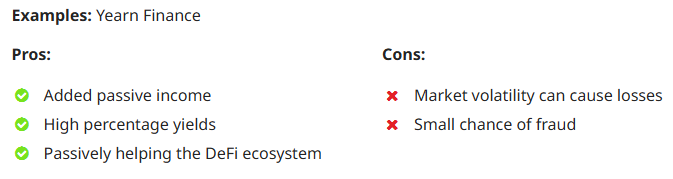

10. Yearn Finance – Yield Farming Platform with Automated Strategies

Yearn Finance is a suite of products focused on helping individuals and decentralized autonomous organizations (DAOs) earn yields from digital assets. This yield aggregator provides services designed to simplify yield farming and help you optimize returns.

By leveraging the numerous options provided by Yearn, you can maximize interest rates. Additionally, you can participate in the platform's development and network governance by holding the native token YFI.

The protocol can automatically adjust your assets and shift them between various high-yield options to provide you with the best asset returns. In other words, you do not need to do much with your portfolio, as the platform handles most of the work. Furthermore, the development team is working to create new vaults and strategies to optimize user yield generation.

DeFi Services: Yield Aggregator

Total Value Locked: $221.97 million

11. What is a DeFi Platform?

DeFi platforms utilize blockchain technology and cryptocurrencies to provide financial services. While this definition is broad, DeFi itself is comprehensive, effectively covering all aspects of decentralized finance.

DeFi platforms are typically decentralized cryptocurrency trading platforms, liquidity provision platforms, lending platforms, yield farming applications, prediction markets, or NFT markets.

A premise of DeFi platforms is peer-to-peer financial transactions. They are generally designed to provide:

- Broader accessibility

- High interest rates

- Low fees

- Strong security

- Near or complete transparency

- Complete autonomy from centralized institutions

Despite the many advantages of DeFi, it is not without its drawbacks. The DeFi ecosystem is still unregulated, which has allowed some bad actors to enter the market. Additionally, programming vulnerabilities in DeFi applications can lead to hacking attacks and scams.

DeFi platforms have not been around for long, but their popularity has been increasing. In recent years, the number of DeFi users has steadily grown. Research from Statista indicates that by 2028, the market is expected to have around 22.09 million users, a significant leap from 7.5 million users at the end of 2021.

12. Types of DeFi Platforms

As mentioned above, DeFi platforms come in many different forms. Below, we will explain the most common types we recommend.

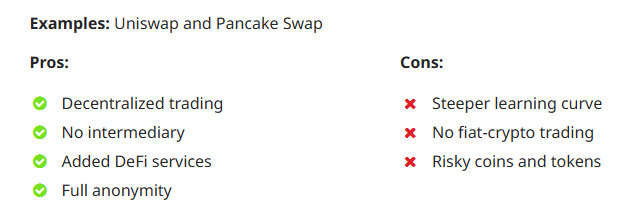

1) Decentralized Exchanges (DEXs)

Decentralized exchanges are peer-to-peer cryptocurrency trading markets. Unlike centralized exchanges, which act as intermediaries, DEXs are only used to facilitate exchanges between traders, who trade independently and can freely determine the terms of the trade. The entire process is typically completed through smart contracts.

DEXs facilitate cryptocurrency trading, so there are no fiat purchase options like those on centralized exchanges, nor can crypto assets be exchanged for cash. To use a DEX, you need to have a cryptocurrency wallet containing digital assets.

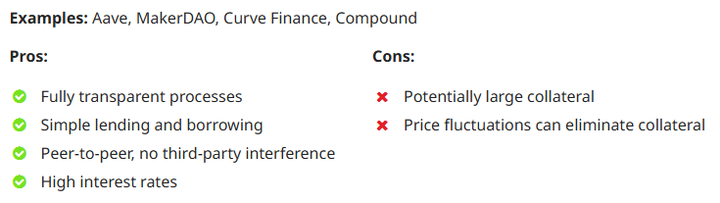

2) Lending Platforms

As the name suggests, these platforms allow users to lend cryptocurrencies. Those who want to lend cryptocurrency can deposit their assets on the platform and earn interest by allowing others to borrow. Borrowers need to provide collateral and pay a certain interest rate to borrow cryptocurrency.

To some extent, this system is similar to banks, but it operates in a completely decentralized peer-to-peer model. Moreover, the platform is unregulated, and everything is handled by smart contracts, ensuring security and transparency.

3) Liquidity Mining Platforms

These platforms enable cryptocurrency holders to profit from holding digital assets through liquidity mining. They allow users to lend crypto assets to various decentralized applications (dApps) to provide liquidity and earn corresponding returns. These returns are typically presented as annual percentage yields (APY), based on the interest rates of borrowers.

Liquidity mining is key to the realization of decentralized finance (DeFi). Unlike staking, liquidity mining rewards users for lending assets rather than participating in network governance. Many decentralized exchanges (DEXs) offer liquidity mining services, but there are also dedicated liquidity aggregation platforms.

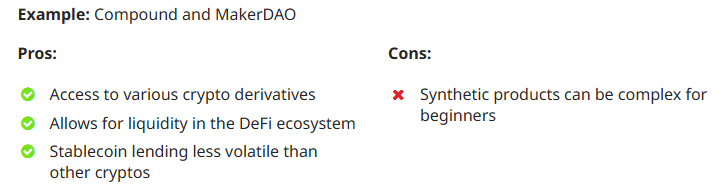

4) Stablecoins and Synthetic Assets

Stablecoins and synthetic assets are services of decentralized finance (DeFi) platforms rather than the platforms themselves. Stablecoins play a crucial role in DeFi as they are widely used in decentralized exchanges (DEXs), lending platforms, and liquidity mining platforms. In this guide, you have learned about MakerDAO—a platform focused on stablecoin trading.

Synthetic assets are crypto derivatives whose value is derived from the value of other assets. Top DeFi platforms offer synthetic products like options, swaps, and futures. Therefore, investors can benefit from asset exposure, configurable risk, and cash flow patterns from these products.

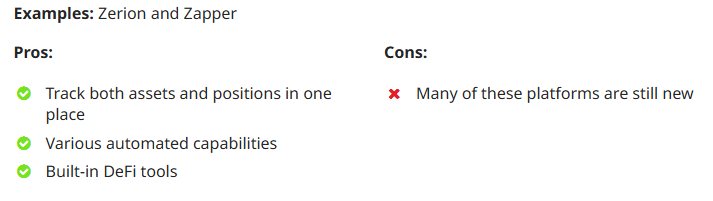

5) Asset Management Platforms

The DeFi space is becoming increasingly diverse, and traditional Web3 wallets can no longer effectively track various digital assets, whether tokens, coins, NFTs, or DeFi positions. This is where DeFi asset management platforms like Yearn Finance, Zerion, and Zapper come into play.

These platforms are multi-chain compatible and can detect DeFi positions, not just assets in crypto wallets, and most features are automated. Using these platforms, you can track all your assets and positions through a single dashboard.

6) How to Choose a DeFi Platform—Our Criteria

Choosing the right DeFi platform, whether a DeFi staking platform or another type, requires careful consideration of several important criteria. Let’s take a look at these criteria.

- Clarify your goals First, determine your goals on the DeFi platform (e.g., the amount you hope to earn through the platform). Then, assess whether the platform can meet those goals. In this regard, you should check the platform's annual percentage yields (APYs).

- Evaluate security measures Due to the lack of regulation in the DeFi space, it is crucial to check the security measures provided by the platform. If the platform's security measures do not meet current standards, you may face potential risks of cyber attacks. Check whether the platform offers security measures such as multi-signature wallets, end-to-end encryption, and regular audits.

- Check the platform's reputation In addition to security, it is also important to look at the platform's reputation. If the platform itself is not trustworthy, security measures are of little use. The DeFi space is rife with scams due to the lack of regulation, so it is essential to choose a verified, secure, and trustworthy platform.

- Explore the platform's features and characteristics After ensuring the platform's security, you should focus on the most important aspect—the platform's features. If you are looking for yield farming, the platform should offer a variety of liquidity pools. If you want to earn through staking, the platform should provide good APYs and a diverse selection of tokens. Additionally, the platform needs to be able to interoperate with other DeFi protocols, as you may want to use other decentralized applications (dApps) and DeFi platforms.

7) Are DeFi Platforms Safe for Beginners?

If you are using a reputable platform with excellent security measures, DeFi is safe for both beginners and advanced users.

However, beginners need to understand what they are participating in and how DeFi services operate. The DeFi space can be very risky for novice investors, primarily due to the high volatility of cryptocurrencies, which leads to significant uncertainty regarding related products.

Options like staking and lending in DeFi can yield very high profits. However, if you make some wrong decisions or purchase underperforming tokens or enter failing projects, you could also lose all your investments.

Most importantly, you must always maintain control over your private keys throughout the process. Finally, avoid letting the opinions of the crowd influence your decisions.

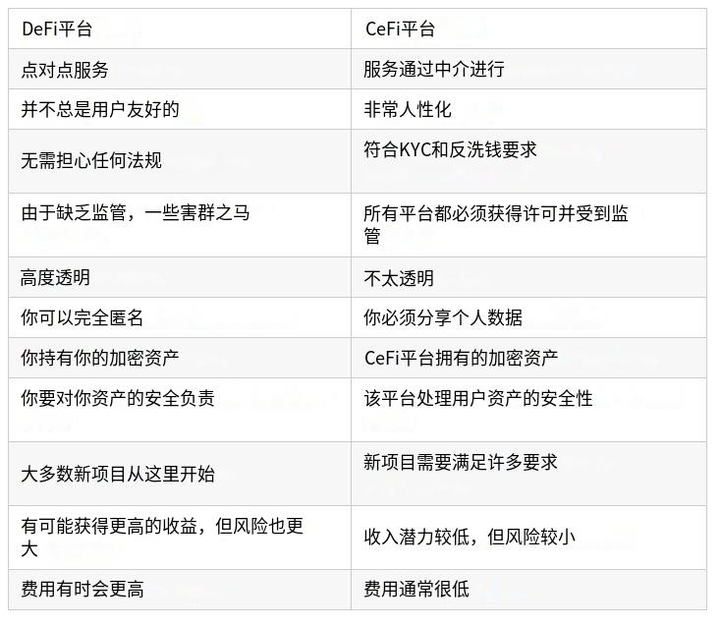

8) DeFi vs. CeFi Platforms: Which is Better?

As you might guess, decentralized finance (DeFi) and centralized finance (CeFi) are two opposing concepts. DeFi relies on decentralized networks, focusing on innovative and completely transparent financial services, operating through smart contracts; while CeFi relies on traditional intermediaries, with platforms adhering to all regulations in this field and placing a strong emphasis on user experience.

To better understand the differences between the two and decide which financial platform is better, let’s look at the pros and cons of each type of platform:

13. Conclusion

The DeFi space is vibrant and continuously evolving, which is why you will encounter a variety of platforms offering one or more DeFi products.

Given the vastness of the market, finding the platform that best suits your needs can be challenging. However, by following the steps in this guide and referring to our recommendations, the entire search process should become much easier.

Article link: https://www.hellobtc.com/kp/du/02/5667.html

Source: https://cryptonews.com/cryptocurrency/best-defi-platforms/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。