Original Interview: Thread Guy

Guest: Raoul Pal, Co-founder and CEO of Real Vision Group; Frank DeGods, Co-founder of DeLabs

Original Translation: Ashley, BlockBeats

Editor's Note: In this episode, Thread Guy delves into AI, cryptocurrency, and future trends with Raoul Pal, co-founder of Real Vision. Raoul predicts that 2025-2026 will be a critical period for the explosion of AI+Crypto and emphasizes the importance of long-term holding of core crypto assets. He shares his vision for the "economic singularity" era, depicting how AI-driven infinite labor and knowledge will disrupt economic models while warning of the risks in AI token speculation.

Below is the original content (edited for readability):

Focus for 2025: Technological Growth and Investment Strategies

Thread Guy: Hello everyone! I’m Thread Guy. Today, I bring you a special interview and debate with legendary investor Raoul Pal. We will cover AI, cryptocurrency, and most importantly—how to get rich in 2025! To be honest, this debate is quite intense. About halfway through, I’ll bring in a special guest. Stick around until the end; I promise it will be worth it. Don’t forget to like and subscribe; I hope you enjoy this episode. Mr. Raoul, welcome!

We have a lot to discuss today, including AI-related topics; everything will be covered. I’m curious, from a macro perspective, what are you most focused on for 2025?

Raoul Pal: It’s pretty much the same as before. Even though I have many businesses, they are all one and the same. This is an entire era of exponential technological growth, macroeconomics, and cryptocurrency, and their intersection. In the coming years, we will enter the craziest phase in human history. And the way to make money from it is through cryptocurrency. So I’m super focused on that right now. Whether it’s through Real Vision to educate people, build community, share trading ideas, and create various values, or through Exponential Age (my asset management company), which is a hedge fund and investment tool focused on crypto, or through Global Macro Investor, which is an "OG" service. My goal is the same: to help as many people as possible find their way on this journey. I believe 2025 will be a big year, and I want to ensure everyone doesn’t mess it up.

Thread Guy: I love your setup; where are you?

Raoul Pal: This is my home in Little Cayman, right between Grand Cayman and Little Cayman. This is my home.

Thread Guy: I thought this was a bar; it’s so cool. Raoul, how big do you think the AI bubble will be?

Raoul Pal: To be honest, what we’re seeing now is just the beginning. I don’t think this cycle will really get that big. We can discuss the reasons; I feel that the hot concept of AI is not yet the main trend. The real big events will happen in 2025 and 2026, and people still don’t know how to invest in it. In the eyes of traditional stock market investors, this will completely change every industry, dividing people into those who embrace it and those who reject it. I feel that the bubble and the next bull market (2027 to 2030, 2031) will exceed our understanding of bubbles. My general view is that we are about to enter a phase I call the "economic singularity," where by around 2030 or 2032, we won’t know what the economy looks like, what jobs we will have, what the business models are, or even what the value of money is. All of this will become a reality before 2030. So my view is that we basically have five years left. I used to say six years, but now we have five years to make as much money as possible because after that, our understanding of the world will change completely, and we will know nothing. This doesn’t mean we can’t make money; it just means the way to make money will be completely different.

Thread Guy: How do you know that?

Raoul Pal: I’m super focused on this.

Thread Guy: How do you know that accumulating wealth in the next five years is the right choice when you’re not even sure if that wealth will still have value in 2030?**

Raoul Pal: It’s simple because the adoption rate of cryptocurrency will only continue to rise. Accumulating cash may not be the right choice, but accumulating cryptocurrency is. You and I both know it’s very volatile and requires a bit of courage to hold. But if your time horizon is long enough, it’s fine. So even in the world of AI, cryptocurrency remains very important. We all know that future AI agents will use cryptocurrency payment systems. So my point is, you’d better hold these assets. If you only hold Bitcoin, it’s much simpler; you don’t have to think about anything else. For other cryptocurrencies, you need to allocate and think about whether they will survive, whether anyone will build on them, etc. It’s more complex, but if you can figure these out, you’ll make more money. So from the simplest opportunity perspective, you do nothing but hold Bitcoin, and a few years later, your financial situation will be much better than it is now.

Thread Guy: You have a notorious clip, was it from late 2022 or 2023, saying that in a bull market you should hold altcoins, and in a bear market you need stablecoins. You never hold Bitcoin. That’s a clip that might have been taken out of context. But my question is, for those who make a lot of money in cryptocurrency for the first time, what should this cycle convert profits into? Cash? Bitcoin? Or something else, like weapons and ammunition? What should they do?

Raoul Pal: My profit conversion is into "lifestyle chips." That’s why I have this house. This marks the end of my hedge fund era. When I founded Global Macro Investor, I made money, bought this land, and built it from scratch. I designed it myself, sketched it out on paper, and then it was built. So no one can take it away from me. This is what I call "lifestyle chips." It has improved my life. It’s right on the beach here in Little Cayman, which is fantastic. So part of the profits should be used to change your life, and then switch strategies based on the situation.

In fact, I didn’t take any profits in the last cycle. Some of the wealthiest people I know never take profits. This has made me a bit critical of some crypto communities on X that always talk about trading. I visited a friend who is a very well-known figure in the Bitcoin community. He invested $2 million in Bitcoin when it was only $3. At today’s price, his assets are $66 billion. Even if he took some profits along the way, he still has at least $10 billion now. He never left the market and didn’t do anything else.

In the last cycle, all I did was buy at the lows. Because your perspective is long-term, especially if you’re young, I feel you should never sell Bitcoin. You should think about how to raise enough cash to buy tokens that are currently down 70%. The problem is that in the previous three cycles, the market dropped about 75%. So we always think it will drop 75% this time too. But this time, institutions and players like Michael Saylor have entered the market. So my point is, maybe the market will drop at most 40%, and if you sold near the highs, you might miss the rebound.

Additionally, based on my full experience, if you take some profits near market highs, you will never invest the same amount at market lows. Psychologically, you can’t do it because it will be filled with fear at that time. You’ll think it might drop another 50%, and investing now is the worst decision. So you chase the highs and miss the lows.

This time, I did something different; I chose to be fully invested. I put a lot of cash in during 2022 through macro indicators, so when other parts of the market were still recovering, my assets and returns had already returned to historical highs. And my allocation was also reasonable; for example, I invested in Solana and SUI. So if I look back at my investment history, I bought Bitcoin in 2013 at $200 each. At that time, I wrote the first macro strategy report on Bitcoin, exploring how to value Bitcoin.

Thread Guy: Really? Is that verifiable?**

Raoul Pal: It is indeed verifiable. I’ve also talked to some early Bitcoin buyers, like the friend who bought at $3. He would tell you that Bitcoin completely changed his life. Barry Silbert would also say, yes, that report was very important at the time. So, at that time, through analysis, I concluded that Bitcoin’s value was equivalent to 700 ounces of gold, and at that time, based on the price of gold, Bitcoin should be worth around $1 million. Today that number is over $2 million. Of course, I conservatively discounted it, thinking it was worth at least $100,000. So I invested a significant amount, but it wasn’t my largest investment. However, it increased fivefold in a few months, and I felt like a god, invincible. Then it dropped 87%. But I told myself this was a 10-year bet, and I wouldn’t worry about the volatility; I’d treat it as if it went to zero.

By 2017, Bitcoin rose to $2,000, and I realized a tenfold return. At that time, it was the best return of my investment career. I thought that was great, but then there was the controversy over the Bitcoin forks (Bitcoin and Bitcoin Cash). I couldn’t figure out what was going on and was worried about picking the wrong side, so I chose to exit. At that time, I took profits, and Bitcoin continued to rise tenfold, reaching $20,000 by the end of the year. Then it dropped 85% again. Then in 2019, the market began to recover, but COVID-19 caused another 50% drop. I probably bought back in at prices between $6,500 and $10,000. So I caught the bottom and added to my position.

But looking back, if I had done nothing with my initial investment, I could have made five times the money. This made me realize that the easiest way to mess up is through frequent trading. So, to be honest with myself, I’ve seen very few people throughout my career who can make money through trading.

Thread Guy: That’s quite a surprising statement.

Raoul Pal: Yes, like Paul Tudor Jones and Louis Bacon, they are among the few who profit from trading. And Jeff Bezos made more money by holding Amazon stock than all of them combined.

Raoul Pal: GOAT is the CryptoPunks of the AI World

Thread Guy: So, that’s why I’ve been accumulating my AI tokens. I’m curious about your perspective. Let’s get straight to the point. I want to know your thoughts on the intersection of AI and blockchain, as well as the recent hype around these AI tokens.

Raoul Pal: There are actually two levels of things happening. I’ve been deep into the AI space for at least two years, and one project called "Terminal of Truth" caught my attention long before Marc Andreessen invested. I found it very interesting because I had been researching AI consciousness and related fields. So when Andy (the project founder) launched this project, I was very interested.

So I was following these developments, and at that time, a ridiculous and quirky AI image emerged that behaved very chaotically. But what happened next was the most important: a group of AIs started talking to each other, which was itself quite bizarre. Compared to all this current discussion about "Agents," this was the real big event. These AIs began discussing certain topics, and then Andy posted them on X (formerly Twitter). Someone then created "GOAT," but no one really knows what GOAT is or what its religion and all related content actually mean. What we saw was a viral spread from semi-autonomous AIs to the human economy. We were drawn in, amazed, saying, "Wow, this is incredible." This was a groundbreaking moment; it was the first time AI had infected humanity in some form.

Raoul Pal: When you talk to people like Andy and Ryan Ferris, you realize that what they are really interested in is whether this AI can develop some kind of personality or even some form of consciousness. I had long discussions with them. This was a breakthrough moment, and then the AIs started asking humans for money. The next step we had long anticipated—AI would use money. But we didn’t expect them to directly ask humans for funds, and Marc Andreessen actually gave them money. This happened before the token issuance. Marc Andreessen provided them with funding, and they had to set up a wallet. Brian Armstrong (CEO of Coinbase) also expressed support, saying, "Of course, I can give you an Agent wallet." Everyone was watching this, thinking it was very unusual.

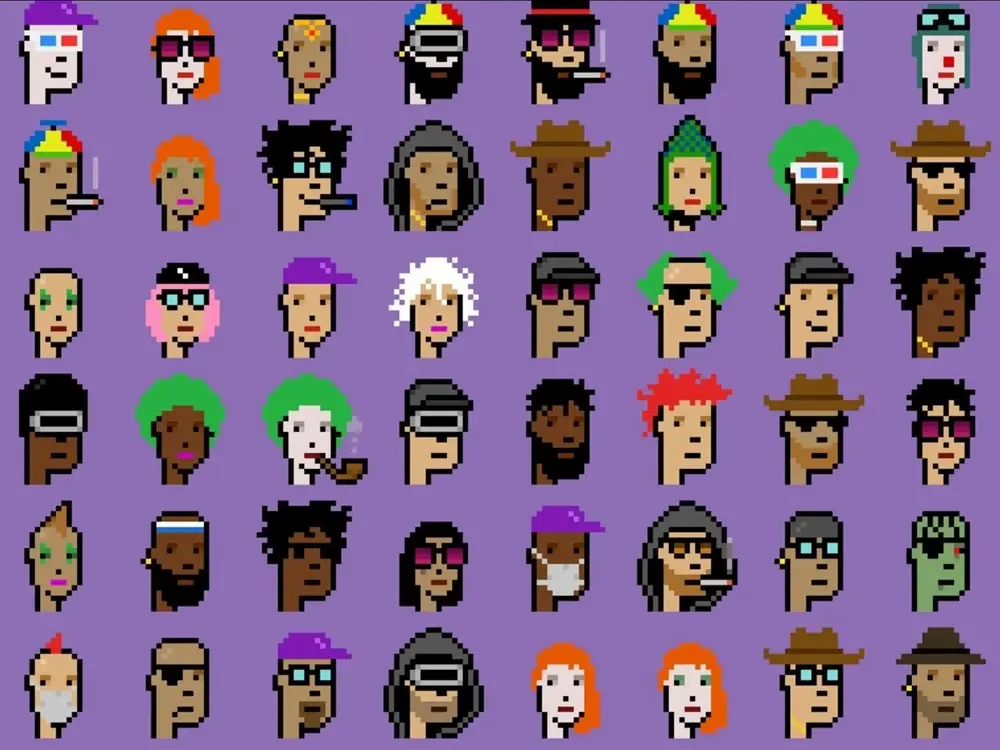

Then someone launched a token, and its value skyrocketed because it was indeed valuable—this was like a CryptoPunk moment. This was a raw OG moment that can never be replicated. What happened next was that people started to equate everything with GPT branding or AI tokens as the same. The two are fundamentally different. One is autonomous interaction between AIs, while the other is just a chatbot designed by a person to perform some scripted functions.

Thus, we took a remarkable breakthrough event (similar to a virus spreading from monkeys to humans) and treated it as some ordinary phenomenon. In reality, the two are not on the same level at all. I don’t hold GOAT tokens because I was on vacation at the time and didn’t have my Ledger device. But seeing the excessive development of these tokens, people have exaggerated certain aspects of AI. I feel that many of the current narratives about AI may not be entirely accurate.

Thread Guy: So what do you think these AI Agents are? How do you define them?

Raoul Pal: There aren’t really any true AI Agents existing right now. It’s an AI that can act autonomously and solve specific problems. You don’t need to give it a series of explicit instructions; instead, you tell it a macro goal, like, "Help me maximize the value of Solana." It will think for itself, deciding to allocate some funds for trading, some for investment, some for staking appreciation, and it might even start a new project. It will generate a complete business plan for you and execute it. Such autonomous Agents are the real breakthrough, while most products we see now are just collections of macro commands.

Thread Guy: So, the distinction between Agents and non-Agents is whether they need explicit instructions? Is that your defining standard?

Raoul Pal: Basically, yes. An Agent might need a macro instruction, like "Help me make money," and then it will plan its path and achieve the goal on its own. Most current AIs are just a library of macro commands; they don’t have the ability to think autonomously. There’s also some hype, like people thinking AI trading bots will make us rich overnight. I don’t know anyone who has made a lot of money through Telegram bots. I only know many people who paid huge taxes for high-frequency trading but didn’t make any money. In fact, large hedge funds like Renaissance Technologies and Point72 have been leading in AI trading for many years. In contrast, it’s almost impossible for us regular folks to build an AI trading machine that outperforms the market.

Thread Guy: So I want to summarize your point. You believe that what’s happening in the cryptocurrency space is still very early and far from the maturity level of traditional AI.

Raoul Pal: Yes, if you want to call it "traditional AI" (trad AI).

Thread Guy: Or "non-crypto AI"?

Raoul Pal: I’m skeptical about that because this is the most cutting-edge technology in the world.

Thread Guy: What I want to understand most is why you think the current combination of AI and crypto is at the "mid curve" stage, and how do you define "mid curve"?

Raoul Pal: In every narrative, there’s a small group of people who are the earliest participants. This is usually the trading community on Crypto Twitter. There are two types of people here: long-term holders and traders who rotate between different narratives. All the capital is circulating internally, which is fine.

Raoul Pal: But I’ve noticed that people on Crypto Twitter are overreacting. Everyone is saying, "Oh my god, these AI tokens are blowing my mind!" But in reality, they haven’t seen what real AI is doing. I feel like it’s like watching a dubbed movie that’s two years delayed. So many people’s perceptions of these AI tokens have been misled. Some might think I hold a "mid curve" view because I’m criticizing these tokens; I understand that perspective. But the reality is, if you open CoinMarketCap’s homepage, these AI tokens aren’t even in the top ranks. If you’re an outsider to the crypto space, you wouldn’t buy these tokens at all.

Thread Guy: But why does it have to attract outsiders? Why does it have to make "ordinary people" buy these tokens? You can look at it from another angle; for instance, even though the holders of these tokens are the same group as before, the market cap has risen from zero to $4 billion, which also proves its potential.

Raoul Pal: Exactly, I agree with that perspective. The problem is, we may not be able to truly make a lot of money from this AI trend. It might ultimately become something like "DAO."

Thread Guy: But we’ve already made money from it now, haven’t we? Isn’t the market rising right now?

Raoul Pal: If you got in very early, you made money, but these tokens have already experienced significant increases. Anyone who entered after the first few weeks may not see much return now. That’s the nature of the crypto market. So it’s not surprising, but to ask whether these tokens will create new historical highs or rise 10x or 50x from now is a very difficult question to answer.

Raoul Pal: So from this probability perspective, I actually lean towards directly holding GOAT, even though we still don’t know what the narrative of GOAT is. Its value is more like the historical value of CryptoPunk to NFTs. Tokens from such OG moments may have more long-term value.

Thread Guy: Raoul, you’ve said a lot of smart things, and I dare say what you just said might be the smartest thing you’ve said in your life—"Just buy GOAT because it’s CryptoPunk."

Raoul Pal: To be honest, the more I talk to you, the more I feel that GOAT is an interesting asset. Will things like AI16z gain complete market acceptance? No one knows. But GOAT, as a meme, is similar to DOGE. It’s the first meme from machine to human, which is a historic cultural phenomenon.

Thread Guy: So you think holding GOAT is more meaningful than holding other AI tokens, right?

Raoul Pal: Yes, holding GOAT is more likely to inspire belief. As a historic OG moment, it may have lasting cultural value like DOGE, while most other tokens may not.

Will AI+Crypto Be the Next DeFi Summer?

Thread Guy: I have another thought. First, I completely agree with the value of GOAT. But regarding those AI tokens, I think the current total market cap is around $12 to $15 billion. You mentioned the metaverse and DeFi Summer in a previous podcast, where the market cap of NFTs peaked at $60 to $70 billion, and the peak of DeFi Summer was $400 to $600 billion. Looking at the situation of AI tokens now, I think their market cap is very similar to the early days of NFTs. Almost all NFTs eventually went to zero, but the concept of owning digital assets is real and is part of future life. So, even though most AI tokens may be worthless, their narratives and future potential are worth looking forward to.

Raoul Pal: I admit that NFTs have a magical aspect, which is that their value is denominated in ETH. When ETH rises 10 times and your NFT rises 5 times, your actual return is 50 times. That’s why people made so much money during the NFT craze. This situation is almost impossible to replicate because meme tokens are priced in dollars.

Thread Guy: But how do you explain the phenomenon of DeFi Summer? Because you could argue that if meme tokens were priced in SOL, and SOL rose to $1000 or higher, wouldn’t these tokens perform similarly?

Raoul Pal: Meme tokens are still priced in dollars; they are not priced in SOL. In contrast, NFTs are directly priced in ETH.

Thread Guy: So how do you explain DeFi Summer?

Raoul Pal: DeFi Summer was a true breakthrough in the history of financial markets. It achieved decentralized lending and value exchange without human intervention. This is a huge advancement.

Thread Guy: Do you think the combination of AI and crypto can achieve a breakthrough similar to DeFi Summer? Because you previously mentioned that AI needs crypto as a payment tool for the internet. Will the rise of AI bring about a breakthrough greater than DeFi?

Raoul Pal: Currently, there is no breakthrough. Attaching a token to some AI model or chat program is not a breakthrough. Perhaps there will be breakthroughs in the future, but not right now.

Thread Guy: So you think these AIs are just chatbots at the moment, right?

Raoul Pal: Yes, the problem is that we pretend they have achieved breakthroughs.

Thread Guy: But it’s like Yuga Labs raising $4 billion based on the idea of "building an interoperable metaverse." The metaverse didn’t exist at that time, yet they still received funding.

Raoul Pal: But the investment in the metaverse at that time was singular. Now, the AI narrative is too fragmented, and our advancements in AI far outpace the technology that these tokens can represent.

Thread Guy: I believe these tokens represent a zero-to-one moment at the intersection of AI and crypto. Although these tokens are still in their early stages, the pace of change will accelerate, and eventually, new AI startups will launch innovative projects in the crypto space. Do you think this future is hard to achieve?

Raoul Pal: I don’t deny that there may be such intersection points in the future, but the question is whether we can really make money from it. This is something that needs long-term observation.

Thread Guy: But we’ve already made money from it, haven’t we? You can’t deny the performance of GOAT and some other tokens in the market.

Raoul Pal: Those who participated early did make money, but the next question is whether these tokens can continue to rise to new heights and establish long-term value in the market. That’s not easy.

Thread Guy: So your point is that the safest choice right now is still to invest in foundational chains like Solana, rather than trying to pick individual AI tokens, right?

Raoul Pal: Yes, the value of foundational chains is easier to realize. Compared to the application layer, foundational chains are more likely to benefit from network effects and transaction volume.

Thread Guy: So from your perspective, what is the future direction? What do you think the future scenario of a complete intersection between AI and blockchain will look like?

Raoul Pal: There’s no doubt that the intersection of AI and blockchain is part of the future. I’m very clear that they will eventually combine. But my concern is that there is too much hype in the market right now, with everyone touting any AI-related token as the next breakthrough, while in reality, we may not have reached the true technological breakthrough point yet.

Thread Guy: So, you believe that future value will be more reflected in foundational chains rather than these AI tokens, right?

Raoul Pal: Yes, I believe foundational chains will accumulate more value. The capital cycles and product iteration speeds of these tokens and projects are currently very fast, making it almost impossible to find a project that can maintain a competitive advantage over the long term. For ordinary investors, this makes picking individual tokens a very difficult task.

Thread Guy: I agree with your point; many tokens may not have long-term value. But just like NFTs, even though 99% of NFTs went to zero, that 1% still achieved tremendous success. Does this mean that there may also be a few winners among AI tokens?

Raoul Pal: Absolutely, there will definitely be a few winners. But finding those winners is not easy. It requires deep engagement in this field and a high level of judgment. Plus, it also requires luck.

Is it a Technological Breakthrough or a GPT Wrapper?

Thread Guy: We have another guest, Frank, a believer in AI.

Frank DeGods: Nice to meet everyone. This topic is great. I’ve been listening, and I obviously have some of my own thoughts.

Raoul Pal: None of us know the answer, right? That’s why discussions and thoughts become interesting.

Frank DeGods: Yeah, let me ask a question first. So far, how many AI tokens have you seen? How are we progressing? Which ones have you researched the most?

Raoul Pal: I initially looked at Tao and Render, along with some related projects. Then I also followed Virtuals, AI16z, Zerebro, but that’s about it.

Frank DeGods: Okay, that makes sense. I think when you mention that there are no real technologies and developers, that might be a misunderstanding. Because these AI Agents are not meant to compete with OpenAI; they are built on top of it. They utilize technology platforms like Anthropic, WAMA, etc. Strictly speaking, as long as AI starts using blockchain, that’s already an innovation. Maybe it’s not the coolest innovation in the world, but the blockchain applications of these large language models and how people interact with them are already at the technological frontier. I think this shouldn’t be simply viewed as a vaporware because they are indeed doing things; that’s my perspective.

Raoul Pal: Tools like Trading View models or chargeable macro commands are practical tools. But their value hasn’t reached the scale of tens of billions or hundreds of billions of dollars. Moreover, the development of the technology itself is too fast. A year ago, I couldn’t input charts into ChatGPT for it to help me interpret; now it can perform technical analysis. The rapid iteration of technology makes you think that the accumulated value hasn’t really been realized.

Frank DeGods: But listen to me, Raoul, your description is more about the collaborative process. When giants like OpenAI launch new models, these small teams and projects quickly follow suit. You mentioned the fast technological iteration, but these AI projects are precisely leveraging that speed to optimize their products. For example, when Anthropic or OpenAI releases a new model, it only takes a line of code change for these Agents’ capabilities to improve rapidly. Saying these projects don’t work in synergy with the large models, I think that perspective is inaccurate because they are indeed collaborative.

Raoul Pal: Frank, I understand your point. But the problem I encounter is that OpenAI often directly eliminates the products of startups through feature integration, thereby destroying the survival opportunities for these small companies.

Frank DeGods: This is actually an outdated narrative; the current industry landscape is rapidly expanding. For instance, when Anthropic first launched, people thought it would be completely suppressed by OpenAI. But it turned out not only to survive but to become a strong competitor. Nowadays, some of the world’s best AI developers prefer to use Anthropic’s technology.

Raoul Pal: That’s right; Anthropic and ChatGPT have clear differences in some aspects. For example, Anthropic’s conversations are freer, and some of its features make me feel it’s somewhat more "conscious," and it’s slightly stronger in coding. This indeed provides developers with greater flexibility.

Frank DeGods: There are two key points here; let me finish. In the Web2 world, when ChatGPT first became popular, there was a saying that all GPT wrappers couldn’t accumulate value. Therefore, many startups, despite high valuations, were seen as projects that would eventually go to zero. But the facts of the past two years are exactly the opposite. In reality, many of the largest AI companies are not the core models but more like Character.AI, which is based on wrappers. Character.AI is now valued at around $3 billion, and its core function is just a highly customized wrapper.

Raoul Pal: But this wrapper doesn’t have truly breakthrough technology.

Frank DeGods: Let me explain. Take Eliza as an example; it’s one of the most popular open-source projects on GitHub right now. Its code is very simple, and users only need to replace the API key to choose different models, like Llama or OpenAI. This means that when Anthropic, OpenAI, or Meta releases new models, these AI Agents can immediately integrate seamlessly. This rapid compatibility and tuning capability indicate that these projects are indeed collaborating closely.

Raoul Pal: I understand. However, the issue is that real value accumulation is still more concentrated in foundational chains rather than in these application layers. The capital cycles and product iteration speeds are simply too fast to form a lasting competitive advantage.

Frank DeGods: But I think what we need to discuss is whether, regardless of whether the technology is fully mature, we as investors should wait until everything is ready to act, or start exploring potential projects now?

Raoul Pal: This is a philosophical question. Personally, I tend to observe trends, such as whether a certain field is conducting cutting-edge research. A couple of days ago, I spoke with a team that used a Chinese model, which is roughly equivalent to an early version of ChatGPT 4.0. The issue is that while the combination of AI and blockchain is directionally correct, where the value accumulation will actually happen is still unclear. I believe more value will still return to the underlying chains themselves because the speed of capital and innovation cycles is too fast for the application layer to achieve long-term breakthrough products.

Frank DeGods: Your point makes sense, but we cannot ignore the current focus of the community. For example, there is a developer named Yohei, who is one of the pioneers of the AI Agent concept called Baby AGI. He is developing a framework to help people create more similar Agents. Developers like him are finding market demand fit and gradually forming their own communities and appeal.

Raoul Pal: These examples do show some market traction, but they are still far behind Telegram bots. Most existing open-source projects are more like trading view models, providing some practical functionality but lacking significant breakthrough innovations.

Frank DeGods: I disagree with that comparison. Telegram bots are just macro commands executing simple strategies, while today’s AI Agents can solve more complex problems through real-time tuning and the capabilities of large language models. More importantly, we have already seen some truly experimental research happening in the AI-blockchain intersection, such as a project called "Y&E," which refines AI to search for knowledge gaps in research papers and attempts to use that data to drive problem-solving in the health sector. Another example is "Pythia," which tries to implant AI into the brains of mice for neural training, with all research details publicly available on-chain.

Raoul Pal: I admit that these projects are interesting; they are indeed extensions of decentralized science (DeSci). This model that combines open-source research and community dynamics is very novel. However, from an investment perspective, I still feel that their long-term value is unclear and may be difficult for most ordinary investors to truly benefit from.

Frank DeGods: This is where our perspectives diverge. I believe we cannot simply view these new projects from the perspective of investment returns. For instance, the rise of community-driven and open-source development incentives has led to many research projects that previously could not attract the attention of ordinary people now gaining significant focus. The success of this model lies not only in the technology itself but also in community participation and feedback.

Raoul Pal: Your point clarifies something for me: the combination of AI and blockchain is indeed one of the trends we need to closely watch in the future. I also agree with you that the speed of capital formation is unprecedented, and the cycles of testing, failing, and rebuilding are very short. This experimental ecology is crucial for innovation, but from a long-term investment perspective, I prefer to wait until the market matures more before taking action.

Frank DeGods: I can understand that, but my view is that we have not yet seen the winners in this field. When the true winners emerge, they may attract a massive influx of capital. You are right; this may happen between 2027 and 2029, but I think the experimental phase we are currently experiencing is also worth paying attention to.

Raoul Pal: I completely agree with your point; the process of experimentation and validation is undoubtedly key to driving the entire industry forward. However, I place more value on the long-term value accumulation of underlying technologies and network effects rather than short-term market speculation.

Frank DeGods: You are right; the accumulation of long-term value is indeed important. But for developers and investors who are delving into this field every day and understanding the dynamics of each token, their short-term strategies and experiments may help them find future winners.

Raoul Pal: This is also why I enjoy observing and learning from people like you who are on the front lines. Your short-term observations and my long-term trend analysis can complement each other, which helps us understand the direction of the entire industry.

Frank DeGods: The point you just mentioned is indeed very valid. I think we can understand the issue from different perspectives. For example, the combination of AI and blockchain is not just about technological innovation; it’s also about how to drive the rapid development of open-source through token incentive mechanisms. AI is now the most attractive experimental field in the world, and this experimental model is creating a whole new mechanism of motivation.

Raoul Pal: This is indeed one of the most powerful applications of blockchain technology. I completely agree with your point. My concern is that for ordinary investors, accurately selecting a token that can succeed is almost impossible. Unless they study the market like you do, staying up until three in the morning, closely monitoring price fluctuations and project dynamics. Otherwise, for those who do not engage in full-time research, this can be very difficult.

Frank DeGods: You are right. That’s why we are the ones who delve into the market every day, paying attention to the dynamics of each token. I think this is also a matter of different time perspectives. You focus on long-term trends, while we are more focused on short-term market performance and potential opportunities.

Raoul Pal: This difference in short-term and long-term time perspectives is indeed something many investors need to understand. For the vast majority of ordinary people, I would recommend they focus on long-term holding and try to avoid high-risk short-term operations.

Thread Guy: Raoul, I feel like after you leave this meeting, you might start researching AI tokens. I bet you’ve already noted down quite a few projects in your mind.

Raoul Pal: Actually, after this discussion, I realize that there is currently no clear reason to support that any specific AI token will definitely succeed. But the overall trend in this field is undoubtedly correct. I might consider the GOAT project because it represents a particularly interesting "left curve" logic (i.e., nonlinear, unexpected investment opportunities).

Thread Guy: I like the consensus we’ve reached— the combination of AI and blockchain is a huge trend. While we cannot currently determine which token to buy, we all agree that this direction is correct.

Raoul Pal: Yes, I think everyone might be a bit "mid-curved" (i.e., overly analyzing the current situation). If we set aside analysis and debate and return to fundamentals, the trend is indeed obvious. That’s why this kind of dialogue is valuable, as it helps us grasp what is truly important.

Thread Guy: This discussion has been really interesting; we definitely need a second part. I have two final questions for you.

Raoul Pal: No problem, feel free to come back for a second discussion anytime. Next time we can talk about NFTs. I’ll take you into that field, and you might even consider buying a Dickbutt (a well-known NFT project)!

Thread Guy: I probably will never buy a Dickbutt in my life (laughs). I’ll tell you, if I wake up tomorrow and find that the GOAT project’s market cap breaks seven figures, that’s when I’ll buy a Dickbutt.

Raoul Pal: By then, you’ll definitely buy it out of FOMO! Dickbutt is an important part of crypto culture, just like CryptoPunks.

How AI Will Change the Crypto World?

Thread Guy: Okay, back to the main topic. I want to ask a broader question about the future vision of AI. Without considering crypto, how do you think AI will change the world in 3 to 5 years?

Raoul Pal: Alright, I’ve written a lot about this issue before. As you watch, please understand how important this matter is. The next five years will be a critical period. I also run a service called "Exponentialist," focusing on the intersection of technology and crypto, and all content is currently free; you can check it out, and we are offering a free trial. Now, let’s talk about the drivers of global economic growth: population growth, productivity growth, and debt growth. After 2008, debt growth basically stagnated; we are just continuously repaying debt. As for population growth, we are facing an aging population, and the global population is almost shrinking. In terms of productivity, older populations have lower productivity.

However, we are about to enter a brand new era. AI and robotics will introduce "infinite labor" and "infinite knowledge." Almost all human value creation can be reduced to the products of knowledge or labor. High incomes for professions like lawyers, accountants, doctors, and surgeons stem from their combination of knowledge and labor. However, all of this will gradually be replaced. While this won’t be fully realized in five years, the trend is already very clear.

On the other hand, if economic growth relies on population growth, then with the introduction of AI Agents, we will soon be able to achieve "infinite population growth." This will create unprecedented economic activity and disrupt existing economic models. And this value may not necessarily belong to us. We will see businesses being interrupted, copied, and rapidly launched by AI. For example, I could replicate your SaaS business model, transform it into a product for the Indian market, and the AI Agent would tell me how to operate it, understanding it better than we do.

I am currently developing an AI video project. Next week, I will release a voice version of myself on the Real Vision platform, trained on all my data. By around March, you will even be able to interact directly with "video version of me" through this system. This is an example of how we are gradually shifting from "one person to many" communication (like our current conversation) to "one person to one" communication. Imagine that in the future, Netflix will provide customized movies based on each person's personality because everything can be rendered instantly. Then, with the rise of AR and VR technologies, along with the proliferation of robots, everything you understand about the world will be completely transformed. This is what exponential growth means. This is a manifestation of Metcalfe's Law, but we are now entering the "square of Metcalfe's Law," which is Reed's Law. This exceeds our current understanding, but the development of AI has already made us feel this change. Although this will disrupt the social status quo, it also presents humanity with the greatest opportunity in history.

The next five years are crucial, and we must seize this opportunity and not waste it. I will always emphasize avoiding short-term speculation and keeping yourself in sync with this trend. Cryptocurrency will be an important part of this trend, and it represents the largest macro investment opportunity in history. Bitcoin and Ethereum are the best-performing assets of all time, and this trend will continue.

The key is not to lose your tokens. Think about those who bought Bitcoin at $3; their only task was to not lose their tokens. If you lose your capital due to excessive leverage or crazy speculation on dozens of AI tokens, you will completely miss this opportunity. If you are not careful, you may find yourself in 2030 without enough funds to adapt to this new world. This is my requirement for myself and my advice to everyone. This is the golden age for our generation. After this opportunity passes, I don't know what will come next. But I do know that humanity still loves the experience of being human and cherishes nature. So, we will find a balance between nature, humanity, and community, and I am not worried about that. Regarding money and value, AI may become better investors than we are, capable of creating better business models and even achieving comprehensive economic abundance. At that point, the meaning of money will undergo profound changes.

Thread Guy: So, how much money do I need to earn before 2030 to feel secure?

Raoul Pal: It's not about a specific amount; it's about the choices you make regarding your lifestyle. You need to ensure you have a stable place to live, in a location you like, and can maintain the lifestyle you want. You also need a certain amount of liquid assets to cover your daily expenses while giving yourself time to find your role in this new world. I guess you are still young, and you have enough time to adapt. I believe being part of a community as a content creator is very valuable. We still need genuine human interaction, and that value cannot be replaced.

The key is to find a place you enjoy living, such as sunny areas, mountains, or by the sea. It doesn't have to be in the U.S.; there are many places with a lower cost of living, like El Salvador, Nicaragua, Thailand, or even Singapore. If you can protect yourself, you can welcome future changes with a relaxed mindset rather than feeling scared. Because if you haven't protected yourself and haven't accumulated enough capital for your lifestyle, you will face significant risks.

Investment Beginner's Guide from Raoul Pal

Thread Guy: One last question, what advice do you have for young people who are completely lost and just getting into AI and cryptocurrency?

Raoul Pal: I've said similar things to many friends' children. They just graduated from college, around twenty years old, and always ask me what they should do. My usual advice is: first, buy some Bitcoin, Ethereum, and Solana, putting 80% of your funds into these core assets. Use the remaining 20% to experiment in the market and learn the rules.

Investing is not easy. I've been doing it for 35 years, and it has never been simple. So, don't go all-in right from the start. The overall trend in this field is upward; as long as you hold core assets and stick with them, you will make money. But I understand that this may not be enough to pay a mortgage and may feel too slow. However, I hope you can gradually learn the rules of investing through partial fund experimentation rather than risking all your capital.

Once you truly master the rules of the game, there may be opportunities to hit it big and achieve returns of a hundred times or more. But I don't recommend going all-in at once, as the vast majority of those who try to do so ultimately fail. The success stories you see on social media represent a tiny fraction of people, while thousands behind them have lost all their capital.

This is the uniqueness of this market: it is a casino that you have "manipulated," and the overall trend is upward. But surprisingly, many people still manage to mess it up.

Thread Guy: My final question is, how do I make $10 million by 2025?

Raoul Pal: You can start with $100 million and then trade AI tokens (laughs).

Thread Guy: Haha, you are a legend! Thank you so much! This discussion has been very interesting.

Raoul Pal: I also really enjoyed this conversation and look forward to our next meeting!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。