Author: Liam

The first elected crypto president of the United States, Trump, is leading by example to show the world how MemeCoin can rewrite the rules of the global capital market.

On January 18, just two days before his inauguration, Trump announced his own "official" Memecoin TRUMP on his Truth Social and X accounts, shocking the world.

Trump wrote on his social media platform Truth Social: "My new Trump official meme is here! It's time to celebrate everything we represent: victory! Join my specially created Trump community. Get your Trump meme now."

Initially, the crypto community questioned the legitimacy of the token. Some warned it could be a hacking attack or a social engineering scheme. In fact, even Elon Musk was unsure if Trump's X account had been hacked. However, as Trump's posts remained online and Polymarket data indicated only a 10% chance of the account being compromised, skepticism began to fade, and the token's price continued to rise.

The opening price of TRUMP was $0.1824, but within 12 hours, it surged over 15,000%. As of 10 AM Eastern Time, 12 hours after the token's launch, its trading price was around $30.

Since its launch 12 hours ago, the market capitalization of this MemeCoin project has soared to $30 billion, approximately three times the market value of Trump's media technology group DJT (around $8.7 billion). This is an exponential growth process, with its market cap increasing by $1 billion every few minutes.

According to estimates from blockchain analytics platform Arkham Intelligence, "crypto president" Trump saw his net worth skyrocket to $28 billion overnight, thanks to the virtual currency "TRUMP," which increased his estimated net worth by 400%. Trump's affiliates CIC Digital LLC and Fight Fight Fight LLC control 80% of the supply, and the value of the cryptocurrency he holds alone has surged to $22.4 billion. Forbes valued Trump's net worth at $5.6 billion last November.

Industry investors have stated that due to cryptocurrency, Trump and his family made more money in the past 12 hours than they have in the last 50 years. This might explain why he is so supportive of cryptocurrency? The price of cryptocurrency has not yet been factored in. Under Trump's leadership, cryptocurrency prices are expected to continue rising.

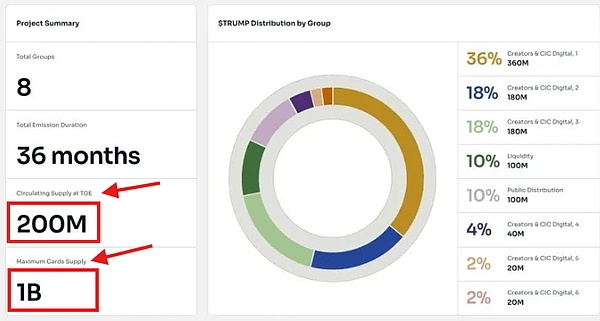

Conor Grogan, Coinbase's head of product operations, stated in a post on X: "80% of the token supply is locked in a multi-signature wallet worth $3 billion, controlled by the creator, who also added $40 million in liquidity." He added that the project received millions in seed funding from Binance and Gate, both of which do not serve U.S. customers. Other analysts pointed out that 80% of the circulating supply of the token is allocated to Fight Fight Fight LLC and CIC Digital LLC, which are associated with the Trump organization, with only 20% of the supply evenly distributed among public investors and liquidity.

Although Trump controls the vast majority of the tokens, these tokens remain locked, meaning the U.S. president is unlikely to "betray" his millions of most loyal fans… at least for now.

Additionally, while Solana-related memecoins pushed Solana's market cap to a record $118 billion, the price of Ethereum, a major source of liquidity, saw a counteracting decline, with its market cap dropping 5% overnight, losing about $240 billion in value.

Trump's remarks come as the elected president continues to support cryptocurrency initiatives. He has been openly skeptical of cryptocurrency but made a 180-degree turn during his campaign, promising to reshape the U.S. cryptocurrency landscape and make America the "global cryptocurrency capital." Trump nominated Paul Atkins to be the chairman of the Securities and Exchange Commission (SEC), expecting him to lead these efforts. Atkins is a well-known cryptocurrency advocate and former SEC commissioner, set to replace Gary Gensler, who has faced criticism for his crackdown on the industry.

Finally, while many are excited to join this largest momentum trade in history, which even overshadows social media phenomena like Gamestop and AMC, some, like senior Bloomberg ETF analysts, remain skeptical, believing Trump's special attempt "seems exploitative" and is "an ongoing non-compulsory error."

Whether he is right or wrong depends on how long it takes for this bubble to burst.

Putting aside the bubble, what significant implications does this historic moment of the "president issuing currency" hold for the world?

Global macro investor Raoul Pal states that the signal here is the speed and simplicity of capital formation. Previous MemeCoins and ICOs were merely experimental cases; the real capital game has yet to arrive, and it will fundamentally change capital markets.

Jeff Dorman, former Citigroup and current Chief Investment Officer of digital assets, believes the market has lost rationality regarding $Trump, completely missing the upward process.

He said that, first, potential token issuers and investors in the U.S. have been concerned about "regulatory issues" for over the past three years. Now, with the president himself being both the issuer and the investor, those concerns can be completely alleviated.

Now, the president issuing Memecoin does not mean the world will only focus on memecoins. Trump has validated the technology but only introduced a single use case for it. Potential issuers and investors can go beyond this limited application scenario.

The internet boom began with ".com companies," which existed solely because of the internet. But most have failed. The internet only developed when non-internet-native companies began to use it. Now, every company is a ".com company." Walmart, Domino's, JPMorgan, etc., are now all ".com companies."

The TRUMP token signals to every company, municipality, university, and personal brand that cryptocurrency can now serve as a mechanism for capital formation and customer guidance. New York City will issue a token, Harvard University will issue a token, Netflix will issue a token.

We are now officially saying goodbye to the "dot-crypto" phase of blockchain. All existing use cases of cryptocurrency come from crypto-native companies, but in the future, the world will propose innovative ways to use tokens.

When this happens, many currently useless tokens and projects will disappear, but the largest and best projects will thrive with the support of millions of new investors, issuers, and users.

In Jeff Dorman's view, if you are an investment banker, you must start pitching token ideas to your clients.

Now. The immediate price movements on Friday night indicate that cryptocurrency is now a joke, and the only winners will be the blockchain issuing joke coins ($SOL). But this is shortsighted; the lack of liquidity over the weekend is more important than anything else.

Those who call this the "cycle top" have lost their minds. Post-traumatic stress disorder is real, and all of you were so severely damaged in 2022 that you cannot imagine what will happen in the upcoming crypto-friendly environment.

Jeff Dorman concluded, so to summarize—while I personally do not care much about meme coins or the TRUMP token, I am very concerned about the future application scenarios of blockchain. And the President of the United States has just given the green light for all future possibilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。