As of this writing, the circulating supply of XRP stands at 57.49 billion, with 41.04% concentrated in the top ten wallets. Of these, eight are managed by Ripple, while the ninth-largest wallet belongs to the San Francisco-based crypto firm Uphold, which currently holds 1.85 billion XRP. The tenth-largest wallet is controlled by South Korean exchange Bithumb, securing 1.44 billion XRP.

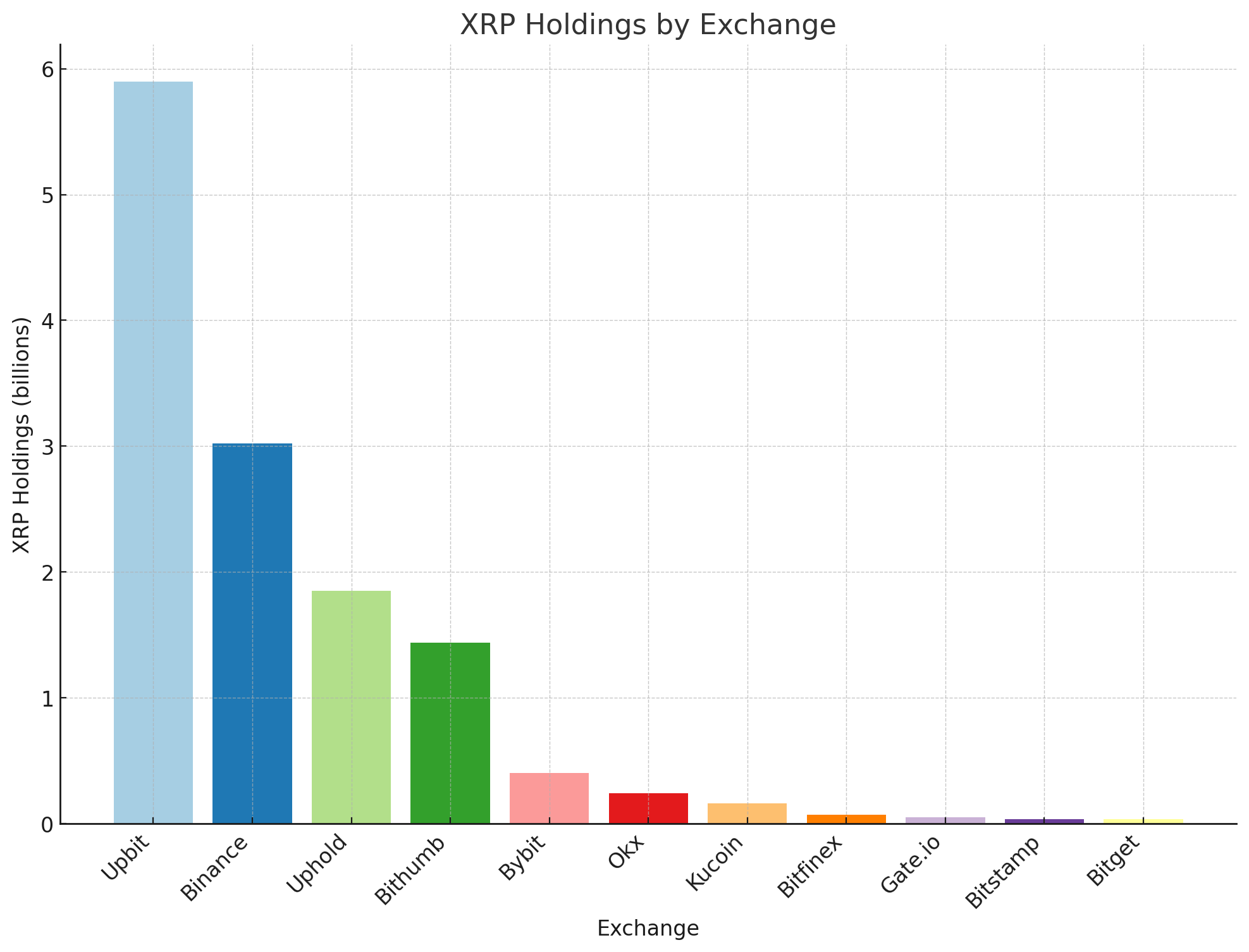

Cryptoquant data further reveals that Bithumb holds a total of $1.5 billion worth of XRP. Its rival, the South Korean cex platform Upbit, maintains a reserve of 5.9 billion XRP. Binance accounts for 3.02 billion coins, while Bybit controls 400.64 million. Okx holds approximately 243.39 million, Kucoin 159.44 million, Bitfinex 71.75 million, and Gate.io 49.26 million. Meanwhile, Bitstamp manages 35.27 million XRP, and Bitget controls 33.85 million, as per Cryptoquant’s data.

Source: Cryptoquant data and xrpscan.com metrics.

The 11 centralized exchange platforms mentioned collectively account for 23.09% of the total XRP supply. Beyond the holdings on cex platforms, 14.98 million XRP tokens are currently locked or deposited in liquidity pools, often on decentralized exchanges (dex) or comparable platforms. Data also reveals that the top 50 XRP accounts control 63.83% of the total supply, while the top 100 wallets account for 71.82% of the 57 billion circulating tokens. Even so, XRP exhibits a broader distribution compared to its fork, stellar (XLM).

In contrast, XLM’s top ten wallets hold 58.62% of its supply, and the top 100 accounts collectively manage an overwhelming 96.08% of the stellar lumens in circulation. As 2025 progresses, the clustering of XRP within centralized exchanges and a handful of large wallets highlights a critical dynamic in cryptocurrency markets: the tension between accessibility and concentrated control. Centralized platforms play a vital role in providing liquidity and simplifying access, yet the significant holdings by a small group prompt questions about market power and potential risks.

This contrasts starkly with the distribution patterns of more widely dispersed tokens like bitcoin (BTC), showcasing the varied strategies at play within the crypto space. As both investors and regulators analyze these trends, the evolving realm of digital assets continues to challenge traditional ideas of ownership and control, fostering new approaches to asset management and allocation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。