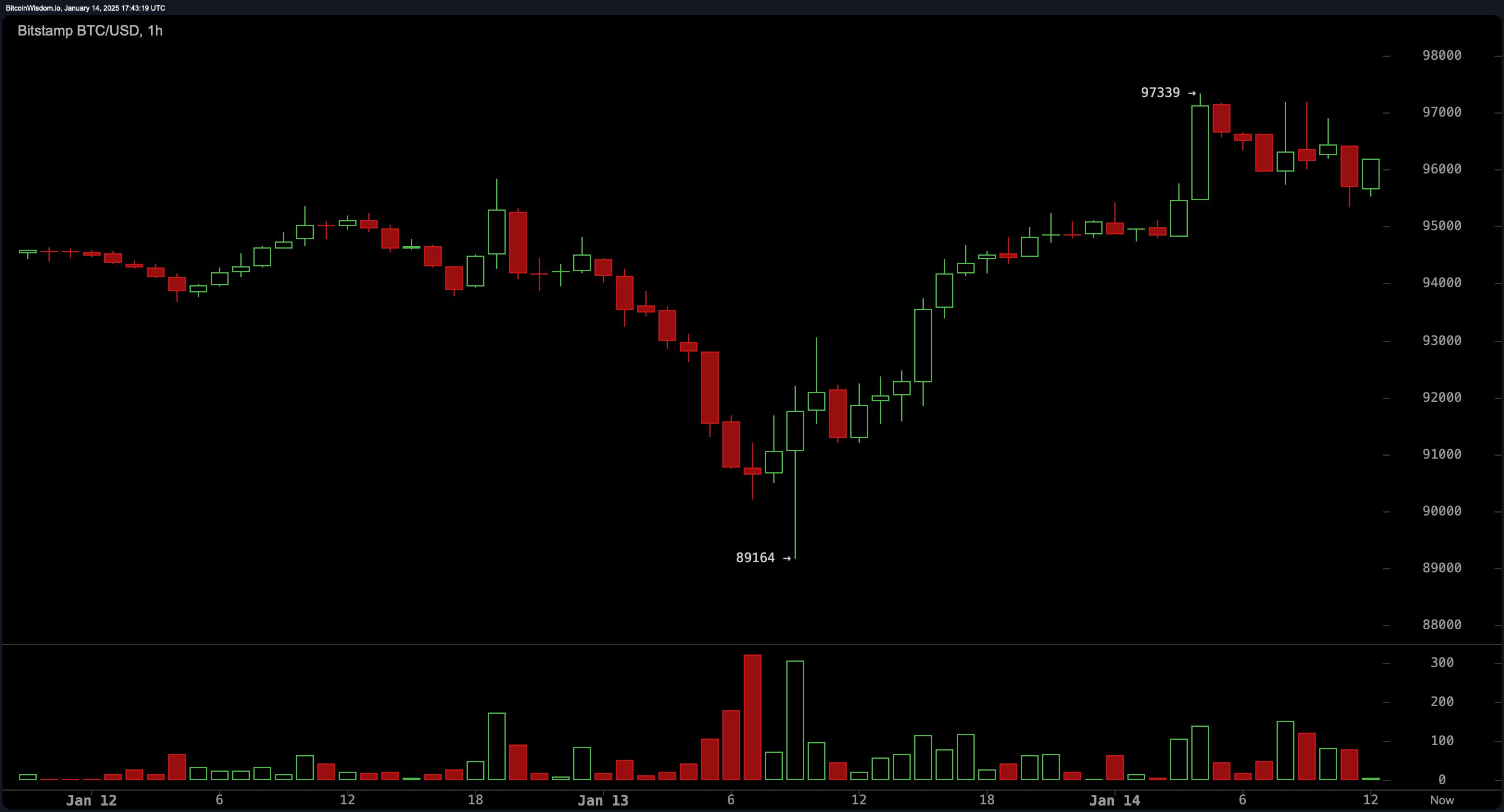

In an adjustment that reflects shifting sentiment, markets now foresee no rate cuts before Oct. 2025. According to QCP Capital analysts, this shift contributed to a 1.5% decline in equity futures and a temporary slide in bitcoin prices below $90,000, though the cryptocurrency later rebounded above $95,000.

BTC/USD 1H chart on Jan. 14, 2025.

On Tuesday, QCP said it forecasts that upcoming data on the Producer Price Index (PPI) and Consumer Price Index (CPI) could challenge conventional expectations, suggesting the persistence of a prolonged high-interest-rate regime. Analysts also point out ongoing speculation around the possibility of additional rate hikes.

As yields push higher, pressures on market durability continue to grow. QCP describes a cautious atmosphere within the cryptocurrency sector, noting bearish signals in bitcoin options activity. Investors are rolling put options to levels below the key $90,000 threshold, reflecting widespread apprehension.

Meanwhile, elevated levels in front-end volatility and the VIX index indicate that financial markets may remain turbulent through January, QCP commented on Tuesday. Despite these headwinds, the firm pointed to opportunities for renewed market optimism as conditions evolve. “Still, there’s hope for a catalyst,” the market update notes.

QCP added:

Reports suggest Trump may sign executive orders on day one, addressing ‘de-banking’ and repealing a contentious crypto accounting policy, which could provide a boost to the market.

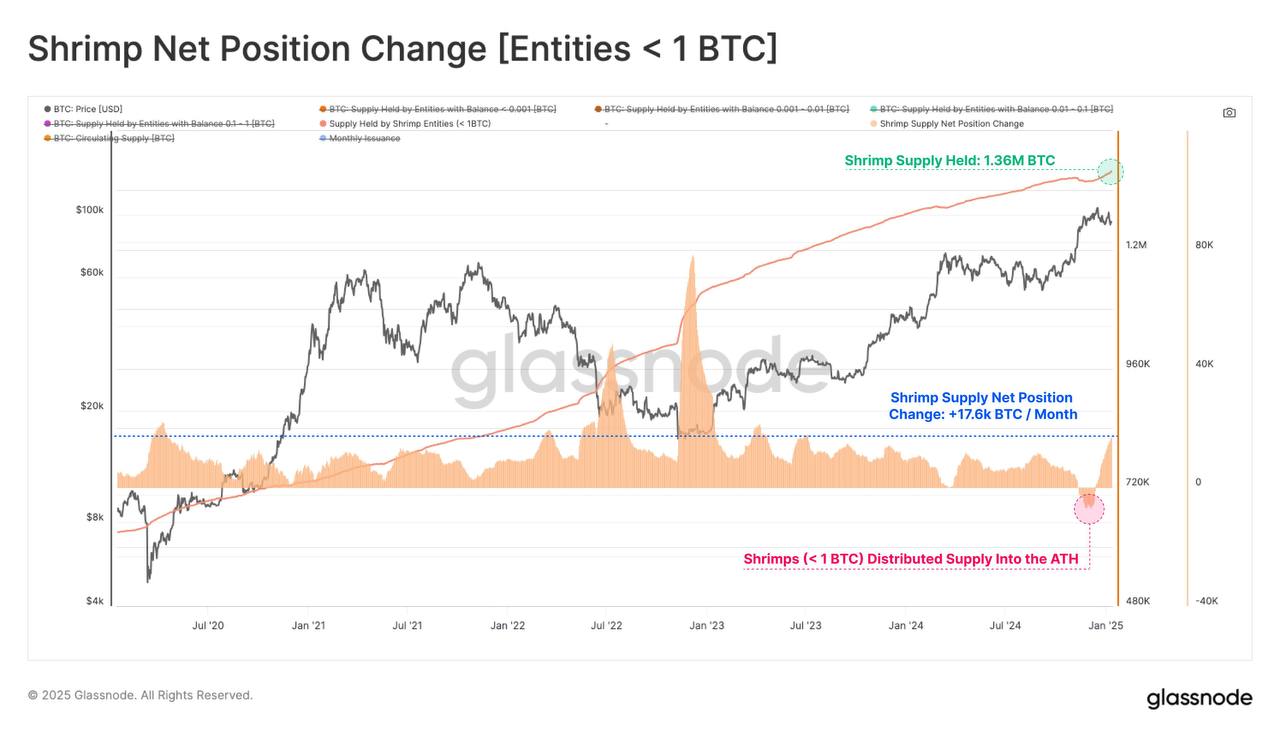

Meanwhile, onchain analytics firm Glassnode reveals that smaller bitcoin holders, affectionately termed “Shrimps” (those owning less than 1 BTC), are amassing bitcoin at an extraordinary rate. After a phase of distribution during bitcoin’s previous all-time highs, these investors are now accumulating an impressive 17,600 BTC each month. “The cohort now holds around 1.36M BTC, equivalent to 6.9% of the circulating supply,” Glassnode reported on Monday.

Source: Glassnode on Jan. 13, 2025.

As markets contend with heightened volatility and macroeconomic uncertainties, analysts note that this wave of accumulation by smaller participants reflects both the intricate nature and the opportunities within the cryptocurrency sphere. The dance between climbing yields, fluctuating markets, and shifting investment patterns signals a pivotal juncture for global finance and digital assets. Over the coming weeks, the balance between caution and optimism may shape the trajectory of these multifaceted conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。