Since its launch in February last year, Pump.fun has quickly attracted user attention with its unique mechanism and innovative concept. It currently accounts for over 70% of the token issuance on the Solana network and contributes to over 56% of decentralized exchange (DEX) activity. In just the past 24 hours, the platform has issued over 45,000 tokens, with a total issuance exceeding 5.5 million tokens for the year. Revenue in December reached $79.94 million, surpassing the performance of mainstream networks like Tron and Bitcoin.

1: What is Pump.fun?

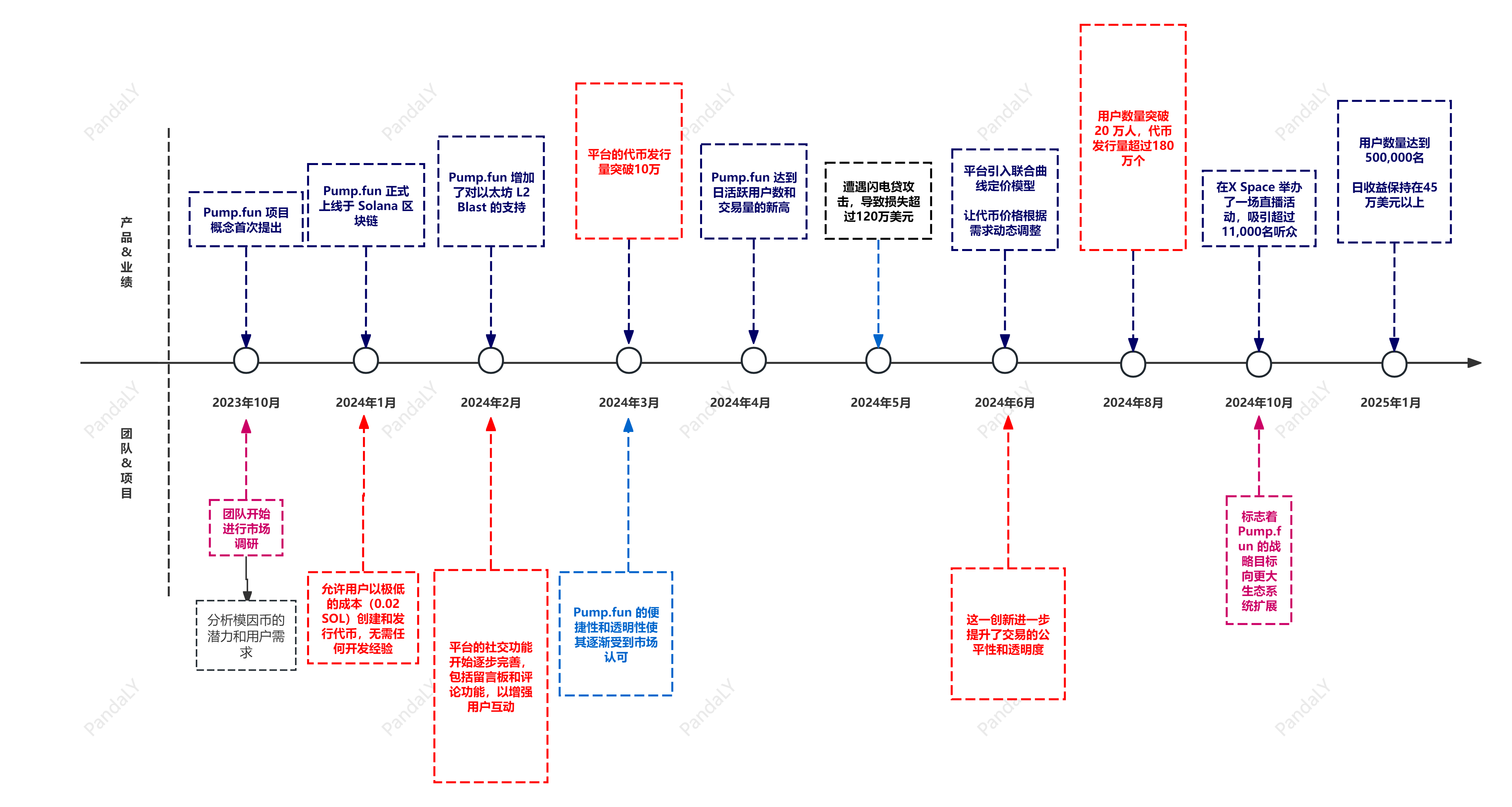

Pump.fun is a meme coin creation and trading platform based on the Solana blockchain, dedicated to simplifying the token issuance process and lowering technical barriers, allowing any user to easily create and trade their digital assets. With its innovative mechanism design and deep integration with meme culture, Pump.fun has become an important project at the intersection of DeFi and meme culture. The following image shows the creation process and key events of Pump.fun.

2: Reasons for Pump.fun's Popularity

The rise of Pump.fun relies not only on its technical advantages but also on its precise capture of the intersection between the meme market and user demand, filling the need for meme coin trading and interaction.

1) The Rise of Meme Culture

With the development of social media and the internet, memes have become a popular cultural phenomenon. Against this backdrop, speculative meme coins have quickly gained popularity, and Pump.fun has seized this trend, providing users with an efficient creation and trading platform.

2) A Low-Threshold Platform for Everyone

Traditional token issuance processes are complex and expensive, while Pump.fun has significantly simplified this process. Users can quickly create tokens by paying about 0.02 SOL, making it easy for users without a technical background to enter the meme ecosystem.

3) The Solana Ecosystem:

Solana is known for its high throughput and low transaction fees, making it the preferred blockchain for many emerging projects. Pump.fun leverages Solana's technical advantages to provide users with a fast and efficient trading experience.

4) The Combination of DeFi and Meme

The booming DeFi market has led to the emergence of more innovative projects. Pump.fun combines meme culture with DeFi, providing users with more participation opportunities and enhancing the project's appeal.

3: Technical Highlights of Pump.fun

The operational mechanism of the Pump.fun platform includes both internal and external trading methods.

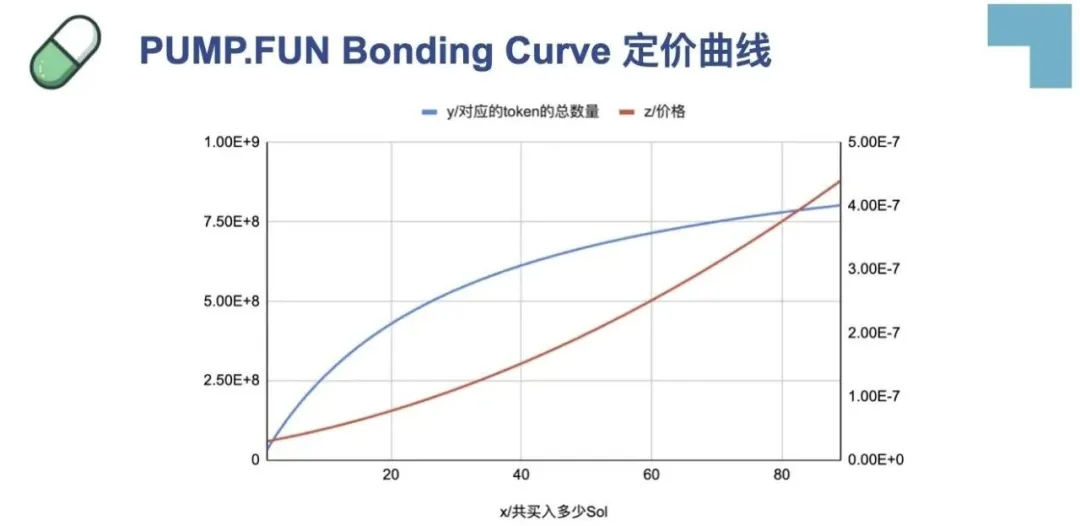

- Pump.fun's Internal Mechanism — Introducing the Bonding Curve Model

Within Pump.fun, when the amount of funds is small, tokens will be traded in the platform's built-in trading market. At this time, users can buy and sell directly on the platform without transferring to external platforms. The price of internal trading is volatile, using Pump.fun's unique mechanism where the price gradually increases with subsequent purchases, but this is not linear; it follows a curve known as the Bonding Curve.

The Bonding Curve is a mathematical model widely used in crypto-economics, especially in token economics and Automated Market Makers (AMM). Its main function is to determine the price and supply of tokens through algorithms. Here are some key features of the bonding curve:

1: The bonding curve defines the relationship between the price of a token and its supply. Typically, this curve is designed so that as the supply of tokens increases, the price of the tokens also increases.

2: This design aims to incentivize early investors, who can purchase tokens at a lower price when the supply is low and potentially gain profits as the market expands.

- Pump.fun's External Mechanism

When the market value of a token reaches $69,000, Pump.fun will automatically inject $12,000 worth of liquidity into the decentralized exchange Raydium and burn a portion of the circulating tokens. This mechanism aims to ensure market liquidity while preparing for subsequent external trading.

External trading adopts an Automated Market Maker (AMM) mechanism, and Pump.fun will automatically inject liquidity. This mechanism effectively protects user assets from malicious manipulation through designed security strategies that prevent liquidity from being withdrawn, enhancing the platform's security.

4: Potential Risks and Concerns

Although Pump.fun has reduced various risks through technological and mechanism innovations, some potential issues still need attention:

* Smart Contract Vulnerabilities

Since Pump.fun relies on smart contracts to execute token creation and trading, any vulnerabilities in the code could be exploited by hackers, leading to fund losses or contract functionality failures. Once deployed, smart contracts are difficult to modify, making it crucial to ensure the security of the contract code.

* Liquidity Risks

Although the platform employs liquidity protection mechanisms, liquidity issues may still arise during significant market fluctuations. This could force users to incur losses when unable to trade at reasonable prices.

* Market Manipulation Risks

Due to the speculative nature of the meme coin market, manipulators may use their influence to control the market through false information or coordinated trading (such as "Pump and Dump" behavior), resulting in losses for other investors.

Be vigilant for the following signals:

Developer Dumping: Developers (project creators) may sell their assets before migrating to Raydium, causing a significant price drop. This behavior may be difficult to detect as it resembles normal trading activity.

Pump.fun Bundle: Developers may artificially inflate prices through multiple wallets and then sell all assets before reaching Raydium. Watch out for top holders who suddenly have a large number of new wallets.

Large Buyers and Sell-offs: Developers may create the illusion of large buyers to attract new investors, only to sell off tokens shortly after. Be cautious of single holders controlling over 10% of the token supply.

* Dependence on Decentralized Exchanges

There are potential risks in Pump.fun's interactions with third-party decentralized exchanges, such as Raydium, where any potential security vulnerabilities or governance flaws could impact Pump.fun's liquidity and the safety of user assets.

* User Data and Asset Security

If the platform fails to adequately protect users' personal information and account security, it may suffer from hacking attacks, leading to data breaches or stolen funds. On May 16 last year, Pump.fun was attacked, and the attacker exploited a vulnerability to participate infinitely in the meme coins released by the platform, resulting in a loss of $1.9 million. Recent events like the DEXX incident serve as warnings about security issues, and the platform must strengthen the protection of user information and funds.

Conclusion

The rapid rise of Pump.fun represents the immense potential of the combination of DeFi and meme culture. With its mechanism design and technological innovation, it has become a core project in the Solana ecosystem. However, challenges such as technical security, liquidity, and market manipulation still need to be addressed. In the future, whether Pump.fun can consolidate its advantages while addressing potential risks will determine its long-term competitiveness in the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。