💥Update: Non-farm data exceeded expectations with an increase of 256,000 jobs, higher than the previous value of 227,000, and the unemployment rate decreased to 4.1%. Combined with the Federal Reserve's statement in the December meeting minutes about "slowing the pace of interest rate cuts," it is highly likely that the Fed will pause rate cuts this month.

Non-farm data tracking: https://www.aicoin.com/en/data/ur

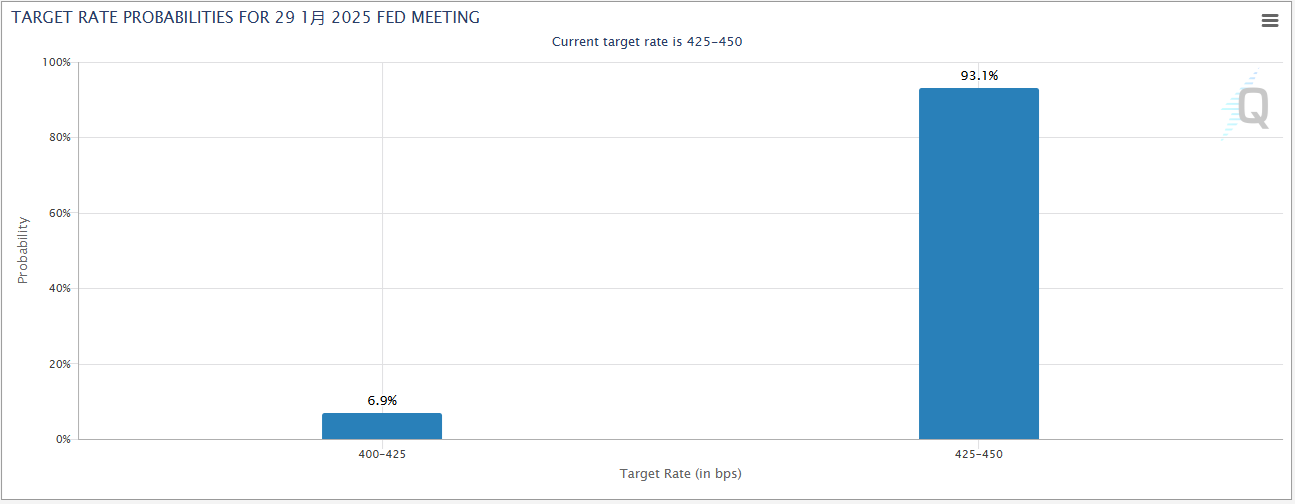

Data shows that the market has adjusted its expectations for the number and magnitude of interest rate cuts by the Fed this year. As of the time of writing, the interest rate market bets that the probability of the Fed pausing rate cuts this month is as high as 93.1%; the probability of the Fed maintaining interest rates in March is 57.7%; there is a significant divergence in the probabilities for rate cuts and maintaining rates in May, which are almost equal.

New President Taking Office: Bull Market or Prelude to Crisis?

Currently, investors are gradually stabilizing their pricing of Fed policy and shifting their focus to potential policy changes that may come with the new U.S. president taking office. However, there are significant differences in the market's interpretation of Trump's upcoming presidency:

• Optimists: Trump may promote a policy framework favorable to the development of cryptocurrencies, which is a long-term positive.

• Pessimists: Concerns that the Trump administration will expand the fiscal deficit, combined with its tariff policies, may suppress global economic growth, constituting a macroeconomic negative.

At the same time, concerns about rising inflation in the U.S. have significantly impacted market sentiment. As U.S. Treasury yields rise to annual highs, there is a noticeable outflow of funds from risk assets. AICoin (aicoin.com) data shows that this week, the price of BTC has retraced over 11% from its highs, while mainstream coins like ETH and SOL have dropped over 15%, with the total market capitalization evaporating by nearly $440 billion.

According to the editor's analysis, there is a negative correlation between Bitcoin prices and U.S. interest rates. As high-yield government bonds attract capital inflows, global liquidity is decreasing, and the liquidity support for the crypto market is weakening.

Justice Department's $6.5 Billion Bitcoin Sale: Is Market Panic Overdone?

Currently, the market is filled with speculation that the bull market has ended and Bitcoin is about to see the "80" range. Meanwhile, several analysts believe that BTC is likely to continue its short-term correction:

• Keith Alan, co-founder of Material Indicators: This correction is not yet over, and the deep correction target may reach $86,500 (a 20% retracement from the historical high).

• Well-known analyst AlphaBTC: Expects BTC to test the $90,000 support and hopes for a rebound from that level, but it depends on further price developments. If $90,000 is broken, it may test $88,600 and $87,500.

• Traders Krillin and Jelle: Expect BTC to maintain between $90,000 and $92,000 in the short term and may rebound after gaining strength in the coming month.

• Julio Moreno, head of research at CryptoQuant: The on-chain unrealized profit rate has significantly decreased, and a short-term drop to $88,000 is a healthy adjustment, laying the foundation for a future price breakthrough of $100,000.

• Jamie Coutts: Based on the macro backdrop of a strengthening dollar, BTC may further correct to $80,000, but the strong market buying indicates that long-term expectations remain bullish.

Additionally, news yesterday stated that the U.S. Justice Department has been authorized to sell $6.5 billion worth of Bitcoin seized from Silk Road. This news has heightened market concerns, especially during the transition between the Biden and Trump administrations. However, some viewpoints suggest that the market's negative reaction to this news may be exaggerated, mainly based on the following points:

The pace of the sale may be orderly to achieve the best price, rather than a one-time shock to the market.

The market has partially digested expectations, and price adjustments may have already reflected this risk.

Since September 2024, the market has absorbed over 1 million Bitcoins sold by long-term holders, yet the BTC price has still risen from $60,000 to over $100,000.

Historical data shows that large-scale government sales are usually reflected in market prices in advance, with limited impact. For example, when Germany sold 50,000 Bitcoins in 2023, the market quickly rebounded after hitting a bottom.

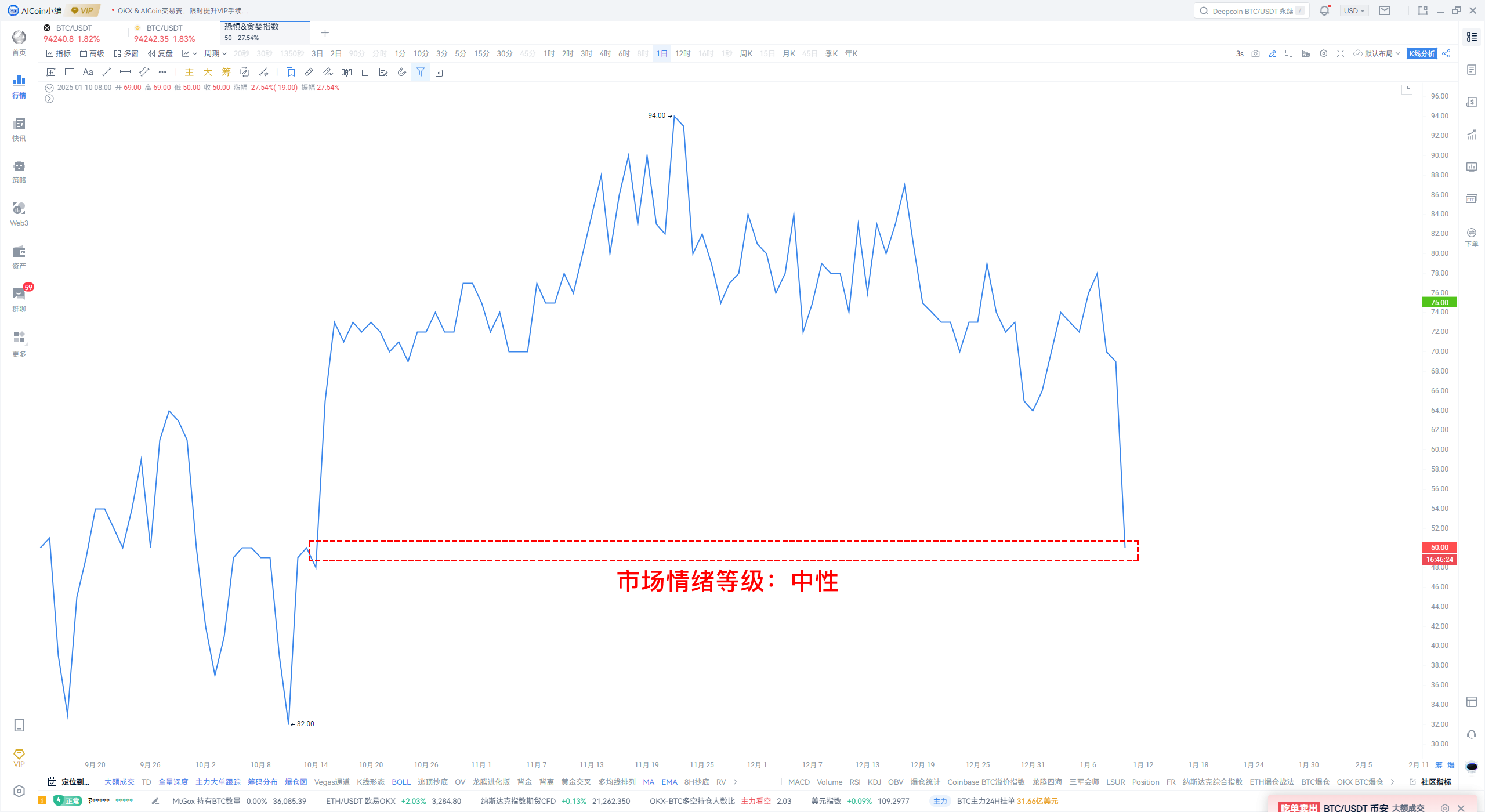

As of the time of writing, market risk aversion has surged, and the Fear & Greed Index has shifted from greed to neutral for the first time since October 15.

BTC Technical Analysis: Head and Shoulders Pattern Suppression

Overall, as the first important macro data for 2025, tonight's non-farm report, combined with the opening of U.S. stocks, is expected to trigger significant volatility.

The major order list shows that BTC bulls have begun to act, with a total of $576 million in buy orders accumulated in the past 24 hours, net buying of $206 million, with an average buying price of $92,824.43, currently up 1.48%.

Major order list: Overview of large orders and transaction conditions for BTC, ETH, etc.: https://www.aicoin.com/vip

According to technical analysis, the current Coinbase BTC premium shows signs of turning positive, Bitcoin prices have re-established above the EMA52 moving average in a 45-minute custom period, and the downward channel in the 3-hour and 4-hour periods has been broken. At the same time, BTC is approaching the neckline of the head and shoulders pattern on the daily level.

Key technical levels:

• Upper resistance: $95,450, $97,105**

• Lower support: $92,000, $91,000**

Conclusion

The market currently faces multiple variables from non-farm data, policy expectations, and the macro environment. In the short term, Bitcoin price fluctuations will still be dominated by liquidity and market sentiment, while the long-term trend may depend on the policy direction of the new government. Investors should pay attention to the impact of tonight's non-farm data on Fed policy expectations and remain vigilant for market changes after key technical level breakthroughs.

Recommended Reading:

“Bitcoin Performs 'Pinning Horror'! Who Will Laugh Last in the Bull-Bear Battle?”

“Non-farm Effect: When Traditional Economic Barometers Rock the Digital Currency Giant”

“Editor Shares: Coinbase Premium, Small Data, Big Use!”

Content is for sharing only and for reference, not constituting any investment advice!

If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。