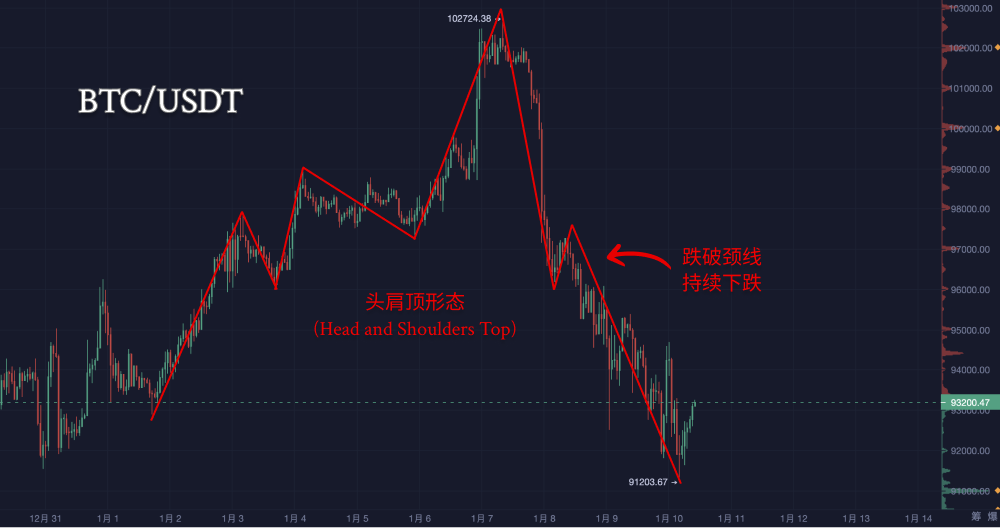

Pattern Analysis

Head and Shoulders Top

In the chart, it is evident that from January 3 to January 7, the price of Bitcoin formed a relatively complete head and shoulders top structure.

- Left Shoulder: Approximately from January 3 to January 6.

- Head: Around January 7, the price quickly fell back after reaching a high of $102,724.

- Right Shoulder: On January 8, the price rebounded but failed to approach the head's high, then fell again.

- Neckline Position: Roughly at $95,000, which is a key support point.

- After January 8, the price broke below the neckline, marking the completion of the pattern, which typically indicates significant downward momentum.

Descending Channel

- Since January 8, the price has entered a relatively steep descending channel, with peaks and troughs gradually lowering, indicating that bearish forces are dominant.

- The current trough ($91,203) and the rebound high point (around $93,000) show that the short-term trend remains weak.

Pin Bar Signal and Volume

On January 10, the chart shows a "downward pin bar" pattern, where the price quickly dipped to $91,203 and then surged, reflecting a possible phenomenon of short-term stop-loss triggers leading to a reversal.

Support and Resistance Analysis

Short-term Resistance Level: $94,303: Need to pay attention to whether it breaks out with volume; a breakout may open up further upward space.

Short-term Support Level: $91,203: This is a key defensive area for bulls; if it breaks, it may further decline.

The probability of range-bound fluctuations is high: there is a significant possibility of oscillating between $91,203 and $94,414, requiring attention to trading volume and key level breakouts.

Technical Indicators and Sentiment Analysis

Volume: As the price approaches $92,000, a significant trading volume area appears, indicating that overall, the trading volume is unstable, reflecting large fluctuations in market sentiment.

MACD: The current MACD is in the negative zone but shows a trend towards the zero axis, indicating a weakening of selling pressure.

RSI: The RSI value is close to 50, not entering overbought or oversold territory, suggesting that it may continue to oscillate in the short term.

EMA: The 7-hour EMA ($92,914) is below the 30-hour EMA ($93,563), and the 120-hour EMA ($96,005) is far above the current price, indicating a continued downward trend in the medium to long term.

Market Sentiment: Combined with the "rapid pin bar," the market shows panic sentiment, with long positions significantly liquidated during the sharp drop, and sentiment remains bearish.

Bollinger Bands Analysis

1. Upper Bollinger Band ($94,416.43)

- Resistance Level Confirmation: The area near the upper band is usually a short-term resistance zone; the market may maintain oscillation or retracement until the price effectively breaks above the upper band.

- If the price can break through and stabilize above the upper band, it may initiate a new upward trend. If the price is blocked near the upper band, it may face retracement pressure in the short term.

2. Lower Bollinger Band ($91,571.20)

- Support Level Confirmation: The area near the lower band is a strong support zone, and prices touching this area usually have a rebound demand.

- Observation Point: The current lowest point of $91,203.67 is already close to the lower Bollinger Band, indicating strong bearish pressure, but if the support holds, a short-term rebound may occur. If it breaks below the lower band and continues to operate, it may trigger a larger downward trend.

3. Middle Bollinger Band ($92,993.82)

- Neutral Zone: The middle band is the equilibrium line for prices; currently, the price hovers below the middle band, indicating that the market is still in a weak phase.

- Key Signal: If the price can stabilize above the middle band, it indicates an improvement in market sentiment. If the middle band continues to suppress, the market may continue its downward oscillation trend.

Market Volatility and Short-term Trend

- Bollinger Bands Opening Widening: The current Bollinger Bands are widely opened, indicating increased market volatility, with significant divergence between bulls and bears. It is suitable to pay attention to whether reversal signals appear near the upper and lower bands to determine the next market direction.

- Short-term Trend Judgment: Oscillating Downward: The price operates between the middle band and the lower band, indicating that bearish forces are dominant. If the next few candlesticks cannot break through the middle band, the probability of continuing weak oscillation remains high.

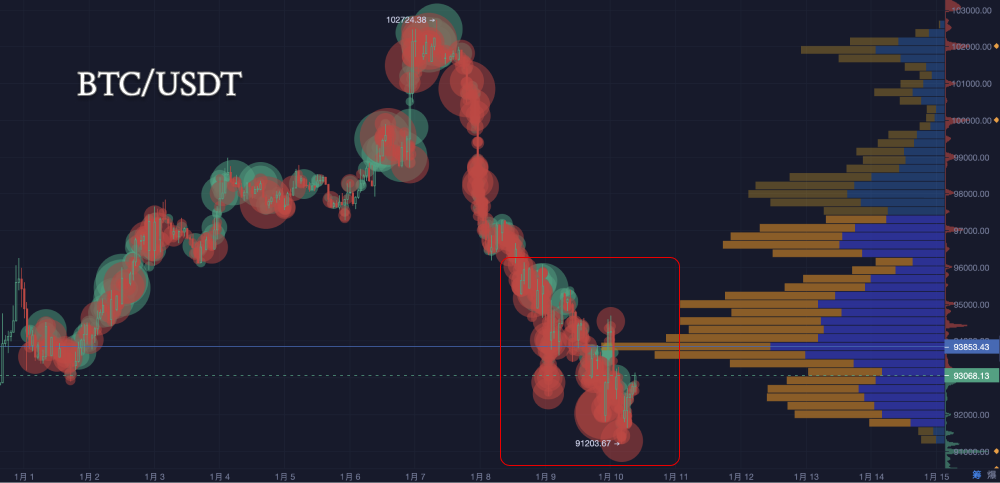

Large Transactions & Chip Distribution Analysis

Large Transaction Analysis

- Red: During the price decline since January 8, a large number of red circles appeared, indicating that selling pressure continues to increase. Particularly near the low point of $91,203.67, the number of red circles significantly increased, possibly indicating accelerated selling by bears.

- Green: There are also some green circles during the decline, but they are fewer and concentrated in local rebound positions, indicating that bulls are attempting to absorb but with limited strength. The increase in green circles near the current price may indicate that some funds are trying to bottom out at low levels.

- Trading Interpretation: The current market is in a bearish dominant state, but there is bottom-fishing behavior near $91,203, requiring attention to the effectiveness of support in that area. If subsequent green circles increase and break through the current downward trend, a rebound may occur.

Chip Distribution Analysis

- Chip Peak Position: In the chart, the area with the densest chips is around $94,083.85. This indicates that the $94,000-$95,000 range is a previous dense trading area, currently acting as an upper resistance zone.

- Current Chip Distribution: The chips near the current price of $92,927.30 are relatively few, indicating that trading is not active at this position. If the price continues to decline, there is little chip support near $91,000, which may lead to further declines.

- Chip Interpretation: There is a lack of sufficient chip support below the price; if bulls cannot effectively absorb, it may continue to test $91,000 or lower support. The upper $94,000-$95,000 area is dense with chips, requiring a volume breakout to open up upward space.

Today's Trend Prediction

Base Prediction: Oscillating Bearish

- Volatility Range: The price may oscillate between $91,500 and $94,500.

- Rebound Target: A short-term rebound may test the $93,000 - $94,500 area, but pressure is significant.

- Downward Risk: If it breaks below $91,000, it is highly likely to further test the $88,000 area.

Secondary Prediction: Strong Rebound

If the price stabilizes above $92,500 and continues to increase in volume, it may challenge the $95,000 area, but macro-positive factors or capital push are needed.

Strategy Suggestions

Short-term Traders

- Long Position Strategy: Attempt to establish long positions near $91,500, with stop-loss set below $91,000, targeting $93,500 - $94,500.

- Short Position Strategy: If the price rebounds to $94,500 but fails to break through, consider lightly establishing short positions in the $94,000 - $94,500 range, targeting $91,000.

Medium to Long-term Investors

In the current price range, consider gradually building positions on dips, but keep the position within 30% of total investment, waiting for future prices to return above $105,000 in the medium to long-term trend.

Stop-loss and Take-profit Settings

- Stop-loss Suggestion: If entering near the lower band, set the stop-loss below $91,000. If building positions near the middle band, set the stop-loss below $92,500.

- Take-profit Suggestion: The target price can refer to the upper band around $94,416; after breaking through, gradually raise the take-profit position.

Risk Warning

The current market volatility is high, and it is essential to closely monitor the global macro environment (such as Federal Reserve dynamics, CPI data) and significant news in the cryptocurrency space (such as large on-chain transfers, exchange fund flows, etc.).

Disclaimer: The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。