On January 9th at 16:00, the AICoin Research Institute conducted a graphic and text sharing session titled 【Coinbase Premium Insights into US Market Funds】. Below is a summary of the live broadcast content.

Today, the research institute will analyze the indicators of the US stock market, starting with the classic - the Coinbase market premium.

First, let’s take a look at the host's homework.

Homework 1: Arbitrage

In the last three days, the host's arbitrage has also been in a slight loss state, but the host continues to hold long-term.

This is the result from the host's 30,000 USDT principal.

Why does the host always mention a principal of 30,000 USDT?

Because the host arbitrages with this 30,000 USDT principal every month and takes out the profits.

Generally, with a 30,000 USDT principal, the minimum profit can range from 300 to 800 USDT in arbitrage earnings per month. Therefore, every month, the host not only helps everyone explore whether arbitrage is feasible but also earns a little bit of pocket money through AICoin's arbitrage tools, achieving the freedom to eat.

This is the host's first homework. In recent days, it has been tough for everyone, but currently, the funding rate has turned positive, making it suitable for arbitrage and potential profits.

If you want to get started with arbitrage, you can learn here, as there is a large group of arbitrage professionals.

In fact, there are many arbitrage players because once the positions are opened, they just chat and wait for the money to come in.

So, if you want to learn about arbitrage, feel free to join AICoin's arbitrage club and collaborate with professional arbitrage players. We also provide a wealth of tutorials here at AICoin.

Homework 2: AI Grid

The second homework!! Still exploring the AI grid for everyone: since the host is doing long grids, during this pullback, the host's 700 USDT also trembled, with the yield dropping from a high of 14% to 3%.

At this time, let’s first look at the K-line, which has returned to the bottom of the range. The host does not plan to move the grid for now.

If the K-line breaks below this 90,000 range, the host will create a new grid to accompany everyone, using the grid to make money. If it really drops, the host will also run a new range, which will be announced later. The host's testing results hope to help everyone explore trading tools.

A friend in the comments asked, "Will there be any rebates for high-frequency grid trading?"

In fact, many people run high-frequency grids, partly to make quick profits and partly to increase trading volume, which enhances their account level. With a higher VIP level, trading fees will decrease, and then senior managers from the exchange will connect with you. This is a process that professional traders can go through.

Grids can make a lot of money! If you want to learn about grids, you can open the AICoin client.

Currently, the grid host will continue to explore for everyone and accumulate experience. If later everyone also starts using the arbitrage and grid tools, you are welcome to come to our live room for more exchanges! For professional players, we invite you to share, truly achieving common prosperity in the live room!

Homework submitted, and the current summary is:

- Arbitrage opportunities have turned positive and can continue to operate.

- Grid trading needs to see if the current price breaks below 90,000 or stabilizes above 90,000. If it breaks below 90,000, the host's next planned grid is expected to be between 86,000 - 96,000. If it stabilizes, the host will continue to maintain the grid range of 96,000 - 106,000.

Practical Sharing

Next, the host will share how to gain insights into US market funds through the Coinbase premium.

First, has anyone used the Coinbase premium index?

Let’s take a look together.

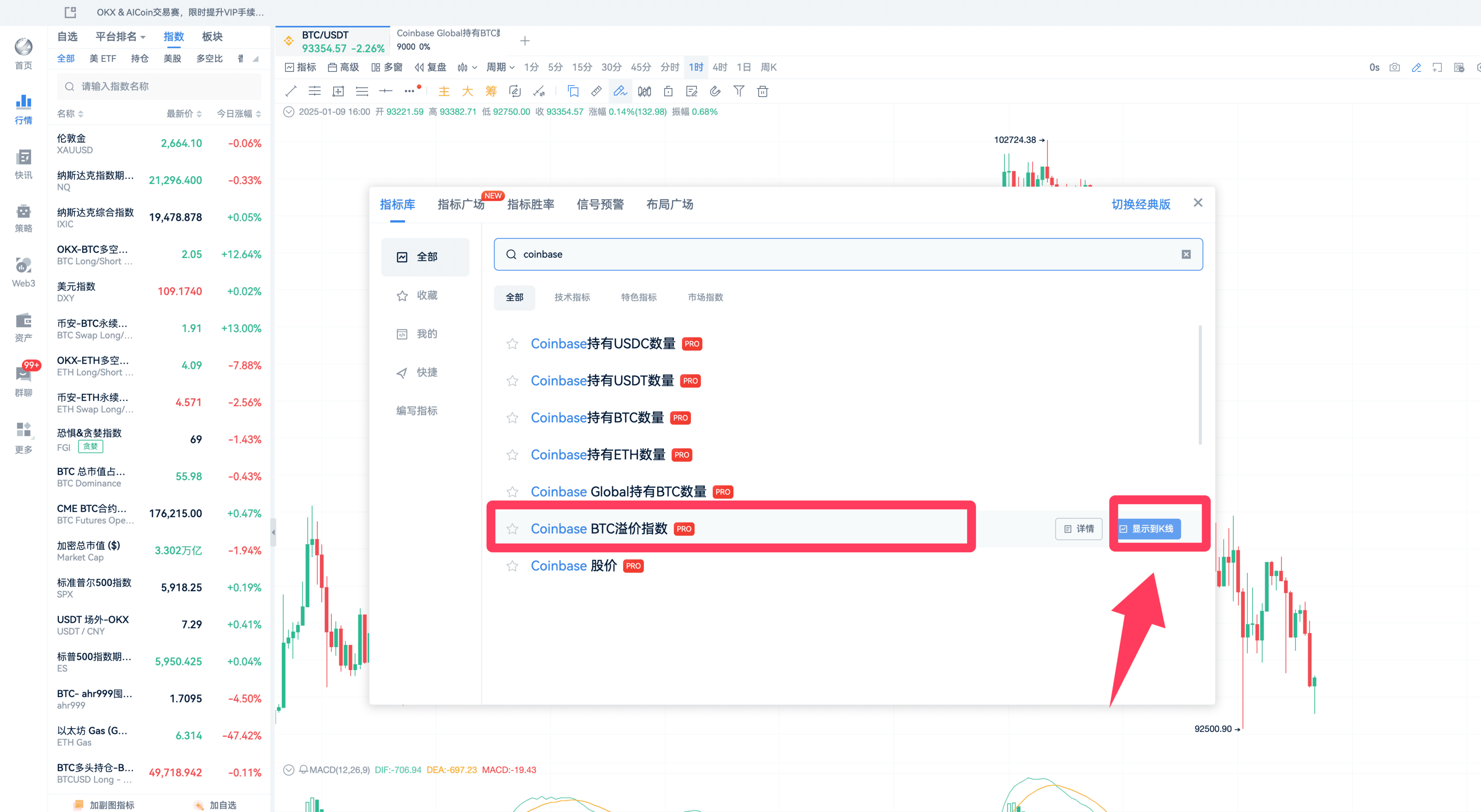

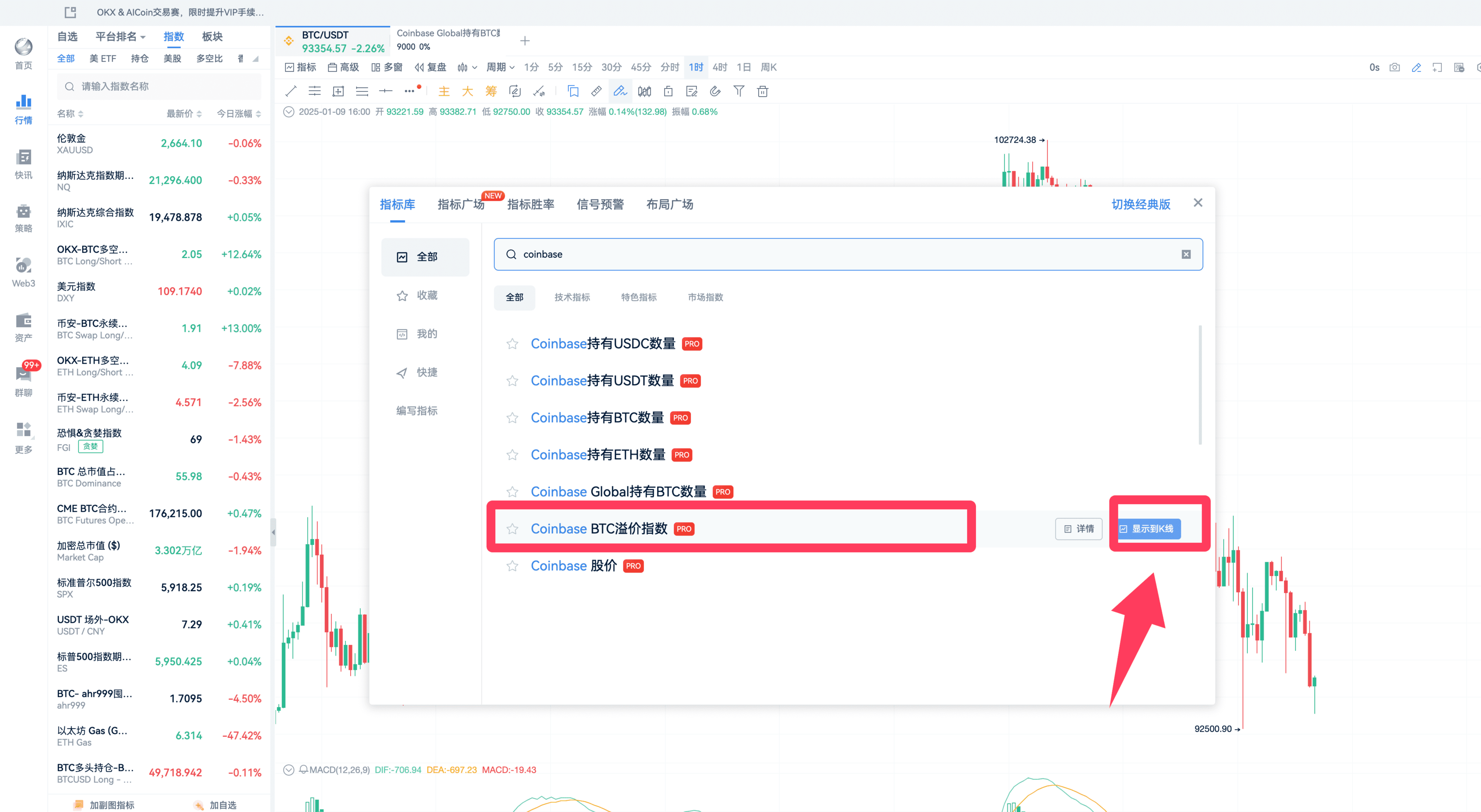

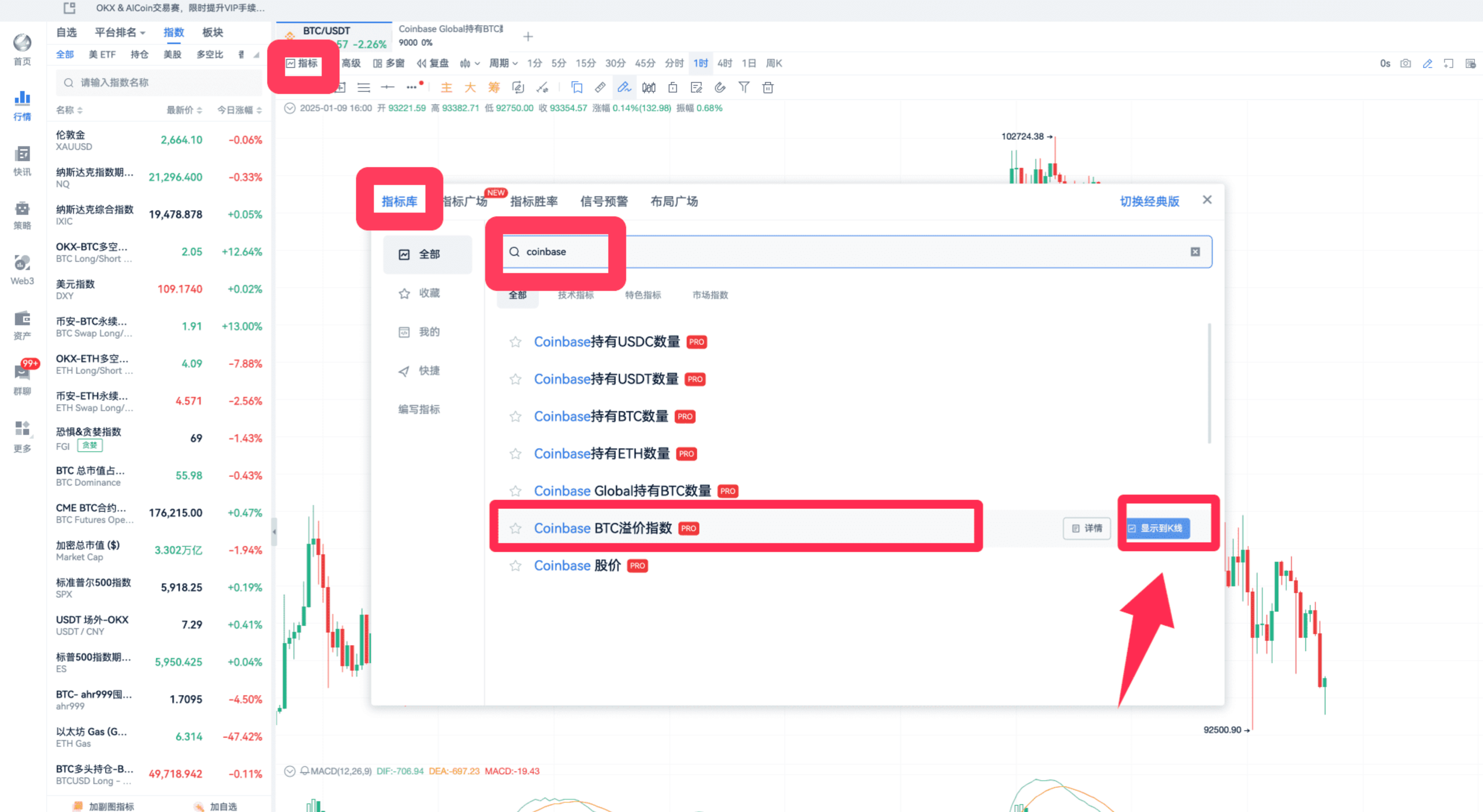

Search for Coinbase here.

Place it on the K-line.

This is a premium index.

How is the data for this indicator formed?

The Coinbase BTC premium refers to the price difference between Bitcoin on the Coinbase exchange and other exchanges (such as Binance, Kraken, etc.), serving as a barometer of US investor demand.

When the price of Bitcoin on Coinbase is higher than on other exchanges, it is called a positive premium; conversely, it is a negative premium.

In essence, it is the price difference, which can be understood as the premium situation between Coinbase and other exchanges.

So how should it be used more reasonably? There are several aspects:

- Reflecting US market demand

Coinbase is one of the largest cryptocurrency exchanges in the US, and the price difference between it and other major global exchanges can reflect the demand situation in the US market.

When the BTC price on Coinbase is higher than on other platforms (like Binance), it usually indicates that US investors have a higher demand for BTC and are willing to pay a higher price to purchase Bitcoin.

We all know that Wall Street controls the largest funds globally, so the Coinbase premium will be the most impactful indicator for the cryptocurrency market.

- Institutional investor sentiment indicator

The trading activity on the Coinbase platform is primarily driven by institutional investors, and the changes in its premium can reflect the strength of institutional buying or selling demand.

When the Coinbase premium is positive, it indicates strong buying demand from institutional investors, while a negative premium may suggest increased selling pressure from institutional investors. Consequently, users on other exchanges may follow suit.

- Extending the next function of Coinbase: revealing capital flows

When the premium rises, it indicates capital inflow into the US market, while when the premium falls or turns negative, it indicates capital outflow.

Similarly, the premium index can present arbitrage opportunities: traders can use the premium difference for cross-platform arbitrage. For example, when the premium is positive, they can buy Bitcoin on the lower-priced platform and sell it on Coinbase for profit. However, this is currently a relatively theoretical concept, as manual opportunities are rare and difficult for our live room friends. Programmatic arbitrage still has a bit of profit space.

This index can also be used for market predictions.

When the Coinbase premium turns from negative to positive, it usually means that the main force in the US market has started buying, and the rise of Bitcoin will be relatively stable.

When the premium rises significantly, it indicates an increase in the buying strength (demand) of the main buyers, likely leading to a noticeable upward trend. Conversely, when the Coinbase premium turns from positive to negative, it may signal a weakening of US demand.

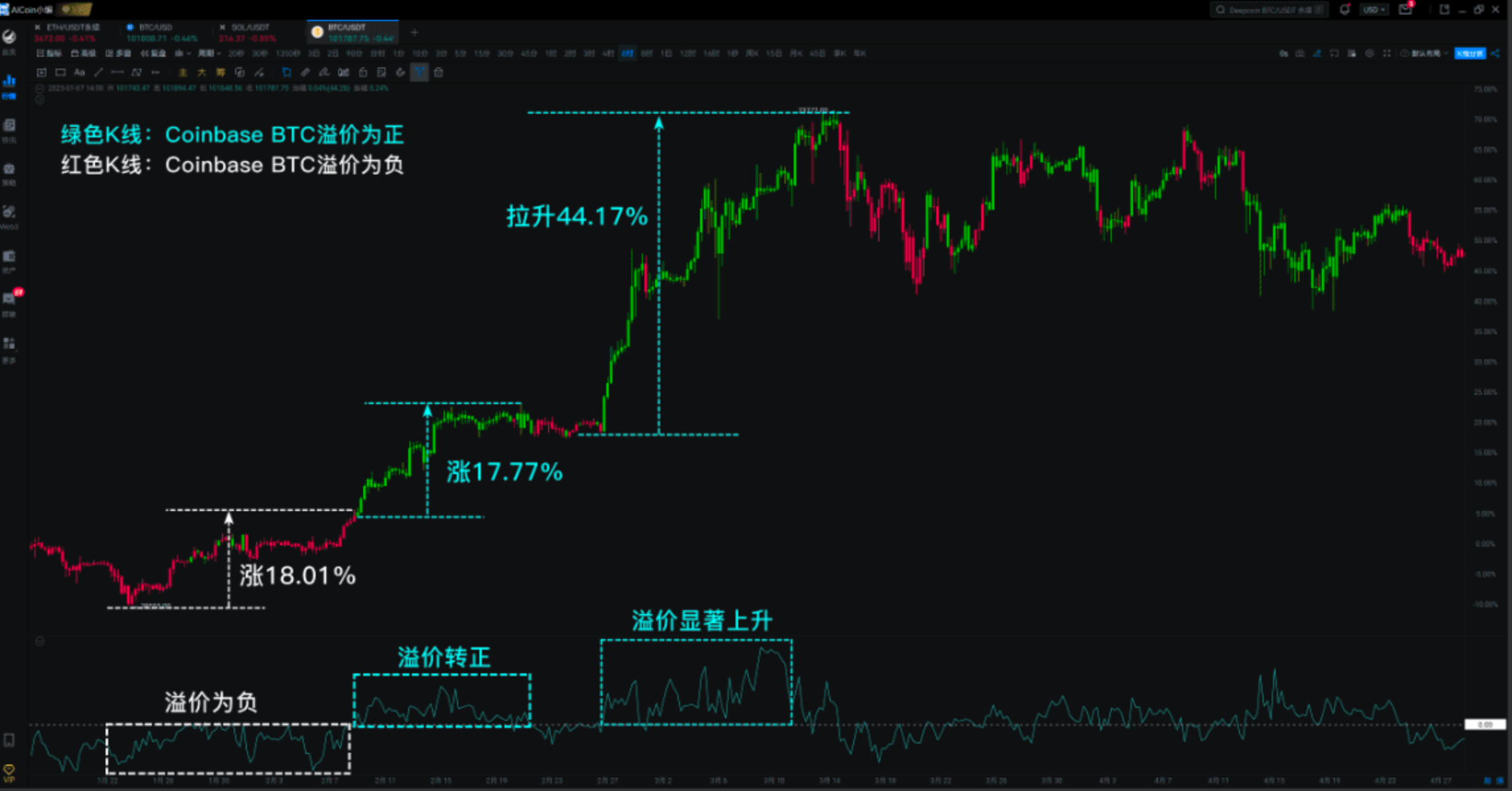

Let’s take an example of Bitcoin's performance in the first quarter of 2024:

When the premium is negative, the BTC price slowly rises, increasing by 18% over 17 days.

When the premium turns positive, the Bitcoin price maintains an upward trend, with a significant increase in the rate, rising about 17.8% over 12 days.

When the premium is positive and rises significantly, BTC skyrockets, increasing by 44.17% over 17 days!

The Coinbase premium index can be utilized in this way!

It is recommended that everyone add it to your auxiliary indicators for use.

Currently, PRO members using this index also support alert functions.

The Coinbase index sharing ends here. You can take a closer look at this chart to understand it; this is a very practical indicator exclusive to PRO members.

Some friends asked where to find the indicator; you can refer to this chart.

That concludes all the content of the live broadcast.

Thank you all for your attention, and stay tuned to our live room.

In a bull market, let’s explore the trends together and find trading opportunities! Use AICoin well to earn a free life.

Recommended Reading

For more live broadcast insights, please follow AICoin's “AICoin - Leading Data Market, Intelligent Tool Platform” section, and feel free to download AICoin - Leading Data Market, Intelligent Tool Platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。