Master Discusses Hot Topics:

Yesterday, when the market dropped, many people pointed fingers at the Silk Road, calling it the culprit. However, in the capital market, any news that can be quantified is not considered a true negative.

During the period of Grayscale selling and the Mentougou liquidation, didn't the market also go through some turmoil before it passed? What truly scares people is the unknown. Once the cards are on the table, the panic is almost over.

Now, let's talk about tonight's non-farm payroll data. Many believe there will be significant movement, but it's not that exaggerated. The market always acts in advance; the real decline has already been digested in the previous days.

The key to the non-farm data is whether to raise interest rates in January, but the December meeting has already signaled no rate hike, so there's nothing new to stir up now. Today's data might cause slight fluctuations in the market, but let's skip the dramatic waves; as Master mentioned in yesterday's article, it won't be explosive but it won't crash either.

Last night, Bitcoin took advantage of the US stock market being closed and managed to hold a rebound during the Asian session. After three consecutive daily declines, a rebound was almost expected. This rebound came with volume, clearly not fabricated, but rather a breath of fresh air in the market adjustment.

As for after tonight's non-farm data, I tend to remain optimistic about the rebound in the 9.5k-9.6k range, as the bulls' resilience is still there. If you ask me why, Master just wants to say the bull market is still on, the bull market is still on!

Speaking of which, let's recall last October. At that time, Bitcoin fell below 59k, and the market was filled with pessimism, with countless people calling for a bear market. Some KOLs even set a target price of 20k, but a month later, Bitcoin broke through 80k.

A little over a month later, the price doubled. In comparison, the current situation is much more optimistic. It has risen 57% and has only been consolidating for two months, so is it too early to say a bear market has arrived?

If it were to fall back into a bear market, it would at least have to return to 59k. And right now, even the bottom of the 65k range is still stable, so why rush to conclusions? Not to mention next year's halving cycle, which has historically never been a wrong bullish signal. The last time the halving occurred, Bitcoin doubled six months later; no need to elaborate, everyone knows!

Master Looks at Trends:

Resistance Levels:

First Resistance Level: 94200

Second Resistance Level: 93500

Support Levels:

First Support Level: 92400

Second Support Level: 91700

Today's Suggestions:

Last night, after maintaining a rapid downward trend, Bitcoin still has the potential to seek a trend reversal in the short term. From a technical analysis perspective, due to the formation of a bullish divergence, a rebound may occur in the short term, and maintaining a consolidation trend in the 92.4~93.5K range is particularly important.

After a short-term adjustment at the first resistance level, if it forms a pullback to the support area and raises the low points, one can attempt a very short-term rebound trading opportunity. Upon reaching the first resistance, a reasonable pullback target is expected to be 92.4K.

If it adjusts after reaching the upper resistance and pulls back to the first support level and stabilizes, it can be seen as a reasonable pullback, with 91.7K considered a short-term bottom support. Currently, it is not advisable to expect a V-shaped reversal; if the price oscillates in the 92.4~93.5K range and forms a consolidation, it will create better conditions for further rebounds.

After multiple large fluctuations in the current market, if there is no significant volume accompanying a clear long bullish line, it is expected that there will be heavy selling pressure above (i.e., many trapped positions). When attempting rebound trades, it is essential to maintain a short-term trading strategy, suggesting quick entries and exits to take profits promptly to reduce risk.

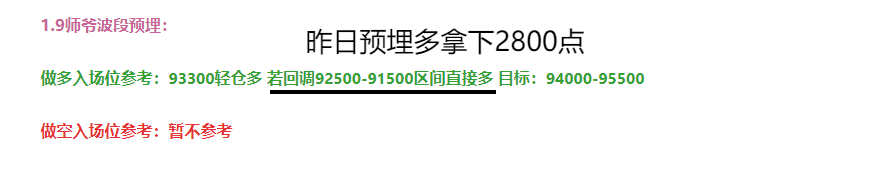

1.10 Master’s Band Trading Strategy:

Long Entry Reference: 90600-91055 range with small loss and light position; if it dips to around 88800, go long directly. Target: 93500-94200

Short Entry Reference: 95400-96050 range with light position; Target: 94200-93500

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, liquidation, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm Reminder: This article is only written by Master Chen on the official public account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in discerning authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。