This article takes you deep into the ecological highlights and development logic of $SONIC, fully revealing this hot star project and analyzing the future growth blueprint of $SONIC.

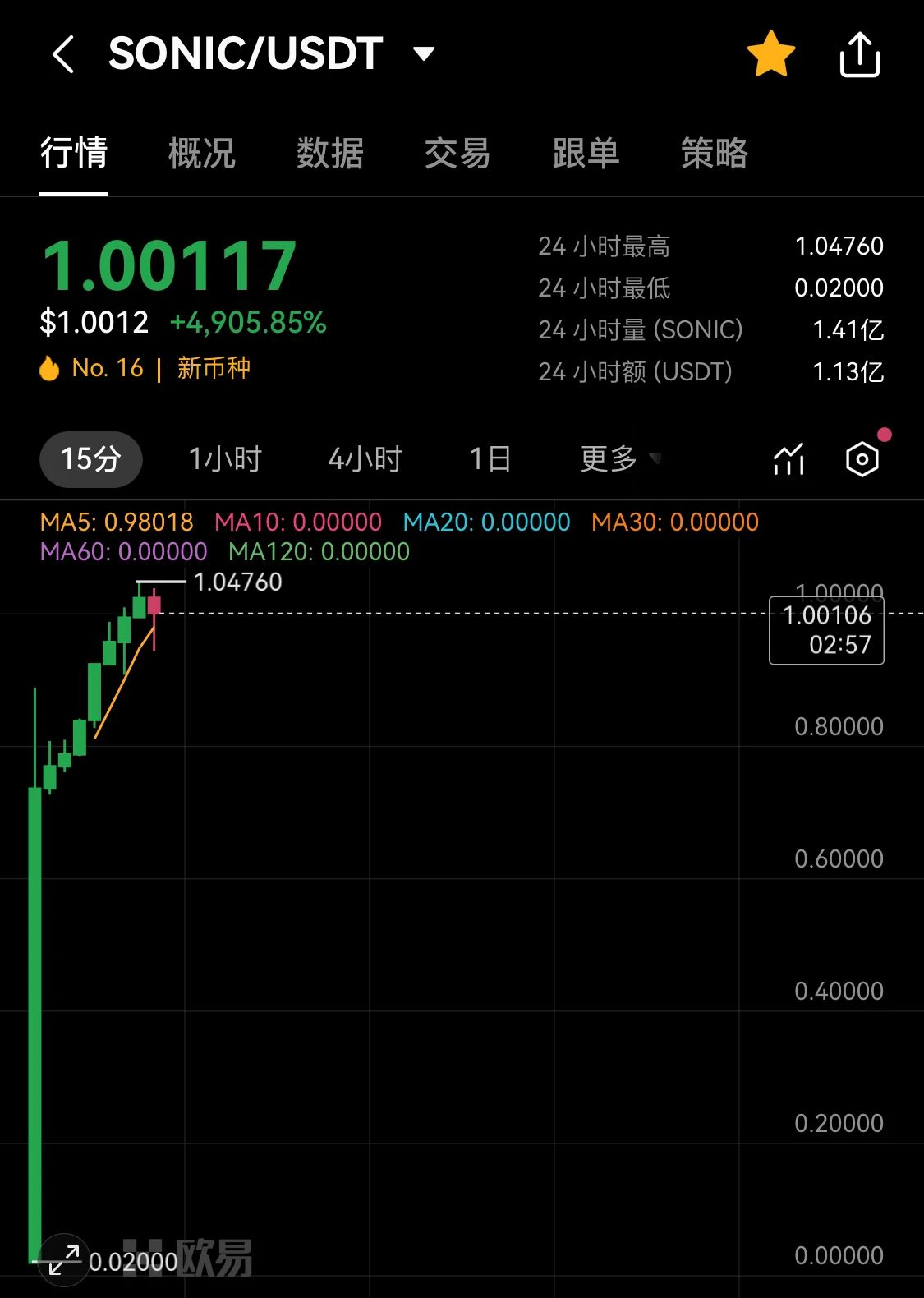

On January 7th at 20:00 Beijing time, the SONIC SVM token $SONIC officially landed on leading global trading platforms such as OKX, BYBIT, and BITGET, and will launch tomorrow on South Korea's top exchange, Upbit.

This multi-platform simultaneous launch has made $SONIC the market focus, and its performance post-launch has been remarkable, with prices soaring in a short time, peaking at over 5000%, attracting significant attention from both inside and outside the industry.

What has led to such a strong market performance for $SONIC on its launch day? What unique advantages, ecological potential, and market strategies are hidden behind this impressive achievement? This article (January 6, 137Labs "The Next Massive User Growth Engine in Web3 - SONIC SVM" X SPACE text accumulation) will take you deep into the ecological highlights and development logic of $SONIC, revealing this hot star project from technical strength to community operation, from project positioning to market layout, and analyzing the future growth blueprint of $SONIC.

Q1

Can you talk about why 137Labs discovered and favored Sonic SVM in their investment research?

Ivan mentioned that 137Labs noticed Sonic SVM as early as June and believed it was a project worth paying attention to. At that time, Sonic SVM had just completed its financing and launched the Odyssey campaign aimed at attracting users through this new user acquisition activity. As the first Rollup project under the Solana ecosystem, Sonic SVM has significant market potential. Any core project that launches first in a particular ecosystem will seize the market opportunity, gain more users and traffic, and also increase TVL.

By November, Sonic SVM announced that it had successfully attracted 1 million users through TikTok, which led 137Labs to elevate this project to a key focus. Ivan particularly emphasized that projects that can gain traffic through TikTok are worth high attention because TikTok's user base and its short video dissemination capability make any traffic acquired through this platform extremely valuable.

For example, at that time, Telegram converted users into Ton chain users and then transformed them into Token holders through Ton chain's mini-games. Although the conversion process was complex, it successfully promoted the market value growth of the Ton chain. Therefore, any Web3 project that can acquire massive users through similar platforms has enormous market potential.

Ivan believes that the current user scale in the Web3 and Crypto fields is relatively small, while TikTok can bring hundreds of millions of users to these fields. If a platform can successfully attract so many users, its prospects and valuation will be very considerable.

OneOne mentioned that when looking for Alpha projects, he usually focuses on those with innovative new technologies, narratives, or gameplay. He believes that Sonic SVM is a typical project that meets this standard. In researching new projects, he discovered this new technology based on Solana—Light Protocol. This technology piqued his interest, and upon further research, he found that Sonic SVM was utilizing this new technology, and in addition to Light Protocol, Sonic SVM also had other innovative technological updates that met his standards on a technical level. OneOne emphasized that his focus is more on the project's technological innovation, especially the depth and uniqueness of the technical implementation, which is the main reason for his interest in Sonic SVM.

Q2

Sonic SVM is referred to as the TikTok App Layer; how should this positioning be understood? Why is it considered comparable to TON? In what aspects does Sonic have advantages or shortcomings compared to TON? Where does the attractiveness of its business model lie?

Ningning mentioned that 2025 may become the era of "fat applications," and the "mass adoption" of Web3 will enter a new stage. He believes that in the past, when promoting the popularization of Web3, we usually relied on some abstract infrastructure, such as DID or account abstraction, but these did not directly lead to user conversion. The problem is that ordinary users do not have as strong a demand for decentralization and privacy as the industry expects; they are more concerned about how to conveniently enter the Web3 world and enjoy high returns on-chain. Therefore, user acquisition in Web3 needs to address not only technical barriers but also simplify the user onboarding process.

In this context, Ningning emphasized that Sonic SVM's success in attracting users through TikTok is a key strategic move. TikTok has a large and high-quality young user base, especially in North America and Europe, where users are very friendly towards Web3 and cryptocurrencies. Compared to Telegram, TikTok's user base is of higher quality and more accepting of cryptocurrencies and other Web3 applications. Sonic SVM's choice to attract users through TikTok is a market opportunity it has keenly captured, and positioning itself as the "TikTok chain" is very appropriate because it can find target users in the largest traffic pool.

Technically, Sonic SVM is like a Layer 2 based on Solana, inheriting Solana's high TPS and concurrency characteristics while maintaining efficient performance. Although Sonic SVM, as an L2, has certain centralization issues, Ningning believes these issues are not significant to users; what users care more about is the security, data transparency, and verifiability on-chain, all of which Sonic SVM can provide. Users are more concerned about being able to enter the Web3 world through a simple method (such as one-click connection with a TikTok account) and participate in high-yield DeFi applications.

Ningning also emphasized that Sonic SVM's business model reflects a very successful "product-market fit." By simplifying the user access process and providing high-value assets on-chain, Sonic SVM offers unique appeal to Web3 users. This has a clear advantage compared to traditional financial products, as Web3 can provide high returns and unparalleled asset types. Ningning believes that Sonic SVM's positioning and user acquisition strategy fully demonstrate the attractiveness of its business model.

Ivan conducted an in-depth analysis from a business perspective on why Sonic SVM is referred to as the "TikTok App Layer" and its comparison with TON.

Similarities between Sonic SVM and TON:

First, Sonic SVM and TON share a common foundation; both have large social media user bases behind them. Sonic SVM is backed by TikTok, while TON is supported by Telegram. According to 2024 data, TikTok has 1.58 billion monthly active users, while Telegram has 950 million monthly active users. Both platforms have a massive user base, which has great potential for promoting Web3 and cryptocurrencies. Additionally, the teams behind these two projects have close ties to their respective social platforms. TON is led by the founding team of Telegram, while Sonic SVM's founders have experience with ByteDance (the parent company of TikTok). Furthermore, the Sonic SVM team has a deep cooperative relationship with the Solana Foundation and the Solana ecosystem.

Second, both Sonic SVM and TON utilize mini-games as a means of attracting users. TON previously attracted users through the "Tap to Earn" game, while Sonic SVM also employs a similar approach, using mini-games and other content to draw users into the Web3 world.

Third, both have social platform identity verification and wallet recovery; both can generate login information and perform wallet recovery through social media platforms, simplifying the user onboarding and operation process, enhancing user convenience.

Differences between Sonic SVM and TON:

First is the dissemination capability of short videos; compared to Telegram, TikTok's short video content has greater dissemination and virality. Research shows that the conversion rate of short video users is 2.2 times or even higher than that of text content. Therefore, TikTok provides Sonic SVM with a more potential dissemination platform.

Second is the difference in user value; TikTok's user base mainly comes from North America, Europe, and the Asia-Pacific region, where users have strong payment capabilities. In contrast, Telegram's user base is more from developing countries such as Eastern Europe, Southeast Asia, and Africa, where users have weaker payment capabilities. TikTok's high proportion of young users has a higher conversion rate, especially in marketing promotion, where the conversion efficiency of young users can reach up to 70%. In contrast, the proportion of young users on Telegram is 19%, with relatively low conversion efficiency. Regarding ARPU (average revenue per user), TikTok's ARPU is $11.7, while Telegram's ARPU is only $1, a difference of over 10 times. The gap in ARPPU (average revenue per paying user) is even more significant. This also indicates that TikTok's user commercial value is significantly higher than that of Telegram. Additionally, regarding data authenticity, TikTok requires users to undergo KYC verification, while Telegram allows non-KYC users to use its platform.

The third difference is the choice of traffic platforms. While Telegram is currently the main platform for early user acquisition in cryptocurrency projects, TikTok is just starting as a traffic platform and has significant development potential. TikTok's vast traffic pool and its young, high-paying user base provide Sonic SVM with a huge potential market. In contrast, the TON chain, as an emerging project, started later, and its on-chain activity and ecological projects are still developing, while the Solana ecosystem is already very mature. As a Layer 2 solution for Solana, Sonic SVM can seamlessly integrate into Solana's ecosystem, benefiting from its mature technical support and project resources.

Therefore, Sonic SVM's business model is highly attractive. For cryptocurrency projects, user acquisition and payment capability are crucial. Sonic SVM has enormous user conversion potential through TikTok's user base, especially its young users with high payment capabilities. The payment ability and willingness to convert of TikTok users enable Sonic SVM to attract more user funds, thereby driving on-chain activities and the growth of TVL.

Moreover, users not only need to come in but also need to bring funds to create a pool of deposited funds and liquidity, which can generate higher value for Sonic SVM. Through TikTok, a high-conversion platform, Sonic SVM is expected to attract a large amount of capital, further promoting the prosperity of its DeFi, GameFi, and other ecosystems.

Compared to TON, Sonic SVM, through its integration with TikTok, can better align Web3 technology with user needs, especially in terms of user conversion and payment capability. Therefore, Sonic SVM can not only achieve user growth but also promote the popularization of Web3 applications.

Q3

Binding wallets to social media accounts raises the question: if the social media account is hacked, is there a risk of the wallet being stolen?

Ivan pointed out that wallets bound to social media accounts are typically referred to as account abstraction (AA) wallets. While this method simplifies the user experience, it may also introduce some risks. Users do not directly hold their keys; instead, they are hosted by the social media platform or other third parties. This means that even if the social media account is hacked, attackers cannot directly access the private keys. The only thing attackers can do is transfer assets from the account. However, if users can promptly change the password of their social media account and have enabled two-factor authentication, then even if the account is hacked, a quick response can protect the account.

Ivan mentioned that if users have not set up two-factor authentication and attackers have already stolen the social media account, the best course of action is to immediately change the password and log out of all other devices. This way, attackers cannot continue to operate the account. Enabling two-factor authentication is one of the most effective preventive measures, significantly increasing the difficulty of account theft; even if the password is leaked, attackers still cannot log into the account.

Of course, the emergence of such risks is also closely related to the security of the platform itself. If the platform fails to effectively safeguard user account security, there is indeed a possibility of large-scale account theft. However, if the platform prioritizes security and strengthens protective measures, such risks can be controlled.

Q4

What are the key innovations in SonicSVM's technical architecture? What are the core features of HyperGrid and HSSN? How does Sonic's technical solution differ from Ethereum Rollup? Can you summarize the essence of HyperGrid in one sentence?

OneOne mentioned that SonicSVM's technical architecture can be understood by comparing it to Ethereum's Layer 2 solutions, but it is not a Layer 2 of Solana. Unlike Ethereum's Layer 2 (such as Optimism, Arbitrum, etc.), SonicSVM's technical innovation lies in its bidirectional synchronization mechanism. Ethereum's Layer 2 synchronizes states in a unidirectional manner, meaning they sync states to the Ethereum main chain, but the main chain's state does not write back to Layer 2. One of the core technologies of HyperGrid—HyperGrid Shared State Network (HSSN)—achieves bidirectional synchronization, meaning that Solana's state can be synchronized to the Sonic chain, while Sonic's state can also be synchronized back to Solana, allowing for closer collaboration between the two chains.

Another innovative feature of HyperGrid is its grid structure. This grid allows multiple nodes to perform state synchronization in parallel while improving system throughput through state compression and Byzantine fault tolerance mechanisms. Specifically, by increasing the number of grid nodes, SonicSVM can handle more state synchronization requests, thereby enhancing the system's processing capacity, which is crucial for throughput improvement.

In addition to the grid structure and throughput enhancement, HyperGrid's technical framework is also compatible with the Solana Virtual Machine (SVM). This allows applications originally on the Solana chain to seamlessly migrate to the Sonic chain. This technical innovation ensures that applications running on the Sonic chain can interoperate with those on the Solana chain, providing a level of "equivalence" similar to Ethereum Layer 2—meaning that native Solana chain applications can run on the Sonic chain without modification of code.

Finally, OneOne emphasized that SonicSVM's grid structure allows it to exceed Solana itself in speed, thus having a performance advantage. This design of bidirectional synchronization and high throughput demonstrates SonicSVM's differentiated advantages compared to Ethereum Rollup. Overall, the essence of HyperGrid can be summarized as: achieving cross-chain interoperability and higher throughput capabilities through efficient state synchronization and grid architecture.

Ivan first introduced the similarities between Hypergrid and Ethereum Rollup. Hypergrid is called "Grid" because it consists of multiple grids, each of which can be seen as a Rollup, similar to Ethereum Rollup or Solana's Layer 2 solutions. Each Grid is on an equal level with other Grids and can be viewed as Layer 2. Ethereum's Layer 2 (such as Optimism, Arbitrum) relies on the Ethereum main chain to complete consensus, state availability, and settlement, while Hypergrid, similar to Solana, delegates these functions to the Solana main chain.

In this regard, Hypergrid manages and verifies states through the HyperGrid Shared State Network (HSSN). Compared to Ethereum Rollup, Hypergrid's state generation and sorting processes are similar; both first complete sorting in the Grid and generate state hashes, then pass this information to HSSN. HSSN is responsible for uniformly managing these sorted transactions and states and ultimately submitting them to Solana for final confirmation. Once confirmed by Solana, the entire transaction becomes immutable.

To explain how HSSN works, Ivan used a simple analogy: Solana is like a "club" that often faces various issues due to busy operations. To alleviate Solana's burden, HSSN suggests that Solana open multiple "branches," meaning each Grid acts like a branch, handling local transactions and state sorting. Each branch (Grid) generates the state hash of transactions and then submits it to HSSN, which performs global sorting and unified accounting, ultimately submitting all data to Solana for final confirmation. This mechanism not only reduces the pressure on the Solana main chain but also improves the overall system's efficiency through decentralized processing.

Additionally, HSSN's ZK verification (zero-knowledge proof) mechanism further optimizes system performance. Through Light Protocol's ZK verification, Hypergrid can further reduce Solana's load and avoid potential risks such as DoS attacks. At the same time, ZK verification can also accelerate the final confirmation of states, ensuring that transactions are irreversible.

In terms of interoperability, Ivan emphasized the compatibility between Hypergrid and Solana. Hypergrid not only allows ecological projects on the Solana chain to seamlessly migrate to Hypergrid but also enables all assets and data on the Solana chain to migrate seamlessly to Sonic SVM. This means that assets and data can be directly transferred to the Sonic chain without relying on third-party cross-chain bridges. Therefore, Hypergrid has strong interoperability between chains, enabling seamless flow of assets and data between different chains.

Moreover, Grids can also connect seamlessly with each other, allowing assets and data to be transferred between different Grids without any barriers. Specifically, this means that assets and data on one Grid can be directly migrated to other Grids or other parts of the Sonic chain, ensuring smoothness and consistency in cross-Grid and cross-chain operations.

Ivan further explained that HSSN's global sorting mechanism ensures consistency across the entire system, avoiding state conflicts and forks. The introduction of global sorting ensures that all transactions conducted in Hypergrid maintain consistency, preventing common conflicts or fork issues in distributed systems, thereby further enhancing the reliability and stability of transactions.

Finally, Ivan summarized the technical characteristics of Hypergrid. On a technical level, Hypergrid is similar to Ethereum Rollup in terms of sorting mechanisms, ZK proofs, and finality confirmation. The sorting methods of the Rollup layer and Grid layer are similar; each Grid in Hypergrid completes transaction sorting and generates the corresponding state. The method of generating ZK proofs is also similar. In terms of finality confirmation, both Hypergrid and Ethereum Rollup rely on the mainnet (Solana and Ethereum) to confirm the finality of transactions, ensuring that transactions are immutable.

However, Hypergrid has significant differences from Ethereum Rollup in terms of global sorting and interoperability. Ethereum Rollup relies on the Ethereum main chain to complete sorting, while Hypergrid completes global sorting through the HSSN system, with Solana responsible for finality confirmation. Unlike Ethereum Rollup, Hypergrid does not rely on Solana for sorting; it only depends on Solana for finality confirmation after sorting is completed, thereby reducing reliance on the Solana main chain and increasing flexibility.

Secondly, Hypergrid and Ethereum Rollup also differ in terms of interoperability. Interoperability between Ethereum Rollups is often complex, such as OP chain, Arbitrum chain, Base chain, etc. The transaction consistency and asset consistency among these chains are not perfect, thus requiring reliance on cross-chain bridges for data and asset migration. In contrast, Hypergrid can achieve native inter-chain interoperability, allowing seamless migration of assets and data between Grids without relying on third-party cross-chain bridges. This gives Hypergrid a significant advantage in cross-chain interoperability.

Finally, Ivan summarized in one sentence that this is a ZK version that can be compared to the OP superchain, and it comes with a decentralized sorting network as a modular execution layer for SVM.

Q5

In addition to the technical aspects, what other highlights of SonicSVM are worth noting? For example, ecosystem development, supporting investment institutions, the latest operational data, or recent activities?

Ningning first pointed out that one of the biggest highlights of SonicSVM is its successful attraction of a large number of real users, especially on TikTok and similar platforms. This strategy involved a collaboration with TikTok to host an event that directed millions of TikTok users to its platform. Although most of these users were attracted through airdrops or points, the process of successfully converting them into deep Web3 users, and how to transition from "shallow" Web2 users to "heavy" Web3 users, is worth paying attention to. Ningning believes that such attempts are worth continuously observing for their conversion effects.

Next, Ningning mentioned that SonicSVM has made some innovations in user incentives. It has drawn on last year's Telegram mini-program games and upgraded them. In this way, developers and project parties can use SonicSVM's framework to develop mini-program games based on its platform. For most TikTok users, their interests may be more focused on entertainment, cultural consumption, and IP products, rather than the financial investment interests typical of native Web3 users. This difference means that products in the SonicSVM ecosystem may lean more towards entertaining content, such as casual mini-games and IP-based NFT consumption.

Ningning further pointed out that SonicSVM's ecosystem may differ from traditional Web3 ecosystems, especially compared to DeFi applications or Layer 2 solutions. Its user base is more focused on entertainment and cultural consumption, particularly catering to the needs of Generation Z. Similar consumption trends have become very popular in the Chinese market, where young people are keen on spending related to anime and gaming. Therefore, SonicSVM may attempt to combine NFTs and Web3 IP with traditional Web2 IP for commercialization and IP development to attract young consumers.

Finally, Ningning concluded that SonicSVM's approach is significantly different from traditional Layer 2 solutions. Traditional Layer 2 typically focuses on how to enhance economic opportunities in Web3 through technical means to attract investors and traders. In contrast, SonicSVM's goal is more about how to shift the development of the Web3 ecosystem towards younger demographics, promoting entertainment and cultural consumption to attract users to the blockchain.

Ivan's response elaborated on the highlights of SonicSVM in terms of user growth, investment institution support, ecosystem development, and future prospects. First, he emphasized that SonicSVM has attracted nearly 8.7 million registered wallet users even before launching its mainnet and without any incentive mechanisms, with 2 million coming from TikTok. This data indicates that SonicSVM can successfully guide users from traditional Web2 platforms to Web3. Additionally, the largest of the four Mini Games launched by SonicSVM has reached 2.1 million monthly active users on TikTok, demonstrating the platform's appeal and potential.

In terms of investment support, Ivan mentioned that SonicSVM has received funding from several important institutions, including Bitkraft, a top gaming industry fund in North America with nearly a billion dollars in managed assets, further proving SonicSVM's potential in the gaming sector. At the same time, Galaxy Digital, as an important infrastructure solution provider in the Solana ecosystem, also supports SonicSVM, highlighting the project's close ties to the Solana ecosystem. Furthermore, SonicSVM has also received investments from OKx and Mirana Ventures (Bybit's affiliate), which provide a solid foundation for SonicSVM's future development.

In terms of personal investment, SonicSVM has received angel investments from Lily Liu, the president of the Solana Foundation, and several core members of the Solana ecosystem, further tightening its relationship with the Solana ecosystem and providing more resources and support for its future development.

Ivan also further analyzed the future development potential of SonicSVM. He believes that SonicSVM is not just a GameFi chain or DeFi chain; its biggest highlight is its SVM equivalence, which means that any project on Solana can seamlessly migrate to SonicSVM, greatly facilitating the migration and integration of Solana ecosystem projects. This feature will attract developers and users from the Solana ecosystem, providing strong momentum for the expansion of SonicSVM's ecosystem.

Additionally, Ivan mentioned that in the future, SonicSVM may give rise to platforms similar to pump.fun, including decentralized exchanges, lending protocols, and perpetual contracts. He believes this will make SonicSVM's ecosystem richer and more diverse, breaking through the traditional frameworks of gaming and financial applications.

Finally, Ivan specifically noted that with some IP and meme projects on TikTok, such as MooDeng, reaching nearly a billion dollars in market value, SonicSVM could become an ideal platform for these projects. He believes that SonicSVM can convert TikTok users into Web3 users, creating a Web3 ecosystem that includes not only entertainment elements but also allows users to participate in high-yield activities like DeFi. Through this platform, users will gain more profit opportunities in the Web3 world, presenting significant market potential and innovative opportunities.

Q6

What are the highlights of SonicSVM's tokenomics design? What aspects of token distribution and circulation models can attract investor attention?

OneOne mentioned the collaboration between SonicSVM and TikTok, which will directly impact the design of the tokenomics. He believes that SonicSVM's TGE has already distributed a portion of tokens to TikTok users in the early stages, a strategy that can ensure the continued participation of TikTok users in the future, further driving platform activity and token circulation. If the TikTok user base can remain active, SonicSVM may provide a continuous way for them to participate, which will be reflected in subsequent token distributions, attracting more TikTok users to engage in the Web3 ecosystem.

Secondly, OneOne pointed out a potential for user participation by drawing a comparison to the Pump.fun project. As a Web3 platform, Pump.fun's lack of regulatory mechanisms has led to non-compliant live content. In contrast, TikTok has a strict content review mechanism that can effectively avoid these issues. OneOne believes that SonicSVM can leverage TikTok's live streaming capabilities to transfer content that cannot be regulated on the Pump.fun platform to TikTok, ensuring content compliance and enhancing the platform's credibility and user experience.

Thirdly, OneOne further analyzed the unique advantages brought by the collaboration between SonicSVM and TikTok. He believes that this partnership and the traffic from TikTok can lower the barriers for users to participate in the project, for example, users can conduct on-chain transactions directly on TikTok. Additionally, collaborating with TikTok can bring key externality effects; as a large number of users from TikTok flow into SonicSVM, the platform will inherently attract traffic, and this externality effect will draw the attention of exchanges. Many exchanges favor projects with user traffic, as this means more trading activity and fee income. For instance, projects like the TON chain, which have a large user base, can gain greater exposure on exchanges and list more tokens on the platform. This externality effect is significant for attracting exchange support and enhancing the liquidity of project tokens.

Q7

How do you view the future market capitalization development potential of SonicSVM? What valuation expectations can you share?

Ningning believes that the concept of consumer chains may see a significant increase in market capitalization in 2024. He stated that traditionally, projects backed by technologies like ZK Rollups and top-tier investment institutions are often seen as capable of achieving market capitalizations in the billions or even tens of billions. However, Ningning pointed out that despite the initial attention on ZK technology and related projects, market performance has not fully met expectations. In contrast, some consumer chain projects that have been undervalued in the primary market (such as SonicSVM and the Abstract of the Fat Penguin) may unexpectedly perform well in the secondary market. This will expand the concept of consumer chains from the primary market into the minds of secondary market investors. Therefore, Ningning believes that as market awareness of consumer chains gradually increases, SonicSVM's market capitalization may see a significant boost.

In terms of valuation expectations, Ningning boldly predicts that after the end of Q1 2024, SonicSVM's market capitalization will reach at least $3 billion, reflecting his optimistic outlook on the project's future development potential.

Ivan proposed a detailed valuation method for SonicSVM's future market capitalization development, with the core idea revolving around the conversion of deposited funds and active funds. His valuation model is primarily based on TikTok's monthly active user count (MAU) and combines the current crypto penetration rate to estimate the number of potential users who have not yet engaged with the crypto world. By multiplying these users by SonicSVM's high conversion rate and user entry funds, Ivan believes SonicSVM can accumulate a substantial amount of funds from TikTok users and effectively convert them through mechanisms like the project's Mini Games.

Formula: Deposited Funds = TikTok's MAU × (1 - Crypto Penetration Rate) × Sonic SVM Conversion Rate × User Entry Funds

Ivan pointed out that the conversion rate of SonicSVM's Mini Games is significantly higher than that of other platforms (such as Mini Games on Telegram and the user acquisition conversion rates of exchanges), enabling SonicSVM to quickly attract a large number of Web3 users and bring considerable deposited funds to the platform. This deposited fund can be understood as TVL but will be greater than TVL, as not every user will put money into Dex or ecosystem projects. Furthermore, SonicSVM not only relies on the accumulation of funds but can also activate on-chain economic activities by converting these funds into active funds. Ivan used gas fee consumption as an example to explain this, indicating that active users will drive transactions and protocol usage, thereby creating activity for the on-chain ecosystem.

Furthermore, Ivan proposed a metric called Return on Equity, drawing an analogy to Solana's performance, indicating that once these deposited funds are converted into active funds, they will generate higher trading volume and activity through the platform, ultimately reflecting in market capitalization growth. The final valuation formula is: Deposited Funds × ROE = Generated Fees, minus costs, and then multiplied by PE. Ivan believes that SonicSVM's market capitalization has significant upward potential.

Ivan also emphasized the uniqueness of SonicSVM compared to other projects. He believes that although many KOLs may appear in the market for valuation comparisons, such benchmarking is not very meaningful because SonicSVM is the only Web3 project operating on a TikTok user base. This combination of TikTok + Web3 gives SonicSVM an irreplaceable position among similar projects, which is an important driver of its market capitalization growth.

Finally, Ivan added that SonicSVM has advantages in technological innovation, especially in achieving gasless and approval-free operations. With this design, users do not need to perform cumbersome blockchain operations, such as paying gas fees or confirming wallet actions, making the Web3 experience much simpler and similar to the smoothness of Web2 applications. This significantly lowers the user entry barrier and enhances user stickiness on the platform.

OneOne, in response to questions about SonicSVM's future market capitalization development potential, first raised an important point: TVL is not applicable to all types of projects, especially public chain projects. He explained that public chains, as platforms, not only support single applications like DeFi but can also accommodate various different applications and businesses. Therefore, relying solely on TVL to assess the value of a public chain is not entirely fair; a more suitable valuation method—PEG—should be adopted. OneOne pointed out that the PEG valuation method predicts market capitalization by assessing the project's on-chain growth rate over a specific future period. This approach considers not only changes in TVL but also user growth, on-chain activity, and multiple dimensions. For platform projects like SonicSVM, PEG can more comprehensively consider its growth potential across various fields.

Furthermore, OneOne discussed the difference between FDV and circulating market capitalization, emphasizing their roles in valuation. FDV is primarily used to predict the project's market capitalization after all tokens are issued, reflecting the project's overall market potential. In contrast, circulating market capitalization reflects the market's current expectations of the project, embodying investors' confidence and future potential. OneOne noted that circulating market capitalization is often related to market dreams; some projects may achieve high market capitalization based on appealing stories or concepts, but their actual performance may not match such valuations.

OneOne also specifically emphasized that valuation methods need to be flexibly adjusted at different stages and for different projects. For example, in the short term, the Fisher equation can be used to calculate token liquidity and market expectations, while for projects like SonicSVM, short-term valuations should also focus on token liquidity and market reactions. He believes that in the short term, PEG valuation can be combined and adjusted according to changes in market expectations to more accurately predict SonicSVM's market capitalization potential.

In summary, OneOne believes that for projects like SonicSVM, the most reasonable valuation method is to adopt PEG and estimate it in conjunction with market expectations for the project's future growth. He suggests that by setting upper and lower limits, more precise predictions for market capitalization expectations can be provided. At the same time, he pointed out that as SonicSVM launches more content related to meme culture, its valuation model may need to be adjusted to accommodate the volatility brought by this cultural attribute. Overall, OneOne's response emphasizes the flexibility and specificity of valuation methods, particularly in public chains and platform projects, where adopting a comprehensive and market-responsive valuation strategy is crucial.

Conclusion

With the impressive performance of $SONIC and the upcoming listing on Korean exchanges, we believe that more practitioners, developers, and ecosystem projects will join SONIC SVM. In the future, as Sonic SVM continues to expand its ecological landscape, optimize its technical architecture, and deeply explore user value, we have reason to expect it to spark more innovative waves in the Web3 field. Whether it is its unique positioning as the "TikTok chain" or breakthroughs in technology and business models, Sonic SVM has already made an undeniable mark in the industry. Let us look forward to how this dazzling new star will continue to write its legendary chapter in the future crypto world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。