Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Azuma (@azuma_eth)

AI is the main theme of this cycle, and many believe it is a track that will continue to exist and evolve. Conversely, there are many reasonable criticisms that most AI agents today are superficial, and we need another 3-5 years to make this technology more meaningful.

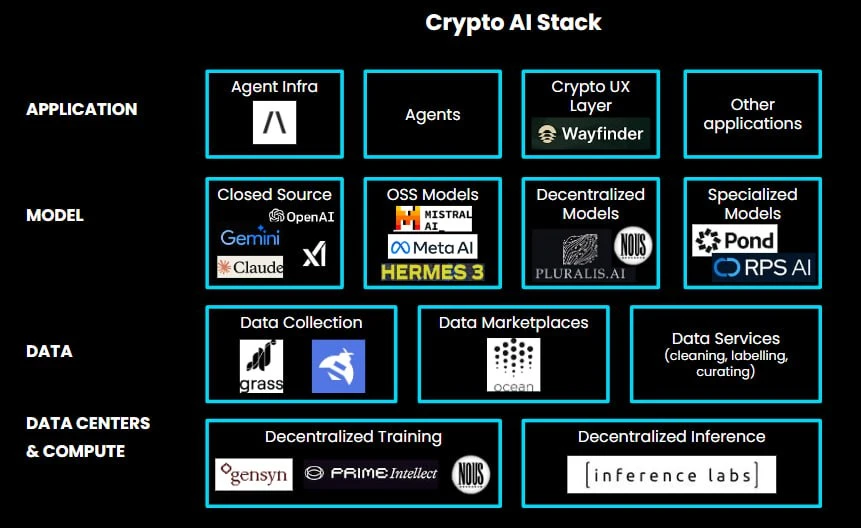

As a preface, the category of Crypto x AI projects spans multiple levels. The true technological prospects of Crypto x AI are mostly related to guiding better reasoning through the crypto economy or providing decentralized access to computation. Delphi's article is a good starting point to understand the entire stack.

However, this article focuses on the current state of agents. While there are exciting innovations at the lower levels of the stack, agents seem to have captured the attention of the mainstream cryptocurrency community. As Crypto x AI agents continue to evolve, here are five trends worth noting.

Trend 1 | Framework + Launchpad: Value Accumulation Begins to Matter, Frameworks May Persist

Value accumulation is starting to become important. Why is this the case?

To take a step back, why do people hold assets? There are two main reasons people exchange dollars for assets:

They can sell the asset to others at a higher price due to the narrative rotation that attracts new buyers;

Over time, the asset will generate more cash flow for them.

@izebel_eth wrote in his article “Old Coins Worse, New Coins Better” that the only thing that matters is the flow of funds. The following two reasons reflect two bullish fund flows:

Growth of new holders;

Token sinking (leaning towards deflation);

However, in most cases, we do not see anything resembling true token deflation or value accumulation. Using tokens through agent terminals (like AIXBT) is more akin to staking than traditional value accumulation.

This is also why frameworks like Virtuals, ai16z, Zerebro, and Arc have recently gained popularity. ai16z started primarily as an investment DAO, and since releasing details about its upcoming launchpad and token value accumulation, it has become a leader among such protocols.

Today, the framework + launchpad space is very saturated, and first-mover advantage has propelled their success. There are many reasonable doubts about the utility surrounding these launchpads, as many agents themselves are useless. However, those frameworks (Eliza V2 + launchpad, Zentients, Arc, and their handshake plans) have not launched their main products either. If they successfully attract developers and users, they may continue to lead the entire track.

Why will frameworks continue to exist?

Regardless of whether agents have true value, frameworks used to launch agents will perform well because they still have a “product-market fit” (PMF) with speculation. Frameworks + launchpads allow users to have both a factory + a casino. To some extent, Virtuals have replaced pump.fun in the Base ecosystem.

More optimistically, as technology advances, leading frameworks may launch more advanced agents, while the development speed of open-source software libraries like Eliza will be faster. Many of these launch platforms will also become a coordinating layer for communication between groups and agents, which will use their tokens for some form of value transfer. For more in-depth articles on Eliza's value capture, see Teng Yan's article from last week.

Virtuals, ai16z, Zerebro, and Arc are currently the main players in this track, but the launchpad space is becoming increasingly saturated. The frameworks with the fastest iteration speed, greatest scalability, and most unique features are the ones to watch.

Trend 2 | The Next Round of Agents Will Prioritize Utility and Value Accumulation, DeFAI (DeFi x AI) May Be the First Class of Agents to Achieve Product-Market Fit

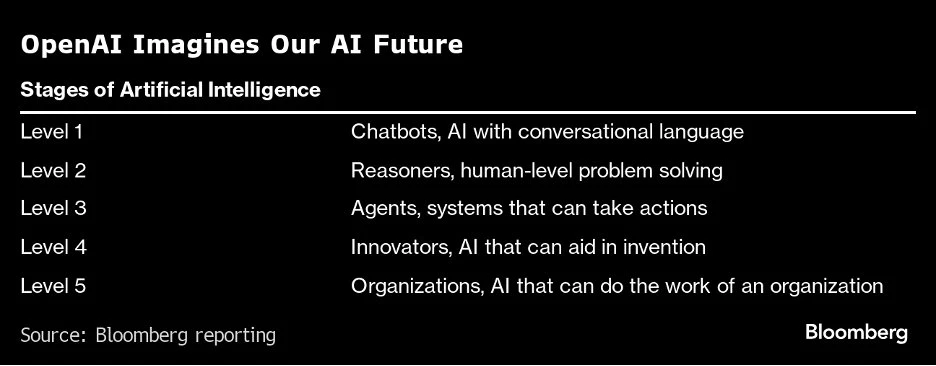

Most agents only have meme tokens and no utility. For the agent industry to grow, the next round of agents must further refine their use cases. New opportunities will come from agents that can truly accumulate value and take action. I believe that in the next year, first-tier agents will leap to third-tier agents.

We will first see this in the DeFi space. We will see more terminals that allow people to express desired outcomes in natural language or voice, as well as agents that can perform tasks behind the scenes. Existing wallets and protocols will also integrate agents to improve user experience.

Representative projects include: Wayfinder, Griffain, Hey Anon, Limitus, Neur.

You can learn more about related content from 0xJeff's article.

Trend 3 | Consumer Layer: The Revival of Entertainment Agents, Autonomous Worlds, and Games

Attention-driven agents will develop more complex personalities and multimedia interactivity. This may trigger the next wave of gaming and metaverse technologies.

One issue with existing agents is that they are becoming increasingly similar, turning into commoditized, exaggerated chatbots. While some agent projects will shift towards infrastructure (many are already doing so), some are starting to think about useful products/applications, while others may continue down the path of attention tokens. However, the next generation of attention agents will be better, developing more complex personalities and offering greater interactivity. This can be achieved through audiovisual expressions or by giving agents a three-dimensional presence and physical bodies.

There have already been early attempts in this area, with Jeffy writing an article about implanting a body into Zerebro here, and some well-known KOL agents launching directly through audiovisual forms like short videos. Slopfather and Ropirito are two early adopters of the video model.

However, I believe more agent projects will incorporate these features to make agents more vibrant. The product-market fit (PMF) in this field will be achieved through the consumer layer, where individual users may want to create personalized agent companions or interact with KOLs. This trend has gradually become popular outside of cryptocurrency, with some users spending hundreds of hours conversing with AI companions on websites like character.ai, which Google recently acquired for $2.7 billion.

Additionally, these 3D agents may find market fit in the existing consumer layer, particularly in gaming and the metaverse. Agents can add deeper backstories to the worlds within stories. Imagine having an agent act as an NPC, capable of completing tasks or playing games independently, with evolving memories and personalities. True game autonomous worlds may be realized through agents.

Representative projects include:

Soulgraph aims to provide tools for agents to have more customized personalities and memories;

Holoworld AI has established Web2 partnerships with companies like L'Oréal, Bilibili, and Fox to create digital avatars.

There are also representative projects in gaming, metaverse, virtual worlds, and autonomous agents:

Hyperfy is a metaverse platform that allows anyone to create virtual worlds and adopts Eliza plugins;

Parallel Colony is an AI simulation game where the agents are the players, and you can converse with them;

Digimon is a creature game similar to Pokémon, where the creatures evolve mentally based on interactions;

SMOL also uses the Eliza framework, where the characters in the game are agent-driven by LLMs and can take actions in the virtual world based on your commands.

Trend 4 | Agentic Organizations: The Return of DAOs

Decentralized Agentic Organizations are the next form of evolution for DAOs. Swarm or multi-agent systems are exciting because they can coordinate and execute more advanced strategies, similar to running a company. Heterogeneous swarms composed of many different types of specialized agents/models working together may outperform a single large model.

While fully autonomous agents and swarms may still be far from us, the next iteration of DAOs will likely focus on the interaction between individuals and groups. This will reduce the inefficiencies of bureaucracy and lower the costs and time of human execution. In the context of capital flow, the next step for income-generating agents is to become complete organizations that earn revenue.

Representative projects include:

Agent swarm infrastructure: Projects like SwarmNode.ai and FXN specialize in multi-agent frameworks and coordination work, while more mainstream agent frameworks like Zerebro and ai16z have also expressed intentions to build at this layer.

DAO launchpad: Most of the early traffic we see is concentrated on investment DAOs. I believe daos.fun will be the first major DAO launchpad, which nurtured ai16z. There are also some newer launch platforms like daos.world, where AI-driven funds like 3BC are gaining attention.

Trend 5 | Verifiable Agents: Current Agents Will Evolve Towards Greater Autonomy and True Ownership of Their Liquidity

Currently, most agents require a high degree of human intervention. The next wave of agents will move towards true autonomy, starting with managing their own funds.

The intersection of agents and cryptocurrency lies in the fact that cryptocurrency provides a financial pathway for truly economic agents. However, most agents do not control their own treasury or have it managed by human teams. To achieve truly economic agents, agents must be able to autonomously manage their own funds. This can allow agent behavior to begin evolving, as you can impose economic constraints on agents, requiring them to pay for their own reasoning costs, introducing Darwinism into the agent world where they must earn income to survive.

Representative projects include:

Freysa is one of the first agents to control its own agent and has performed excellently (including gaining the attention of Musk). Recently, they announced they are building a framework that allows agents to have verifiable autonomy in TEE + agent-controlled keys;

Lit Protocol also has an agent framework that allows autonomous agents to conduct on-chain transactions through a private key storage and execution system;

Galadriel launched an SDK called Proof of Sentience, enabling developers to conduct comprehensive verification of agents on-chain.

Conclusion: Before We See a Billion People on the Chain, We Will First See a Billion Agents on the Chain

The user experience of cryptocurrency itself is unfriendly to human users. But agents will not care about this friction. We will start with interactions between humans and agents, but the direction of cryptocurrency AI development is the interaction between agents, at which point swarms of autonomous agents will interact and trade on-chain, taking responsibility for their own economic conditions.

To empower agents economically, enabling them to incentivize behavior (pay service fees) and coordinate real-world activities, they need the ability to control and deploy capital. Cryptocurrency is the "home planet" for these agents—blockchain will allow agents to participate in permissionless financial activities. Stablecoins and high-performance Layer 1 solutions are ideal tools for achieving cost-efficient, round-the-clock, global transactions.

Beyond the current hype and narratives, we have ample reason to maintain long-term excitement about the on-chain agent economy. Many real use cases, including DAOs and revenue-generating agents, are much closer than we imagine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。